- within Tax topic(s)

- within Tax topic(s)

The Financial Secretary of the Hong Kong SAR Government, the Honourable Mr. Paul Chan Mo-po delivered the 2022-23 Budget Speech in the Legislative Council on 23 February 2022.

Tax Highlights of the Budget Speech

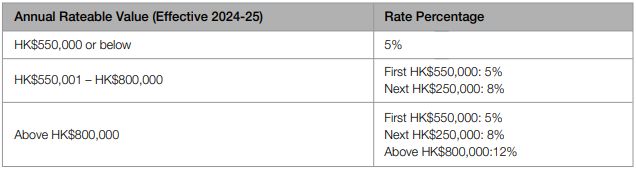

Rating System

Proposed progressive rating system for domestic properties to be rolled out in 2024-25, under which the rate to be charged on the rateable value will be changed from the current flat rate of 5% to progressive rates. Details of the new rating system are set out in the below table:

Other Levies

- Rates for non-domestic properties to be waived for the four

quarters of 2022-23, subject to a ceiling of HK$5,000 per quarter

in the first two quarters and HK$2,000 per quarter in the last two

quarters for each rateable non-domestic property.

- Rates for domestic properties to be waived for the four

quarters of 2022-23, subject to a ceiling of HK$1,500 per quarter

in the first two quarters and HK$1,000 per quarter in the last two

quarters for each rateable domestic property. Only those eligible

owners who are natural persons can apply for rates concession for

one domestic property under their name staarting from

2023-24.

- Business registration fees for 2022-23 to be waived.

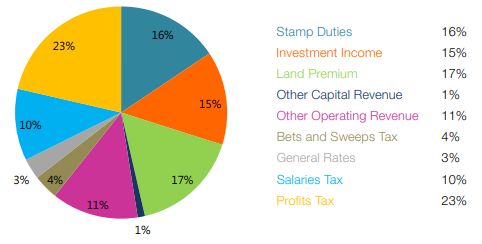

Analysis of Government Estimated Revenue for 2022-23

Economic performance of Hong Kong in 2021

In terms of economic performance, with the roll-out of vaccination schemes around the world as well as the strong fiscal and monetary support throughout 2021, global economic activities revived remarkably. Given the sharp rebound in demand from major economies, production and trading activities in Asia were vibrant. Meanwhile, the International Monetary Fund estimated that the global economy staged a strong rebound by 5.9% for 2021.

Hong Kong's overall economy saw a recovery in 2021 with a Gross Domestic Product growth of 6.4%, reversing the declining trend in the past two consecutive years. The labour market in Hong Kong continued to improve in 2021, with the seasonally-adjusted unemployment rate dropping substantially from 7.2% in early 2021 to 3.9% in the latest period (November 2021 to January 2022). Due to the continued recovery of the local economy and the accelerated rise in import prices, consumer price inflation increased progressively in 2021. However, owing to the fall in private housing rentals earlier on, the increase of the consumer price index remained mild. Netting out the effect of the Government's one-off measures, the underlying inflation rate was 0.6% for 2021 as a whole, down 0.7% from 2020 (1.3%).

As regards the non-residential property market, due to the recovery of the local economy and the abolition of the Double Stamp Duty imposed on non-residential property transactions in November 2020, there was a rebound in transaction activities last year. The Government indicated that it would continue to increase land supply and closely monitor the property market development.

Efforts to combat COVID-19

The Anti-epidemic Fund ("AEF") was set up in February 2020 to enhance Hong Kong's capability in combating COVID-19 and to provide relief for industries and members of the public hit hard by the epidemic. Recently, the Government approved a further injection of HK$27 billion into the AEF for the sixth round of relief measures for relieving the financial burdens of both individuals and businesses. Together with the fundings allocated during the last five rounds of relief measures, the total funding allocated by the Government to the AEF is HK$228 billion. The relief measures under the AEF, together with the counter-cyclical measures already launched in the previous two budgets, involved a total financial commitment of over HK$460 billion. Besides, the Government had devoted substantial resources to fighting the epidemic, including providing isolation facilities, setting up a temporary hospital, launching the vaccination programme, providing testing services and increasing the supply of medications, medical equipment etc., involving a total of over HK$24 billion.

According to the 2022-23 Budget Speech, the Government will allocate substantial additional resources in the coming financial year for combating COVID-19, including additional funding totaling HK$47.5 billion to strengthen testing work and provide additional support for the Hospital Authority, procure more vaccines as booster doses for the general public, procure anti-epidemic items and services, implement anti-epidemic measures, enhance environmental hygiene services and construct various anti-epidemic related facilities. Besides, the Government has earmarked HK$20 billion for other potential anti-epidemic needs.

In addition, among other measures to reduce the financial pressure of small and medium-sized enterprises ("SME"), the Government will also extend the application period of all guarantee products under the SME Financing Guarantee Scheme ("SFGS") for one year to the end of June next year. The Special 100% Loan Guarantee under the SFGS will also be further enhanced by increasing the maximum loan amount per enterprise from the total amount of employee wages and rents for 18 months to that for 27 months with the loan ceiling raised from HK$6 million to HK$9 million, and by extending the maximum repayment period from 8 years to 10 years.

To view the full article, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]