- within Finance and Banking topic(s)

- in United Kingdom

- with readers working within the Securities & Investment industries

- within Wealth Management, Law Practice Management and Coronavirus (COVID-19) topic(s)

EBA RECOMMENDS AN EQUIVALENCE REGIME IN PRINCIPLE, THOUGH REAL-WORLD IMPLEMENTATION MAY PROVE CHALLENGING

(A) Introduction – EBA's Constructive Appraisal of the EU Covered Bond Framework and the Growing EU Covered Bond Market, including the promise of an Equivalence Regime

The European Banking Authority ("EBA") published, in response to the European Commission's ("EC") call for advice of July 2023, its advice on the EU Covered Bond Framework (the "EBA Advice") on 23 September 2025.

The EBA Advice is detailed in nature, covering recommendations to improve the EU Covered Bond Framework, focusing on the main components of Directive (EU) 2019/2162 (the Covered Bond Directive - "CBD") 1 (including, amongst other items, the scope of eligible assets and composition of cover pools (including derivative contracts), the role of the cover pool monitor, coverage and overcollateralization requirements, liquidity requirements and the requirements for soft-bullet covered bonds with extendable maturities).

As requested by the EC, the EBA Advice also covers the advantages and disadvantages of the introduction of an equivalence regime for "third-country covered bonds", the conditions which would need to be in place for an equivalence assessment for such covered bonds and suggestions as to the design and process of an equivalence assessment.

Based on the EBA's market review and feedback from industry leaders (including the European Covered Bond Council), the EBA Advice concludes, positively, that an equivalence regime for third-country covered bonds would expand the global investor base for EU issuers and affirm the European Union ("EU") legislative framework as a global benchmark for covered bond regulation.

(B) The Real-World Implementation of an Equivalence Regime – The Challenges that Lie Ahead

- Timing Challenges as the EU Covered Bond Framework Evolves: The EBA Advice proposes detailed changes to the EU Covered Bond Framework across the core provisions of the CBD and other relevant EU regulations. It is therefore very difficult to forecast when an equivalence regime could be implemented by the EC and, given the proposed evolution of the CBD and the EU Covered Bond Framework as a whole in coming years, the yardstick against which any equivalence determination could be made - the current provisions of the CBD (which provides a "minimum harmonization" regime for covered bonds of financial institutions established in the member states of the EU) or some later iteration of the CBD, once it has been further updated to align with some or all of the EBA Advice.

- Reciprocity of a Third Country's Covered Bond Framework for EU issuers of Covered Bonds: The EBA Advice proposes, as a component of an equivalence determination in respect of a third country's covered bonds, the requirement for the third country's regulator to provide a reciprocal determination in relation to the covered bonds of financial institutions established in member states of the EU. Whilst the CBD will, undoubtedly, become more harmonized if certain of the EBA Advice is implemented by the EC, the CBD will still, inevitably, provide for significant discretion for competent authorities across the EU in their implementation of the EU Covered Bond Framework, reflecting pan-European regional differences in residential and commercial-real estate markets and the provisions of related-mortgage loans. It may be challenging for a third-country regulator to review the regulatory environment for covered bonds in each of the 27 EU member states, assessing, in each case, aspects such as the relative strength of the domestic banks, bank regulation, residential mortgage underwriting (and other legal and regulatory requirements) and comparative loss history and make an umbrella determination to treat covered bonds as functionally equivalent in each EU Member State and, from a legal and commercial perspective, of the same risk profile, such that these covered bonds might receive an equal reciprocal treatment by the third-country regulator.

- Maturity of Domestic Markets: As mentioned under "Scope and Design of the Equivalence Assessment" below, the EBA has identified, as a precondition for triggering an equivalence determination, the requirement for the third-country regulator to demonstrate the maturity of its domestic covered bond market, including the domestic investor base, currency make-up (other than the euro), repo-eligibility, favorable prudential treatment and market growth. It is unclear what degree of importance that the EC might attach to this precondition. This is an important question as the domestic covered bond markets of third countries are, by comparison to the size of the EU market, relatively small. The issue in these markets of local-currency covered bonds increased somewhat during the pandemic, as central banks added covered bonds to the list of assets they would purchase to stabilize credit markets and provide for monetary easing, as well as expanded and simplified the assets that financial institutions could pledge to obtain central bank funding. However, post-pandemic, such issuance in local currency in the domestic markets outside of the EU has since declined once more. The likelihood of attracting high levels of sophisticated investors in these domestic markets to purchase covered bonds denominated in euro must, against this backdrop, be considered low. Moreover, it remains uncommon for EU financial institutions to seek to access these third-country domestic markets directly, given that issuance and purchase (settlement, clearing and transfer) of covered bonds in the currencies of these domestic markets is available to EU issuers and EU sophisticated investors through the international clearing systems. Questions therefore arise as to the value of such a precondition (and whether this focus is misplaced or not) for triggering an equivalence determination, as it may delay or otherwise impede the stated goal of the EU reforms to expand the EU Covered Bond Framework as a global benchmark for covered bond regulation.

