Web banking, mobile apps, disruption, chatbots, robotic automation processes, robo-advisors... quite a slew of new terms have fast become ubiquitous amongst private bankers. In just a few years, new technologies have redefined how relationship managers can interact with their clients. It wasn't too long ago that some private bankers were still studying the digital turn—now, no matter how voraciously they steered into it, they're in that turn.

Luxembourg's private banking sector has more arenas in which to compete than ever. As the world has become on-shore, globalised, and transparent, so has customer interaction become intensely digital-based, thanks to among other things a burgeoning number of fintech disruptors in this space.

But does it necessarily follow that the private bank of the future must be solely digital?

There is, of course, no black-and-white answer to that question.

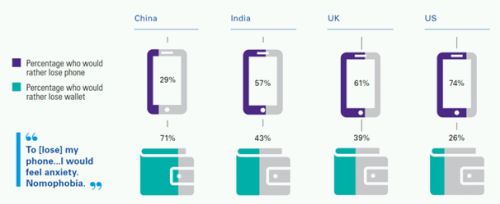

In a survey on customer behaviour that KPMG very recently published, " Me, My Life, My Wallet," thousands of participants across the world were asked their thoughts on an improbable situation: would they prefer to lose their smartphones or their wallets? As shown in the graph below, the results vary widely depending on the region: the further east you go, it seems, the more anxious people are about losing their smartphones. A word even exists now to describe this anxiety: nomophobia, i.e. "no-mobile-phone-phobia"!

While you're reading these lines and looking at the graph, you're probably still pondering the answer you would give to that question. Would you be a wallet-keeper or a phone-keeper? Perhaps you're also wondering how this question even relates to private banks and their digital ambitions. Well, this question simply illustrates that some people are early adopters, fans of newness, who will be keen to interact with their private banks using apps, chatbots or robo-platforms—while others will be more traditionalists, favouring the personal interaction they always have had with their relationship managers.

With that in mind, private banks need to maintain an "omni-channel" approach: they must build, combine, and maintain a variety of the physical and technological channels and tools at their disposal. They must be ready to both welcome their customers in a good old meeting in the bank's premises, but also incorporate innovative digital tools—in short, they must enable good customer experiences for wallet-keepers and phone-keepers alike.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.