- within Finance and Banking topic(s)

- with readers working within the Law Firm industries

Barbados Welcomes YOU, and Your Investment

Or if you're not here yet, we're confident it's just a matter of time.

Barbados is attractive to investors as a secure and reputable jurisdiction that facilitates global growth and profitability, in various sectors including international business, financial, wealth management and insurance services, global education services, information & communication technology (ICT), renewable energy, medicinal cannabis, fintech and niche manufacturing, to name a few.

Emerging sectors are growing exponentially around the world and Barbados is well-positioned to benefit from this. Our success as a centre for global business has been built on transparency, effective regulation, adherence to international best practice standards and the attraction of businesses of substance. Additionally, Barbados is the only Caribbean jurisdiction with an established and growing Double Taxation Agreement (DTA) network that enables investors to enhance their global competitive advantage. On the ground, we have the infrastructure, highly-skilled workforce, competitive costs and tax structure and, importantly – a supportive government wanting you to succeed.

Read on to learn more about Barbados' investment opportunities across our diversified economy – there's an opportunity for everyone. Some priority sectors have special incentives like concessions on imports and tax allowances – refer to our incentives section for more details.

Ready to make the next move? Our doors at Invest Barbados are always open, and the experienced team is ready to support you through your investment journey.

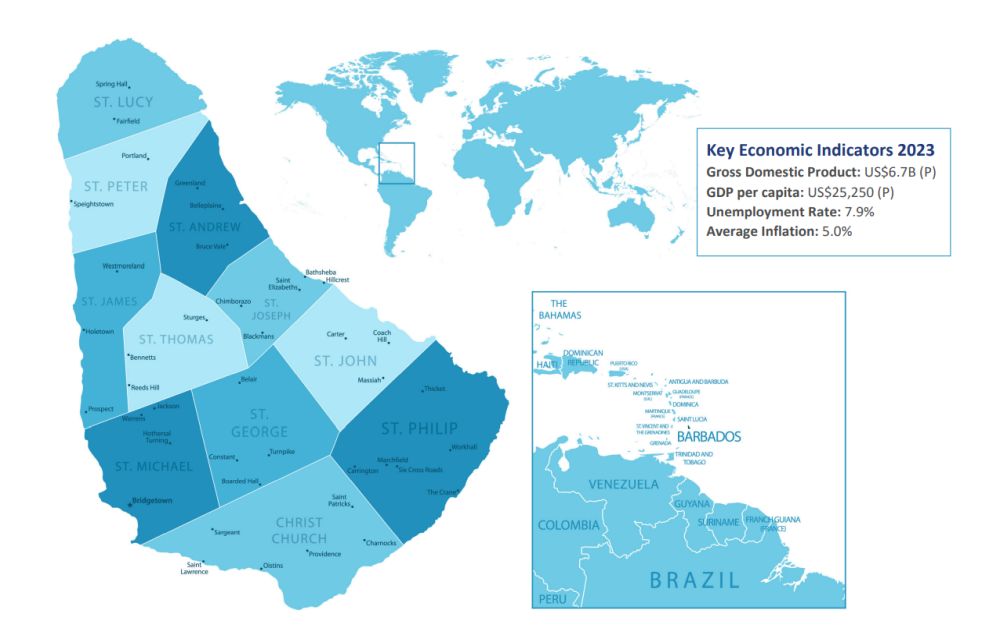

Quick Facts

General Information

Size: 166 sq. miles/430 sq. km.

Capital: Bridgetown

Government: Parliamentary Republic

Language: English

Time Zone: GMT – 4 hours

Population: 265,332 (2023)

Workforce: 134,300 (2023)

Literacy Rate: 99.6%

Climate: Air Temperature 22-30°C/70-90°F

Relative Humidity: 60-70%

Currency: Barbados Dollars (BDS$) BDS$ 2.00 – US$ 1.00

Major Trading Partners: CARICOM, USA, UK, Canada, Germany, Japan

Why Barbados?

We know you have options. But we're confident you'll come to the conclusion that Barbados offers everything that your business needs with all that your heart desires.

Here's why:

- A business-friendly environment for businesses of substance, with a pro-investment Government ready to support you

- A long history of political and social stability, with a legal system based on English common law – so your investment is safe here

- Excellent physical infrastructure with an international airport and modern seaport to get you and your goods on and off the island quickly and efficiently

- The right people for the job – Barbados has a well educated and available pool of qualified industry professionals

- All the connectivity you need – we have island-wide 4G LTE and fibre optic high-speed internet

- An expanding international treaty network, ensuring clarity and straight-forward tax considerations

- All of the above while enjoying an enviable lifestyle in the most beautiful location. Think world-class sporting events, a packed social and cultural calendar, exquisite local dining, excellent schools, top-notch health system and more. Life in Barbados is good and you'll fit right in.

Investment Incentives

Let's dig a little deeper. Here are some of the specific incentives that make Barbados the right choice for you, your business or investment.