In view of these challenges, real-world implementation of an equivalence regime for third-country covered bonds may prove challenging.

WHY DOES AN EQUIVALENCE REGIME MATTER?

The introduction of a third-country equivalence regime would have significant implications for the regulatory treatment of non-EU covered bonds and, for the financial institutions of third countries that play an increasingly important part in the EU covered bond market, investor sentiment in, and the pricing and liquidity of, their covered bonds.

The preferential treatment, in particular, relates to the following three dimensions:

- Eligibility for preferential capital treatment under Regulation (EU) 575/2013 (the Capital Requirements Regulation - "CRR")2

- Eligibility for the Liquidity Coverage Requirement ("LCR") (and Net Stable Funding Ratio ("NSFR"))

- Eligibility for repo transactions with the European Central Bank ("ECB")

Currently, EU banks investing in third-country covered bonds are unable to benefit from preferential capital treatment (risk weights3) or preferential Loss Given Default (LGD)4 for covered bonds under the CRR5 , even if credit rating agencies consider such third-country covered bonds to be functionally equivalent and as creditworthy as the covered bonds of EU banks.

Accordingly, as long as an equivalence regime has not been introduced, covered bonds that do not meet the criteria and requirements for eligible covered bonds according to the CRR (including covered bonds issued by a financial institution established outside the European Economic Area) are not eligible for preferential risk weights of 10% or the preferential LGD value of 11.25%, and can only be assigned a risk weight of 20% and an LGD of 45% for senior exposures without eligible collateral, reducing the attractiveness of such covered bonds to large constituents of the EU investor base (including EU banks).6

Consequently, an equivalence decision could, potentially, unlock the preferential treatment for qualifying third-country covered bonds under the CRR, making them more attractive to EU investors, thereby having a positive pricing benefit to the third-country financial institutions which issue covered bonds into the European capital markets.

In terms of liquidity, third-country covered bonds may, today, qualify as Level 2A assets under the EU Liquidity Coverage Ratio (LCR) framework, but only after a case-by-case assessment of supervisory equivalence.7 A formal equivalence regime under the CBD would, in the EBA's view, also streamline and standardize this recognition process for liquidity purposes, as an equivalent third-country covered bond regime under the CBD would imply equivalent supervisory and regulatory arrangementsThe ECB currently applies a flexible, case-by-case approach to the eligibility of third-country covered bonds as collateral, particularly for covered bonds from "non-EEA G10 countries". 8 Non-EEA G10 countries under the CBD are Canada, Japan, Switzerland, the United Kingdom and the United States. The establishment of an equivalence regime under the CBD could, in the EBA's view, potentially standardize future collateral eligibility decisions by the Eurosystem.

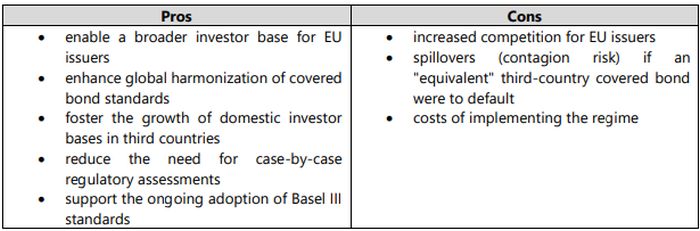

The EBA has identified several pros and cons associated with the proposed regime:

The EBA ultimately concludes that the benefits of a third-country equivalence regime for covered bonds outweigh the risks, particularly as, in its view, reciprocity and robust safeguards can help mitigate potential downsides. The EBA makes, accordingly, the following recommendation:

"Having considered the pros and cons, and in view of the current policy momentum that followed the introduction of a preferential risk weighting at a global level in the Basel Accord, the EBA is of the opinion that there is a relevant case to develop a third country equivalence regime."

