Michael Kortbawi and Tala Azar explain how the DIFC has emerged as a strong contender for insurance firms thinking about shifting headquarters.

Brexit was a decision that shook the financial world. On June 23rd 2016, a sliver of a majority voted for the United Kingdom to exit the European Union (EU). The schism caused consternation, and the possible impacts of such a move saw the GBP plummet 10% the day the news came to light.

Clarity has proved to be elusive since. It has neither been a hard Brexit nor a soft one, and most definitely not a red, white and blue one. It's been a protracted, hard fought affair marked with internal divisions within the UK before even approaching the EU negotiating table.

The extended nature of the exit negotiations have obscured the eventual shape a deal might take. And while some form of equivalence agreement might be reached on the trade of goods, global industry is bracing for barriers in the services market The lack of clarity, the possibility of services being disrupted, and the threat of firms not being able to source skilled human capital within the UK market, has led to many global insurance companies setting up contingency plans. Firms are eyeing financial hubs on the European mainland, and also looking further afield for domiciles in which to headquarter.

DIFC Gateway for Emerging Markets

The Dubai International Financial Centre (DIFC) has emerged as an exceptionally strong contender for insurance firms thinking about shifting headquarters. The Dubai unique financial free zone operates on a common law legal structure tailored to the needs of financial services companies.

Add to the mix Dubai's strategic location – where 66% of the world's population falls within an eight hour flight - and the city's first-world infrastructure, and one has a winning proposition. DIFC has come into its own as a global financial centre that slots into the time zone gap between London, New York, Hong Kong and Tokyo – making it easy to do business around the world.

Dubai's easy labour laws and its open approach to the developed and developing world make it a crucial gateway for businesses seeking growth in new markets. Meanwhile, quality of life and other perks makes Dubai a destination of choice for global talent.

DIFC Legal Framework

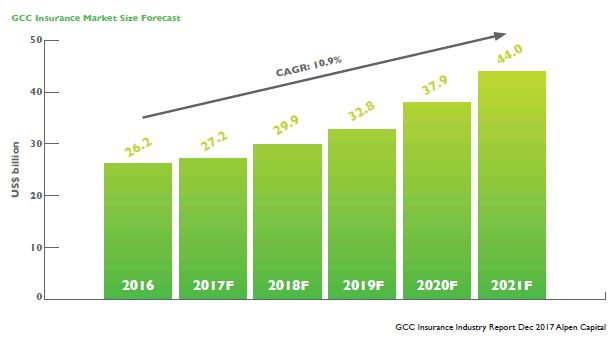

DIFC also places firms right in the heart of the UAE, which is the region's largest insurance and reinsurance market. Blue-chip insurance firms, such as Berkshire Hathaway Specialty Insurance Company and Llyod's of London, both have already gravitated to DIFC as their chosen Middle Eastern hub.

The financial free zone has the added benefit of being designed from the ground up to cater for financial service providers, with legal and regulatory structures designed to be intuitive, easy to access and aligned with other global capitals. Firms can provide insurance services by establishing a new limited company, or registering as a branch of a foreign entity. With 100% foreign ownership laws, and legal proceedings conduced entirely in English, DIFC is streets ahead of the competition as a destination that prioritises financial service delivery.

Then there are tax benefits to consider. Firms are free of income and corporate tax dues for the first 50 years of operations. There is free movement of capital with no repatriation taxes, and zero import and export duties.

The capital requirement varies depending on the activity and is determined by applying the higher of the (i) applicable Base Capital Requirement set out in the DFSA PIB Module, (ii) the Expenditure Based Capital Minimum set out in the DFSA PIB Module, or (iii) the Risk Capital Requirement set out in the DFSA PIB Module. The Base Capital Requirement for each activity is set out below:

|

PIN License |

Captive Insurer/ Reinsurer (Class 1,2 and 3) |

Insurance Intermediation |

Insurance Management |

|

US$ 10,000,000 |

US$ 150,000, US$ 250,000 to US$ 1,000,000 |

US$ 10,000 |

US$ 10,000 |

Not only is the DIFC a growth catalyst for established firms but also a powerful incubator for startups. Consider the firm's InsurTech programme that specialises in sparking technological solutions for insurance companies, or the Fintech Hive at DIFC – the region's very first financial technology accelerator.

Welcome to the new heart of the region's insurance and reinsurance industry. DIFC has come into its own as a destination par excellence for insurance providers focused on engaging with the world.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.