- within Employment and HR topic(s)

- within Employment and HR topic(s)

- within Accounting and Audit, Law Department Performance and Consumer Protection topic(s)

Recent amendments to Mauritian labour laws introduce significant changes that affect both employers and employees across various sectors. These changes include a new framework for employing migrant workers, updates on parental leave and regulations for work during extreme weather, all aimed at enhancing worker protections and promoting fair employment practices. It is expected that further regulations will be published in the coming weeks in order to provide for wage adjustments across all industries.

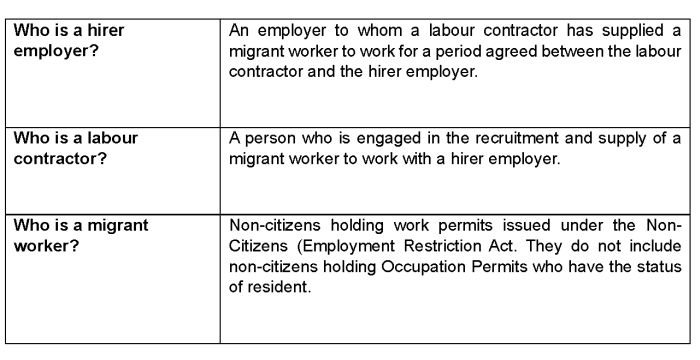

I. Migrant Workers

The Act introduces a new legal framework for the employment of "migrant workers" by "labour contractors" who recruit and supply those migrant workers to the "hirer employers" for a specific period of time.

A new section regarding the joint liability of job contractors and employers as regards remuneration and obligations of the labour contractor is being added. An overview of this framework is as follows:

- Registration Requirement: The labour contractors must apply and register with the Ministry of Labour before they can operate.

- Sector and Job Restrictions: Labour contractors will be allowed to supply migrant workers to hire employers in specific economic sectors and job categories as the Minister may prescribe.

- Employment Contract: The employment relationship will be between the migrant worker and the labour contractor, who shall be the employer, regardless of whether or not the migrant worker is supplied to work with the hirer employer for a given period.

- Employment Conditions: The remuneration and terms and conditions of employment of the migrant worker shall be regulated by the Remuneration Regulations applicable to that sector.

- Joint and Several Liability: Both the labour contractor and hirer employer will be jointly and severally liable for (i) the payment of remuneration; (ii) ensuring compliance with the worker's employment conditions, including safety, health and welfare; and (iii) making statutory contributions related to the employment of the worker.

- However, the hirer employer's liability will be limited to the sum payable to the labour contractor under their contractual arrangement. The hirer employer also cannot set up as a defence to a claim from a migrant worker seeking to recover remuneration, the fact that they have already paid to the labour contractor any sum due under their contractual arrangement.

- Liability for Workplace Incidents: The hirer employer will be liable for any act of violence at work and for any accident, injury or death sustained by the migrant workers out of, and in the course of, their employment.

Regarding the termination of a migrant worker, before repatriation of the worker, additional requirements have to be met by the employers. These include:

- Giving at least 20 working days written notice to the Ministry;

- Payment of any unpaid remuneration to the worker; and

- Ensuring that the worker has been paid all benefits to which he is entitled.

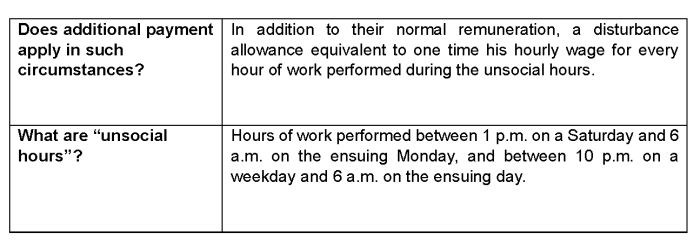

II. The right to disconnect during unsocial hours

The work-from-home provisions have been amended to include the right of workers to disconnect i.e. to disengage from work and work-related communications (including emails, telephone calls, video calls or other means of sending and receiving messages) during unsocial hours when they are not working.

They may be required to perform work during unsocial hours in situations of emergency, or where the working hours of the worker correspond to the working hours in the market country served.

III. Time off in lieu of remuneration for overtime

A worker may opt for paid time off instead of receiving remuneration due to overtime and work performed on public holidays. The number of hours of time off is computed using the same rate applied for overtime payment: 1.5 times the number of overtime hours on weekdays, 2 times the number of overtime hours worked on public holidays during normal working hours and 3 times the number of overtime hours worked on public holidays after normal working hours.