SCOPE AND DESIGN OF THE EQUIVALENCE ASSESSMENT

(a) Preconditions for triggering the equivalence assessment

To trigger an equivalence assessment, the EBA has identified the following core conditions:

- Scope of Regime: The third country's covered bonds must be issued by supervised credit institutions such that they can be subject to a prudential and supervisory regime that is at least equivalent to that of the EU9

- Core structural aspects: The covered bonds must be dual recourse debt instruments which benefit from a preferred creditor status over segregated cover assets under domestic insolvency law (please see under "Principles for the equivalence assessment" for further detail)10

- Maturity of domestic market: The third-country regulator must demonstrate the maturity of its domestic covered bond market, including domestic investor base, currency make-up (other than the euro), repo-eligibility, favorable prudential treatment and market growth

- Supervisory cooperation and, potentially, reciprocity: Both must be on the cards – the third country's regulator(s) must commit to treating EU covered bonds on an equivalent basis within their own jurisdiction (e.g. preferential capital treatment) and be ready to cooperate and exchange information with their EU counterparts – as mentioned above, the equivalence determination by a third country's regulator is likely to be a tough proposition, given the minimum harmonization of the terms of covered bonds across member states of the EU and the fact that, if the EBA Advice is to be implemented, in whole or in part, the CBD and CRR will need to be updated over time

(b) Scope of the equivalence assessment

If the EC makes a positive determination, the third-country covered bonds may be treated as "European covered bonds". However, for the third-country covered bonds to benefit from preferential capital treatment, the EBA is of the view that an additional determination should be required of the EC.

This additional determination may involve either a Commission-validated equivalence of the third country prudential framework, accompanied by an official list of eligible "premium-like" covered bonds compiled by the third country authority or a contractual (or offer-level) confirmation of Article 129 CRR compliance, supported by a certified legal review for investors and supervisors:

"The compliance of the third country regime with Article 129 of the CRR shall be ensured via a confirmed equivalence of the framework with CRR requirements performed by the EBA and validated by the COM, coupled with either a list of domestic eligible 'premium-like' covered bonds provided by the third country authority, or checked contractually and confirmed by a review provided by a certified legal firm upon request of the investor."

As the main benefit for a third-country covered bond issuer under an equivalence regime will be the granting of a "premium" label, the technical legal assessment of the third-country regime against Article 129 of the CRR will become a critical aspect for third-country covered bond issuers and their legal counsel under this proposed equivalence regime.

PRINCIPLES FOR THE EQUIVALENCE ASSESSMENT

The EBA concludes that the equivalence regime should balance the need for safety and investor protection with the flexibility required to accommodate different legal and market models across jurisdictions. In the EBA's words:

"...it will be challenging to strike the right balance between the safety features of product components and the necessary flexibility for third countries and their market traditions...".

The EBA considers that the principles to be evaluated as part of the equivalence assessment should include:

| Structural features |

Dual recourse: the covered bonds constitute unconditional payment obligations of the issuer (first layer of recourse), secured on a defined pool of assets in the case of issuer insolvency or resolution (second layer of recourse), with the covered bond creditors at least pari passu with other unsecured creditors in the general insolvency proceedings over the issuer's general estate to the extent claims of these covered bond creditors remain unpaid after execution of their security right over the segregated assets (third layer of recourse)11 Bankruptcy remoteness: the payment obligations attached to covered bonds are not subject to automatic acceleration upon the insolvency or resolution of the relevant credit institution12 Eligible cover assets: the third-country framework must allow for assets similar to those set out in the CBD to be eligible as cover assets for the covered bonds13 Composition of the cover pool: the third-country covered bond framework should require the composition of the cover pool to limit risk concentrations with regard to obligors, collateral assets and sectors14 |

