- within Tax topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Accounting & Consultancy, Retail & Leisure and Law Firm industries

- within Tax topic(s)

- in United Arab Emirates

- with readers working within the Law Firm industries

- within Tax, Family and Matrimonial and Environment topic(s)

1. INTRODUCTION

1.1. Carried Interest means an additional incentive, or a percentage of gains earned by investors, distributed to a specific class of unitholders (usually investment managers or sponsor), only if the Alternative Investment Fund ("AIF")'s performance exceeds agreed preferred rate of return called as hurdle rate of return. In recent years, AIFs have gained significant prominence and with the developments in their regulatory and taxation regime, general partners1 of AIFs have been careful to efficiently structure their commitment and carried interest to mitigate adverse consequences.

1.2. There are no specific provisions under the Indian tax law for taxation of carry interest distributed by an AIF to a specific class of unit holders. Recently, the Government of India has asked the private equity and venture capital industry to spell out how other countries tax their fund managers.2

1.3. This Infoalert, being part of a series of alerts on AIFs, aims to summarise the key tax considerations related to distribution of carried interest by AIFs in India.

2. WHAT IS CARRIED INTEREST AND ITS TYPICAL STRUCTURE

2.1. Definition of Carried Interest

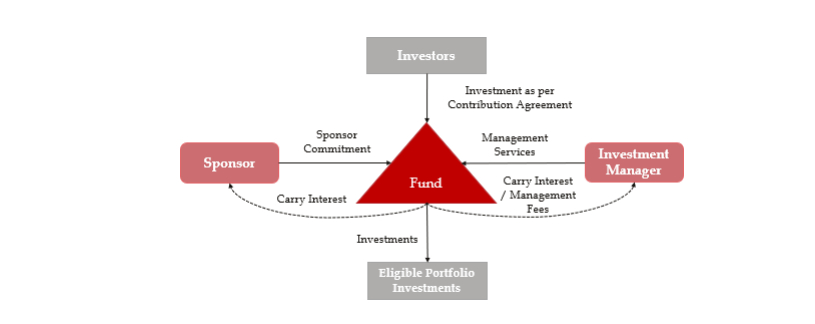

Carried interest is a share of profit distributed to an investment manager or a sponsor of the AIF, contingent upon the AIF achieving returns exceeding the agreed-upon hurdle rate. It represents a percentage of additional returns distributed to a specific class of unitholders – typically the investment manager or sponsor - in accordance with the distributed waterfall mechanism outlined in the AIF's private placement memorandum ("PPM"). This allocation is performance based rather than proportional to their investment in the AIF.

2.2. Carried Interest Structure

2.2.1. Generally, in India, most AIFs are structured in the form of trusts, and their carried interest is structured as a percentage of returns [often around 20% (twenty percent)], which is distributed to a specific class of units held by the investment manager or sponsor after certain performance benchmarks are met. To understand how carried interest operates, it is essential to examine the key constituents of the AIF structure, which are as follows:

- Manager3 means any person or entity who is appointed by AIF to manage its fund and may also be same as sponsor of the fund. For providing such services, managers charge fixed management fees irrespective of the performance of the fund. Such management fees are taxable as business income and Goods and Service Tax ("GST") is also applicable on the same.

- Sponsor4 means any person or persons who setup the AIF and incudes the promoter in case of a company and the designated partner in case of a limited liability partnership. Further, manager or sponsor shall have a continuing interest in the AIF of not less than 2.5% (two-point five percent) of the corpus or INR 50 million (Indian National Rupees Fifty Million), whichever is lower, in the form of investment in the AIF and such interest shall not be through the waiver of management fees. In case of a Category III AIF, the continuing interest shall be not less than 5% (five percent) of the corpus or INR 100 million (Indian National Rupees One Hundred Million), whichever is lower5.

- Unit6 means beneficial interest of the investors in the AIF or a scheme of the AIF and may be fully or partly paid up. Different classes of units may be issued by an AIF, or a scheme of the AIF based on the eligibility criteria prescribed in the private placement memorandum ("PPM").

- Hurdle rate of return means a predetermined preferred rate of return for each class of units that must be achieved by the fund to distribute carried interest to the manager or sponsor, as the case may be.

- Distribution Waterfall is the part of PPM which describes the priority of distribution of returns and allocation of distribution proceeds between different classes of units issued by the AIF to its investors.

2.2.2. A diagrammatic presentation of a carried interest mechanism is as follows:

2.2.3. Carried interest represents the percentage7 of additional returns distributed by the fund to a specific class of units 8 in the distribution waterfall, after the distribution of capital contributed by the investors and agreed hurdle rate of return.

2.2.4. For Example, in an AIF:

- Class A units are held by the investors (Limited Partners); and

- Class B units are held by the sponsor or managers of the fund for their capital contribution (General Partners).

The terms of PPM may provide that class B unitholders are eligible for carry returns at the rate of 20% (twenty) and the hurdle rate of return is 12% (twelve percent). Carry interest is paid to class B unit holders only after the return of capital and hurdle rate of return at the rate of 12% (twelve percent) is paid to class A unit holders. Thereafter, the balance remaining (after payment of carried interest), if any, will be distributed to class A unitholders and class B unitholders, respectively.

