Executive Summary

Labuan IBFC continues to provide fit-for-digital business structures to facilitate various digital financial-related businesses in the Centre

The financial services landscape has undergone a profound transformation over the past decades. With the increasing trend of BigTech and FinTech companies offering financial services' products, central banks and regulators are working to accelerate DFS-related regulations in their own respective countries. The digital transformation landscape is pivoted by a growing digitally-savvy population with increasing customer expectations. As such, financial institutions should accelerate their transformation. Distributed ledger technology, also known as blockchain is a trending topic within the financial industry, where activities can decentralize and eliminate certain intermediary processes, validating and authenticating transactions. Additionally, automation is also seeing a growing impact in the banking and financial services space – to optimize operational efficiency, perform credit decisioning, and prevent fraudulent transactions. Hence, central banks and regulators must transform together with the advancements to ensure the growth of its financial services industry and the country's economy as a whole.

Digitization is a forward-looking concept that is expected to be realized within a short period of time. However, new financial services' companies in the emerging market environment will face challenges including, but not limited to the following:

- Rigid regulatory policies and frameworks;

- Lack of inclusivity practiced by bigger banks and firms;

- High vulnerability to cyber-attacks; and

- Higher focus on generating initial returns rather than the longterm benefits.

Labuan IBFC recognizes the rapid transformation within the financial services landscape and has subsequently taken progressive approach in embracing digital revolution by facilitating innovative digital business to take root in Labuan IBFC. The Centre has a ready "toolbox" of solutions to meet the needs of the rapidly expanding digital industry within a regulated environment. The accelerated growth for financial services in Labuan IBFC are driven by four key factors:

- Strategic location in Southeast Asia (SEA);

- Favorable regulations and frameworks for vast financial offerings that provide a safe environment for companies to test the prototype/minimum viable product;

- Provide differentiated solutions that are not offered by other jurisdictions in Asia such as digital takaful captives; and

- A substance-enabling jurisdiction to provide better tax certainty.

Global DFS Outlook and Trends

The global financial services landscape has pivoted into digitization and digital engagement, accelerated by the COVID-19 pandemic. DFS are on the rise to fill the gap of traditional financial institutions, due to the strict compliance and various siloed systems. With the spike of DFS, traditional financial institutions are now looking for ways to transition to a more agile setup. Governments have taken the opportunities to leverage on the digital transition to fast track the financial inclusion agenda.

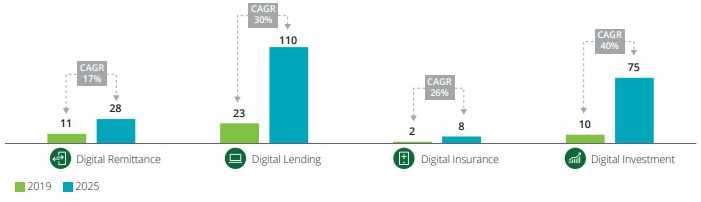

The digital payments market is the largest segment within the digital spectrum and accounts for more than 80% of global digital market revenues. Digital payments' gross transaction value is estimated to reach USD1 trillion by 2025. Other DFS such as digital lending, Insurtech, and digital investment are still relatively nascent but shows increased growth of more than 20% from 2019 to 2025.

DFS Revenue Growth

Unit: USD bil

Global Digital Market

- Global digital market revenues in 2018 were about USD106 billion and expected to grow to more than USD214 billion in 2024 (preCOVID-19 forecast).

- The digital markets in the APAC and Americas regions are currently the largest, with both having around 40% of the global market share. The EMEA region is significantly smaller, with around 20% of the total market share. The digital market in the APAC region is projected to be the fastest growing.

- Although COVID-19 causes uncertainty in the digital market, it creates opportunities for the digital market as well. The adaptability and digital innovation allows the sector to truly realize its growth path.

To view the full article, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.