- within Finance and Banking topic(s)

- with readers working within the Retail & Leisure industries

- within Coronavirus (COVID-19), Litigation and Mediation & Arbitration topic(s)

Expanding Offshore

When a Canadian hedge fund manager has built up a successful track record using a domestic Canadian fund vehicle, as a logical next step it may wish to use the same investment strategy to attract international investment.

This process will generally involve setting up an offshore fund structure. The Cayman Islands, in particular, have established themselves as a pre-eminent centre for this type of work, with the majority of the world's hedge funds being domiciled in the jurisdiction. (Estimates typically range between 70% and 80%.) The Cayman Islands model, based on tax neutrality and professional efficiency, has been reviewed extensively by managers, investors and their advisors over the years and is regarded as a triedand-tested solution, robust enough to withstand (among other things) the challenges of the 2007-2008 global financial crisis, the global COVID-19 pandemic of recent years, and the subsequent market turbulence in each case.

Fund Structuring

The offshore hedge fund structure most commonly used for non-US and US tax-exempt investors is generally the Cayman Islands corporate fund, i.e. the exempted company, either as a standalone vehicle or as part of a master-feeder structure. The traditional master-feeder structure for a hedge fund will typically involve a Cayman Islands corporate feeder fund (for US tax exempts and non-US investors) and a Delaware limited partnership as a US pass-through feeder fund (for US taxable investors), each investing into a Cayman Islands master fund (which makes the appropriate election to be regarded as transparent for US tax purposes). The master fund (which is also typically structured as a Cayman Islands exempted company, or sometimes as a Cayman Islands exempted limited partnership) will generally hold all the assets and carry out the trading activities in this structure. While there can be variations on the theme (e.g. to ensure management and performance fees / allocations can be taken out in the most tax-efficient manner), this common structure generally allows international investors with different tax treatments to invest in the same fund in a tax-efficient manner for all concerned. In addition to these tax efficiencies, the consolidation of investment capital in the master fund increases the level of overall fund assets and so can reduce trading and operational costs through economies of scale.

The Canadian Dimension

When establishing an offshore hedge fund for a Canadian manager, two key issues to address from the outset will be the 'mind and management' of the fund, and whether the fund is carrying on business in Canada as a result of the Canadian management. Under Canadian tax legislation, there is a 'safe harbour' provision which specifies designated investment services that may be carried on by the Canadian manager of an offshore hedge fund without risk of causing the fund to be carrying on business in Canada and thereby subjecting the fund to Canadian tax on income earned in Canada. These designated investment services include investment management and advice with respect to qualified investments. However, any activities constituting 'mind and management' control of the fund occurring in Canada, such as general governance authority, whether within or outside the safe harbour provision, could nonetheless cause the fund to be resident in Canada, and thus taxable there on worldwide income. The precise tax analysis can differ as between different Canadian advisors, and it is important that managers work closely with their legal counsel and tax advisors to obtain the appropriate advice on Canadian tax issues. For example, there may be sensitivities around the location of the other service providers to the fund (e.g. the administrator), the board of directors of the fund (and master fund), and the holder(s) of any non-participating voting shares in the fund, among other things. Canadian tax advisors will generally advise that not only must ultimate legal control reside outside of Canada, but that de facto control must also be maintained outside Canada, and to that end certain advisors will recommend that as many services as possible be provided outside of Canada for Canadian-managed offshore hedge funds.

This is generally achieved by implementing the following types of measures:

- appointing an administrator and other service providers for the fund that are located in the Cayman Islands or another jurisdiction outside of Canada;

- appointing a board of directors for the fund that comprises at least a majority (if not all) independent directors that are not resident in Canada (there are a number of providers of professional independent directors based in the Cayman Islands);

- ensuring that the fund's governance takes place outside of Canada; and

- where the fund issues participating non-voting shares to investors, having the non-participating voting shares in the fund (typically referred to as 'founder' or 'management' shares) held independently of the fund manager and its affiliates – for example, arrangements would typically be made for the voting shares to be held in charitable trust and particular care should be taken to ensure that the charitable trust documentation satisfies the requirements that independence and control are maintained outside of Canada.

