Macroeconomic headwinds, lower VC funding and M&A downturn risks remain high. However, innovations in new emerging AI technologies are attracting larger investments, giving it a major boost. MENA banks have performed better than their international peers. Other growth sectors like fintech, e-commerce/ retail, health tech, food delivery, transport and e-logistics have also been impacted. However, they continue to see large transactions, but with lower frequency, due to wider opportunities that still exist in various emerging markets in Asia and MENA due to lower internet penetration.

Some of the market trends that have emerged this year include:

1. Geopolitical risks: remain high with Russia and Ukraine war continuing. The Middle East, however, is doing much better, with a renewed focus on development and diversification. US & China are talking again, so this provides hope for the future.

2. Climate change, energy transition & ESG: have taken center stage as a global priority since the risks have sharply increased due to El Nino, unprecedented higher degree heat waves and forest fires raging across some cities in US and Europe while there were floods in Asia and China.

3. Financial risks: also remain high due to the US/ Europe banking crisis, higher interest rates, oil prices and coupled with tighter credit slowing growth. Stubborn food inflation remains at elevated levels; thus, recession in the above major economies is still quite probable.

4. The dichotomy of Tech: layoffs and talent shortages continues since last year, resulting in e10% payroll downsize by technology majors. Skilled talent shortage remains a big challenge as wages continue to rise despite the economic slowdown.

5. A significant drop in equity investments is seen in new technology start-ups and M&A deals: (including by Big 5 Apple, Microsoft, Google, Amazon and Nvidia) have been adversely impacted due to all the above factors. The median deal count and average size of deals have gone down across all markets, compared to FY 2022,especially in Fintech/ E-commerce/ Retail & Enterprise software. Founders are now pursuing debt finance and convertible notes as a popular alternative, rather than having to endure larger dilution or have marked down rounds. The main exceptions to this include AI, healthcare, biotech and climate tech which continue to receive higher funding.

It is now taking longer to raise funding from series A to B and close bigger growth rounds $100 M plus. VC's or PE firms are high on dry powder but are being selective. Investors' focus on early stage/ seed fund rounds is gaining ground, as they target companies with faster growth potential, and value creation levels that can be sustained with lower risks.

6. Increase in secondary sales: among VC or PE firms is seen as a preferred option since exits via IPO and M&A have reduced considerably due to overall economic uncertainty. One of the recent large secondary sales includes Walmart buying out Tiger Global's stake in India's Flipkart, a major e-commerce platform, at a marked-down valuation of USD 35 Billion (US 38.6 billion previous round), one of the rare transactions.

7. Due diligence: More rigorous due diligence has become a new norm, especially with cross border deals, with legal, commercial synergies and tax being key focus areas as well, besides traditional financial due diligence, that is also slowing down M&A transactions with deals closing late.

8. Bank deposit rates are: also, at an all-time high, resulting in higher income for HNI's, corporates and family offices that have large surplus cash since business and other asset classes of investments become riskier. Risk aversion mindset is highly prevalent with most investors holding on to their funds in the interim to tide over the uncertainty.

GCC Economics:

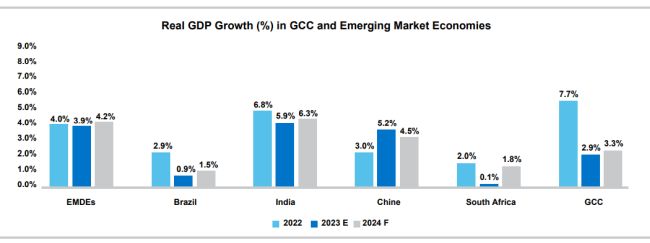

The outlook is stable, with higher oil prices and an improvement in the U.A.E PMI index during H1'23 reflecting improved market conditions. The FDI in the region or U.A.E has increased due to improved investment climate, liberal economic and immigration policies, increase in tourism, real estate prices have risen sharply due to local demand and money inflows, along with infrastructure investments. The region is blessed with young demographics, and a higher degree of revenue diversification being pursued by most GCC countries. Growth in the M.E region will be around 3%+ levels, compared to 7.7%+ last year, because of lower oil prices prevailing with demand side risks.

>

>

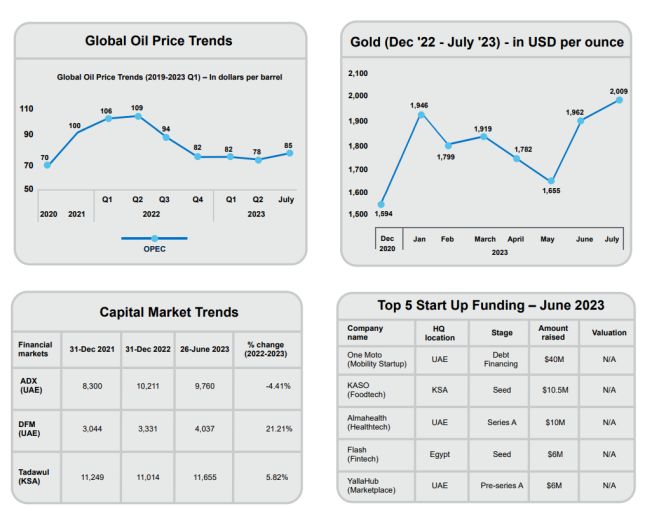

Financial markets, Gold and Crypto markets have also risen after initial shocks during Q1'23 due to US or Europe bankcrisis. Major economies like China are expected to grow at 4.50% and with India still growing at 6.3%+, being the fastest among top five economies. This augurs well for demand side risks that indicate the worst may be over.

GCC economy(s) are expected to grow at 3.3%+ levels next year, due to high oil prices that are expected to average around $90 per barrel level due to OPEC+ production cuts tightening supplies, and this trend is likely to continue through 2024, resulting in budget surplus for most ME countries.

Key takeaways for businesses to navigate through these turbulent times:-

- Diversification into new products and in new markets with potential should be a priority.

- Focus on core expertise, expand existing market share, while exiting from ancillary business that do not create value.

- Cost reduction and optimization measures should be put in place to ensure business is run efficiently.

- Cash flow management should always be a high priority.

- Reducing financing costs is very important through better cash flow management and reducing locked in working capital.

- Fast track technology adoption, software tools and data security upgrades to ensure tax and regulatory compliance is carried out diligently.

- Companies are moving to cloud investments wherever feasible, conserving cash, while they undertake digital transformation and AI projects to boost productivity and efficiency at all levels.

- Outsourcing of key back-office support functions is gaining further ground, with a focus on speed, accuracy and efficiency.

- Close monitoring of business performance is essential, through data driven insights that translate into smarter decisions.

- Staff retention, training and their well-being are essential while implementing the company strategy to manage talent.

It is thus a Volatile, Uncertain, Complex and Ambiguous (VUCA) world, that makes planning difficult. Being agile, adapting to shifting economic and business realities, is needed. It thus requires a more measured response, rather than pursuing hyper growth, which is not possible anymore in most industry sectors. Capital and operational efficiency is key, with equal focus on revenue expansion and profitability that will ensure a sustainable future.

There are many opportunities to grow across industries, through a targeted M&A strategy for faster growth during H2'2023 since the asset valuations and industry multiples are down. Thus, a feeling of "Cautious optimism" is the new paradigm that prevails and is likely to continue in the foreseeable future.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]