- within Finance and Banking topic(s)

- within Finance and Banking topic(s)

- within Antitrust/Competition Law, Transport and Consumer Protection topic(s)

1 General introduction

Under the current Belgian REIT regime, an undertaking investing in real estate can either take the form of (i) a SICAFI/Vastgoedbevak (société d'investissement en immobilier à capital fixe/ vastgoedbeleggingsvennootschap met vast kapitaal), (ii) a SIR/GVV (société immobilière réglementée/ gereglementeerde vastgoedvennootschap) commonly named BE-REIT, (iii) an FIIS/GVBF (fonds d'investissement immobilier spécialisé/gespecialiseerde vastgoedbeleggingsfonds) or (iv) stay unregulated (meaning that only the laws applicable to companies in general, as set forth in the Belgian Company Code will apply). Due to their status of collective investment undertaking, SICAFI/ Vastgoedbevak and FIIS/GVBF are subject to additional obligations deriving from the AIFM Law1.

SICAFI/Vastgoedbevak and BE-REIT are public (i.e. stock-listed) real estate companies.

As an alternative to maintaining the attractiveness and competitiveness of Belgium, the possibility of taking the form of a BE-REIT has been introduced by the BE-REIT Law (as further implemented by the BE-REIT Decree) to allow undertakings investing in real estate that wish to opt for a regulated status (and thus benefit from a preferential tax regime) to avoid the burden of compliance with the Belgian AIFM Law.

An important difference between the SICAFI/Vastgoedbevak and the BE-REIT is that the latter is not an AIF, i.e. an entity that 'raises capital from a number of investors, with an intentionto investing it in accordance with a defined investment policy for the benefit of those investors'. Such a difference is clearly reflected in Article 4 of the BE-REIT Law. Pursuant to such article, the activities of a BE-REIT may only consist of (a) placing, directly or through a company in which it participates in accordance with the law and its implementing regulations, immovable property at the disposal of users, (b) if applicable, possessing 'immovable property'2 as mentioned in Article 2, 5° vi) to xi) of the BE-REIT Law within the limits of Article 7, b) of that same law3 and (c) participate in infrastructure projects as further defined by the legislation. The BE-REIT must thus mainly engage in an operational activity with a long-term strategy instead of an investment activity. The BE-REIT does, therefore, not follow a defined investment policy but has a business strategy based on creating long-term value (instead of engaging in buying in order to sell within the framework of a defined investment policy). To that extent, Article 4 of the BE-REIT Law requires the BE-REIT to (a) exercise its activities itself, (b) maintain direct relationships with its clients and suppliers and (c) have, for the purpose of exercising its activities as described above, operational teams at its disposal that make up an important part of its workforce. The fact that the BE-REIT engages in an operational/commercial activity also entails that, contrary to what is the case for the SICAFI/ Vastgoedbevak, the BE-REIT is not exclusively managed in the interest of the shareholders but must take into account the overall interest of the company.

The BE-REIT Law also provides for the possibility of an institutional BE-REIT (société immobilière réglementée institutionnelle/institutionele gereglementeerde vastgoedvennootschap), the shareholders of which qualify as 'eligible investors'. The institutional BE-REIT is not stock listed. In this respect, the conditions to convert into an institutional BE-REIT have been eased, and the list of 'eligible investors' provided by the BE-REIT Decree includes retail investors subject to a minimum investment value of EUR 100,000.

Last, the BE-REIT Law foresees the form of social BE-REIT, an unlisted vehicle dedicated to investment in real estate used for social purposes (e.g. education, care).

All former SICAFI/Vastgoedbevak have converted into BE-REIT, therefore only the BE-REIT regime is commented on below.

Sector summary*

Top five REITs*

* All market caps and returns are rebased in EUR and are correct as of June 28, 2024. The Global REIT Index is the FTSE EPRA Nareit Global REITs Index (EPRA, June 2024).