In addition, restrictions apply in relation to the promotion and sale of shares in the fund to Canadian investors, so the Canadian fund manager may not want to admit its Canadian investors directly into the Cayman Islands fund it manages. In certain circumstances, it may be possible to establish a blocker fund, or a series of blocker funds, to address this concern.

Canadian Tax Treaties and Cayman Enterprise City

Historically, Canada has had strong links with Barbados due to its double tax treaty with the jurisdiction, which essentially allowed certain profits made by a Barbadian foreign affiliate of a Canadian resident corporation to be repatriated to Canada tax-free after paying lower taxes in Barbados. The Cayman Islands signed a Tax Information Exchange Agreement with Canada, which became effective on 1 June 2011, effectively allowing the same practice as between a Cayman Islands-resident foreign affiliate and its Canadian-resident corporate parent (as a result of the Cayman Islands being considered a designated treaty country for the purposes of the Income Tax Act of Canada). The advantage in using the Cayman Islands, however, is that there is no tax payable at the Cayman Islands stage of the process (unlike Barbados), nor are there any exchange control restrictions or regulations in the Cayman Islands. The Cayman Islands has also established a special economic zone, known as Cayman Enterprise City ("CEC"), where Canadian businesses may quickly and easily set up a substantive offshore base with a real corporate presence and mind and management in the Cayman Islands. The CEC comprises a number of specialist business parks, aimed at the internet, technology, academic, media, film, biotech, and commodities and derivatives industries, and combines the tax and jurisdictional benefits of the Cayman Islands with a number of government-mandated measures designed to attract new business (including exemptions from work permits, taxes and import duties, and an easy, fast-track setting up of operations in three to four weeks). Accordingly, the Cayman Islands offers significant opportunities for Canadian businesses looking to establish a tax-neutral offshore presence in a designated treaty country and whose specialism falls within one of the above areas.

Regulatory Framework and Compliance (Initial and Continuing Requirements)

'Mutual funds' have been regulated in the Cayman Islands since 1993. Under the Cayman Islands legislation, the term mutual fund in fact equates to 'investment fund', rather than a regulated retail fund (which is the US context for the term). Only 'mutual funds' that carry on business in or from the Cayman Islands are subject to regulation by the Cayman Islands authorities. Responsibility for such regulation rests with the Cayman Islands Monetary Authority ("CIMA").

What is a mutual fund under Cayman Islands law?

Under the Mutual Funds Act (As Revised), a mutual fund is defined to mean any company, unit trust or partnership (wherever established) that issues equity interests redeemable at the option of the investor, the purpose or effect of which is the pooling of investor funds with the aim of spreading investment risks and enabling investors to receive profits or gains from investments. In a typical Cayman Islands masterfeeder structure, both the feeder fund and the master fund will generally be mutual funds for these purposes (unless an exemption applies – see below).

Although the Cayman Islands definition is a wide one, some investment funds are still excluded from the definition and, consequently, from regulation. Funds that do not qualify as a mutual fund include closedended funds (where the investors cannot redeem at their own option – such funds may instead fall to be regulated as 'private funds' under the Private Funds Act (As Revised)), single investor funds that are not master funds to a CIMA-regulated feeder fund (because there is no 'pooling of investor funds'), and funds that issue debt rather than equity interests.

Is a fund carrying on business from the Cayman Islands?

Subject to the exclusions referred to above, open-ended funds (where investors have the right to redeem at their option) established in the Cayman Islands are subject to regulation, and foreign funds will be caught by the regime if they are carrying on business from the Cayman Islands. It is a question of fact whether a fund is carrying on business from the Cayman Islands, although funds that (irrespective of their domicile) make an invitation to the public in the Cayman Islands to subscribe for interests will be caught by the regime.

Which funds are specifically exempted from regulation?

Not every fund that carries on business from the Cayman Islands is required to be regulated by CIMA. If appropriate regulation is already in place, i.e. the fund is listed or regulated by an entity recognised by CIMA and marketed by a CIMA-regulated entity, the fund may qualify for an exemption from registration under section 4(4) of the Mutual Funds Act.

