- within Corporate/Commercial Law topic(s)

- in North America

- with readers working within the Law Firm industries

- within Corporate/Commercial Law topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in North America

- with readers working within the Accounting & Consultancy, Basic Industries and Technology industries

The March 2025 edition of Fox & Mandal's newsletter examines the impact of additional tariffs imposed by the US government; enhancing the scope of fast-track mergers, post-listing validity of ESOPs issued to founders pre-listing; streamlining the rights issue framework for listed companies; revised MSME classification; speculative investment not financial debt under IBC; and other regulatory changes in India's corporate, capital markets, insolvency, and banking sectors.

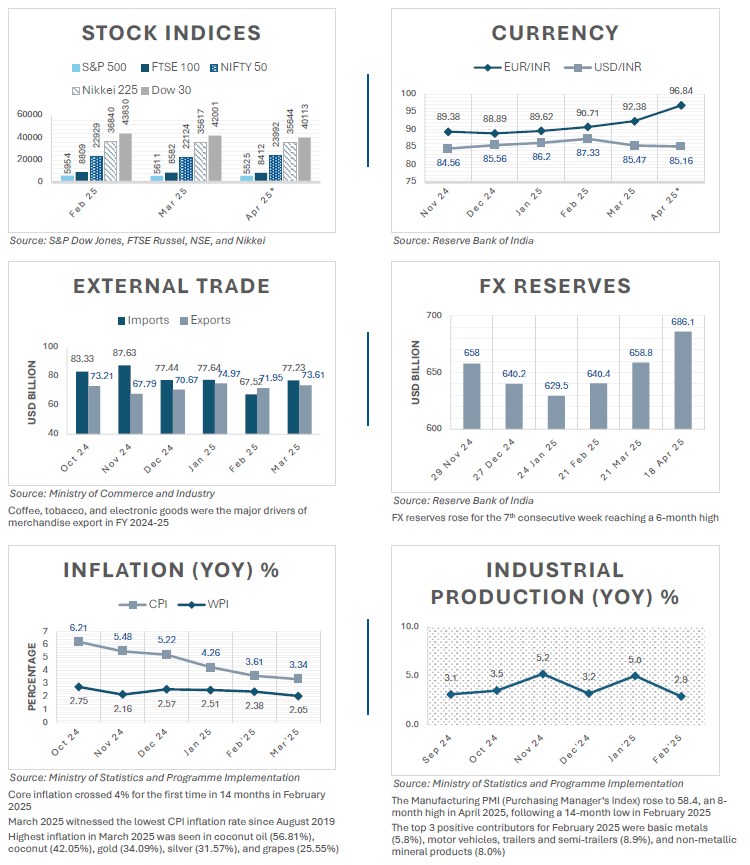

INDIAN ECONOMY

Snapshot of key economic indicators | April 2025

* As per latest available data for April 2025

US 'LIBERATION DAY' TARIFFS

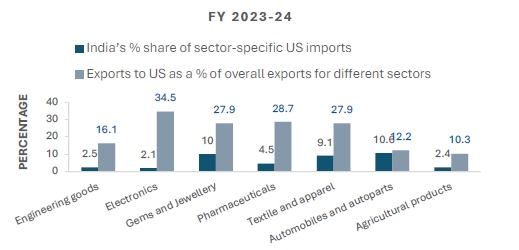

Impact of 'discounted tariffs' on Indian industry sectors

On April 2, 2025, a day proclaimed by US President Donald Trump as 'Liberation Day', a sweeping set of reciprocal tariffs was rolled out to target countries with sustained trade surpluses. While the move affects global trade flows, its impact on India is nuanced – offering both risks and selective opportunities depending on the sector and competitive dynamics.

Timeline of key events

- January to March 2025: The US administration signals a strategic shift toward trade 'reciprocity' under its 'Make America Wealthy Again' doctrine.

- April 2, 2025: US implements a reciprocal tariff structure, imposing 26–27% tariffs on imports from countries with persistent trade surpluses with the US. Key sectors include automobiles, steel, electronics, and apparel.

- April 3 to 15, 2025: India initiates consultations to seek clarity and exemptions on sensitive categories and proposes discussions toward a limited bilateral trade framework.

- April 13, 2025: The US announces exemptions on laptops, computers, and smartphones while maintaining a 20% tariff on China.

- Ongoing (as of mid-April 2025): The new tariff structure prompts a global re-routing of trade flows, opening competition-based realignments.

India – US trade

USA is India's largest export destination, accounting for 17.7% of India's overall exports in FY 2023-24.

| Year | India's total

export (USD billion) |

India's export to

US (USD billion) |

Percentage |

|---|---|---|---|

| 2022-23 | 451.07 | 78.54 | 17.4 |

| 2023-24 | 437.07 | 77.51 | 17.7 |

| Apr'24 – Jan'25 | 358.63 | 68.45 | 19 |

While the US tariffs of 2025 will affect various Indian industry sectors, the country's competitive positioning in some areas can help mitigate the negative impact, especially when compared to competitors like China, Vietnam, and the European Union (EU).