2 Requirements

2.1 Formalities/procedure

The BE-REIT must obtain a licence as a collective investment undertaking from the FSMA. Then it can be registered on the list of Belgian regulated real estate companies (BE-REIT list). The granting of the licence by the FSMA is based on a licence request comprising the following information, out of which the FSMA can assess the compliance with the BE-REIT Law and the BE-REIT Decree:

- The articles of association, which must, e.g. provide that the company has been constituted for an indefinite term;

- The demonstration of an appropriate administrative, accounting, financial and technical organisation that ensures independent management;

- The board of directors is composed only of individuals unless the BE-REIT has been incorporated under the form of a public limited liability company (société anonyme, SA/naamloze vennootschap, NV) managed by a sole director, in which case the sole director must be a public limited company managed by a collegiate board;

- The directors and the persons in charge of daily management have the appropriate professional reliability and experience to ensure independent management;

- Individuals supervise the effective daily management;

- A minimum investment budget has been determined for a period of three years as of the registration on the BE-REIT list;

- The BE-REIT has called upon one or more independent real estate experts, who are responsible for the valuation of the investment in real estate. Such experts have to be chosen from a list annexed to the application and may not have direct links to the so-called 'promoter' of the BE-REIT

- The real estate expert has the required professional reliability and experience;

- The BE-REIT complies with the rules on risk diversification;

- An entity in charge of the financial services is appointed;

- The identity of the 'promoter' and the confirmation of its obligations; and

- The BE-REIT commits to comply with the listing requirements.

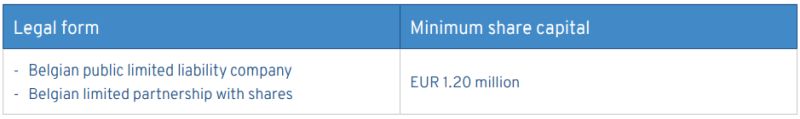

2.2 Legal form/minimum share capital and securities

Legal form

A BE-REIT must be a public limited liability company (société anonyme, SA/naamloze vennootschap, NV), incorporated for an unlimited period of time. The statutory seat and general management of the BE-REIT must be located in Belgium. Note that as a result of the entry-into-force of the new Code of Companies and Association, the corporate form of a limited partnership with shares (SCA/Comm VA) is not available anymore, meaning that existing BE-REITs having this corporate form shall have to convert into a public limited liability company (SA/NV) and if such conversion has not taken place before January 1, 2024, they will automatically be converted into public limited liability companies (SA/NV) with a single director on that day.4 The alternative offered by the Belgian Company Code to the former SCA/Comm VA is, therefore, the SA/NV with a single director, as the liability and the powers of such a single director can now be organised to reproduce the legal characteristics of the former SCA/Comm VA. In this respect, the single director can, e.g. be held jointly and severally liable with the BE-REIT if its Articles of Association provide so, could be granted a veto right for distributions, and can be revoked by a motivated decision of the general meeting of the shareholders at a three-quarters majority, even if appointed in the Articles of Association of the BE-REIT.

The status of BE-REIT is open to corporations only; a foreign entity that is similar to a BE-REIT cannot benefit from a passporting regime nor request the application of the BE-REIT (tax) regime to a branch it would have in Belgium and/or the real estate assets it directly owns in Belgium. This restriction might be considered contrary to European law further to the ECJ Ruling in case L-Fund (C-537/20 dd. April 27, 2023).

Minimum share capital and securities

The required minimum share capital amounts to EUR 1.20 million. In principle, each shareholder has an equal right to participate in the profits of the BE-REIT. However, different categories of shares may be issued if allowed by the articles of association. The BE-REIT is allowed to issue securities other than shares (e.g. bonds, convertible bonds) to the exclusion of profit shares (parts bénéficiaires/winstbewijzen).

A BE-REIT is also allowed to raise capital in cash through the so-called Accelerated BookBuild ('ABB') process without having to grant a preferential subscription right or irreducible allocation right to existing shareholders. The ABB refers to a capital increase in which the creation of the order book is spread over a short period of time of a few hours or a few days, with little or no means of publicity, so as to allow the company concerned to find financing quickly and/or to take advantage of special conditions of the market. Given the timing, this type of operation is carried out through the authorised capital technique. Please note that the cumulative capital increases via the ABB process cannot exceed 10% of the share capital upon the capital increase decision over a period of 12 months.