Types of Regulated Funds

Regulated open-ended funds in the Cayman Islands fall into four categories:

- Registered funds

- Administered funds

- Licensed funds

- Limited investor funds

Administered funds and licensed funds have no minimum investment thresholds, but – being aimed more towards the retail investor – have more onerous registration and licensing requirements than registered funds. Since sophisticated and institutional investors have been, and remain, the focal point of the Cayman Islands funds industry, the vast majority of open-ended funds fall to be regulated as registered funds under section 4(3) of the Mutual Funds Act. A fund can register with CIMA as a 'limited investor fund' where the fund intends to have no more than 15 investors and those investors have the right to appoint or remove the fund's operators, i.e. the directors in the case of a corporate fund, by a majority in number. Prior to the admission of a sixteenth investor, a limited investor fund will be required to reregister with CIMA as a registered fund (or satisfy the requirements to become an administered or licensed fund).

Essential Requirements to Qualify for the Regime

A fund qualifies for the regime under section 4(3) if:

- the minimum initial investment per investor is at least US$100,000 or the equivalent in any other currency; or

- the equity interests are listed on a recognised stock exchange.

Provided the initial investment amounts to US$100,000 or more, subsequent investments can be made in smaller increments and interests may be redeemed, withdrawn or repurchased, leaving an invested amount of less than US$100,000. There are some statutory exemptions from the US$100,000 minimum initial investment threshold for investments by the fund's operators and promoters.

Registrations/Permits/Licences Required

No prior approval is required for the registration of a fund falling within section 4(3). The registration process is straightforward and the statutory requirements are satisfied by filing the appropriate documentation and payment of the appropriate fee (see details below). Provided the appropriate documents have been filed and the fee paid, the fund will be promptly registered (typically with effect from the date of the application filing) as a regulated mutual fund. Once registered, the fund is able to market its interests and accept subscriptions without delay.

Once the documents have been filed, CIMA will actively review them and may require additional information from the fund or amendments to the documentation, or may take other appropriate steps. Recently, CIMA has taken a proactive role in reviewing documents and seeking further information.

Required Documents in Order to File

Subject to any exemption that is specifically granted, the documents to be filed in order to register a typical feeder fund or standalone fund as a regulated fund under section 4(3) are:

- an offering document;

- an application form (including details of each director and the fund's other service providers);

- a copy of the certificate of incorporation of the fund;

- a written consent of both the fund's administrator and the fund's auditor confirming acceptance of their appointment by the fund; and

- an affidavit in support of registration from a director of the fund.

The above documents are filed in electronic format through CIMA's Regulatory Enhanced Electronic Forms Submission (REEFS) portal, and must contain certain prescribed details (including, but not limited to, details of the fund's anti-money laundering officers, which must be in place at launch).

A similar set of documents is required in connection with the electronic filing to register a master fund under section 4(3), save that no separate offering document is required for the master fund (and the relevant disclosures can be covered in the feeder fund's offering document).

A limited investor fund must include with its registration application a certified extract of its constitutional documents evidencing the right of the investors to appoint or remove the fund's directors. In addition, a limited investor fund can file any one of an offering document, summary of terms or marketing materials, so unlike a registered fund, a limited investor fund does not have to prepare and file an offering document.

In addition, the proposed directors of the fund (and, if applicable, master fund) are required to be either registered with or licensed by CIMA prior to launch. (See further below on the requirements as to directors).

The offering document for a CIMA registered fund must describe the equity interests in all material respects and contain such other information as is necessary to enable a prospective investor to make an informed decision whether to invest. In addition, the offering document must also contain the disclosures set out in CIMA's rule on the contents of offering documents (the "Contents Rules"). Many of the disclosures required will already be covered in a standard form offering document, but the directors and fund's manager will need to ensure that all applicable requirements of the Contents Rules have been addressed, as well as CIMA's rules relating to the segregation of assets and the calculation of asset values (see further below on the requirements of these additional CIMA rules).