Sectoral impact on Indian industry

- Engineering goods (22% of India's US exports): India's engineering goods sector (industrial machinery, electrical equipment, and steel products) faces a 25% tariff on steel and aluminium exports to the US. While the higher duties could raise costs for Indian exporters, the sector's limited dependence on US steel demand – relative to robust domestic consumption – helps cushion the impact. Furthermore, India's strength in manufacturing cost-competitive machinery and electrical equipment may allow it to retain competitiveness despite the new tariffs.

- Electronics (13% of India's US exports): Initially subject to a 27% tariff, India's electronics exports—particularly smartphones, laptops, and tablets – have now been exempted from the new duties following the US government's amendment on April 13. India now enjoys parity with Vietnam, both benefitting from zero tariffs on these high-volume exports, while China continues to face 20% tariffs. This 20% advantage over China strengthens India's competitiveness in consumer electronics makes this sector particularly resilient.

- Automobiles and auto parts (3% of India's US exports): A 25% tariff on automobiles and auto parts will affect India's exports, mainly auto components. India's limited car exports reduce the overall impact, but auto parts, critical for US manufacturing, could remain competitive compared to countries like China. India's focus on cost-effective auto components helps shield it from the full brunt of the tariff. With an increasing demand for electric vehicles, India may benefit from rising EV parts exports.

- Textiles and apparel (12% of India's US exports): India's textile exports, particularly cotton- based products, will face the 27% tariff. However, India's self-sufficiency in cotton and higher tariffs on competitors like Vietnam (46%) and Bangladesh (37%) could allow India to gain market share. This shift in demand from other countries may help offset some of the tariff-induced losses in this sector.

- Pharmaceuticals (10% of India's US exports): The pharmaceutical sector remains unaffected by the tariffs, as it is exempted due to its importance to public health. India's strong position in generic drugs, especially in the US, ensures continued growth and stability for this sector.

- Gems and jewellery (11% of India's US exports): The 27% tariff poses a challenge for India's jewellery exports, potentially raising prices for US consumers. However, competition from China, which faces even higher tariffs, may offer some relief. The growing market for lab-grown diamonds could pose additional challenges for India in this sector.

- Agricultural products (29% of India's US exports): Agricultural exports like cereals and spices will see tariff hikes. However, these increases are somewhat offset by even higher tariffs on competitors, such as Ecuador in the shrimp market. Still, price-sensitive products may face reduced demand, impacting India's agricultural export volumes.

- Chemicals (minimal impact): India's chemical exports to the US are relatively small, so the tariff impact is minimal. India may benefit from the higher tariffs imposed on Chinese chemicals, gaining a slight edge in the market.

- Oil and gas: India's oil exports to the US are limited, but rising tariffs could affect global trade dynamics. Venezuela's lower tariffs (10%) might make its oil exports more attractive, potentially affecting India's competitiveness in this sector. However, countries importing oil from Venezuela face an additional 25% tariff, which, combined with Venezuela's already declining export volumes, may limit its advantage.

Companies in FDI-prohibited sectors can issue bonus shares to existing non-resident shareholders

DPIIT's Press Note 2 (2025)

The Department for Promotion of Industry and Internal Trade (DPIIT) has recently released its Press Note 2 (2025) (Press Note) clarifying that Indian companies engaged in sectors or activities prohibited for Foreign Direct Investment (FDI) are authorised to issue bonus shares to their pre-existing non-resident shareholder(s) provided that their shareholding pattern does not change in accordance with the issuance of bonus shares.

While companies operating in sectors prohibited under the FDI policy, such as tobacco, lottery, gambling, chit funds, and atomic energy, are barred from receiving new foreign investment, they often have existing non-resident shareholders whose investments were made prior to the imposition of sectoral FDI restrictions. The existence of such 'grandfathered' investments (permissible under the old law) did not automatically clarify the permissibility of bonus issuances, which, although non-cash in nature, could impact shareholding patterns. Such companies, with significant foreign shareholding, have adopted a cautious approach by seeking prior Reserve Bank of India (RBI) approval.

The Press Note explicitly amends Paragraph 1 of Annexure 3 of the FDI Policy, stating that Indian companies in FDI- prohibited sectors are now allowed to issue bonus shares to their existing non-resident shareholders, provided there is no change in the relative shareholding pattern post- issuance. This means that the proportional ownership of non-resident shareholders must remain the same, effectively preventing any indirect increase in foreign control and maintaining the integrity of FDI restrictions. This permission is further subject to compliance with applicable laws such as the Companies Act, 2013

The Press Note will come into force upon issuance of the relevant notification under the Foreign Exchange Management 1999, (FEMA), with corresponding amendments expected shortly in the Foreign Exchange Management (Non-Debt Instruments) Rules, 2019.

In addition to bringing clarity on the ability of companies in sensitive sectors to issue bonus shares to carry out legitimate corporate actions, including bonus issuances, without breaching FDI norms, the Press Note removes the existing requirement for prior RBI approval, thereby reducing bureaucratic delays and simplifying the compliance process. This reform also boosts investor confidence, enhances regulatory clarity, and ensures that compliant foreign shareholders are not unfairly excluded from the benefits of such actions. Despite this positive development, the issue of whether bonus issues that result in shifts in voting power between resident and non-resident shareholders, due to factors like non-participation or rounding off, would inevitably come under regulatory scrutiny.