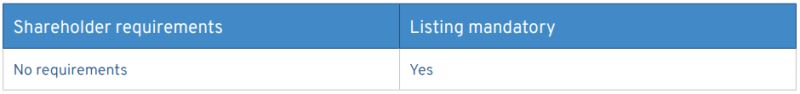

2.3 Shareholder requirements/listing requirements

Shareholder requirements

There are no specific shareholder conditions to fulfil to achieve BE-REIT eligibility.

Listing requirements

All shares of a Belgian BE-REIT must be listed on a stock exchange, with a minimum of 30% free float.

Listing can only occur after registration on the BE-REIT list and after publishing a prospectus. There are specific prospectus requirements for BE-REITs in Belgium.

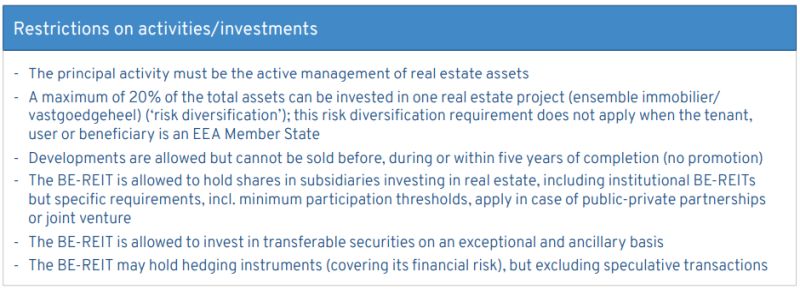

2.4 Asset level/activity test

Immovable property

The BE-REIT may only invest in 'immovable property', whether located in Belgium or not. This includes the following:

- Real estate and rights in rem on real estate;

- Shares with voting rights in real estate companies (including intermediary holding), whose share capital is held (directly or indirectly) for more than 25% by the BE-REIT;

- Option rights on real estate;

- Shares in BE-REITs and in institutional BE-REITs, whose share capital is held (directly or indirectly) for more than 25% by the BE-REIT;

- The units of a foreign collective investment undertaking to invest in real estate and registered on the Belgian FSMA list of foreign collective investment undertakings;

- The units of a collective investment undertaking to invest in real estate, established in the EEA and subject to an equivalent control;

- Real estate certificates;

- Shares of EEA REITs5;

- Shares of SICAFI/Vastgoedbevak;

- Shares of FIIS/GVBF; and

- Subject to limitations, rights resulting from financial leases as defined by IFRS and analogous rights of use.

A BE-REIT may develop real estate, provided that the BE-REIT maintains the completed developments for at least five years (i.e. promotion is prohibited).

On an exceptional basis, the BE-REIT is allowed to invest in transferable securities to the extent that the articles of association authorise such investments. In such cases, investments in transferable securities must be considered ancillary or temporary. Belgian law does not provide for any specific minimum or maximum requirements. The FSMA will exercise its discretion when examining the BE-REIT's articles of association.

The BE-REIT may hold hedging instruments covering its financial risk to the extent that the articles of association authorise such transactions. Speculative transactions are not allowed. The hedging strategy must be disclosed in BE-REITs' financial reports.

Public-private partnerships and infrastructure projects

The list of authorised activities of a BE-REIT includes the execution, as the case may be indirectly and/or in a joint venture, of DBF agreements, DB(F)M agreements, DBF(M)O agreements, or agreements for the concession of public works (i.e. the participation to public-private partnerships). Important to note: the BE-REIT can conclude this type of contract directly or in a joint venture with a project company (with such a project company having the possibility to opt for the status of institutional BE-REIT).

These agreements must relate to buildings or infrastructures for which:

- The BE-REIT is liable for their putting at disposal and maintaining or operating, for a public entity or the citizen as a final user; and

- The BE-REIT can assume, in whole or in part, the financing risk, the availability risk, the demand risk or the operation risk, and the construction risk.