Registration/Permit/Licence fees – Initial, Ongoing and Upon Termination

The fee payable on registration is currently US$4,268 for a typical Cayman Islands feeder or standalone fund, and US$3,048 for a typical Cayman Islands master fund. In each case, the registration fee covers the balance of the calendar year in which the fund is registered.

Thereafter, the prescribed annual registration fees, also US$4,268 or US$3,048 (as applicable) at current rates, are payable on or before 15 January in each year until the fund deregisters as a mutual fund, whereupon it will be released from the obligation to pay fees. There is also an annual filing fee of US$365 payable in connection with the filing of the fund's annual return and audited accounts with CIMA. Formal steps must be taken with respect to any deregistration or change in status and, until those steps have been taken, the obligation to pay fees continues irrespective of whether the fund is actually conducting business, with penalties for late payment.

Requirements for Local Service Providers

There are only two statutory requirements as to the use of local service providers: the registered office and the auditor of a registered fund must both be based in the Cayman Islands. Since almost all section 4(3) funds carry on business mainly outside the Cayman Islands, the registered office requirement is usually fulfilled by retaining a registered office provider who will assist in making government and regulatory filings.

There are no further requirements for local service providers to be appointed by the fund, and onshore administrators or custodians may be appointed.

Requirements as to Directors

In the context of a Cayman Islands corporate fund, there are no statutory requirements as to board composition or residency of the directors, save that, as a longstanding matter of policy, CIMA requires the fund to have a minimum of two directors who are natural persons and are identified in the offering document, and the fiduciary duties owed by the directors require them to hold as many meetings as are necessary for the fund to operate effectively. CIMA has also issued further guidance and rules on corporate governance matters for the funds it regulates (see further below), which include an expectation that the directors will hold at least one board meeting each year.

In addition, the Cayman Islands imposes a registration requirement on the directors of registered funds. This involves a short online registration form and payment of a fee (currently, US$854) to be submitted to CIMA prior to the fund's launch and annually thereafter. This registration requirement is upgraded to licensing for professional directors of 20 or more 'covered' funds. However, there is an exemption from the full licensing requirements for employees and principals of the fund's investment manager who sit on the fund's board of directors, provided that the investment manager is registered or licensed with an overseas regulatory authority recognised by CIMA. Each director must inform CIMA of any change in the director's prescribed details filed with CIMA within 21 days of becoming aware of the change.

Operating and Selling Restrictions

There are no restrictions on a section 4(3) fund's investment objectives or policies, risks, rates of return or power to borrow (other than those the fund chooses to set out in its offering materials and constitutional documents), nor is there any requirement for annual shareholder/investor meetings. The sophisticated investors at which these products are aimed are left free to make their own determination as to whether to invest, and generally the marketing and selling of these products will be according to the securities laws and regulations of the relevant investor's own jurisdiction. In this way, the Cayman Islands avoids imposing the expense and administrative burdens of such regulation directly on the funds. No offer or invitation to subscribe for interests in the fund may be made to the public in the Cayman Islands (unless such interests are listed on the Cayman Islands Stock Exchange), but the 'public' in the Cayman Islands does not include 'sophisticated persons', 'high net worth persons' or various exempted Cayman Islands entities.

Continuing Requirements for Regulated Mutual Funds

Financial Reporting

All mutual funds must, unless specifically exempted, file audited accounts signed off by a Cayman Islands-based auditor within six months of the financial year-end. For funds that register in the second half of their financial year, it is possible to avoid the administrative burden and expense of an audit at the end of the first trading year, by electing for an initial fiscal year-end that ends up to 18 months (but no more) from the date of registration.

CIMA also requires that each registered fund file a Fund Annual Return ("FAR") form with the annual audited accounts in electronic format. The electronic FAR form, containing a summary of basic information about the fund, is filed annually by the fund's local auditors, although the operators of the fund remain responsible for the accuracy of the contents of these forms.

Audits must be performed in accordance with the International Standards on Auditing or the generally accepted auditing standards of the United States of America, Japan, Switzerland or any other jurisdiction (including Canada) which is not designated by the Financial Action Task Force as a 'High Risk Jurisdiction subject to a Call for Action'.

