- within Media, Telecoms, IT and Entertainment topic(s)

- in Asia

- in Asia

- in Asia

- within Media, Telecoms, IT, Entertainment, Energy and Natural Resources and Employment and HR topic(s)

1 Introduction

The Capital Requirements Policy (hereinafter the 'Policy') serves as a foundation for the financial soundness of legal entities holding a licence issued by the Malta Gaming Authority (hereinafter 'MGA' or 'Authority') to provide a gaming service by remote means and/or a critical gaming supply.

The Policy aims to ultimately safeguard the integrity and sustainability of the gaming industry by obliging Licensees to have sufficient resources available for their continued and sustainable operation, in line with the Authority's regulatory objectives enshrined in Article 4 of the Gaming Act (Chapter 583 of the Laws of Malta) (hereinafter the 'Act').

Pursuant to the above, the Policy delineates the minimum share capital requirements, the obligation to maintain a Positive Equity Position, as well as the process to be followed by Licensees when their equity is depleted to a Net Liability Position.

2 Applicability

The Policy is applicable to both Licensees and Licence Applicants, as defined within the Policy.

3 Minimum Share Capital Requirements

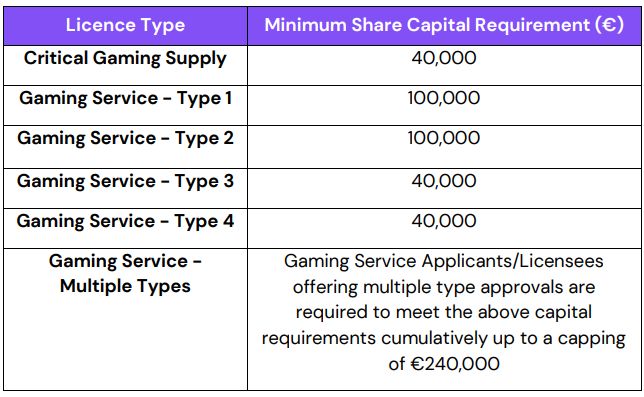

Applicants and Licensees shall be required to satisfy, hold and maintain a minimum nominal share capital (hereinafter referred to as the 'Minimum Share Capital') as stipulated in the table hereunder throughout the duration of the licence. For the sake of clarity, the Minimum Share Capital shall be comprised exclusively of issued and paid-up share capital and share premium reserves.

In the case of an Applicant for a Corporate Group Licence, the Minimum Share Capital required may be either singularly satisfied by one Corporate Group Entity which will be covered by the prospective Corporate Group Licence (the 'Prospective CRP Entity') or cumulatively and not necessarily equally, by two or more Prospective CRP Entities. With respect to existing Corporate Group Licences, the above shall be satisfied by the Corporate Group Entity covered by the Corporate Group Licence (hereinafter 'CRP Entity') or cumulatively and not necessarily equally, by two or more CRP Entities.

4 Fulfilment of Minimum Share Capital Requirement

By virtue of Regulation 9 (1) of the Gaming Authorisations Regulations (S.L. 583.05), the Authority, in line with the governing principles and in furtherance of the regulatory objectives established by the Act, is prescribing licence prerequisites. The Minimum Share Capital requirements emanating from this Policy shall be construed as such, and the Authority reserves the right to reject an Applicant that does not satisfy the said requirements.

The Policy is a binding instrument in terms of Article 7 (2)(a) of the Act.

5 Maintaining a Positive Equity Position

In pursuit of ensuring that Licensees are in a financial position to be able to sustain their operations, Licensees are required to have and maintain a Positive Equity Position throughout the duration of their licence. The Authority will ascertain whether a Licensee has a Positive or Negative Equity Position by considering the total assets and liabilities reported within the Licensee's financial statement. The equity position shall be comprised of the Minimum Share Capital and reserves classified as equity within the Licensee's statement of financial position.

The Authority acknowledges that, without prejudice to any other laws or regulations, it shall not require a Licensee to lock away its capital, and does not object to the use of equity for the Licensee's working capital needs.

In such case that a Licensee has a Negative Equity Position, such Licensee shall be required to restore such Negative Equity Position within the stipulated timeframe established by the Authority in terms of this Policy.

Without prejudice to Section 5.4 below, a CRP Entity which has not contributed to the Minimum Share Capital shall still be required to maintain a Positive Equity Position.

5.1 Restoring Equity Position - Type of Permissible Capital

A Licensee's Negative Equity Position may be restored through issued and paid-up share capital, share premium reserves, and other reserves or components classified as equity within the statement of financial position. In this regard, restoration of capital may not necessarily be effected by additional funding, as above-mentioned, but may be achieved through the conversion of existing shareholders' loans to capital.1

5.2 Restoring Equity Position – Timelines

Licensees closing their financial year end (hereinafter the 'FYE') with a Negative Equity Position shall be required to restore their capital within six (6) months from their FYE (hereinafter the 'Restoration Period'), regardless of whether the financial statements covering the previous financial year have been audited. The restoration of a Licensee's equity must result in a Positive Equity Position, irrespective of any further losses incurred during the Restoration Period.

During the Restoration Period, the Licensee is prohibited from increasing its loans payable until its equity position has been restored, as described above, or unless such loans qualify for classification as capital in accordance with International Financial Reporting Standards, or any other accounting standards which may be accepted by the Authority from time to time. This is without prejudice to the Authority's right to exercise its discretion to allow an increase in loans payable in exceptional circumstances, provided it is deemed justifiable by the Authority and the Licensee implements any of the necessary safeguards as specified in Section 5.4 of the Policy.

