- within Law Department Performance topic(s)

- in European Union

Entities that are considering incorporating in the BVI or the Cayman Islands need to familiarise themselves with the new Economic Substance (ES) legislation, to balance substance requirement costs against the benefits of incorporating in their chosen jurisdiction. The intended activity, or activities, and the structure of the company should be reviewed against the substance legislation to ensure that the location of incorporation is viable for the vision of the entity.

What is 'Economic Substance'?

The legislation, Economic Substance (Companies and Limited Partnerships) Act 2018 for the BVI or The International Tax Co-operation (Economic Substance) Act (2021 Revision) as amended for the Cayman Islands (the Cayman Act), were introduced in the jurisdictions to satisfy new requirements of the OECD. These directives are designed to address an EU-based unfair tax practices initiative that requires certain entities that are incorporated or registered in low and no tax jurisdictions across the globe to demonstrate that they are operating in the jurisdictions in which they are tax resident (i.e. demonstrate 'substance').

Who does it apply to?

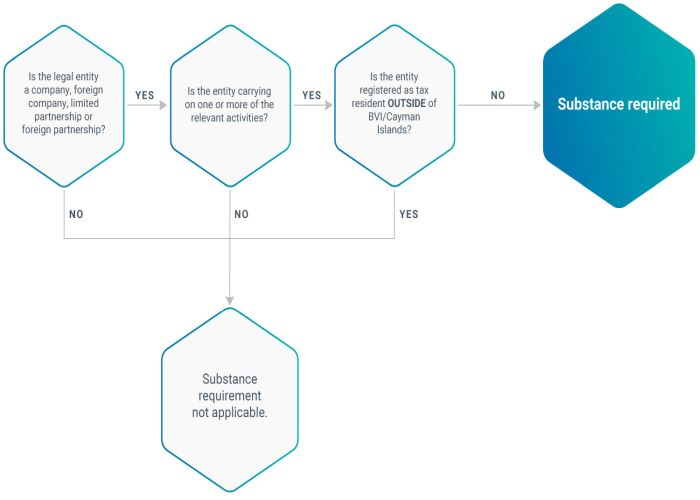

The legislation applies to all companies and limited partnerships (LP - BVI) or limited (liability) partnerships (LLP – Cayman Islands) with legal personality, unless they are considered non-resident for the purposes of the Act, and to all foreign companies doing business that are engaged in 'relevant activities', although a recent amendment to the BVI legislation will require Limited Partnerships without legal personality to also comply from June 2021 onwards.

It is expected that the Cayman Islands exempted limited partnership (ELP) will be in scope for ES and, if successful, a Revision to the Cayman Islands Act will come into force by 1 July 2021 with a transition period of six months, effectively meaning that notifications should be submitted by 1 January 2022.

For the Cayman Islands, domestic Cayman Islands companies and investment funds fall within the exemption category and only require the submission of a notification to the Registrar of Companies in the Cayman Islands.

Trusts are not included in the requirement for the BVI or the Cayman Islands.

What are the 'relevant activities'?

In order to establish whether an entity will need to demonstrate substance, the legislation provides definitions for nine 'relevant activities':

- Banking

- Distribution & service centres

- Finance & leasing

- Fund management

- Headquarters

- Holding

- Insurance

- Intellectual property

- Shipping

What are the classification groupings?

| Relevant activity | Tax residency – outside of the BVI / Cayman Islands | Requirement |

| No | Not applicable | Out of scope: simple annual filing confirming that the entity does not carry out any relevant activities. Annual confirmation of the classification grouping. |

| Yes | Yes | Out of scope: but a slightly higher level of filing is required, including the supply of documented evidence covering the entire financial period, supporting the claim of tax residency as well as low-level data relating to the parent entity (if applicable). Annual filing and confirmation of unchanged classification group. |

| Yes | No | In scope for substance. Entities in this category must demonstrate that they are operating at appropriate levels in the BVI/Cayman Islands (demonstrating substance), unless they are a pure equity holding company, or PEHC (a reduced substance test applies). A higher level of data is required for filing and will vary according to the relevant activity. Annual confirmation of the classification grouping. |

How does an entity demonstrate substance?