Fund Documentation

No annual updates are required to the fund's constitutional documents or offering materials. However, where there is a continuing offering of equity interests, a fund will be deemed not to be compliant with the relevant provisions of the Mutual Funds Act where there are any material changes in the information contained in the offering document or in the prescribed details filed with CIMA, and the updates are not filed with CIMA within 21 days of the fund's promoter or operator becoming aware of the material changes. Where there is a change in registered office or operator, both the appropriate Cayman Islands Registry and CIMA should be informed and the relevant registers must be updated within the applicable statutory time constraints (e.g. within 30 days for a change in directors), failing which penalties will be incurred. Where there is a change to the auditor or administrator, a consent letter signed by the newly appointed auditor or administrator will also need to be filed with CIMA.

Anti-Money Laundering Obligations

Prior to launch, a regulated fund will need to put in place the following procedures:

- identify and perform due diligence on investors, including where applicable the beneficial owners, controlling persons, authorised persons and intermediaries acting on behalf of such investors (KYC); and

- on an ongoing basis, adopt a risk-based approach to identify and assess money laundering and terrorist and proliferation financing risks (AML/ CFT / CPF) including sanctions screening, keep records, implement internal controls and designate an Anti-Money Laundering Compliance Officer, a Money Laundering Reporting Officer and a Deputy Money Laundering Reporting Officer.

It is possible to delegate the maintenance of the above procedures to a suitable delegate. Commonly some or all of procedures will be delegated to the fund's administrator, since it is typically the administrator that, in practice, will be receiving and processing subscriptions for the fund, including the necessary KYC information required under applicable AML / CFT / CPF laws. In delegating in this way, the fund must ensure that:

- the administrator agrees under the administration agreement to take responsibility for AML / CFT / CPF;

- the administrator does so on behalf of the fund (not just itself); and

- the administrator applies Cayman compliant policies and procedures

CIMA Rules for Regulated Mutual Funds

A regulated mutual fund will need to comply with CIMA's rules on the calculation of asset values (the NAV Calculation Rules) and segregation of assets (the Segregation Rules).

The NAV Calculation Rules require the fund to establish, implement and maintain a written NAV calculation policy that ensures the fund's net asset value (NAV) is fair, complete, neutral and free from material error and is verifiable. The NAV Calculation Rules set out a number of requirements to which the NAV calculation policy must adhere, including that the NAV be calculated at least quarterly, that the NAV calculation policy be disclosed in the fund's offering document, and that the NAV calculation policy must be reviewed at least annually in accordance with the NAV Calculation Rules.

The Segregation Rules require, in summary, that the fund's portfolio be segregated and accounted for separately from the assets of any service provider (subject to certain exceptions), that the fund's directors ensure the safekeeping of the fund's portfolio and that service providers do not use the fund's portfolio to finance their own or any other operations.

The fund's directors are responsible for ensuring compliance with these requirements in a manner that is consistent with the fund's offering document and appropriate for the size, complexity and nature of the fund's activities and investors.

CIMA Powers

CIMA has wide-ranging supervisory and enforcement powers to ensure compliance with the Mutual Funds Act. In particular, CIMA may take certain actions if it is satisfied that a regulated mutual fund is or is likely to become unable to meet its obligations as they fall due or is carrying on or is attempting to carry on business or winding up its business voluntarily in a manner that is prejudicial to its investors or creditors. The powers of CIMA include the power to require the substitution of the directors of the fund, to appoint a person to advise the fund on the proper conduct of its affairs or to appoint a person to assume control of the affairs of the fund. There are other remedies available to CIMA including the ability to apply to court for approval of other actions.

In addition to the offences for non-compliance set out in the Mutual Funds Act, CIMA also has the power to impose administrative fines for breaches of prescribed provisions of the Mutual Funds Act committed by entities and individuals.

Breaches of prescribed provisions are categorised as being 'minor', 'serious' or 'very serious'. There is a sliding scale of fines from a fixed fine of US$6,100 for minor breaches; up to US$61,000 for individuals and US$122,000 for entities for serious breaches; and up to US$122,000 for individuals and US$1.2 million for entities for very serious breaches.