| Principles for European Covered Bond label |

Segregation of cover assets: the cover assets must be segregated from the issuer's general/insolvency estate, putting the cover pool beyond the legal reach of non-covered bond creditors15 Cover pool monitor: the segregation requirements and sufficiency of eligible assets must be monitored by a qualified, independent external party who is free of any potential conflict of interest16 Coverage requirements: the covered bonds shall be secured by claims for payment attached to the cover assets, including those necessary to comply with requirements of minimum statutory or contractually committed over-collateralization17 Cover pool liquidity buffer: cover pools shall, at all times, include a liquidity buffer composed of liquid assets available to cover the net liquidity outflows of the covered bonds18 Conditions for extendable maturities: if maturity extensions are permissible, the conditions for extension shall be specified in the covered bond law and shall meet the requirements of Article 17 para. 1 of the CBD |

| Covered Bond public supervision |

Public supervision: a public authority shall be tasked by law with supervision of issuers' compliance with mandatory covered bond law (including in the event of insolvency or resolution)19 Powers of competent authorities for the purposes of covered bond public supervision: The public authority shall have the powers necessary to perform covered bond supervision (investigative/exploratory powers and enforcement and sanction powers) 20 |

NEXT STEPS

The EC will now consider these recommendations and may elect to make legislative proposals, though the EC's timetable remains uncertain.

We will continue to alert our clients to the EC's follow-up and any potential legislative proposals.

Footnotes

1. See: EU Covered Bond Directive.

2. See: EU Capital Requirements Regulation.

3. Pursuant to Article 129 para. 4 and 5 CRR covered bonds may be assigned a lower risk weight (starting at 10 %) under the internal risk based approach if they fulfill the requirements of Article 129 para.1 CRR.

4. Pursuant to Article 161(1)(d) CRR covered bonds under the internal risk-based approach may be assigned an LGD value of 11,25 %.

5. Article 129 para 1 of the CRR refers to covered bonds as defined in point (1) of Article 3 of the CBD, i.e. a debt obligation that is issued by a credit institution in accordance with the provisions of national law transposing the mandatory requirements of the CBD and that is secured by cover assets to which covered bond investors have direct recourse as preferred creditors.

6. See Article 161(1)(a) CRR.

7. Pursuant to Article 11 para. 1 (d)(ii) of Commission Delegated Regulation (EU) 2015/61 to be eligible as Level 2A assets covered bonds issued by credit institutions in third countries must, inter alia, comply with the following requirement: "...the issuer and the covered bonds are subject by the national law in the third country to special public supervision designed to protect bondholders and the supervisory and regulatory arrangements applied in the third country must be at least equivalent to those applied in the Union.".

8. Article 70 para. 6 of the ECB Guideline (EU) 2015/510 provides the following requirement debt instruments issued by issuers established in a non-EEA G10 country: "Debt instruments issued by issuers established in non-EEA G10 countries shall only be considered eligible if the Eurosystem has ascertained to its satisfaction that its rights would be protected in an appropriate manner under the laws of the relevant non-EEA G10 country."

9. See Article 107 para. 4 CRR; This requirement implies equivalence of treatment of unsecured exposures as per Article 119 of the CRR and it is assessed against Commission Implementing Decision (EU) 2021/1753 on the equivalence of the supervisory and regulatory requirements of certain third countries and territories for the purposes of the treatment of exposures in accordance with the CCR.

10. See definition of covered bond in Article 3 para 1 CBD.

11. See Article 4 para. 1 and 2 CBD.

12. See Article 5 CBD.

13. See Articles 6,7 and 11 CBD.

14. See Article 6 para. 8 and Article 10 CBD.

15. See Article 12 CBD.

16. See Article 13 CBD.

17. See Article 15 CBD.

18. See Article 16 CBD.

19. See Articles 18 and 20 CBD.

20. See Articles 22 CBD.

Visit us at mayerbrown.com

Mayer Brown is a global services provider comprising associated legal practices that are separate entities, including Mayer Brown LLP (Illinois, USA), Mayer Brown International LLP (England & Wales), Mayer Brown (a Hong Kong partnership) and Tauil & Chequer Advogados (a Brazilian law partnership) and non-legal service providers, which provide consultancy services (collectively, the "Mayer Brown Practices"). The Mayer Brown Practices are established in various jurisdictions and may be a legal person or a partnership. PK Wong & Nair LLC ("PKWN") is the constituent Singapore law practice of our licensed joint law venture in Singapore, Mayer Brown PK Wong & Nair Pte. Ltd. Details of the individual Mayer Brown Practices and PKWN can be found in the Legal Notices section of our website. "Mayer Brown" and the Mayer Brown logo are the trademarks of Mayer Brown.

© Copyright 2025. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.