- within Tax topic(s)

- in Asia

- within Tax topic(s)

- with Finance and Tax Executives

- in Asia

- in Asia

- with readers working within the Accounting & Consultancy and Aerospace & Defence industries

In the UAE, family foundation is a popular legal structure primarily used by wealthy families and high-net-worth individuals for wealth preservation, succession planning, and asset protection. They are becoming increasingly popular in the UAE, especially after the introduction of the Abu Dhabi Global Market (ADGM) and Dubai International Financial Centre (DIFC) foundations regimes.

The UAE Corporate Tax Law (Federal Decree-Law No. 47 of 2022 on Corporate Taxation, effective for tax periods beginning on or after 1 June 2023, and the Ministerial Decision No. 261 of 2024) lays down various aspects of taxation of Family Foundation. However, still lot of clarity was required on status of foundation, tax treatment on considering Family Foundation as pass through entity, reporting requirements, accounting treatment, etc.

The Federal Tax Authority (FTA) has issued the much-awaited guide on Taxation of Family Foundations in May 2025. This article tries to capture the important aspect of the tax regime of Family Foundations and clarifications brought about by the guide.

What is a Family Foundation?

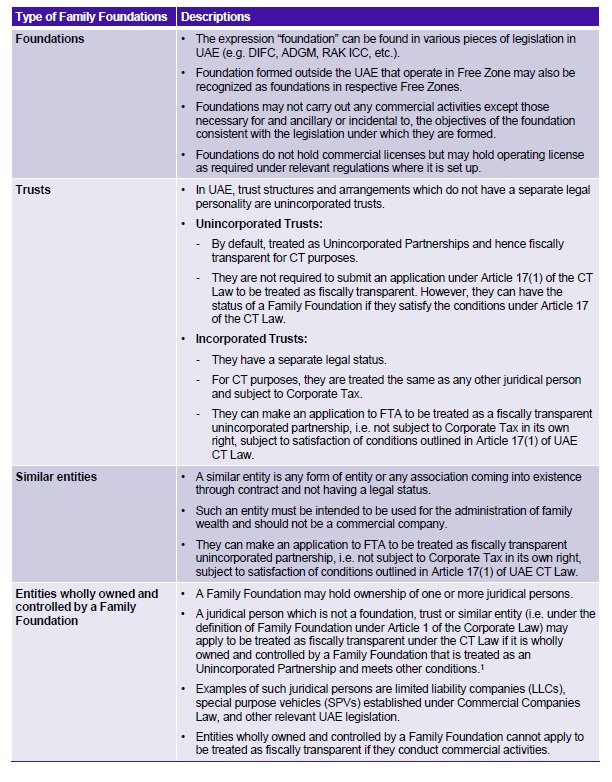

A Family Foundation in the UAE is not a new legal entity but a tax classification applied to entities such as foundations, trusts, or similar entities. To be recognized as a Family Foundation for corporate tax purposes, an entity must:

Qualify as a foundation, trust, or similar entity under relevant UAE or foreign laws, and Meet specific conditions outlined in Article 17(1) of the Corporate Tax (CT) Law (discussed ahead).

These entities are often used to manage family wealth across generations, facilitate estate planning, and support philanthropic efforts.

The guide clarifies that these entities would be treated as juridical person and corporate tax would apply like any another tax payer. It also clarifies that such entities which are formed in Free Zone, Free Zone regulations would also apply. Thus, it can be inferred that Family Foundations or similar entities would also be eligible to claim the Free Zone Tax benefits subject to meeting the required conditions.

An entity formed in the UAE as well as a non-UAE entity can meet the conditions to be a Family Foundation.

Where the entity has a separate legal personality (i.e. distinct from its beneficiaries), it will be a juridical person and subject to Corporate Tax in its own right. However, an application to be treated as fiscally transparent may be made to the FTA where the relevant conditions are met.2

Conditions for Recognition as a Family Foundation

For a foundation or trust or similar entity to be treated as a fiscally transparent Family Foundation (i.e., exempt from corporate tax in its own right), it must satisfy all of the following:

Beneficiary Condition

Beneficiaries must be identified/identifiable natural persons or public benefit entities.

Beneficiaries include direct/immediate beneficiaries as well as indirect beneficiaries.