Upon determination of a breach, CIMA will provide a breach notice to the relevant party. There will be a 30-day opportunity to reply to the breach notice and to rectify a minor breach to CIMA's satisfaction. If CIMA is not satisfied that a minor breach has been rectified (e.g. failure to pay annual registration fees by 15 January annually), it is required to impose the fixed fine.

For serious breaches (e.g. failure to update CIMA within 21 days of becoming aware of a material change to the prescribed documents / information previously filed with CIMA) or very serious breaches (e.g. carrying on business as a mutual fund without being registered with CIMA and authorised to do so), CIMA has discretion over the imposition and amount of any fine, up to the cap for the relevant category.

In addition, CIMA may, from time to time, seek specific information in respect of a particular fund or funds generally, including for AML / CFT / CPT purposes or to respond to a request from a fellow regulator in another jurisdiction (e.g. CIMA has memoranda of understanding and other information-exchange agreements with financial regulators in various countries, including Canada, the UK and the US).

Additional Ongoing Obligations

Cayman Islands hedge funds must conduct their affairs in accordance with their constitutional documents and the requirements of the law generally. These will include fiduciary duties of the directors plus statutory obligations of the fund, including:

- to keep proper books and records;

- to notify the Cayman Islands Registrar of changes in name or other registered details;

- to file annual returns and pay annual fees; and

- in the case of exempted companies, to maintain the relevant registers (e.g., of directors and officers, shareholders, mortgages and charges over company property) at the fund's registered office in the Cayman Islands.

CIMA has also issued a statement of guidance on the nature, accessibility and retention of records, which sets out CIMA's minimum expectations with respect to a regulated mutual fund's record keeping arrangements.

Taxation, Information Exchange and Transparency

The Cayman Islands has no direct taxes of any kind. There are no income, corporation, capital gains or withholding taxes, nor are there any death duties. Under the terms of relevant legislation, it is possible for the fund to register with, and apply, to the government of the Cayman Islands for a written undertaking that it will not be subject to various descriptions of direct taxation, for a minimum period, which in the case of an exempted company is up to 30 years. In addition, there are no exchange control restrictions or regulations in the Cayman Islands (unlike many other jurisdictions, including some of the Cayman Islands' offshore competitors), so monies can be freely transferred in and out of the Cayman Islands, subject to AML / CFT / CPT laws and regulations.

Cayman Islands hedge funds therefore provide a tax-neutral base in which to combine investors from a number of jurisdictions investing in assets located in the same or other jurisdictions. This neutrality is often important, because it provides a level playing field for all investors and avoids creating a vehicle in a jurisdiction that may favour some investors more than others. This does not affect investors' obligations to pay tax in their jurisdiction of residence: it simply removes what would otherwise be an extra layer of foreign taxation at a particular level of the structure.

In addition, the Cayman Islands is a cooperative and transparent jurisdiction in relation to the exchange of tax information and Cayman Islands authorities cooperate with governments worldwide to ensure that the Cayman Islands cannot be used to evade home country taxes. For example, the Cayman Islands implemented the US FATCA regime in 2014 and, as an early adopter, implemented the OECD Common Reporting Standard (CRS) on reporting and due diligence for financial account information in 2016. The Cayman Islands government has also been actively cooperating on the UK's various beneficial ownership initiatives so as to further enhance its existing robust arrangements with the UK government, including the implementation of the Cayman Islands' own beneficial ownership regime in 2017, and its commitment to introduce public beneficial ownership registers in line with UK requirements as and when this becomes the global standard.

In 2021, the Cayman Islands introduced an economic substance ("ES") regime, which was responsive to global OECD standards on base erosion and profit shifting regarding geographically mobile activities. The Cayman Islands ES regime introduces annual filing requirements for all investment funds, with additional reporting and substance requirements for 'relevant entities' (which typically will exclude investment funds and the vehicles through which they operate and invest) that are registered in the Cayman Islands and conducting 'relevant activities' for the purposes of the regime.

