- in North America

- within Strategy topic(s)

The Securities Investment Business Act of the Cayman Islands (the SIB Act) is the primary securities statute in the Cayman Islands and regulates the conduct of securities activities in or from within the Cayman Islands. If the SIB Act applies to the activities of an entity or person then the entity or person must apply to the Cayman Islands Monetary Authority (CIMA) for a licence or registration under the SIB Act unless one of a limited number of exemptions applies.

Does the SIB Act apply to me?

The SIB Act applies to any Cayman Islands companies and partnerships, foreign companies and partnerships registered in the Cayman Islands, or any natural person who has established a place of business in the Cayman Islands (relevant persons), who engage in "securities investment business".

Any relevant person which is acting or proposing to conduct securities investment business anywhere in the world could potentially come within the scope of the SIB Act. It is important to note that a physical presence in the Cayman Islands is not a prerequisite for the SIB Act to apply.

Whether or not the SIB Act applies to your business or entity will involve a fact specific analysis and you should contact your usual Harneys representative for further information or assistance. The remainder of this guide is intended to offer help in making an initial determination.

How does the SIB Act define "securities"?

Under the SIB Act, "securities" are broadly defined to include shares, stocks, interests in partnerships, interests in limited liability companies (LLCs), trust units, debt instruments, warrants, certificates, options, futures and rights or contractual entitlements under CFDs (contracts for difference).

As should be obvious, securities under this definition could be in any form, electronic, digital or otherwise. This is important when looking at businesses which issue virtual or digital assets or provide certain services in relation to virtual or digital assets. Please see our Guide to virtual asset service providers in the Cayman Islands for a more detailed discussion of the Cayman Islands virtual asset service provider regime. The SIB Act does not have any equivalent to the US 'Howey Test'.

What is "securities investment business"?

"Securities investment business" is defined as undertaking any one or more of the following activities in the course of business with respect to securities:

- dealing - this includes buying, selling, subscribing for or underwriting securities as an agent or principal in certain circumstances

- arranging - this includes making arrangements with respect to the buying, selling, subscribing for or underwriting securities as an agent or principal

- managing - includes managing securities belonging to another person in circumstances involving the exercise of discretion or

- advising - includes giving advice to third parties in their capacity as an investor or potential investor or as agent for an investor or potential investor; or giving advice on the merits of buying, selling, subscribing for or underwriting securities or the exercise of any rights conferred by a security, as an agent or principal Under the SIB Act, a licence or registration may also be required where the description or title under which a person carries on business suggests they are undertaking securities investment business; or if the person makes any representations (written or otherwise) that they are carrying on securities investment business or otherwise holds themselves out as carrying on securities investment business.

Are any activities excluded from the definition of securities investment business?

It is important to note that some valuable exemptions apply and relevant persons undertaking these activities will be out of scope for the purposes of licensing or registration under the SIB Act. These include:

- dealing in securities evidencing indebtedness in respect of any loan, credit, guarantee or other similar financial accommodation or assurance which such person or his principal has made, granted or provided

- a company, partnership, or trust issuing, redeeming or repurchasing securities that it has issued (the so-called 'issuer exemption')

- a company disposing of its treasury shares

- dealing in options, futures or contracts for differences where none of the parties are individuals and where the sole or main purpose of the transaction is for risk management purposes in connection with non-securities investment business

- a person dealing in securities in connection with the disposal of goods or supply of services where the supplier of the goods or services does not hold himself out as dealing in securities and does not solicit the public to deal in securities

- dealing in securities, arranging deals in securities, or advising on securities in the course of any profession or business not otherwise constituting securities investment business where such dealing, arranging or advising is an incidental part of that profession or business and is not separately remunerated

- an employer dealing in securities in connection with an employee share or pension scheme

- a company, partnership, LLC or trust acting as principal on its own behalf dealing in securities by applying its proprietary assets

- making arrangements for the sole purpose of providing finance to enable a person to deal in securities

What are the exemptions from licensing and registration?

Non-registrable persons do not need a licence nor do they need to register with CIMA. Non-registrable persons are:

- a relevant person being part of a joint enterprise where the other person carries on securities investment business and such business is carried on for the purpose of the joint enterprise

- certain Government or statutory bodies or public authorities

- a relevant person carrying on securities investment business only in the course of acting in any of the following capacities: director, partner (including general partners), LLC manager, liquidator, trustee in bankruptcy, receiver of an estate or company (including an LLC), executor or administrator of an estate, or a trustee acting together with cotrustees in their capacity as such, or acting for a beneficiary under the trust,

provided that in each case that person is not separately remunerated for any of the activities which constitute the carrying on of such securities investment business other than as part of any remuneration the person receives for acting in that capacity and either:

- as a necessary or incidental part of performing functions in that capacity or

- is acting on behalf of a company, partnership or trust that is otherwise licensed or registered under the SIB Act.

In addition, CIMA will exempt a person from registration or licensing under the SIB Act, where the person operates a trading platform which engages in securities investment business which utilises virtual assets only. Also, CIMA may exempt a person from registration or licensing under the SIB Act where CIMA determines that the activity would more capably be supervised under the Cayman Virtual Asset (Service Providers) Act (VASP Act) or that additional licensing or registration under the SIB Act is unnecessary as the person is already licensed under the VASP Act.