5.2.1 Worked Example

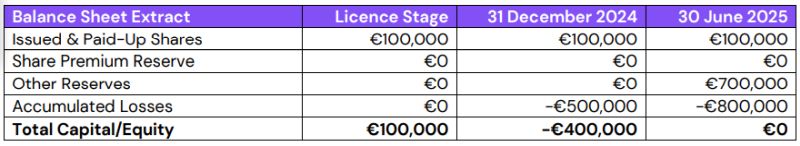

As illustrated in the table below, if a Licensee holds a gaming service Type 1 licence and as at 31 December 2024 (its FYE) it closed off with a Negative Equity Position of negative four hundred thousand Euro (-€400,000) then, in principle, its capital would need to be topped up by at least four hundred thousand Euro (€400,000) in order for its equity position to be restored. If, however, within the Restoration Period (i.e. the period covering 1 January to 30 June 2025) the Licensee incurs an additional loss of three hundred thousand Euro (€300,000), it shall ensure that the equity position as at 30 June 2025 is fully restored (i.e. €0 as at 30 June 2025) by capitalising at least seven hundred thousand Euro (€700,000).

5.3 Restoring Equity Position – B2B Licensees

Licensees who are solely licensed to provide a critical gaming supply (hereinafter 'B2B Licensees') pose a reduced risk and may incur significant start-up costs. In light of the foregoing, a B2B Licensee shall be obliged to restore its Negative Equity Position once it exceeds three million Euro (-€3,000,000). This notwithstanding, the Authority reserves the right to mandate an earlier restoration of equity, should it be deemed necessary in the interest of safeguarding the B2B Licensee's financial stability.

5.4 Derogation from Maintaining a Positive Equity Position

The Authority hereby notes that should a Licensee or, where applicable, a CRP Entity, be unable to Restore its Equity Position in terms of this Section, the Authority may allow derogation from such requirement in the following circumstances:

- The Authority is satisfied with the consolidated performance and stability of the Group to which the Licensee in a Negative Equity Position pertains;

- The Authority deems that sufficient safeguards have been implemented by the Licensee in the Negative Equity Position. Such safeguards may include, but are not limited to: a pledge in favour of the Authority over some or all of the assets held by the Group, the provision of bank and/or parent company guarantees, or insurance coverage; and/or

- CRP Entities that are unable to Restore their Equity Position may be exempted from being required to each Restore their Equity Position if the Licensee can demonstrate to the Authority that the consolidated financial statements of the Corporate Group Licence show a Positive Equity Position.

6 Enforcement

A Licensee shall continuously fulfil and comply with all relevant requirements and be responsible for all obligations emanating from this Policy in accordance with Regulation 3 (1) of the Gaming Compliance and Enforcement Regulations (S.L. 583.06). The Authority reserves the right to consider any nonadherence with this Policy and take any enforcement action in terms of the applicable legislation.

7 Transitory Period

Licensees granted a licence during the year 2025 or any subsequent year, shall be mandated to Restore their Equity Position by no later than 30 June of the year following the granting of the licence, regardless of their FYE. For the avoidance of doubt, any subsequent Negative Equity Position must be restored within the Restoration Period specified under Section 5.2 above.

Licensees with a Negative Equity Position as at 31 December 20242 shall not be required to fully Restore their Equity Position within the Restoration Period referred to in Section 5.2. Nonetheless, such Licensee shall be required to fully restore their equity position within an extended timeframe, to be determined by the Authority on a case-by-case basis, which period shall not exceed five (5) years from publication of this Policy (hereinafter the 'Extended Restoration Period'). In determining the Extended Restoration Period applicable to a Licensee, the Authority shall take the following into consideration:

- The Licensee's business model;

- The Licensee's operational status;

- The extent of the negative equity and the Licensee's financial performance as a whole;

- The overall financial standing of the CRP Entities and the Group; and

- The amount and frequency of the proposed capital injections.

The determination of the Extended Restoration Period shall be without prejudice to the Authority's discretion to request the Licensee to effect earlier capital injections and/or to restore the Negative Equity Position earlier, particularly in cases where the Licensee's Negative Equity Position continues accumulating during the Extended Restoration Period.

For negative equity levels exceeding €1 million as at 31 December 20243 , Licensees shall be required to submit a detailed recapitalisation plan to the Authority by 30 November 2025. The recapitalisation plan, which shall be subject to the Authority's approval, must outline how and when the equity will be restored and shall be accompanied with the latest financial statements as well as the forecasted financial statements4 elucidating such recapitalisation. Should material changes to the Licensee's financial standing occur during the Extended Restoration Period, the Authority reserves the right to request a revised recapitalisation plan and may also request earlier capital injections and/or the earlier restoration of its negative equity.

Footnotes

1. The restoration of a Licensee's equity position shall be permissible in this manner due to the fact that, in the event of insolvency proceedings, the Licensee's equity may be utilised to pay creditors, whilst shareholders' loans would rank equally to other creditors, thus leaving considerably less funds available to creditors in the latter case.

2. For a Licensee whose FYE does not fall in December, this shall be based on said Licensee's FYE for 2025.

3. For a Licensee whose FYE does not fall in December, this shall be based on said Licensee's FYE for 2025.

4. This shall as a minimum include the Statements of Comprehensive Income and Statement of Financial Position as well as a description of all assumptions considered in the preparation thereof.

Originally Published by Gaming Authority (MGA)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]