The BE-REIT should also be allowed to take care, in the long term, of the development, establishment, management and operation, as the case may be in a joint venture and through sub-contracting of:

- Installations and warehouses for the production, transport, distribution or stocking of energy in the broad sense;

- Installations for the transport, distribution, stocking and purification of water; and

- Incinerators and waste installations.

The infrastructure activity can also be operated by a project company in which the BE-REIT shall participate. In such a case, and as a derogation to the minimum participation threshold, the BE-REIT is allowed to take initially a participation of less than 25% in the share capital of the project company concerned, provided that this percentage is increased within two years (or a longer period of time if required by the public partner) after the construction phase, in order to comply with the minimum participation requirement for investing in a joint venture. The project company can also opt for the status of institutional BE-REIT and benefit from its tax regime.

Risk diversification

The BE-REIT may not invest more than 20% of its total assets into one single 'real estate project'. A 'real estate project' is defined as 'one or more properties in which investment risk is to be considered as a single risk for the BE-REIT'. According to the FSMA, the concept of a real estate project is based on the idea that separate properties can nevertheless represent a single real estate project from the point of view of the investment risk associated with them6.

This risk diversification requirement and limit of 20% of the BE-REIT's assets do not apply when an EEA Member State is the tenant, user or beneficiary.

Under certain specific conditions, it is possible to obtain a derogation of this rule from the FSMA, provided that the leverage limit of the BE-REIT does not exceed 33% of its consolidated assets.

The FSMA has recently clarified that an Investment by the BE-REIT in a FIIS can be qualified as an investment in shares with voting rights in real estate companies (in which case, these holdings would not be limited by the 20% threshold provided for in the BE-REIT Law) provided i) the relevant FIIS has explicitly opted for FIIS status, even if it does not qualify as an AIF within the meaning of the AIFM Directive 2011/61/EU (such as, for example, a FIIS with only one investor) and ii) the FIIS meets the definition of a real estate company within the meaning of the BE-REIT Law.

It is also specified that the restriction for the BE-REIT to grant loans or vest securities for third parties does not apply in the framework of the infrastructure activities described for public-private partnerships in view of a bid bond or similar mechanism. Subject to a series of conditions, the limit according to which a mortgage or other guarantee cannot exceed 75% of the relevant asset's value is also not applicable, and the indebtedness related to those infrastructure projects is also not subject to the leverage limit and not taken into account to determine the leverage limit of a BE-REIT.

Joint ventures

Considering the interests of the BE-REIT's investors, the regulation also contains specific provisions applicable to joint ventures.

The minimum participation required is 25% (plus one share) in the capital of the subsidiary, which can also opt for the status of institutional BE-REIT. For the BE-REIT, those participations (in the absence of exclusive or joint control) cannot exceed 50% of its consolidated assets.

It is prohibited for a BE-REIT to enter into a shareholder's agreement that derogates its vote cast according to its participation (being at least 25% plus one share) in a joint venture.

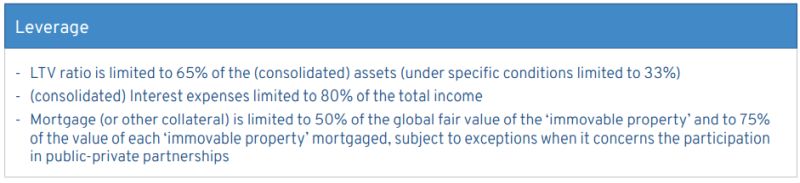

2.5 Leverage

Belgian legislation requires that the aggregate loans do not exceed 65% of the total fair value of the assets of the BE-REIT (at the time of entering into the loan). Furthermore, the annual interest costs may not exceed 80% of the total annual operational and financial income. If the BE-REIT holds shares in affiliated companies investing in real estate, the leverage restrictions will be applicable on a consolidated basis.

In order to guarantee proactive management, the BE-REIT must present a financial plan to the FSMA as soon as its consolidated debt-to-asset ratio exceeds 50%.

In the case of the BE-REIT has obtained a derogation to the risk diversification rule, the debt-to-asset ratio may not exceed 33%.

