-Part I-

FROM METAL COINS TO DIGITAL CURRENCY: TRACING THE EVOLUTION OF MONEY AND CURRENCY

Fact or Fiction?

Money is a made-up concept. A fiction made real by a social contract. Whatever we agree is money, becomes money. The form of money changes with each society, placed in the terroir of its time and place.

Initially, commodities, like useful stones and precious metals doubled up as money. However, as humanity journeyed up the exponential path of progress and development, central banks emerged, issuing their own precious metal coins and paper currencies backed by these coins.

However, somewhere between the first and the second World Wars (mainly owing to the need to fund these wars) these forms of commodity backed money gave way to central bank 'fiat' money or currency. Fiat is Latin for 'let it be done', implying that these forms of currencies, act as money because the issuing authority (essentially the central bank) says so. Fiat currencies are thus the bedrock on which all current monetary policies are built.

In contrast to backed or unbacked government money, is the world of informal money. Informal money can take extremely diverse forms, from scraps of bronze during the bronze age, to community issued currencies, to currencies backed by time, or mutual credits. The most sophisticated and popular form of informal money is the infamous 'cryptocurrency'.

This modern form of cryptographic money, be it Bitcoin or its many derivatives, is the most novel and prolific form of informal money, in that this money is a creature of cyberspace, represented in a series of 1s and 0s.

Cryptographic money uses cryptography to secure transactions and control the creation of new units, held by the owner in the form of digital tokens, stored in digital wallets. Interestingly, like money, a cryptographic wallet can take on any form, from paper, to a pen drive to any substrate of the holder's choice, including one's own physical body (if this person is capable of remembering their private and public keys).

New Money

The exponential increase in the adoption of cryptographic money by individuals, business and nation states alike caused understandably consternation to central bankers around the world, as cryptocurrencies were seen as potential disruptors to the traditional financial systems.

These fears though may be overblown (though not unfounded), as informal currencies and formal currencies occupy different niches of any economy. Informal currencies often emerge to fill gap in the formal money economies, and the facts indicate that there is a large and thriving market for decentralized, peer-to-peer electronic cash, one that can be transacted without the need for intermediaries like central and retail banks.

The e-Rupee

This led central banks around the world, including India's Reserve Bank of India, to issue its own Central Bank Digital Currency (CBDC) in a bid to fill this gap in the market. These CBDCs are being designed to act like physical cash, albeit in digital form.

More details, regarding the actual user experience, and the tech stack on which India's CBDC will operate, are still awaited.

It is worth noting that while the forms of currency (and money) may have changed over time, the underlying purpose of money remains the same. That is, to serve as a medium of exchange, a store of value, and a unit of account. This latest evolution of money has been driven by the same facts that took us from gold coins to paper currencies, that is, the need to improve the efficiency and convenience of transactions and to meet the changing needs of society, by using the latest technology available.

Thus, the introduction of CBDCs, like the one issued by the RBI, reflects the changing needs of society. From the use of commodities such as gold and silver, to paper money and now to digital currencies, the forms of currency have changed to better serve the needs of society. However, each new form of money brings with it its own challenges, which is where robust and transparent debates are needed between the government and the citizenry. This debate starts with understanding what CBDCs are, and more importantly, what they are not.

-Part II-

THE IMPORTANCE OF SOUND MONEY IN A WORLD OF ECONOMIC CRISES

Money, the medium of exchange that has been in use for centuries, is a fascinating subject to study. We spend our whole lives in pursuit of this elusive 'object', though it is not clear to most of us what it really is. We know what it does for us, and for most of us, that's enough.

However, there is more here than meets the eye. Today, we'll delve into money a bit deeper. What are the different forms of money and why do different schools of economic thought view it differently?

So, let's start with the basics. What exactly is money?

Money can be defined as anything that fulfils three criterions, that of being a medium of exchange, a store of value and a unit of account. This means that goods and services are valued in, as well as, sold and bought for money. Money is also used to store value over time, meaning that money earned today, can be spent tomorrow. Unlike an egg, which might have to be bartered away before it rots.

