- with readers working within the Banking & Credit and Insurance industries

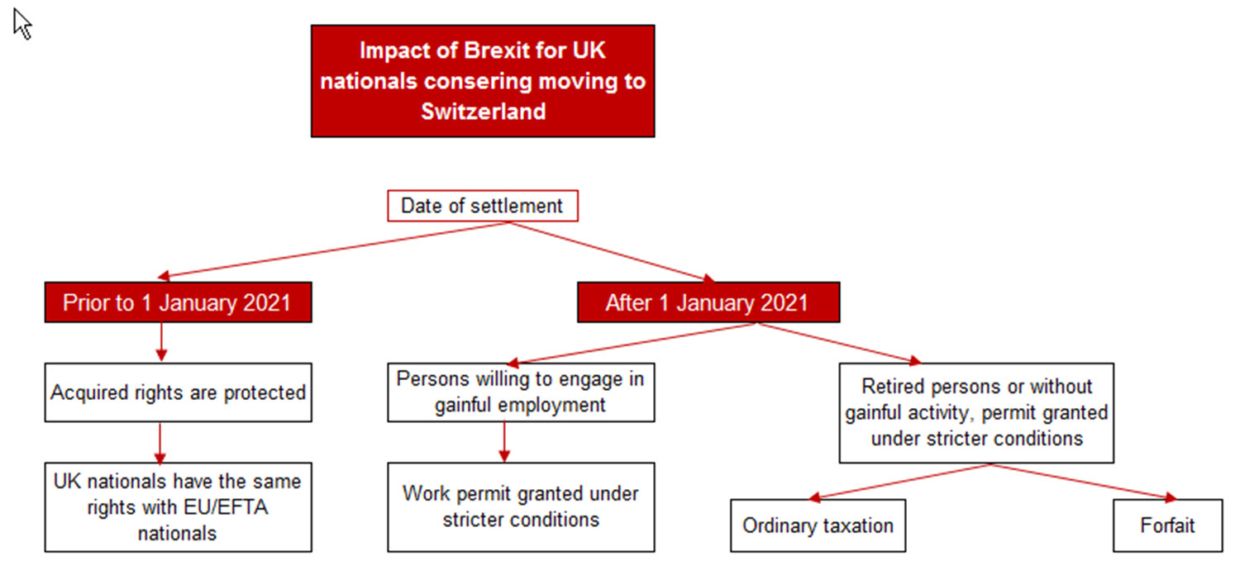

One of the consequences of Brexit is that the bilateral Agreement on the Free Movements of Persons between Switzerland and the EU no longer applies to the UK as from 1st January 2021. UK nationals are as a result no longer regarded as EU/EFTA nationals but as "third-country" citizens, who are subject to stricter admission requirements for residence purposes in Switzerland.

A more careful preparation in before moving to Switzerland is hence strongly recommended since the conditions are now more stringent for UK nationals.

A bilateral agreement signed between Switzerland and the UK, the UK-SWISS Citizens' Rights Agreement, protects rights acquired before the 31 December 2020. UK nationals legally residing or working in Switzerland at this date are accordingly covered by this Agreement and their rights are protected as long as they remain Swiss residents.

If a UK national engages in a gainful employment in Switzerland as from 1 January 2021 and will accordingly be an "ordinary" taxpayer, he/she will need to apply for a residence and/or work permit when moving to Switzerland as "third-country" national. He/she no longer has an unconditional right to be a Swiss resident but has to apply for a Swiss residence permit, subject to a number of strict conditions.

In this context, the Swiss authorities will analyse whether it is in the general economic interest of the country to grant the permit, considering the current state of the economy and the labour market. For example, an authorisation will be granted if it is difficult or impossible to find a Swiss or a European worker with equivalent professional/technical qualifications or with the same skills and knowledge. Also, quotas are applied and only 3,500 UK nationals will be granted working permits in Switzerland in 2021.

By way of exception, posted UK employees in Switzerland (workers sent by UK companies for short-term mission) for less than 90 days per calendar year are still treated as Europeans. They will be benefiting from the bilateral Service Mobility Agreement, which will be into force at least until 31 December 2022.

Finally, Brexit also impacts retired British nationals who wish to settle in Switzerland: they will be admitted only if they are more than 55 years old, have sufficient financial means to largely cover their life costs and have strong and specific ties with the country.

Candidates to the lump-sum taxation regime (so-called "forfait") will still be accepted, albeit with much higher financial conditions. The minimum forfait (i.e. the minimum deemed income on which the forfait taxpayer is taxed) has increased to a minimum bracket of CHF 750,000 to CHF 1,000,000 (depending on the canton granting the forfait), with a minimum yearly tax burden of – very roughly said – CHF 290,000.

All in all, the situation of UK nationals willing to settle in Switzerland can be summarised as follows:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.