Licensing or registration?

If no exemption applies then a person will either need to obtain a licence from CIMA or register with CIMA as a "Registered Person".

Registered Persons do not need a full licence but must file a registration application with CIMA before starting business. Registered Persons are:

- a company that carries on securities investment business exclusively for one or more companies within the same group (ie under common ownership)

- a person who carries on securities investment business exclusively for a sophisticated person (a listed or regulated entity, or an experienced investor that invests more than US$100,000 per transaction), a high net worth person (an individual with a net worth of at least US$1,000,000 or a person with total assets of at least US$5,000,000) or an entity whose investors are either sophisticated persons or high net worth persons (Sophisticated Investors)

- a business regulated by a recognised regulatory authority in the country in which the securities investment business is being conducted

How does the SIB Act work in practice?

To put the SIB Act into context, we have set out below some case studies.

Investment managers

A Cayman Islands exempted company or a foreign registered company which provides discretionary asset management services to an investment fund will be carrying on securities investment business. If the manager is providing services only to a fund that is regulated by CIMA then the manager would qualify as a Registered Person on the basis that it is providing services only to a person within the category of Sophisticated Investors. On the other hand, if the manager is providing services to an unregulated fund then in order for the manager to qualify as a Registered Person the investors in the fund would have to fall within the category of Sophisticated Investors.

The investment manager must register as a Registered Person and comply with the economic substance test under the International Tax Co-operation (Economic Substance) Act (the ES Act). Further details can be found in our Guide to economic substance in the Cayman Islands.

Brokers and market makers

Brokers will be carrying on securities investment business and must either apply for a licence or registration depending on their client base. In relation to being a Registered Person, it should be noted that the securities investment business must be carried on "exclusively" for Sophisticated Investors.

Cayman companies issuing their own equity interests

A Cayman Islands company issuing its own equity interests does not constitute securities investment business as it falls within the list of excluded activities.

A Cayman company issuing a virtual asset which exists on a blockchain network

In this scenario, it is important to look at the exact terms and conditions of the relevant virtual asset to decide if it is a security. As noted above, Cayman Islands law doesn't have any equivalent to the US Howey Test so each virtual asset or token must be looked at on an individual basis. If the virtual asset were a contract for difference, the 'issuer exemption' does not apply and an issuer of such virtual assets would be conducting securities investment business and would need to consider either registration or licensing. Whereas, if the virtual asset were some type of debt instrument, then the issuer exemption applies. In addition, an analysis under the VASP Act needs to be conducted and securities registration or licensing requirements in other jurisdictions would need to be considered depending on where the virtual assets are marketed, issued or sold. Please see our Guide to virtual asset service providers in the Cayman Islands for a more detailed discussion of the Cayman Islands virtual asset service provider regime.

Buying and selling securities for your own account or as agent

This is not securities investment business. Additionally, if the purpose for engaging in securities transactions may be for risk management where the main business is other than securities business then this is also not securities investment business. Other excluded activities are detailed above.

A word of caution, in this scenario if the principal holds itself out generally as a market maker, its activities may then fall within the definition of "securities investment business", which would require the principal to obtain a licence or consider registration.

General partner of a partnership

The business of being a general partner of a Cayman Islands exempted limited partnership (established as an investment fund) and which has control and management of the investments of the partnership is carrying out securities investment business on behalf of the partnership but is specifically excluded from the need to be registered or licensed under the SIB Act as long as they are not separately remunerated for the investment services and provided that they do not hold themselves out as carrying on securities investment business separately. In this case, no CIMA registration is required.

We often see Delaware limited liability companies registered as foreign companies in the Cayman Islands to be the general partners of Cayman Islands exempted limited partnerships established as investment funds. If the Delaware LLC also acts as an investment adviser to an onshore fund and is paid by that fund for those investment advisory services as a registered foreign company in the Caymans Islands, the Delaware LLC is potentially subject to the SIB Act and may need to be registered or licensed.

If the Delaware LLC were only general partner to the Cayman Islands fund, then it would be a non-registrable person. However, the fact that it is carrying on securities investment business in its work as an investment advisee for the onshore fund and separately paid for that brings it within the scope of the registration regime. If, for some reason, the onshore fund were not able to qualify as a Sophisticated Investor, full licensing may be required.

Trustees

Many trustees (other than essentially private trustees not carrying on a business) may be carrying on securities investment business. However, such trustees are likely to be exempt from registration or licensing.

Directors of an exempted company

As is the case with trustees and general partners, directors of an exempted company which handle the trading in securities on behalf of the company of which they are directors are likely to be carrying on securities investment business. However, if this is their only activity, they will be exempt from registration.

Licensing requirements

Please contact your usual Harney's representative for details on the license application process, requirements and ongoing obligations of a licensee.

Registration requirements

In order to register with CIMA as a Registered Person an applicant structured as a company must have at least two individuals as directors or one corporate director, each of whom is complying with the Director Registration and Licensing Act (see further below). There are equivalent requirements for an applicant structured as a partnership or LLC.