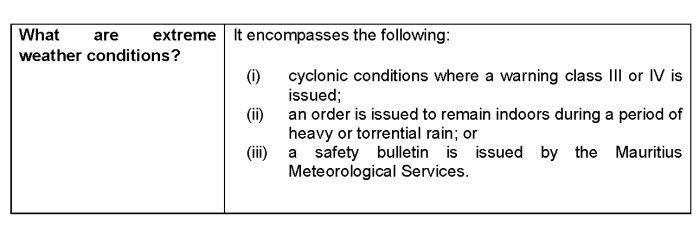

IV. Work in Extreme Weather Conditions

The main implementations include:

- Where a worker is required to attend the employer's premises or any other place where is has been assigned duty during extreme weather conditions, he shall receive, in addition to his normal remuneration, an allowance equal to 3 times the basic hourly rate for each hour of work performed and an adequate free meal.

- An employer may require the worker to work from home if there is no (i) risk to his life or that of his family; (ii) risk of injury; (iii) risk of his residence being damaged; or (iv) electricity of communication breakdown. In these scenarios, the worker will receive 2 times his hourly rate during normal working hours.

V. Parental Leave and Childcare

The changes include:

- Maternity leave has increased from 14 weeks to 16 weeks with full pay with at least 8 weeks to be taken from the day of giving birth. Female workers who give birth to twins, triplets or multiple births, or to a premature baby are entitled to 2 additional weeks.

- Paternity leave has increased from 5 continuous working days to 4 consecutive weeks.

- Employers with more than 250 workers, and on such conditions as the Minister may prescribe, shall provide free-of-charge childcare facilities to a worker whose child is less than 3 years old.

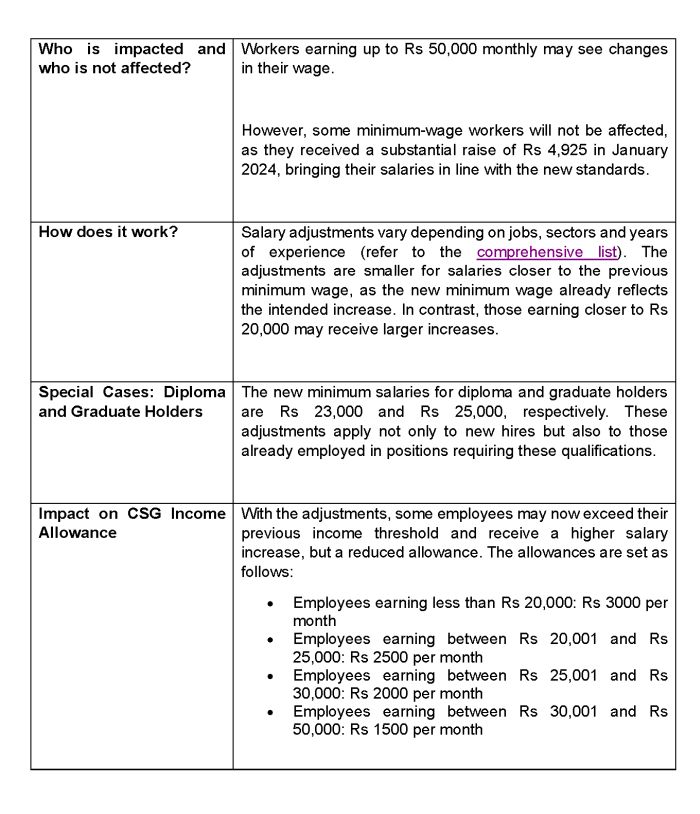

Other Measures: Implementation of Wages Relativity Adjustment*

The Wage Relativity Adjustment, effective from 1 July 2024, brings significant changes to the salary scales in the public and private sectors. It is designed to address disparities and ensure fair compensation across different income levels.

The Government is bringing amendments to 31 existing Remuneration Regulations to provide for wages relativity adjustment for workers drawing a monthly basic wage of up to Rs 50,000, whether or not their wage is prescribed by the Regulations.

A comprehensive list was published on 22 August 2024, and these salary scales have been established for employees in various sectors, including those working with attorneys and notaries, in bakeries, construction and quarrying industries, catering and tourism industries, cinema, and cleaning enterprises amongst many others.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.