Enforcement actions by criminal and supervisory authorities are settled regularly. In light of these developments, companies are advised to take appropriate measures. This month we highlight recent settlements with companies in the US. The first settlement concerns a violation of the US Foreign Corrupt Practices Act. According to the Securities and Exchange Commission, BHP Billiton failed to create and maintain sufficient internal controls over its global hospitality programme connected to its sponsorship of the 2008 Summer Olympic Games in Beijing. The second settlement was entered into between the U.S. Department of Justice and five big banks. According to the U.S. Department of Justice, the banks pleaded guilty to felony charges stemming from foreign currency manipulation and rate-fixing schemes.

BHP Billiton

On 20 May 2015, global resources company BHP Billiton agreed to pay USD 25 million to the Securities and Exchange Commission (SEC). The SEC had accused BHP Billiton of violating the Foreign Corrupt Practices Act (FCPA) for sponsoring the attendance of foreign government officials at the Summer Olympics, as these officials were directly involved with or in a position to influence the company's business and regulatory affairs. In entering into the settlement, BHP Billiton neither admitted nor denied the SEC's findings.

According to the SEC, BHP Billiton did not create and maintain sufficient internal controls over its global hospitality programme connected to the company's sponsorship of the 2008 Summer Olympic Games in Beijing. BHP Billiton allegedly failed both to adequately train its employees and to implement procedures to ensure the meaningful preparation, review and approval of invitations to the foreign government officials. The Associate Director of the SEC's Division of Enforcement stated: "A 'check the box' compliance approach of form over substance is not enough to comply with the FCPA".

According to the SEC, the settlement reflects the company's remedial efforts and cooperation with the SEC's investigation and requires BHP Billiton to report to the SEC on the operation of its FCPA and anti-corruption compliance programme for a one-year period.

Banks charged with foreign currency manipulation and rate-fixing schemes

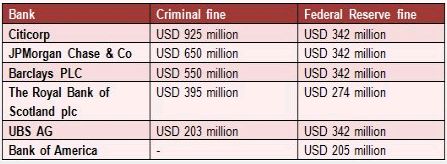

Six banks agreed on 20 May 2015 to collectively pay USD 5.6 billion in fines and regulatory penalties to US and UK regulators, including the U.S. Department of Justice (DOJ) and the US Federal Reserve. Four of these banks – Citicorp, JP Morgan Chase & Co, Barclays PLC and The Royal Bank of Scotland plc – agreed to plead guilty to conspiring to manipulate the price of US dollars and euros exchanged in the foreign currency exchange (FX) spot market. UBS AG pleaded guilty to wire fraud for its involvement in the manipulation of the London Interbank Offered Rate (LIBOR), but was granted immunity for foreign exchange manipulation for being the first one to report the alleged misconduct.

The five banks also agreed to a three-year period of corporate probation. According to the DOJ, the banks will continue cooperating with the ongoing criminal investigations, and the plea agreements do not stop the DOJ from prosecuting culpable individuals for related misconduct.

Bank of America faces no criminal charges, but will pay a fine of USD 205 million to the US Federal Reserve. According to the plea agreements, euro-dollar traders at four banks used an exclusive chatroom and coded language to manipulate benchmark exchange rates to increase their own profits. The DOJ said that by agreeing not to buy or sell at certain times, the traders protected each other's trading positions by withholding supply of or demand for currency, and suppressing competition in the FX market. According to the plea agreements, the alleged misconduct took place between December 2007 and January 2013, although the period of involvement by each of the banks varied.

Source: CBC News

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.