Other Topical Cayman Islands Developments

Governance

As the hedge fund industry has continued to grow and develop over the years, institutional allocators have become an increasingly significant proportion of the investor base. This institutionalisation of the industry, together with the heightened level of regulation both onshore and offshore, has led to increased focus on the area of fund governance. For instance, the use of independent directors on hedge fund boards is now the norm, and is often a requirement of institutional allocators.

The conduct of the business of a Cayman Islands hedge fund is the ultimate responsibility of its board of directors in the case of a company. In practice, however, since a hedge fund will typically have no employees, the board of directors will delegate the day-to-day management and administration functions to professional third-party service providers – that is, the investment manager, administrator, prime broker / custodian, etc. These service providers will report to the board, which will periodically meet to discuss / review the performance of these delegates and the fund generally.

The role of the board of directors of a Cayman Islands hedge fund was considered by the Cayman Islands Grand Court in its landmark judgment released on 26 August 2011 in Weavering Macro Fixed Income Fund Limited (in liquidation) v Peterson and Ekstrom. This was the first time the Court had specifically considered the duties of independent non-executive directors of an offshore hedge fund and the judgment made clear that the Court takes the issue of hedge fund governance very seriously.

Following the Grand Court's decision in the Weavering case, CIMA, as the Cayman Islands hedge fund industry's regulator, issued its final form Statement of Guidance on Corporate Governance for Regulated Mutual Funds (SOG) on 13 January 2014, following a consultation process with industry stakeholders. The SOG echoed a number of principles covered in the Weavering judgement and was intended as nonexhaustive guidance for fund directors and operators on CIMA's minimum expectations for the sound and prudent governance of a CIMA-regulated fund.

Since then, fund governance has remained in the spotlight, with the most recent development of note in the Cayman Islands being the April 2023 publication of CIMA's rules on corporate governance and internal controls (the Governance Rules). The Governance Rules, which are on evolution of the SOG, require CIMA registered funds to establish, implement and maintain a corporate governance framework and adequate and effective internal controls. These rules, which come into effect on 14 October 2023, create new regulatory obligations for mutual funds. The new obligations are not expected to alter current operating practices radically (for example, CIMA expressly contemplates the delegation or outsourcing of relevant requirements to appropriate service providers) and there is flexibility in how and when the arrangements are implemented. However, CIMA will expect compliance to be evidenced by appropriate documentation, and there is an express requirement to hold at least one board meeting annually.

Accordingly, having proactive and engaged directors and appropriate fund governance practices in place from the outset is more important than ever.

Liquidity and Side Letter Issues

A continuing trend in the funds space generally is for bespoke products, particularly for anchor investors and significant allocators. For hedge funds, this commonly includes particular requests around the liquidity, i.e. redemption rights, that such an investor is granted over its investment in the fund.

Funds are generally well advised to include broad and flexible language in their organisational documents to permit the directors latitude in how to deal with fund liquidity issues, depending on the investment strategy being used and what is appropriate in the context. For example, so-called side pocket provisions may be included if there is a significant likelihood, as a result of the chosen strategy, that certain assets in the portfolio may be, or become, illiquid or difficult to value. In addition, or alternatively, certain other mechanisms may need to be included to provide the fund with the necessary tools to operate its strategy in potentially difficult market conditions.

The mechanisms typically employed as solutions for dealing with potential liquidity issues can be broadly grouped into two categories:

- those that completely or partially restrict the investors' ability to exit from the fund (such as side pockets, gates and suspensions); and

- those that enable redeeming investors to exit the fund, but allocate the illiquidity pro rata between both redeeming and continuing investors (such as liquidating special purpose vehicles, payments inkind and reserves / hold-backs).

There have been various well-reported decisions in this area over a number of years – for example, the Matador and Strategic Turnaround cases1 in relation to suspensions and redemptions, and the Harbinger and Washington cases2 in relation to commercial (or so-called soft) wind-downs of funds. A key message from each is that considerable care must be taken in drafting a hedge fund's organisational and offering documents so that they clearly state the investors' entitlements on redemption and the fund's powers to restrict and / or deal with such entitlements, and management's power to wind down the fund in the event of extreme illiquidity or other extraordinary circumstances.