A BE-REIT may only vest a mortgage (or other collateral) on real estate in relation to the financing of its 'immovable property' activities or the 'immovable property' activities of the group. The total amount covered by a mortgage (or other collateral) may not exceed 50% of the total fair value of the 'immovable property' held by the BE-REIT and its subsidiaries. Moreover, it is not allowed to vest a mortgage (or other collateral) on one immovable property for more than 75% of its fair value, except in the case of infrastructure activities in relation to public-private partnerships.

2.6 Profit distribution obligation

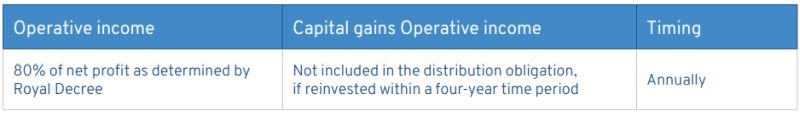

Operative income

Subject to the provisions of Belgian corporate law on capital protection, Belgian legislation requires the BE-REIT to distribute on an annual basis the positive difference between (i) 80% of its net operational result (as determined by Royal Decree) and (ii) the net decrease of its indebtedness7 . No distribution is allowed if the (statutory or consolidated) indebtedness ratio exceeds 65% or will exceed this limit due to the distribution.

The same profit distribution obligations also apply to institutional BE-REITs.

Capital gains

Capital gains are not included in the distribution obligation, provided the capital gains are reinvested within four years.

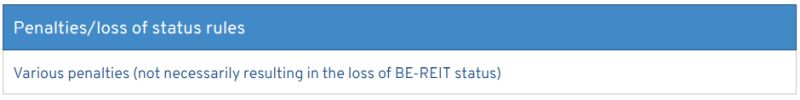

2.7 Sanctions

If the FSMA concludes that the BE-REIT does not observe the laws, regulations and/or its articles of association, this does not necessarily lead to a loss of BE-REIT status. Instead, the FSMA may, for example, make the necessary recommendations to the BE-REIT to remedy the situation, subject to a grace period, which can be linked to a penalty of a maximum of EUR 50,000 per day of delay with a total of EUR 2,500,000. Or, the FSMA might impose temporary sanctions (for example, a public notice). The FSMA could also ask the market authorities to suspend the listing of the shares of the transgressing BE-REIT. The ultimate penalty would be to omit the BE-REIT from the BE-REIT list. The BE-REIT would then lose its status and would become a regular (stock-listed) real estate company. The official loss of status would start as of the date of notification. Additionally, if there is an intentional infringement of certain laws and regulations, a prison sentence and/or a fine could be imposed on the directors of the BE-REIT, as well as on the 'promoter' of the BE-REIT.

The loss of BE-REIT status, which entails the switch from (i) accounts in IFRS to accounts in Belgian GAAP and (ii) tax-exempt status to taxable status, shall also have tax consequences. A recent ruling has clarified these consequences:

- With respect to the results of the year concerned, they will be subject to the BE-REIT tax regime until the loss of the regime and to the ordinary corporate income tax from this date;

- The share capital of the BE-REIT, in the sense of the corporate law legislation, shall be considered fiscal capital for the purposes of corporate income tax and withholding tax;

- The retained earnings, not yet distributed, of the BE-REIT, built up under the BE-REIT status, shall be considered taxed reserves for the purposes of corporate income tax and withholding tax; these retained earnings have indeed been subject to their own tax regime; and

- The revaluation surplus corresponding to the latent gain that has been subject to the exit tax shall be considered a taxed reserve for the purposes of corporate income tax and withholding tax; this revaluation surplus has indeed been subject to its own tax regime. In case these revaluation surpluses have not been subject to the exit tax, they will be considered tax-exempt reserves.

2.8 Institutional BE-REIT

The institutional BE-REIT status is available to companies investing in 'immovable property' as defined above or participating in public-private partnerships, provided that their share capital is owned, directly or indirectly, for 25% + one share by a BE-REIT. The capital of institutional BE-REIT is open to institutional or professional investors but also to retail investors, subject to a minimum investment value of EUR 100,000.

The fact that the status of institutional BE-REIT is available only to subsidiaries of BE-REITs (and not to subsidiaries of other EU REITs) might be considered to be contrary to EU law8.

