The Central Government and the Reserve Bank of India ("RBI") rationalised the legal framework for overseas investments in its entirety and issued:

The Foreign Exchange Management (Overseas Investment) Rules, 2022 ("OI Rules"); and

The Foreign Exchange Management (Overseas Investment) Regulations, 2022 ("OI Regulations").

With the new regime, the government not only aimed to strengthen the regulation of overseas investments by introducing measures like late submission fee ("LSF") on delays in reporting but also provided enhanced clarity to various definitions, and opened new realms of investing overseas for the Indian entrepreneurs viz., overseas investment in Strategic sectors, start-ups, Step-down subsidiary, etc by introducing the new rules.

OVERSEAS INVESTMENT

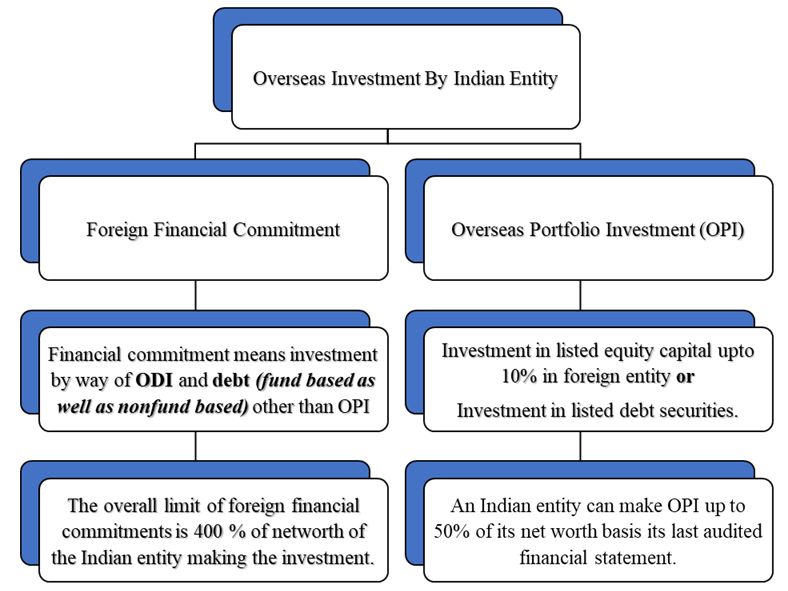

Overseas Investment by an Indian entity means aggregate of foreign financial commitment and overseas portfolio investment in foreign entities.

Financial commitment by way of Overseas Direct Investment ("ODI"):

ODI means investment made by Indian entity in equity capital1 of a limited liability foreign entity2 engaged in bonafide business activity (i.e. permissible business activity under Indian law and laws of the country where foreign entity is situated), in the following manner:

- Unlisted foreign entity irrespective of the percentage of the equity capital being held by the Indian entity.

- 10 % or more of the paid-up equity capital of a listed foreign entity.

- Investment with control in a listed foreign entity up to 10 % of the paid-up equity capital.

Restrictions and Prohibitions

An Indian entity cannot make ODI in the foreign entities engaged in real estate activity (i.e. buying and selling of real estate or trading in transferable development rights), gambling activity of any kind.

With the specific approval of RBI, an Indian entity can make ODI in foreign entity(ies) dealing with financial products linked to the Indian rupee and/or entities registered in Pakistan.

Financial commitment by way of debt (fund based):

An Indian entity can give loan or invest in debt instruments of a foreign entity, in which it has made ODI, subject to the following conditions:

- The debt should be backed by a loan agreement.

- The rate of interest should to be charged at arm's length basis (i.e. a transaction conducted in a manner between unrelated parties without conflict of interest).

Financial commitment by way of guarantee, pledge, charge, deferred payment for acquisition or transfer (non-fund based)

- Guarantee: An Indian entity (including its holding, subsidiary, promoter or promoter group company) can issue corporate or performance guarantee to or on behalf of the foreign entity (including its step-down subsidiary(ies)), in which it has made ODI.

Further, in case of a performance guarantee, only 50 % of the amount of guarantee is reckoned towards the financial commitment limit.

- Pledge or Charge: An Indian entity which has made ODI by way of investment in equity capital in a foreign entity, can pledge the equity capital of such foreign entity or of its step down subsidiary(ies) outside India or create a charge by way of mortgage, pledge, hypothecation or any other identical mode on its assets in India, including the assets of its group company or associate company, promoter or director or on assets of foreign entity, for availing fund or non-fund based facility for such foreign entity or its step down subsidiary(ies) outside India..

In calculating the foreign commitment, the value of the pledge or charge or the amount of the facility, whichever is less, is considered if the facility itself has not already been included in the prescribed limit.

- Deferred payment: A person resident in India, may defer the consideration to be paid to acquire/ invest in equity share capital of a foreign entity subject to the following conditions:

- The period of deferment and the valuation in accordance with the pricing guidelines should be decided upfront.

- the final consideration shall be compliant with the applicable pricing guidelines..

- The part of the deferred consideration in case of acquisition of equity capital of a foreign entity by the person resident in India shall be treated as non-fund based financial commitment.

Overall limit for financial commitment

The total foreign financial commitment made by an Indian entity in all the foreign entities taken together at the time of undertaking such commitment cannot exceed 400% of its net worth as on the date of the last audited balance sheet (i.e. a balance sheet not exceeding 18 months from the transaction date).

Financial commitment of USD 1 billion or more in a financial year by an Indian entity requires prior RBI approval even if the Indian entity is within the aforesaid threshold of 400%.

Further, Maharatna or Navratna or Miniratna or subsidiaries of such public sector undertakings are permitted to invest exceeding the above-prescribed limit of 400% in foreign entities engaged in strategic sectors.

Footnotes

1 "Equity capital" means equity shares or perpetual capital or instruments that are irredeemable or contribution to non-debt capital of a foreign entity in the nature of fully and compulsorily convertible instruments;

2 "Foreign entity" means an entity formed or registered or incorporated outside India, including International Financial Services Centre that has limited liability:

Provided that the restriction of limited liability shall not apply to an entity with core activity in a strategic sector;

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.