It is a tool that facilitates economic activity and has been evolving since the days of our stone age ancestors, who, anthropologist believe, used a wide variety of found objects like flint stones, bones, and seashells as primitive forms of money. A far cry from the e-rupee that the Reserve Bank of India is today piloting.

In fact, money has taken on many forms through the ages. It's a master shape shifter. Morphing into what societies needed at that moment, drawing from technologies available to it.

Thus, to understand what makes sound money, we need to understand the different forms of money and what functions it performs.

Versions of Money

Through the millennia, money has morphed from sticks and stones to metal nuggets and coins, to pieces of paper that represented coins, and finally to the more familiar plastic money, found magically magnetized in credit and debit cards.

But you know that is not all. Money has morphed once again, right before our very eyes. The latest iteration of money comes in the form of cryptographic currencies. You give money blockchain, and it'll give you cryptocurrencies, stable coins, Central Bank Digital Currencies, and much more.

Though money dons many forms, it can be put in three neat buckets :

a. commodity money,

b. fiat money, and

c. cryptographic money.

Commodity money, as the name suggests, is a type of money that is a commodity in and of itself, such as gold or silver. This was money Version 1("V.1"). Flint stones are V.1.1; gold coins, V.1.2; paper currency backed by gold coins are V.1.3. This form of money is extinct for all practical purposes, though in an informal way, it thrives. Gold's use as money is why most Indian families hoard gold, to secure their financial futures.

Fiat money, on the other hand, is money Version 2 ("V.2"). This form of money is backed by the government and has no intrinsic value. Fiat coins and paper currencies are V.2.1; fiat wholesale digital money credited into ledgers held by retail banks -aka- 'fractional banking' would be V.2.2; and CBDCs would be V.2.3.

Cryptographic money is a relatively new form of money that is digital and decentralized by design. Its original superhero was (is) Bitcoin. A form of money that can be owned and possessed by anyone, despite the fact that it is a creature of the code that created it, and lacks any physical existence. Digital humans need (nay, deserve) their own form of digital money. Bitcoin and other cryptocurrencies are V.3.1, whereas stablecoins are V. 3.2.

Function of Money

It's now time to examine the fundamental functions of money. We intuitively understand these functions though our lived experiences, nonetheless, allow me to lay it out.

As noted above, money serves three key functions - it is a unit of account, a store of value, and a medium of exchange.

A unit of account is a standardized unit of measurement for goods and services. A store of value is a means of preserving wealth over time, and a medium of exchange is a tool that facilitates transactions.

By way of a comparison, V.1.0 money, such as seashells or stones, was used as a medium of exchange in bartering. It served as a medium of exchange but lacked the other two functions of money - being a unit of account and a store of value. Though some do argue that as stones or shells were resistant of degradation, they did act as stores of value, especially to facilitate inter-tribe seasonal trade.

A commoditized form of money did not lose value over time, as its value was based on scarcity. Only if the money of a particular society lost its scarcity, would its money lose value. A lesson learnt by many societies which have had their money systems hijacked due to a flood of the commodity that acted as their money, be it sea shells, beads, etc.

Modern forms of money, on the other hand, are more sophisticated and serve all three functions effectively, for most part. Unfortunately, fiat money is designed to lose value over time, as all governments that can print money, do. This leads to the ill of inflation, which slowly diminishes the purchasing power of one's money. Economists call this Modern Monetary Theory (or MMT), we call it getting poorer. This is the reason why the toothpaste costs more despite containing less paste.

Schooling Money

Finally, let's take a look at the different schools of economic thought and how they view money. Austrian economists believe in sound money, that is, money that is scarce and has value in and of itself, such as gold. Keynesian economists, on the other hand, believe in fiat money and believe that the money supply should be managed by the government to boost economic activity.

Today we live in the Keynesian age. There is an argument to be made that sound, commodity (or code) based money is what is needed to ensure local and global economies operate within the environmental boundaries of the planet. Various economics, over the last few decades have spoken out against the fiat money experiment, noting that easy, cheap money is disproportionately responsible for most of the projects and activities that are pushing the global ecosystem and economy outside the safety zone.