In addition, the ability of the fund to offer different classes, tranches and / or series of shares with different terms, and any restrictions on the fund's management in exercising its discretion in this area, should be carefully considered. Careful consideration should also be given to the ability of the fund and its management to enter into side letters granting special (generally preferential) terms to certain investors in order to persuade them to make a particularly significant investment in the fund. Such side letters often give rise to complex issues that require a careful analysis of the relevant documents and surrounding circumstances in any particular case.

Even where a fund's governing documents expressly grant the directors of the fund a broad power to enter into side letters, they are still bound by a general fiduciary duty to act in good faith in the interests of he fund in deciding whether or not to agree to the terms of a side letter. It will be a question of judgement in any given case whether the directors or an investment manager have properly exercised their powers to enter into any given term of a side letter.

Having a robust and experienced board of directors in place can assist a fund greatly in dealing with the types of scenarios outlined above.

The Cayman Islands LLC

The Limited Liability Companies Act (As Revised) was enacted in 2016 and provides for the formation of a new Cayman Islands vehicle: the limited liability company (the LLC).

The key features of the LLC are that it is a legal entity with separate legal personality (like a company) and its members have limited liability, while also providing for flexible governance and administration arrangements in a manner similar to a limited partnership.

The LLC was not aimed at replacing the Cayman Islands exempted company, which works extremely well and is a globally recognised vehicle of choice for offshore hedge funds. Rather, the LLC seeks to fulfil a different need and be a complementary vehicle for users of Cayman Islands structures.

In particular, the LLC represents a response by the Cayman Islands Government to requests from stakeholders for an additional structuring offering that is closely aligned with similar onshore vehicles. It also recognises that an LLC may be preferable to existing vehicles for certain types of transactions.

For instance, in a more bespoke or hybrid structure, where there is a need for particular flexibility around the tracking or calculation of an investor's economic interest in the fund and / or partnership-style capital account mechanics to facilitate allocations and distributions but within a corporate vehicle, the LLC may provide a helpful solution.

Onshore Tax and Regulatory Considerations

There are a number of onshore tax and regulatory initiatives beyond the scope of this chapter (such as the US reporting requirements and withholding tax penalties in relation to certain US-source income under FATCA, and the requirements of the EU Directive on Alternative Investment Fund Managers AIFMD in relation to marketing in the EU) which may affect the operations of an offshore hedge fund outside of the jurisdiction. It will therefore be important for the fund, its manager and promoter to take legal, tax and regulatory advice in all other relevant jurisdictions.

Comparing Jurisdiction

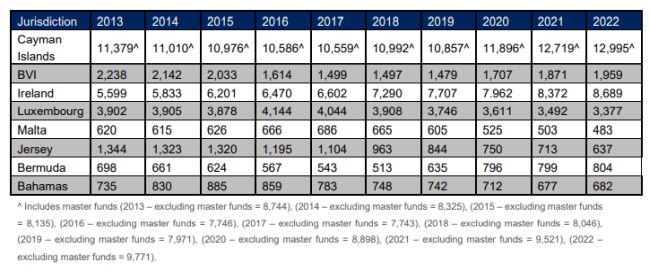

This chapter has focused on the Cayman Islands, as the leading offshore jurisdiction for the formation of hedge funds. By way of comparison, set out in the table below are some statistics (current as at 31 December 2022) showing the number of registered funds in the Cayman Islands versus other main offshore jurisdictions best known as hedge fund formation domiciles, together with figures for Ireland and Luxembourg for informational purposes.

Footnotes

1. In re Matador Investments Ltd [2009] CILR Note 21; and Culross Global SPC Limited v Strategic Turnaround Master Partnership Limited [2010] UKPC 33.

2. Re Harbinger Class PE Holdings (Cayman) Limited [2015] (2) CILR Note 6; and Re Washington Special Opportunity Fund, Inc. (Grand Court, 1 March 2016).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.