The emergence of global crisis due to the novel coronavirus has led many corporate minds to ponder and step-in playing their part to be socially responsible to meet the need of the hour. In India, to encourage corporates towards fulfilling their social responsibility during the pandemic (as declared by the World Health Organisation) and as an endeavour to minimise its impact on public health, certain amends were made to the existing Companies Act, 2013 by the Legislators.

The Ministry of Corporate Affairs ("MCA") issued its first Notification in light of the novel coronavirus disease, also referred to as COVID-19, on March 23, 2020. This Notification specified the decision of the Government of India to treat COVID-19 as a notified disaster and included spending of funds towards the virus as an eligible CSR activity by automatically deeming such expenditure to be treated under item (i) and (xii) of Schedule VII of the Companies Act, 2013 relating to promotion of healthcare, sanitation and disaster management. At this point in time, the MCA had only clarified the inclusion of activities eligible for CSR spends and no emphasis was made on mode of divergence of funds towards such activities.

Many experts were boggled whether a centralised approach or a decentralised approach should be considered by the Government as a mode for accounting expenditure under CSR activities. Thereafter, on March 28, 2020, the MCA issued a second Notification, through an office memorandum, in relation to expenditure towards CSR whereby the MCA issued a clarification under item (viii) of Schedule VII of the Companies Act, 2013 which enumerates that contribution made to any fund set up by the Central Government for socio-economic development and relief qualifies as a CSR expenditure. This (second) Notification clarified that the Government of India had set up the Prime Minister's Citizen Assistance and Relief in Emergency Situations Fund ("PM CARES Fund") with the objective of dealing with emergency or distress situations in light of the COVID-19 pandemic.

Pursuant to the office memorandum issued by MCA on March 28, 2020, many stakeholders sought clarification from the MCA on the eligibility of CSR expenditure related to COVID-19, since this Notification only included PM CARES Fund as a mode of routing CSR spends towards public health and sanitation abridging the pandemic. To elucidate the confusion amongst stakeholders pertaining to the Circular, MCA, thereafter, by way of a general circular on April 10, 2020, provided clarification in relation to a certain set of frequently asked questions on certain permissible and non-permissible corporate social responsibility activities amidst COVID-19.

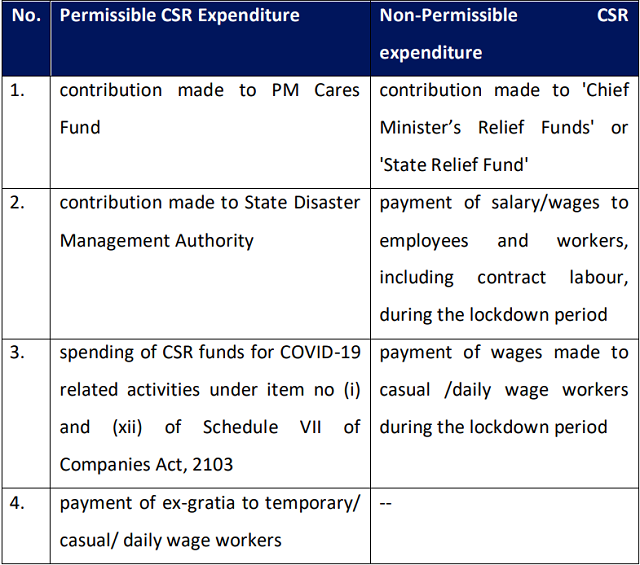

The below set table distinguishes the activities that may be accounted as a CSR expenditure from the activity that cannot be accounted for as a CSR expenditure pursuant to the clarification issued by MCA:

The MCA has therefore made it clear that any contribution made towards PM CARES Fund shall be treated as a permissible CSR expenditure as opposed to the Chief Minister Relief Fund or State Relief Fund. Further, donations made to PM CARES Fund shall also qualify for 80G benefits for 100% exemption under the Income Tax Act, 1961. Several companies have contributed towards CSR funds including Tata Trusts, Coal India Limited, Wipro and Azim Premji Foundation, Reliance Industries, JSW Group.

While Indian as well as global markets are battling against COVID-19, the introduction of expenditure made by stakeholders towards public health and sanitation as a measure to treat the novel coronavirus may be considered as a welcome move to encourage social responsibility amongst corporates.

Originally published 8 May, 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.