Thus, it is only by understanding the nature and function of money, their strengths and weaknesses, and the impact they have on our economy, can we make informed decisions about the monetary system we choose to adopt. Awareness of monetary theories and how money works goes to the very root of our future prosperity.

In this spirit, I would implore each and every one of us to take a closer look at the form of money you use the most often, where it comes from, how much of it exists, who intermediates your use of this money and what factors, within or without your control, can potentially prevent you from enjoying your money to its fullest. Contextualize this with your favourite money's impact on accelerating climate change threatening the planet.

-Part III-

FROM CRYPTOCURRENCIES TO CBDCS: THE POWER OF TRIPLE ENTRY ACCOUNTING

In the world of finance and accounting, there are few concepts as revolutionary as triple entry bookkeeping. While traditional double-entry bookkeeping has been the gold standard for centuries, triple entry bookkeeping is poised to take centre stage, enabling the proliferation of new forms of money like cryptocurrencies and central bank digital currencies (CBDCs). Today, we will explore the power of triple entry accounting and how it is transforming the world of finance.

First, let's start with the basics. Triple entry bookkeeping is a system of accounting that adds a third entry to the traditional debit and credit entries found in double-entry bookkeeping. In triple entry bookkeeping, a third entry is made in a separate ledger that is accessible to multiple parties, allowing for greater transparency and accountability. This third entry is essentially a cryptographic receipt that provides a tamper-proof record of a transaction, which can be verified by multiple parties.

This unique feature of triple entry bookkeeping makes it particularly well-suited to cryptocurrencies and CBDCs. Cryptocurrencies like Bitcoin and Ethereum rely on blockchain technology, which is essentially a distributed ledger that records every transaction made in the network.

|

Technological Ages |

Substrate of Money |

Forms of Money/Currency |

Method of Accounting |

|

Stone Age |

Stones, bones, shells, etc. |

Proto Commodity/ Collectible Money |

None |

|

Metal Age |

Iron, Bronze, Gold, Silver nuggets and coins |

Commodity Money Commodity Currency |

Single Entry |

|

Industrial Age |

Metals (gold, silver) Metal backed Paper & Coins |

Commodity Currency Fiat Currency |

Double Entry |

|

Information Age |

Gold & Silver Backed Paper Paper, Plastic, Digital |

Fiat Currency Fiat backed Money |

Double Entry |

|

Exponential Age |

Currency (Paper, Plastic, Digital, e?) Blockchain backed Money ( Bitcoin, CBDCs, Stable coins) |

Fiat Currency Fiat backed Money Digitally native money |

Double Entry + Triple Entry |

But triple entry bookkeeping is not just useful for cryptocurrencies. CBDCs, which are digital versions of a country's fiat currency, are also starting to use this technology. The People's Bank of China, for example, has been developing a digital version of the yuan that uses triple entry bookkeeping to increase transparency and reduce the risk of fraud.

However, for triple entry bookkeeping to truly revolutionize the world of finance, laws and regulations will need to adapt. Many countries have not yet adapted their legal frameworks to accommodate digital currencies, let alone triple entry bookkeeping systems. In order to leverage the benefits of triple entry bookkeeping, laws will need to be updated to address issues such as tax treatment, anti-money laundering measures, and cross-border transactions. This is slowly, but surely happening.

Triple entry bookkeeping, thus, is a powerful tool that is transforming the world of finance. From cryptocurrencies to CBDCs, this technology is enabling new forms of money that are more secure, transparent, and efficient than traditional currencies. However, for triple entry bookkeeping to reach its full potential, legal frameworks will need to evolve to keep pace with the technology. As we move forward into a digital future, the power of triple entry accounting will be crucial in shaping the new financial landscape.