CIRP cannot be initiated on the basis of speculative investment

Profit-sharing agreement involving reciprocal obligations is not financial borrowing

In a recent decision, the National Company Law Tribunal, New Delhi (NCLT) held that a profit-sharing agreement involving reciprocal obligations in the nature of speculative investment is not a financial debt and cannot be used to initiate Corporate Insolvency Resolution Process (CIRP).1

Krrish Realtech Pvt Ltd (Corporate Debtor/CD) entered into a Memorandum of Understanding (MoU) with MK Jain and his family (Applicants) whereby the Applicants were to advance INR 15 crore as investment (Investment) in consideration of which the CD would purchase allot certain plots belonging to Kelvin Buildcon Pvt Ltd (Kelvin Plots) and allot them to the Applicants by a specified 'cut-off date'. Clause 5 placed a reciprocal obligation on the Applicants requiring them to sell the Kelvin Plots in the market on the following conditions:

- If sold below INR 60,000 per square yard, the CD would have the right of first refusal

- If sold above INR 60,000 square yard, the parties shall share the profit revenue so generated

The CD could not allot the Kelvin Plots by the cut-off dates resulting in breach of the MoU. The Applicants initiated arbitration and secured an interim award in their favour, on the basis of which the Applicants sought initiation of CIRP against the CD under Section 7 of the Insolvency and Bankruptcy Code, 2016 (Code) contending that the Investment was in the nature of a financial borrowing.

The NCLT dismissed the CIRP application and held that since the MoU contained reciprocal rights and obligations and the nature of the transaction was to share the profits, the Applicants would receive a residual gain upon the fulfilment of the Agreement. As such, the transaction was in the nature of speculative investment, which did not qualify as a 'financial debt' under the Code.

The decision underscores the importance of distinguishing between genuine financial borrowings and speculative investments structured as commercial arrangements. Parties advancing funds with the expectation of profit-sharing or contingent returns based on future events must be cautious as such arrangements may fall outside the ambit of 'financial debt' under the Code. Investors should ensure that lending arrangements reflect the characteristics of a loan (such as fixed returns, clear repayment terms, and consideration for time value of money) to avoid adverse outcomes in enforcement.

MCA proposes to widen the scope of fast-track mergers

Draft amendments to the Companies (Compromises, Arrangements and Amalgamations) Rules, 2016

In a bid to simplify and expedite corporate restructuring, the Ministry of Corporate Affairs (MCA) has proposed amendments to the Companies (Compromises, Arrangements and Amalgamations) Rules, 2016 (Rules). These changes aim to significantly expand the scope of fast-track mergers under Section 233 of the Companies Act, 2013. The proposed amendments, originally announced as part of the Union Budget 2025-26, are now open for stakeholder comments till May 5, 2025.

Fast-track mergers were introduced in 2016 to facilitate quicker corporate restructurings between certain classes of companies without requiring approval of the National Company Law Tribunal (NCLT). Currently, this route is limited to:

- Mergers between two or more small companies

- A holding company and its wholly-owned subsidiary

- Two or more start-ups

- A start-up with one or more small companies

The proposed amendments significantly widen the scope of entities eligible for fast-track mergers by including the following new categories:

- Unlisted companies with low debt and no defaults: Mergers between unlisted companies (excluding Section 8 companies), where each has borrowings of less than INR 50 crore from financial institutions or corporate lenders and no defaults in repayment obligations. An auditor's certificate confirming compliance will be mandatory with the merger application.

- Holding companies and their unlisted subsidiaries: The proposed amendments allow any unlisted subsidiary (not necessarily wholly-owned) to merge with its listed or unlisted parent company.

- Fellow subsidiaries of the same holding company: Mergers between two or more unlisted subsidiaries of a common parent company would now be permitted, paving the way for more flexible intra-group consolidations.

- Inbound cross-border mergers: Provisions under Rule 25A(5), introduced in 2023, which allow a foreign holding company to merge with its Indian wholly-owned subsidiary, will now be formally included under Rule 25 itself, ensuring a consolidated and self-contained fast-track framework.

By removing the requirement for approval by the NCLT, the most significant benefit of the proposed amendments is the reduced compliance burden and approval timelines, allowing companies to restructure without having to navigate lengthy and often complex litigation. The reform is particularly supportive of start-ups and MSMEs, thus encouraging innovation and growth.

Additionally, by permitting mergers between fellow subsidiaries and expanding the scope of permissible holding-subsidiary combinations, the amendments promote group synergies and enable companies to undertake internal restructuring more efficiently. Introducing objective thresholds (such as debt limits and non-default status) has enabled more businesses to leverage simplified routes without compromising creditor protection or investor confidence. The proposed reform is a progressive step aligned with India's larger goal of enhancing its ease of doing business.

Recent Developments In India's Corporate & Commercial Laws - April 2025

Footnote

1. MK Jain v. Krrish Realtech Pvt Ltd, Company Petition (IB) No. 348 of 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.