Identifiable natural person includes a class of natural person beneficiaries. Eg; child or grandchild of settlor, unborn child.

Public benefit entity is not specifically defined and therefore takes its ordinary meaning.

A public benefit entity is established for the welfare of the public and society, promoting philanthropy, community services or corporate and social responsibility. For example, a not-for-profit or charitable organization, established either in the UAE or another jurisdiction, is likely to be a public benefit entity.

Public entity does not need to be a Qualifying Public Benefit Entity under CT Law. A Qualifying Public Benefit Entity would, however, be a public benefit entity.

There are no minimum or maximum number of beneficiaries for a Family Foundation.

Natural person beneficiaries may not be from same family.

Principal Activity Condition

The main purpose must be to manage savings or investments, such as holding real estate or shares.

Principal activity must be to receive, hold, invest, disburse, or otherwise manage assets or funds associated with savings and investments.

It may include purchasing and selling stocks, bonds, real estate, or other assets, intended to grow the value of the assets and/or generate an income stream for the beneficiaries.

Expenses for charity, supporting beneficiaries and for meeting operational expenses are permissible.

No Business Activity Condition

Activity can constitute a business activity if the same would have been considered as business activity if it was undertaken directly by a natural person.

It may undertake an activity that would be considered Personal Investment and/or Real Estate Investment, since it is not considered to be the business activity of a natural person.

No tax avoidance conditions

This condition will be met where a Family Foundation is used for the purposes envisaged by CT Law, namely, to receive, hold, invest, disburse or/and manage assets for the benefit of individuals or charitable organizations.

Making application to be treated as pass through and thereby permitting income to be excluded from Corporate Tax would not itself violate this condition

Distribution Condition where beneficiaries include public benefit entities

In case where non-qualifying public benefit entity is a beneficiary, any taxable income (not exempt income) may be liable to tax unless it is distributed to public benefit entity within 6 months from the end of the relevant tax period.

Corporate Tax implication for Family Foundation that is treated as an Unincorporated Partnership

Once the application for pass through status is approved by FTA, a Family Foundation is treated as an Unincorporated Partnership, meaning:

It is not taxed on income.

Income earned and expenses incurred by the Family Foundation are attributed to the beneficiaries (expenses are deductible against the share of income).

Beneficiaries who are natural persons typically do not pay tax on income considered as personal investment or real estate investment income.

Public Benefit Entity Beneficiary A Qualifying Public Benefit Entity will not be subject to Corporate Tax as it is an Exempt Person.

Non-qualifying public benefit entity which becomes a Taxable Person will include its distributive share of the Family Foundation's income and expenditure in its Taxable Income (unless it is exempt income as per Article 22 of UAE CT law).

Foreign public benefit entity which become taxable person may become subject to Corporate Tax as Non-Resident person as a result of Family Foundation being fiscally transparent, for example, by virtue of having a nexus in the UAE.

Other key implications

Payments can be made to beneficiaries who are providing services to the Family Foundation. However, such payments need to be at an arm's length price.

Foreign tax credit on income earned by family foundation can be claimed by the beneficiary in proportion to its distributive share of income.

Distribution by a Family Foundation to its beneficiaries shall not be taxable if the underlying income has already been taxed, earlier as per pass-through mechanism.

Foreign Foundation

A Foreign Foundation satisfying conditions as per Article 17(1) is treated as a fiscally transparent Unincorporated Partnership and will not be a Taxable Person in its own right.

However, a Family Foundation having nexus in UAE (through ownership of immovable property in UAE) is required to register for corporate tax in UAE.

Natural Person beneficiaries of such a foreign foundation will not be subject to Corporate Tax on the income generated by the Family Foundation as the income will meet the definition of Real Estate Investment income.

Multi-Tier Structures

As per MD No.261 of 2024, the benefit of being treated as Unincorporated Partnership is extended to multi-tier structures. In essence, a juridical person wholly owned and controlled by a family foundation, either directly or indirectly through an uninterrupted chain of other entities which are themselves all treated as Unincorporated Partnerships in accordance with the CT Law may apply to be treated as Unincorporated Partnership, if such juridical persons meet conditions as per Article 17(1) of the CT law.