Even though the institutional BE-REIT's regulatory regime is less stringent, it is still subject to FSMA supervision. The key regulatory features are as follows:

- Given its capacity as a subsidiary of a BE-REIT, certain requirements applicable to BE-REITs should also impact the institutional BE-REIT. The risk diversification requirement of the BE-REIT is assessed on a consolidated basis. As the real estate expert is appointed to appraise the BE-REIT's assets and those of its subsidiaries, it was not necessary to subject institutional BE-REITs to the same obligation. Financial reporting obligations apply only to BE-REITs, but they concern consolidated information;

- Like BE-REITs, institutional BE-REITs can issue shares and bonds but with the exclusion of profitsharing certificates. In the case of capital increase by contribution in kind, an institutional BE-REIT fully controlled by a BE-REIT or its subsidiaries is not subject to the requirement of a minimum subscription price. Specific requirements also apply to institutional BE-REITs jointly controlled by BE-REIT in the case of capital increase by contribution in cash with a discount of more than 10%. Other capital transactions are subject to the common corporate law regime; and

- The institutional BE-REIT is subject to the same distribution requirements.

2.9 Social BE-REIT

A new type of non-stock listed BE-REIT is created to finance and promote investments in 'care', subject to their accreditation by the competent authority, and defined as infrastructures dedicated to

- The housing or care of disabled persons;

- The housing or care of elderly persons;

- The care or help of youth persons;

- The collective welcoming and care of children under the age of three;

- The teaching and accommodation of students;

- The operation of a psychiatric institution; or

- The operation of a revalidation centre.

Social BE-REITs are incorporated as cooperative companies with a social purpose, having a minimum fixed capital of EUR 1,200,000. The variable capital can be subscribed by retail investors in a proportion to be determined by Royal Decree. Due to their corporate form, they guarantee a dividend of a maximum of 6% (after deduction of the withholding tax) per year, but the exit is only structured as a buy-back of shares at nominal value. The social BE-REIT must build up a liquidity reserve to execute these buy-back orders, which can themselves be limited.

Important to note that the corporate form of a cooperative company with a social purpose no longer exists under the new Code of Companies and Associations, and the BE-REIT Law has not yet been updated to reflect these changes.9

The social BE-REIT can only invest in 'real estate assets' as defined by the Civil Code and in leasing. Its indebtedness level cannot exceed 33% of its asset value.

2.10 Qualification as an AIF

The BE-REIT does not qualify as an AIF.

3 Tax treatment at the level of the BE-REIT

Unless indicated otherwise, the tax treatment applies to a BE-REIT, an institutional BE-REIT, and a social BE-REIT.

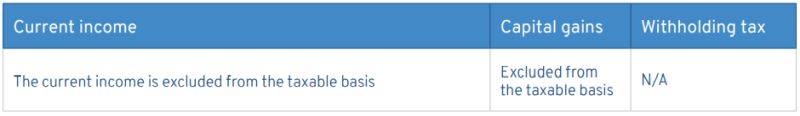

3.1 Corporate tax/withholding tax

The BE-REIT is formerly subject to the Belgian corporate income tax at the rate of 25%. However, the taxable basis is reduced (i.e. de facto zero or nearly zero taxable basis). A BE-REIT is taxed on an accrual basis only on the sum of the non-arm's length benefits received and the expenses and charges due that are not deductible as expenses for tax purposes (other than reductions in value and capital losses on shares), and the undisclosed salaries and commissions. The taxable basis does thus not include rental income or other types of business income, nor exceeding borrowing costs pursuant to ATAD I (Anti-Tax Avoidance Directive).

Due to the fact that the BE-REIT enjoys its own favourable tax regime that allows for a very low tax basis, it is not entitled to take advantage of the Belgian participation exemption nor of the Belgian notional interest deduction regimes. Additionally, Belgian law explicitly excludes a BE-REIT from the foreign tax credit on foreign source income.

Capital gains

Capital gains are excluded from the taxable basis, provided they are received at arm's length terms.

Withholding tax

In principle, non-Belgian source dividends and Belgian and non-Belgian source interest distributed to a BE-REIT are exempt from Belgian withholding tax.