The legislation refers to demonstrating 'adequate' or 'appropriate' substance depending on the relevant activity and the scale and complexity of the operation. Substance would include:

- having an adequate number of employees in the BVI/Cayman Islands to carry out its business;

- having adequate premises in the BVI/Cayman Islands to carry out its business;

- managing and directing its business from the BVI/Cayman Islands (not applicable for PEHC);

- incurring adequate expenditure in the BVI/Cayman Islands; and

- carrying on its core income generating activity in the BVI/Cayman Islands.

Outsourced activities to agents in the BVI/Cayman Islands would be considered suitable contribution to substance declaration.

Ultimately the decision on what level of substance that will be demonstrated lies with the Directors of the entity, however, due to the vague wording of the legislation we would strongly recommend a legal review of the entities that are in scope for substance.

Entities carrying out holding activities would require reduced substance levels. Entities carrying out intellectual property activities, conversely, would require a more substantial demonstration of substance.

Further information can be found in the useful links below.

Financial period

The default financial periods are determined by incorporation date as follows:

Incorporated BEFORE 1 Jan 2019: Financial period runs from 30 June – 29 June annually; or

Incorporated AFTER 1 Jan 2019: Financial period start is the date of incorporation and the end day is 12 months, less a day, later. Example: if the incorporation date is 14 Feb, the financial period will be 14 February – 13 February each year.

Reporting Requirements

| Relevant activity | Tax residency – outside of the BVI / Cayman Islands | Requirement | BVI timing | Cayman Islands timing |

| No | Not applicable | Annual confirmation of classification group. Simple annual filing confirming that the entity does not carry out any relevant activities. | Filing can be submitted once the financial period is complete and must be submitted within six months from that date. | ES notification confirming classification and relevant activities must be filed in January, regardless of financial period timings. |

| Yes | Yes | But a slightly higher level of filing is required including the supply of documented evidence covering the entire financial period, supporting the claim of tax residency as well as low-level data relating to the parent entity (if applicable). Annual filing and confirmation of unchanged classification group. |

Filing can be submitted once the financial period is complete and

must be submitted within six months from that date. |

ES notification confirming classification and relevant activities must be filed in January, regardless of financial period timings. The annual ES return for those carrying out relevant activities must be submitted within 12 months after the end of a financial period. |

| Yes | No | A higher level of data is required for filing and will vary according to the relevant activity. Data must be supplied annually relating to each financial period. Annual confirmation of the classification grouping. | Filing can be submitted once the financial period

is complete and must be submitted within six months from that

date. |

ES notification confirming classification and

relevant activities must be filed in January, regardless of

financial period timings. The annual ES return for those carrying

out relevant activities must be submitted within 12 months after

the end of a financial period. |

Struck off and liquidating entities

Struck off entities (but not yet dissolved) are still required to comply with ES and the annual BVI filing or Cayman Islands ES return, will be required. Their lack of turnover related to the activity in question is demonstrated by the data filed and is then reflected in the 'appropriate' substance levels required.

Liquidated entities are expected to file for any financial period during which they were still considered active in the companies registry. This means that they will always end with a partial period to file. As we are unable to file until a financial period is concluded, we will always require the data needed for filing to be supplied prior to the final dissolution so that we are able to file even after the liquidation is complete.

Penalties

First offence of failure to comply (either by not submitting a filing or insufficient substance demonstration) will trigger a penalty of minimum US$5,000 (BVI) or US$12,200 (Cayman Islands).

A second offence will trigger an escalation of penalty, with a minimum of US$20,000 (BVI) or US$122,000 (Cayman Islands). In BVI, penalties could be as high as US$400,000 for an IP entity. The tax authority could ultimately recommend that the entity be struck from the register for continued failure to comply.

Provision of false data could result in further penalty or prison sentence.

How can we help?

- Support and guidance through the classification process.

- Timely annual filing for ES.

- Facilitate ES assessment or classification with a local partner.

- Development and provision of bespoke substance service packages enhances BVI and Cayman Islands presence: directorship, accounting and tax, corporate secretarial.

Useful Links

- Link to BVI legislation

- Sustainable international business in the BVI

- Link to Cayman Islands legislation

- Sustainable international business in the Cayman Islands

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.