The guide further clarifies that where the family foundation is automatically treated as an unincorporated partnership (such as trusts) then the eligibility of juridical person to be treated as an unincorporated partnership will not be impacted even if the legal ownership of assets of such trust is vested in the trustees. Further, it clarifies that the juridical person must continuously meet all conditions throughout the tax period and if any of the conditions are violated, they will no longer be treated as unincorporated.

Certain issues that may arise in case of multi-tier structure has been explained in the guide by way of examples. We have highlighted some of these as below –

There is no requirement for juridical persons within the uninterrupted chain to have the same Financial Year. However, in case of different tax periods, the juridical person should be mindful that conditions are met in the whole tax periods of all entities in the chain.

In case of interruption in the chain (i.e. if any entity in the chain is not fiscally transparent), any juridical persons which fiscally opaque entities hold will consequently also not be eligible to be treated as fiscally transparent under the Family Foundation provisions.

If a juridical person in the chain is not wholly owned and controlled directly or indirectly by the same family foundation, they cannot apply to be treated as an unincorporated partnership.

Tax Compliance

Requirement for Registration under the UAE CT law

Every Family Foundation or a juridical person wholly-owned and controlled by a Family Foundation and wishes to apply to be treated as an Unincorporated Partnership needs to register for CT purposes and obtain a Tax Registration Number (TRN).

Each juridical person in a multi-tier structure should be registered separately for Corporate Tax before it applies to be treated as fiscally transparent.

Natural person's that are beneficiaries of a Family Foundation that is fiscally transparent are not required to register for Corporate Tax, however, they may be required to register separately for their business activity in UAE that exceeds relevant thresholds.

Beneficiaries of a Family Foundation that are public benefit entities (including Qualifying Public Benefit Entities) are required to register for Corporate Tax.

Timeline for application to be treated as an Unincorporated Partnership

Application must be made before the end of the relevant Tax Period, and it shall be effective from the commencement of that Tax Period.

Family Foundation needs to provide the relevant information including details of the beneficiaries and confirmation that the Family Foundation meets the relevant conditions.

Foreign Foundation having nexus in UAE must also apply within the same timelines as above.

Based on the above, it can be inferred that application for being treated as fiscally transparent for the year ending December 2024 should have been made before December 2024.

Application for an Unincorporated Partnership

A foundation, trust or similar entity which is already an Unincorporated Partnership (i.e. fiscally transparent), is not required to make an application under Article 17(1) of UAE CT Law. However, they can submit the application, for and on behalf of the juridical person(s) wholly owned and controlled by them.

Annual Confirmation Annual confirmation (to track continuous compliance with all prescribed conditions) needs to be filed by the Family Foundation within 9 months from the end of the relevant Tax Period.

The deadline to file annual confirmation shall be 31 December 2025 for any tax periods ended on or before 31 March 2025.

In a multi-tier scenario, the annual confirmation can be submitted by the Family Foundation/unincorporated partnership, for the Family Foundation/unincorporated partnership itself and for other entities wholly owned and controlled by them. Alternatively, the confirmation can be made by each entity.

Failure to continue meeting the conditions

In the event of failure to meet conditions under Article 17(1) of the CT Law, the Family Foundation shall lose its fiscally transparent status and revert to being a Taxable Person from the beginning of the Tax Period in which such failure occurred.

In case of violation of condition by any entity in a multi-tier structure, any entity it holds directly or indirectly will also cease to be covered under the Family Foundation provisions. Concluding thoughts

The taxation guide on Family Foundation provides much needed clarifications on various aspects in a timely manner.

These clarifications are likely to provide clarity to tax-payers in terms of tax treatment of Family Foundations, type of entities covered under Family Foundations, timelines for making application for being treated as pass through entities, elaboration on conditions, status of Foreign Foundation, etc.

However, one of the important aspects which remains unanswered include implications where income from foundation is taxable but the share of the beneficiaries is unascertained. Issue is more prevalent especially where there are natural persons as well as non-qualifying public benefit entities as beneficiaries. Also, there could be practical challenges where there is taxable income and the beneficiaries include future beneficiaries (like unborn children, future wife, etc.).

It would be important for Family Foundation to analyze the overall situation on the tax side before making an application to be treated as pass through. This would include taking into consideration various aspects like whether normal free zone benefits are available, taxation in home country of beneficiary in case of non-resident beneficiaries, timing of making an application, etc.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.