Due to the fact that the (institutional) BE-REIT is subject to corporate income taxes, the BE-REIT will qualify as a Belgian resident. It should thus qualify for double taxation treaties and benefit from the reduced withholding tax rates or withholding tax exemptions.

Other taxes

The special tax regime of the BE-REIT does not affect applicable local income tax, including the annual property tax, which is usually recharged to tenants of office buildings and retail spaces. Such a recharge of the property tax is prohibited for residential tenants.

Furthermore, the BE-REIT is also subject to the subscription tax of 0.0925% on the net amount invested in Belgium at the end of the financial year. The institutional BE-REIT is subject to an annual tax of 0.01%.

VAT

Management services invoiced to BE-REITs benefit from a VAT exemption.

Accounting rules

The IFRS rules apply to the BE-REIT and institutional BE-REIT. Social BE-REITs have a choice between IFRS and BE-GAAP.

To view the full article click here

Footnotes

1. i.e., the Law of April 19, 2014, on alternative collective investment undertakings and their managers.

2. The BE-REIT Law defines what constitutes 'immovable property'. Immovable property is:

(i) real estate and rights in rem on real estate, with the exclusion of real estate of the following nature: forestry, agriculture or mining industry;

(ii) shares with voting rights in real estate companies subject to participation threshold;

(iii) option rights on real estate;

(iv) shares in BE-REITs and in institutional BE-REIT subject to participation threshold;

(v) rights arising out of contracts pursuant to which the BE-REIT leases one or more goods or is granted analogous rights of use;

(vi) shares in public SICAFIs;

(vii) units of foreign collective investment undertakings investing in real estate and registered on the Belgian FSMA list of foreign AIFs;

(vii) units of collective investment undertakings investing in real estate, established in the EEA and subject to an equivalent control;

(ix) shares issued by companies (i) with legal personality; (ii) governed by the law of another EEA member state; (iii) the shares of which are admitted to trading on a regulated market and/or are subject to a regime of prudential supervision; (iv) the main activity of which consists of the acquisition or establishment of immovable property in anticipation of placing such immovable property to the disposal of users, or the direct or indirect possession of participations in companies with a similar activity; and (v) that are exempted from taxes on the revenues arising out of the profit that results from the activty mentioned under (iv) above, provided certain legal obligations are complied with, and that are at least obliged to distribute part of their revenues among their shareholders (i.e., 'Real Estate Investment Trusts' or REITs);

(x) real estate certificates; and

(xi) shares of FIIS / GVBF.

3. The fair value of those investments cannot exceed 20% of the consolidated asset of the BE-REIT.

4. Until the limited partnership with shares (SCA/Comm VA) has been converted into a public limited liability company (SA/NV), the former Belgian Company Code remains applicable to it. As of January 1, 2020, the mandatory provisions in respect of public limited liability companies under the new Code of Companies and Association will apply together with the former ones, even if they have not yet been converted into a public limited company.

5. As further defined by the Law of May 12, 2014.

6. In this respect, the investment risk includes, among other things, the counterparty risk, i.e. the risk that a given counterparty will not perform its obligations. It means that a real estate complex with several units being rented to different tenants that are actually related entities of the same group should be considered as a single "real estate project" based on the counterparty risk, while a single building being rented to different unrelated entities (e.g. a shopping center) would not have the same counterparty risk exposure.

7. The FSMA has published guidelines in order to harmonise the use of specific reserves (e.g., changes in fair value) when computing the distribution obligation, the allocation of the result and the limitation to distribution as contained in the BE-REIT Decree.

8. It being understood that EU REITs still have the possibility to convert their Belgian subsidiairies in FIIS/GVBF.

9. Even under the assumption that a Social BE-REIT will be considered as an 'actual' cooperative company as recognised corporate form under the new Code of Companies and Association, various changes will still need to be implemented in the articles of association and governance of the Social BE-REIT as the new Code of Companies and Associations has e.g., abolished the concept of (fixed and variable) capital and replaced it by the concept of 'equity contributions', which also impacts the distribution mechanism.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]