- Foreign Currency Permit: Entities that earn 100% of their income in foreign currency, are entitled to receive a Foreign Currency Permit (FCP). Holders of a FCP benefit from exemption from exchange control, and exemption from property transfer taxes on transfers of shares or quotas.

- Duty free concessions: Some industries such as manufacturing, renewable energy and tourism have specific duty free concessions on imports, tax exemptions, training grants and more.

- Tax losses: Tax losses brought forward and available for offset are restricted to 50% of taxable income in any income year.

- Foreign tax credits: Tax paid to a foreign country by an individual may be credited against tax payable in Barbados, provided that the credit does not reduce the tax payable in Barbados to a rate of less than 1% of the tax payable in that income year.

- Double Taxation Agreements: These agreements offer reduced withholding tax ranging from 0-15%. Barbados has an expanding treaty network with 40 Double Taxation Agreements with countries including Canada, China, Cuba, Mexico, the UK and the USA.

Attracting Businesses of Substance

Economic substance is a G20/OECD global initiative that requires companies to demonstrate that the profits they register are commensurate with their economic presence and activities in the jurisdiction in which they reside. The Companies (Economic Substance) Act 2019-43 took effect on November 29, 2019, requiring companies to satisfy the economic substance test in relation to any relevant activity carried on in Barbados by the company. An entity whose business is directed, managed and controlled from Barbados is defined as a "Resident Company" and must satisfy the economic substance test.

More details on The Companies (Economic Substance) Act 2019-43 are available on the Invest Barbados website.

- Competitive tax rates: Barbados' general corporation tax rate is 9%, effective January 1, 2024.

Full details are available on the Invest Barbados website.

Setting up a Business in Barbados

Let's look at the practicalities. You can establish a company in Barbados as a Regular Business Company (RBC) or Society with Restricted Liability (SRL). An SRL is similar to what is known as a Limited Liability Company in the USA. Two of the key differences are that an SRL has limited life, and may be automatically dissolved on the occurrence of stipulated events or the end of a fixed period, and also that it must have a minimum of two members and not shareholders.

Other company structures include external companies and unincorporated businesses. Further details can be found on the Invest Barbados website.

Setting up a Regular Business Company (RBC) or Society with Restricted Liability (SRL) in Barbados

Below are some of the legal requirements for starting a business in Barbados. Many of these can now be done online for a quicker, more efficient process and corporate attorneys can of course assist with the paperwork and submissions.

- Register the business name with the Corporate Affairs and

Intellectual Property Office (CAIPO).

Telephone: +1 (246) 535-2410

Website: http://www.caipo.gov.bb

Email: caipo.general@barbados.gov.bb

- Submit incorporation documents and associated government fees (approximately US$400) to the Registrar of CAIPO

- Secure licences from the appropriate regulatory bodies, for

example:

The Financial Services Commission for insurance companies

Telephone: +1 (246) 421-2142

Website: http://fsc.gov.bb

Email: info@fsc.gov.bb

The Central Bank of Barbados for financial institutions

Telephone: +1 (246) 436-6870

Website: http://www.centralbank.org.bb

Email: info@centralbank.org.bb

- Apply to the Barbados Immigration Department for a work permit,

if you are not a citizen of Barbados and would like to work on the

island.

Telephone: +1 (246) 535-4100

Website: https://immigration.gov.bb

Email: immigration.department@barbados.gov.bb

- Register for statutory obligations with:

National Insurance Scheme

Telephone: +1 (246) 431-7400

Website: https://www.nis.gov.bb

Email: customer.service@bginis.gov.bb

Barbados Revenue Authority

Telephone: +1 (246) 429-3829

Website: https://bra.gov.bb

Email: bramail@bra.gov.bb

The Value Added Tax (VAT) Division of the Barbados Revenue Authority

Telephone: +1 (246) 429-3829

Website: https://bra.gov.bb

Planning & Development Department

Telephone:+1 (246) 535-3000

Website: http://townplanning.gov.bb

Email: contact@planning.gov.bb

Incorporating a Business in Barbados

Here's some of the information and documents that you'll need as part of the incorporation process:

- Name of the entity

- The official address in Barbados where the share registers, minute books and other statutory information will be kept

- Contact details of auditor, if applicable

- Financial year-end

- The minimum and maximum number of directors (an entity can have a minimum of one director)

- Details of activities in which the RBC/SRL will be involved

- Name, address, registration/incorporation number of all related entities carrying on business, licensed, incorporated, registered or organised in Barbados

- Profile of each shareholder and director/manager including academic qualifications, training, experience, corporate status, etc.

Companies that earn 100% of income in foreign currency are eligible for an FCP. An FCP application fee of US $125 should be submitted to the Corporate Affairs and Intellectual Property Office the same time the incorporation documents are submitted, and simultaneously, submit the FCP application to the Director, International Business. Companies must provide a statutory declaration of a director/manager certifying that 100% of the income earned by the RBC/SRL will be in foreign currency.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.