3. TAXATION OF CARRIED INTEREST

3.1. As outlined above, there are no specific provisions under the Income-tax Act, 1961 ("the Act") and GST law that explicitly govern the taxation of carried interest distributed by an AIF. The taxation of carried interest income depends upon its characterisation, which may be classified as 'capital gains' or 'business income', based on the specific facts of each case and need to be analysed carefully.

3.2. Typically, fund managers or sponsors have treated their carried interest income as 'capital gains' arising from investment in the units of the AIF and have accordingly offered it to tax under the applicable provision of the Income Tax Act, 1961 ("Act"). For GST purposes, the income from carry units has generally been treated as income from securities, which is not subject to GST.

3.3. Taxation of carried interest classified as 'capital gains' in the hands of Sponsor or Investment Manager

As per Section 45 of the Act, any profit or gains arising from transfer of capital assets shall be liable to capital gains tax in the year of transfer. Section 48 of the Act provides that the income chargeable as capital gains is the difference between the full value of consideration received or accrued for the transfer on the one hand, and the cost of acquisition of such asset plus expenditure in relation to such transfer, on the other. Such capital gains computed in accordance with the provision of Section 48 of the Act will be taxable:

- at applicable tax rates9 in case, where such units are held for a period of less than or equal to 24 (twenty-four) months immediately from the date of their transfer;

- at the rate of 12.50% (twelve-point five percent) plus applicable surcharge and cess in case, where such units are held for a period more than 24 (twenty-four) months immediately from the date of their transfer.

3.4. Taxation of carried interest classified as 'business income' in the hands of Sponsor or Investment Manager

In case, carried interest is characterised as performance service fees, it would be taxable as business income under the Act i.e. taxable at applicable rates and GST may apply.

3.5. As discussed earlier, taxation of carried interest would be dependent upon the facts of each case which needs to be analysed on a case-to-case basis.

Service tax on carried interest

The decision10 pronounced by the Bangalore bench of Customs, Excise and Service Tax Appellate Tribunal ("CESTAT")11 with respect to levy of service tax on carry interest distributed by a Securities and Exchange Board of India ("SEBI")12 registered venture capital fund ("VCF") to its investment manager created a significant ambiguity regarding the taxation of carry interest. The Bangalore bench held that carried interest is neither interest nor return on investment, it is instead a portion of the consideration retained by the fund (VCF) for the services rendered by them to the investors and passed on as a return on investment to the special class of investor. The Bangalore bench of CESTAT observed that the structure was formulated to avoid tax and hence, upheld the levy of service tax on the carried interest distributed by the VCF trust.

Aggrieved by the decision of the Bangalore bench of CESTAT, the VCFs appealed before the Karnataka High Court. The Hon'ble Karnataka High Court13 overruled the decision of Bangalore bench of the CESTAT. While adjudicating the issue, the Hon'ble Karnataka High Court inter alia held that, for levy of service tax an entity must be regarded as juridical person, and for the purpose of the Finance Act, a trust cannot be regarded as a juridical person. The Hon'ble Karnataka High Court further held that the funds (VCF) do not make any profit or provide any services, it simply acts as a pass-through entity; that the fund does not perform any act and there is no service provided to one-self.

The Tax Department approached the Supreme Court of India by way of filing a special leave petition14 ("SLP") against the decision of the Hon'ble Karnataka High Court. The Hon'ble Supreme Court did not find any merits in the appeal and dismissed the Department's SLP.

3.6. While the court rulings provide much needed clarity for AIFs and funds industry, the judgment of Hon'ble Karnataka High Court and from the Supreme Court does not explicitly provide guidance or address the issue on whether similar treatment will be adopted under the GST regime.

4. CONCLUSION

The taxation of carried interest in India has been influenced by many factors and has remained a subject matter of debate. The characterization of carried interest—whether as performance service fees or a return on investment—has distinct tax implications under the Income Tax Act and under the GST law.

Furthermore, while structuring carried interest, fund managers should consider the impact of GAAR15 provisions as well.

Given the substantial contribution of the AIF industry to the Indian economy, the introduction of specific provisions for taxation of carried interest would provide much-needed certainty from both direct and indirect tax perspectives and would be a welcome development for the AIF industry.

In the next and last volume of Infoalert on taxation of AIFs, we will cover certain key tax considerations for setting up funds in GIFT City16.

Footnotes

1 Includes Investment Managers and Sponsors of AIFs

3 Regulation 2(q) of Securities and Exchange Board of India (Alternative Investment Funds) Regulations, 2012 ("AIF Regulations")

4 Regulation 2(w) of AIF Regulations

5 Regulation 10(d) of AIF Regulations

6 Regulation 2(y) of AIF Regulations

7 Usually around 20% (twenty percent)

8 To be held by the Investment manager or sponsor as the case may be

9 Including applicable surcharge and cess

10 Service Tax Appeal No 2900 of 2012 with others

11 Customs Excise and Service Tax Appellate Tribunal

12 Security Exchange Control Board of India

13 Order dated 08-02-2024 in CEA No. 19/2021 with others

14 Special Leave Petition (Civil) Diary No(s). 36360/2024

15 General Anti-avoidance Rules

16 Gujarat International Finance Tec-City

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.