- within Employment and HR topic(s)

- within Real Estate and Construction topic(s)

Labor migration is a significant driver of global economic development, as millions of people relocate to other countries in search of improved work opportunities and living conditions. However, this phenomenon gives rise to complex legal issues that necessitate attention and regulation. Compliance with legislation is a key aspect of labor migration, requiring migrants to be well-informed about the rules and requirements governing their status and employment in the host country. This article will examine the key legal aspects of labor migration for foreign citizens and stateless persons (hereinafter referred to as "foreign citizens") in the Republic of Uzbekistan. The focus will be on the procedures for obtaining work permits, the legislative requirements that migrants need to adhere to, and important considerations related to working conditions, wages, and taxation.

An overview of labor law requirements

The main regulatory act governing the relationship between employers and employees in the Republic of Uzbekistan is the Labor Code. Individual labor relations are governed by specific acts of labor legislation. According to Article 11 of the Labor Code, the rules established by labor legislation in Uzbekistan apply to labor relations involving foreign citizens. In order to be recognized as employees, foreign citizens must meet the following criteria: possessing the legal capacity and capability to work, having reached the minimum legal age, and having entered into an employment contract with an employer.

It should be noted that, as per the Law of the Republic of Uzbekistan "On the Legal Status of Foreign Citizens and Stateless Persons in the Republic of Uzbekistan" No. ???-692 dated June 5, 2021, foreign citizens cannot be appointed or elected to certain positions or engage in specific types of labor activities if such appointments or engagements are connected to the citizenship of the Republic of Uzbekistan

Furthermore, Article 30 of the Labor Code states that foreign citizens permanently residing outside Uzbekistan may establish individual labor relations through an employment contract after obtaining a work permit to engage in labor activities within Uzbekistan. This requirement does not apply to foreign citizens permanently residing in Uzbekistan with a valid residence permit. The term of the employment contract with a foreign citizen cannot exceed the term of the work permit. The expiration or annulment of the work permit serves as grounds for terminating the employment contract.

Obtaining work permit

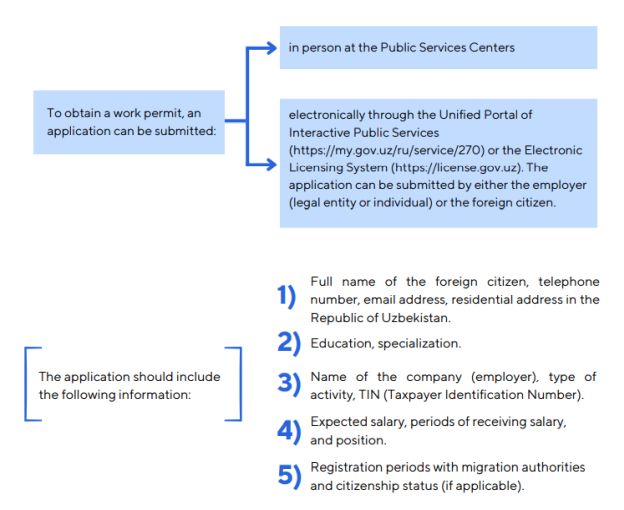

The procedure for issuing work permits to foreign citizens in the Republic of Uzbekistan is regulated by the Resolution of the Cabinet of Ministers of the Republic of Uzbekistan "On the Approval of the Unified Regulation on the Procedures for Issuing Certain Permits through a Special Electronic System" No. 86 dated February 22, 2022. The Agency for External Labor Migration of the Republic of Uzbekistan (referred to as "the Agency") is the authorized body for issuing work permits.

The following documents should be attached to the application:

- Copy of the foreign citizen's passport.

- Draft employment contract confirming the initial agreement with the employer regarding the intention and conditions of attracting the foreign citizen to the Republic of Uzbekistan, including the salary amount (bonuses).

- Photograph of the foreign citizen (3x4 cm).

- Documents confirming the qualifications of the foreign citizen. Copy of the entry visa for foreigners subject to visa regime (work visa "E," work visa "B-1" and "B-2," official visa "C-3," or other types of visas granted to citizens).

- The Agency reviews the application within 15 working days.

- A fee of 1 basic calculation value (BCV) is charged for processing the application (UZS 330,000).

In case of a positive result, the fee for issuing a work permit is as follows:

- For highly qualified specialists, teachers, and specialists attracted to work in Presidential schools and higher education institutions: 1 BCV.

- For qualified specialists: 2 BCV (UZS 660,000).

- For doctors: 5 BCV (UZS 1,650,000).

- For other foreign citizens: 30 BCV (UZS 9,900,000).

The validity period of the work permit is:

- For highly qualified and qualified specialists: up to 3 years, with the possibility of unlimited extensions.

