- within Finance and Banking topic(s)

- within Transport, Employment and HR and Antitrust/Competition Law topic(s)

- with Inhouse Counsel

- in Australia

Introduction

The Sustainable Finance Disclosure Regulation (SFDR), adopted in 2019 and in force since March 2021, was a foundational element of the EU's sustainable finance framework. Its primary aim was to increase transparency on how financial market participants, including asset managers, consider environmental, social, and governance (ESG) factors in their investment processes and products. By mandating detailed disclosures, the SFDR sought to combat greenwashing, protect investors, and channel private capital towards sustainable economic activities, thereby supporting the EU's broader sustainability and competitiveness objectives.

Being the first of its kind in the EU, the implementation of the current SFDR (now called "SFDR 1.0") has led to significant challenges: It has been criticised for its complexity, lack of clarity, and difficulties in practical application. Asset managers and other market participants have faced obstacles in interpreting and applying SFDR and aligning its requirements with other EU sustainable finance legislation. The use of Articles 8 and 9 SFDR as de facto product labels, without clear criteria, has led to inconsistent market practices and concerns about the effectiveness of investor protection.

In response, the EU Commission has now proposed a comprehensive review aimed at simplifying and streamlining SFDR (called "SFDR 2.0 Proposal"). The EU Commission aims to reduce administrative and disclosure burdens and at the same time safeguard the interest of investors by introducing product categories with minimum requirements and more streamlined disclosures.

It is important to note that the SFDR 2.0 Proposal is at an early legislative stage. Being a Level 1 regulation, it is subject to negotiation and potential amendment by the EU Parliament and the Council. As such, the final shape and requirements of SFDR 2.0 may change considerably before its adoption and entry into force. Until SFDR 2.0 starts applying (which will likely be 18 months after its entry into force), the current SFDR 1.0 framework remains fully applicable. Financial market participants should therefore continue to comply with existing requirements and are encouraged to stay informed of SFDR 2.0 legislative developments to anticipate future changes.

We are closely monitoring the legislative process and will keep clients informed of key developments and implications for their business.

Structure of SFDR 2.0

Main building blocks of SFDR 2.0

Proposal, FAQ and impact assessment are available on this EU Commission website.

- Definitions

- Sustainability risk managementv

- Product categories

- Product disclosures

- Naming and marketing

- Use of data and estimates

- Role of authorities

- Grandfathering and voluntary labels

- Submission to ESAP

- Level 2 delegation (replacing current Level 2)

- Application date and transitional provisions

- Product categories in PRIIPS KID

Scope and how SFDR 2.0 differs from SFDR 1.0

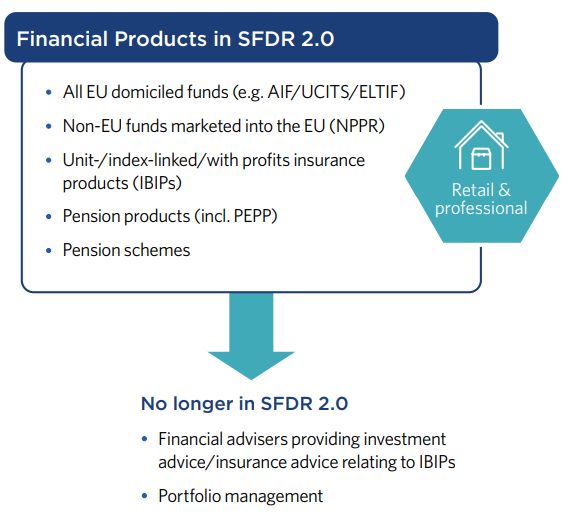

What is in scope of SFDR 2.0?

Grandfathering for existing products

- Opt-out for closed-ended products created and distributed

before SFDR 2.0 application date (see page 24)

- Regime for products opting out depends on contractual obligations to clients/investors (SFDR 1.0 no longer exists)

- No opt-out for alternative investment funds (AIFs) made available only to professional investors (different from leaked draft)

Phase-in for pension and insurance products

- For IBIPs, pension products and pension schemes that were not subject to the ESMA Guidelines on funds' names using ESG or sustainability-related terms (ESMA Fund Names Guidelines)

- Must only apply pre-contractual and periodic disclosures 12 months after the SFDR 2.0 application date (see page 24)

Scope and how SFDR 2.0 differs from SFDR 1.0

SFDR 2.0 versus SFDR 1.0 – comparison

New in SFDR 2.0:

- Product categories (Transition, ESG Basics, Sustainable, combined approaches)

- Minimum exclusions

- Minimum coverage (70% threshold)

- Impact add-on

- Naming and marketing rules

- Periodic disclosures for non-categorized products including information on consideration of sustainability factors

- Use of data and estimates

Removed from SFDR 1.0

- Portfolio management

- Financial advisers (investment advice, insurance intermediaries)

- Principal adverse impacts (PAI) at entity level

- Sustainable investments

- Good governance

- Additional product website disclosures

- Sustainability risks in remuneration policies

- Taxonomy for ESG Basics product category

Remains in SFDR 2.0

- Disclosures sustainability risk management – entity level

- Disclosures on sustainability risk management – product level

- Pre-contractual and periodic disclosures for categorised products (with new content and new Level 2 disclosure templates)

To view the full pdf, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.