An applicant for registration must also satisfy CIMA that the applicant's shareholders, directors and senior officers are fit and proper persons. This is achieved by providing CIMA with completed personal questionnaires and certified identification for all beneficial owners, resumes for all AML officers, and confirmations of certain background checks.

The completed application form together with the corporate documents of the applicant, an organisation chart and a client list must also be submitted to CIMA as part of the application for registration.

Relevant persons who are conducting 'fund management business' may be required to satisfy the economic substance test contained in the ES Act (see our client guide). Under the ES Act, 'fund management business' is the business of discretionary investment management carried on by a relevant entity licensed or otherwise authorised under the SIB Act for an investment fund.

Ongoing obligations for Registered Persons

Registered Persons must notify CIMA of any material changes in the information filed with CIMA within 21 days, including any issue or transfer of the legal or beneficial interest in the shares or interests of the Registered Person.

Registered Persons must separately account for the funds and property of each client and their own funds and property.

Registered Persons must comply with all CIMA regulatory measures as can be found at https://www.cima.ky/securitiesregulatory-measures and on which we can advise in detail.

AML requirements

Registered Persons are required to appoint AML officers and have appropriate AML systems, records, procedures and controls in place to conduct due diligence on clients and clients' source of funds, undertake ongoing monitoring of client activity and make suspicious activity reports where necessary.

They must adhere to the Cayman Islands AML, anti-terrorism and anti-proliferation legislation and CIMA's Guidance Notes of the Prevention and Detection of Money Laundering and Terrorist Financing in the Cayman Islands.

AML officers do not need to be resident in the Cayman Islands and professional service providers can be engaged to provide these services.

Director registration

Under the Director Registration and Licensing Act, all directors (which also includes LLC managers), whether natural persons or corporate directors and whether resident in the Cayman Islands or elsewhere, who act as directors or LLC managers of certain Registered Persons must be registered with, or in certain circumstances be licensed by, CIMA. Full details can be found in our client guide.

Tax information reporting

It is possible that a Registered Person may also be a financial institution under the Tax Information Authority (International Tax Compliance) (United States of America) Regulations and the Tax Information Authority (International Tax Compliance) (United Kingdom) Regulations. Further details can be found in our client guide.

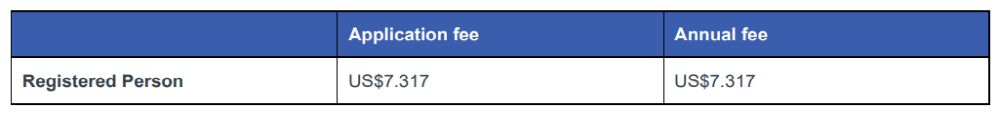

Fees

The application and annual registration fees for a Registered Person are as follows:

The application fee is not pro-rated for the calendar year and the annual fees are payable by 15 January each year.

Relevant annual registration fees for the vehicle will also be payable.

Enforcement by CIMA

The SIB Act provides CIMA with a broad range of enforcement powers. CIMA also has the power under the Monetary Authority Act to impose significant administrative fines of up to CI$1 million (US$1.2 million) for each breach of certain provisions of the Anti-Money Laundering Regulations and certain other Cayman laws and regulations, including the SIB Act, the Mutual Funds Act and the Private Funds Act. The level of an administrative fine will depend on various factors including whether the breach is committed by an individual or a body corporate and if the breach is classified as minor, serious or very serious.

CIMA will regularly conduct desk-based inspections of Registered Persons. If you are subject to an inspection please contact us as soon as possible to assist.

False or misleading market and insider trading

The SIB Act also sets out that it is an offence to create or do anything which is calculated to create a false or misleading appearance of active trading in any securities listed on the Cayman Islands Stock Exchange (CSX) or a false or misleading appearance with respect to the market for, or price of, any such securities.

Any individual who has information as an insider also commits an offence of insider dealing if they deal in CSX listed securities that are price-affected in relation to the information, encourage another person to deal in those securities, or disclose the information to another person otherwise than in the proper performance of their employment, office or profession. the SIB Act sets out certain defences that are available, including if the person is able to show that they would have done what they did even if they did not have the information.

These offences are punishable on conviction by either a substantial fine and/or by imprisonment.

Economic substance

The ES Act was introduced in the Cayman Islands in response to OECD's Base Erosion and Profit Shifting framework and related EU initiatives in relation to what are known as 'Geographically Mobile Activities'.

The ES Act is supplemented by the Guidance Notes issued by the Cayman Islands Tax Information Authority (the TIA) on Economic Substance for Geographically Mobile Activities. Under the ES Act any 'relevant entity' which carries on a 'relevant activity' and receives 'relevant income' in a financial period must satisfy the economic substance test in relation to that activity and make an annual filing with the TIA.

Under the ES Act 'fund management business is a relevant activity, among other activities, and therefore an entity will need to consider the impact of the ES Act.

Please see our Guide to economic substance in the Cayman Islands for further details of the ES Act.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]