- For other foreign citizens: up to 1 year, with the possibility of unlimited extensions

In accordance with the Resolution of the President of the Republic of Uzbekistan "On Measures to Create Favorable Conditions for the Employment of Qualified Specialists from Foreign States in the Territory of the Republic of Uzbekistan" No. ??-4008 dated November 7, 2018, specific requirements and criteria are established for determining highly qualified and qualified specialists.

HIGHLY QUALIFIED SPECIALISTS SHOULD MEET THE FOLLOWING CRITERIA:

Graduates of higher educational institutions ranked among the top 1,000 in internationally recognized organizations' ratings, as approved by a joint resolution of the Ministry of Higher and Secondary Special Education and the State Inspection for Supervision of Quality in Education under the Cabinet of Ministers of the Republic of Uzbekistan.

Possess at least 5 years of work experience in the declared specialty or a specialty indicated in the diploma.

Employment conditions in the Republic of Uzbekistan should involve receiving a salary (remuneration) of at least the equivalent of $60,000 per year.

QUALIFIED SPECIALISTS SHOULD MEET THE FOLLOWING CRITERIA:

Have a higher education degree.

Possess at least 5 years of work experience in the declared specialty or a specialty indicated in the diploma.

Employment conditions in the Republic of Uzbekistan should involve receiving a salary (remuneration) of at least the equivalent of $30,000 per year.

MOREOVER, CERTAIN CATEGORIES OF WORKERS HAVE THE RIGHT TO PERFORM LABOR ACTIVITIES IN THE REPUBLIC OF UZBEKISTAN WITHOUT OBTAINING A WORK PERMIT. THESE CATEGORIES INCLUDE:

- Foreign citizens who have invested in the Republic of Uzbekistan in an amount not less than 8,500 times the BCV (approximately $244,000) established in the Republic of Uzbekistan at the time of investment, in the form of acquiring shares and stakes in business companies, as well as establishing a foreign enterprise, for any position within the organization.

- Teachers and specialists recruited to work in presidential schools, as well as higher education institutions of the Republic of Karakalpakstan, regions, and Tashkent city.

- Individuals who have obtained a residence permit in the Republic of Uzbekistan.

- Specialists of IT-Park residents.

- Employees engaged in remote (online) employment while located in a foreign country.

Regarding the issuance of work permits, there are several conditions and requirements to be met, including:

- Compliance with legislation on labor, labor protection, employment, and compulsory employer's civil liability insurance.

- Compliance of the foreign citizen with the legislation of the Republic of Uzbekistan, including non-criminal liability.

- Notifying the Agency within one week of any changes in the information indicated in the application.

Violation of these requirements may result in the revocation or annulment of the work permit.

LABOR CONDITIONS AND TAXATION

According to labor legislation, foreign citizens enjoy the same rights and labor conditions as citizens of the Republic of Uzbekistan when entering into employment relationships. They enter into fixed-term employment contracts and are entitled to all guarantees provided by the labor legislation of the Republic of Uzbekistan.

As per the Decree of the President of the Republic of Uzbekistan "On Increasing the Sizes of Wages, Pensions, and Benefits" No. ??-45 dated March 28, 2023, starting from May 1, 2023, the minimum monthly wage on the territory of the Republic of Uzbekistan is UZS 980,000 (approximately 85 US dollars).

REGARDING TAXATION, THE TAX CODE STIPULATES THE FOLLOWING TAX RATES FOR INCOME:

- For resident individuals of the Republic of Uzbekistan:

1. Income is subject to taxation at a rate of 12%.

2.Dividends and interest income are taxed at a rate of 5%.

- For non-resident individuals of the Republic of Uzbekistan receiving income from sources within the country:

1. Dividends and interest are taxed at a rate of 10%.

2. Income received under labor contracts (contracts) and civil law contracts, as well as other income, are taxed at a rate of 12%.

TAX RESIDENTS OF THE REPUBLIC OF UZBEKISTAN ARE INDIVIDUALS WHO MEET EITHER OF THE FOLLOWING CONDITIONS:

- Physically present in the Republic of Uzbekistan for a total of more than 183 calendar days during any consecutive 12-month period.

- Present in the Republic of Uzbekistan for a total of fewer than 183 days in the relevant tax period but more than in any other country.

In conclusion, labor migration plays a significant role in global economic development and is of great importance for the Republic of Uzbekistan. However, the legal issues accompanying this process require special attention and regulation. Compliance with labor laws is an integral part of successful migration, and migrants should be aware of the rules and requirements associated with their status and employment. It is important to emphasize that the procedure for obtaining a work permit plays a key role in establishing individual labor relations for foreign citizens in the Republic of Uzbekistan.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.