-Part IV-

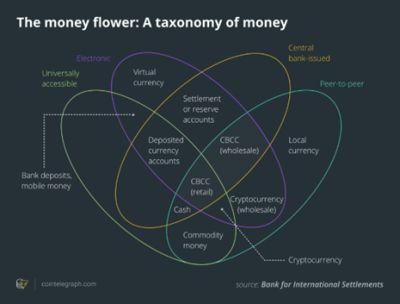

THE MONEY FLOWER

With a mind firmly situated at the crossroads of technology and finance, one must always survey the horizon for novel perspectives to decipher the labyrinthine world of money. It is in such an exploration that the unique illustration of the "Money Flower," as conceptualized by the Bank of International Settlement, manifests itself as an invaluable compass in navigating the sea of monetary affairs.

The Money Flower, a floral taxonomy of currency, paints a vivid portrait of our intricate financial system. It does so by categorizing money according to its degree of accessibility and convertibility into central bank money. By charting the various monetary types and tracing their interrelations, the Money Flower proves itself a powerful tool to comprehend the dynamics between financial institutions and the movement of funds within this system.

To disentangle the Money Flower, we must delve into its taxonomy and its peculiar classification of money. The taxonomy is a latticework of the four petals of the flower, each representing a unique type of money:

- Peer-to-Peer (P2P): This petal signifies money directly exchanged between individuals, independent of intermediaries. It houses such forms as cash, commodity money, and local currencies.

- Central bank-issued: This petal is reserved for money issued by central banks, encompassing banknotes and coins.

- Electronic: This petal is home to money existing solely in electronic form, including bank deposits and digital currencies.

- Universally accessible: This petal symbolizes money usable anytime and anywhere, such as credit cards, debit cards, and electronic bank transfers.

Each monetary form may find a place in multiple petals. For instance, bank deposits are nestled in both the electronic and universally accessible petals, while cryptocurrencies find themselves in the P2P and electronic petals. This flexible categorization enables a nuanced comprehension of diverse money forms and their intricate interactions.

The taxonomy of the Money Flower diverges from the traditional monetary classifications such as M0, M1, and M2. Rather than focusing on the quantity of money in circulation, it emphasizes the characteristics of different money forms. It thus presents a more detailed understanding of varied money types and their usage. This approach proves the Money Flower a more potent instrument for monetary policy and financial stability analysis than traditional definitions.

The Money Flower brings to the fore a comprehensive framework for central banks to fathom the different forms of money in circulation and their economic impact. It enables central banks to better dissect the transmission mechanisms of monetary policy, assess financial stability risks, and design suitable policies to maintain equilibrium. For instance, the rise of digital currencies, with their potential to unsettle traditional financial intermediaries, carries implications for financial stability and central banks' roles. The Money Flower taxonomy equips central banks to understand and manage these implications.

The advent of digital currencies significantly influences the Money Flower taxonomy. As members of both the P2P and electronic petals, digital currencies like Bitcoin and Ethereum underscore their unique attributes. Central banks have adopted varied approaches to digital currencies, some welcoming the technology while others expressing apprehensions about potential risks to financial stability. Regardless, central banks are endeavouring to comprehend the implications of digital currencies for the economy and financial system, developing policies for their safe usage.

The Money Flower taxonomy has profound implications for central bank monetary policy and financial stability. By differentiating money forms into unique categories, it offers a granulated view of the monetary landscape to inform central bank policy decisions. The taxonomy aids central banks in understanding the evolution of digital currencies and their potential financial stability impact. This understanding is particularly vital in today's swiftly evolving monetary landscape, where digital currencies and other unconventional money forms are gaining traction.

In conclusion, the Money Flower taxonomy offers a fresh and inventive approach to categorizing various money forms. It provides a sophisticated understanding of the monetary landscape, informing central bank policy decisions and financial stability analysis. The surge of digital currencies is significantly influencing the taxonomy, with central banks proactively engaging with this trend to remain relevant in the digital age. Practical applications of the Money Flower are manifold, and its usage is likely to amplify as the monetary landscape continues to transform. As members of society, a basic understanding of the taxonomy is invaluable for our financial decisions. As the world of money evolves, staying informed is our best tool to adapt and thrive.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.