The income tax in Egypt applies to any natural person - Egyptian or foreigner – on theirincome from Egyptian sources, whether this income is a salary, from a self- employment, rent collections or fees for services.

The Ministry of Finance in Egypt has made many amendments to the Income Tax law to achieve the social justice. Latest amendment to this Law was issued on May 07,2020.

Based on this amendment, the first EGP15000 that the taxpayer earn annually in Egyptis tax-free, in addition, he will enjoy amount of EGP9000 as personal allowance.

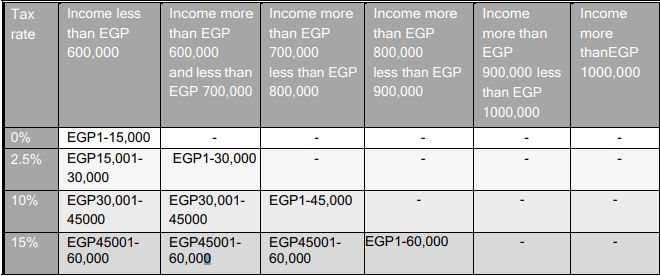

There is also another benefit has been added to this law, as there is classifying of the income levels to six brackets, according to which we can determine the rate of the taxthat will be deducted. As shown in the following table:

Practical case:

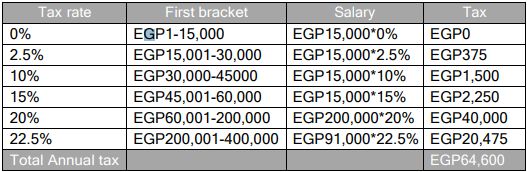

For instance, if an employee's salary is EGP30,000 per month, here is How we cancalculate his income tax.

EGP30,000 x 12 = EGP360,000

Based on his annual income, he will be in the first bracket, therefore the calculation willbe as following:

EGP360,000 – EGP9000 (Personal Allowance) = EGP351,000

According to the above calculation the monthly tax deduction for this employee willbe: EGP64,600/12= EGP5383.3.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.