- within Tax topic(s)

- within Law Department Performance and Insolvency/Bankruptcy/Re-Structuring topic(s)

What's new in Germany

The Growth Opportunities Act (Wachstumschancengesetz), which came into force on 28 March 2024, brings significant changes to the transfer pricing rules for intercompany financing relationships, as outlined in Sections 1(3d) and 1(3e) of the AStG (German Foreign Tax Act). These new rules aim to combat profit shifting through inappropriate financing arrangements by refining the application of the arm's length principle to cross-border financing transactions.

The Federal Ministry of Finance (BMF) published a draft for the revision of the administrative regulations on transfer pricing principles on 14 August 2024 ("BMF draft regulations"), to deal with the new rules. The administrative regulations are only binding for the tax authorities, not for the taxpayers, and present the German tax administration's interpretation of the new rules and has significant meaning for the German TP practice.

The new rules are effective for tax assessment period 2024 and going forward. Especially, the provisions on interest deduction (Section 1 (3d) AStG) do not apply to expenses of financing relationships agreed and implemented before 1 January 2024, unless the continuing transaction is substantially amended after 31 December 2023 or continued beyond 31 December 2024.

Key take-ways

Limiting the interest deduction in German inbound cases

Section 1(3d) AStG stipulates financing expenses for a German domestic taxpayer arising from cross-border intra-group loans can only be deducted, if the taxpayer can credibly demonstrate that:

| Debt Service Capacity | Economic Necessity and Alignment with Business Purpose |

|---|---|

| he was able to meet the debt service obligations (interest and principal repayment) for the entire loan term from the outset. This shifts the burden of proof to the taxpayer, requiring detailed financial forecasts and documentation to demonstrate the borrower's ability to repay the loan. A follow-up financing can be considered in the forecast calculation. | the loan was economically necessary and used for his business purpose. Investments like parking funds in savings accounts or cash pools, for example, are considered generally not compatible with the core business of the company. The goal is to ensure that intra-group loans are used for legitimate business purposes, not as a tool for profit shifting. |

In addition, it emphasizes the principle of conformity of the (publicly) available group ratings: the financing expenses are only deductible to the extent the applied interest rate is equal or below the interest rate that would be granted by an external third party to the borrower based on the group credit rating. While there is an escape clause for individual cases, if the taxpayer can prove a different rating derived from the group rating is aligned with the arm's length principle. According to the explanatory memorandum of the law, the taxpayer must reliably present the creditworthiness assessment, including the arm's length quantitative and qualitative factors, as well as the effects of the group's belonging (implicit support).

Classification of routine financial services

Section 1(3e) AStG classifies intra-group finance activities, such as a pure brokerage service, forwarding of a financing transaction, and a typical treasury function as low-risk routine functions. According to BMF, if a group financing company lacks the ability and authority to control or bear the risk associated with a financing transaction, it is only entitled to a risk-free return as compensation. Based on the previous experience (not stipulated in the regulations, though), these companies' compensation would be calculated using the cost-plus method, with margins typically ranging from 5% to 10%. Financing functions typically serve as support functions for the core value-adding activities of a business. However, the situation differs when the financing function is a primary activity and a central component of the value creation model, such as in the banking or insurance sectors.

However, taxpayers can provide evidence that the financing company is performing non-routine activities, such as managing substantial financial risks (mainly the credit risks). In such cases, higher margins may be justified. This escape clause requires detailed functional and risk analyses to prove that the company takes on risks beyond the routine scope.

What is the problem?

The reliance on group rating is particularly controversial to the OECD recommendation for applying a stand-alone rating and may lead to significant documentation challenges and possibly increasing tax disputes. The question in particularly arises as to how one German group, which both grants and takes out loans, should deal with this new rule. The wording of section 1 (3d) AStG clearly focuses solely on inbound loans. This should logically also apply in the case of outbound loans. If that happens, outbound loans to foreign companies would become cheaper, resulting in German groups receiving less interest incomes when they grant loans.

In essence, §1 AStG is designed to safeguard Germany's tax base in cross-border transactions involving related parties. A possible application of a stand-alone rating in outbound cases by the German tax authorities is feasible through the escape clause, where the burden of proof would lie with the tax authorities. Additionally, the draft BMF regulations introduce the "Notch-Guide", offering a middle ground between group rating and stand-alone rating.

We should stay alert and monitor German transfer pricing audit practices as they evolve.

Actions needed

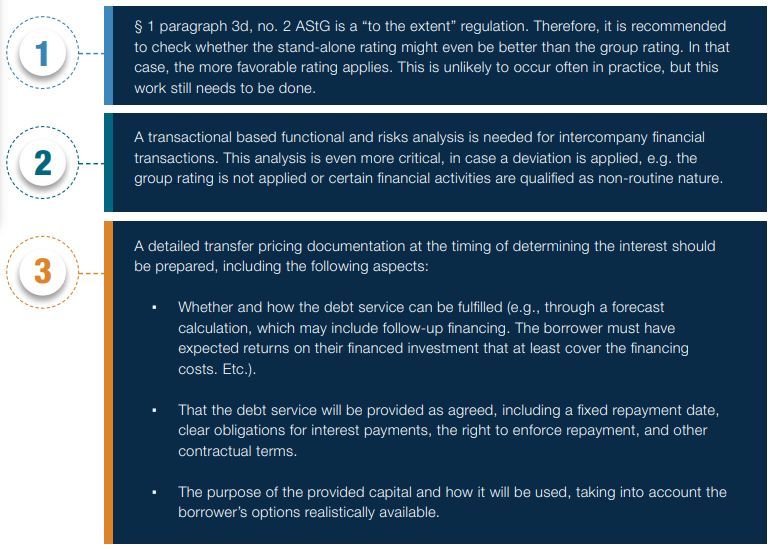

The new rules in Sections 1(3d) and 1(3e) introduce tighter compliance requirements for intercompany financing relationships.

As these rules apply retroactively from 2024, multinational groups should review and adjust existing financing arrangements to ensure compliance, especially considering the potential for increased scrutiny and disputes with tax authorities. The following working approaches may be inspiring:

Originally Published 23 September 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]