- within Corporate/Commercial Law topic(s)

- in United States

- within Corporate/Commercial Law topic(s)

- in United States

- within Media, Telecoms, IT, Entertainment, Accounting and Audit and Privacy topic(s)

- with readers working within the Chemicals industries

Cayman Islands-based companies that might be considering a year-end voluntary liquidation can benefit from early planning and the expertise of a third-party service provider.

Cayman Islands-based companies considering a year-end voluntary liquidation can benefit significantly from early planning and a clear understanding of the relevant deadlines and regulatory requirements. Whether winding down a standard company or a regulated fund, a proactive approach helps avoid unnecessary costs, regulatory fines and the administrative burden of additional filings.

Key Deadlines for Voluntary Liquidations

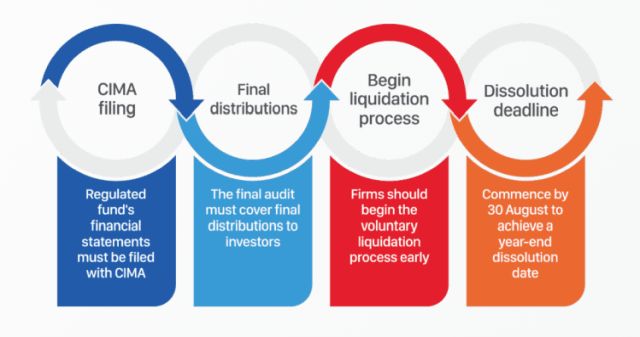

Companies aiming to dissolve before 31 December 2025 should begin the voluntary liquidation process before 30 August 2025. Early commencement is especially important for entities with complex structures or outstanding regulatory obligations. Initiating the process well in advance allows for a smooth wind-down and ensures all statutory and regulatory requirements are met before year-end.

Funds registered with the Cayman Islands Monetary Authority (CIMA) under the Mutual Funds Act (As Revised) or the Private Funds Act (As Revised), should aim to commence the process in advance of 30 August 2025. Ensuring a fund's final audited financial statements are available for filing with CIMA at the commencement of the liquidation process will be critical to achieving a dissolution by year-end.

Procedural Steps and Considerations

- Declaration of Solvency and Shareholder Resolution: The process begins with the directors making a declaration of solvency, followed by a shareholders' resolution to wind up the company and appoint liquidators.

- Regulatory Filings: The resolution and notice of appointment of liquidators must be filed with the Registrar of Companies. Notice of the liquidation must also be published in the Cayman Islands Gazette, inviting creditors to submit claims.

- Creditor Claims and Final Meeting: Creditors are typically given at least 21 days to submit claims. Once the company's affairs are fully wound up, the liquidator calls a final general meeting, giving at least 21 days' notice in the Gazette. The company is dissolved three months after the final account and return are filed with the Registrar.

- Avoiding Stub-Year Costs: Early initiation of the liquidation process helps companies avoid additional regulatory costs and the need for annual filings or reporting for a stub year.

Additional Considerations for Regulated Funds

Regulated funds face further requirements to ensure compliance with CIMA's rules:

- Timely CIMA Filings: A fund must file an application to cancel its CIMA Licence or Certificate of Registration no later than 21 days from the date it ceases business. Failure to comply may result in an administrative fine of up to CI$5,000 (US$6,000).

- Final Audit Requirements: Most funds must complete a final audit covering either the period from the last financial year-end to the date of final distributions to investors, or to the date of the final net asset value calculation (with a subsequent events note confirming final distributions).

- Deregistration Process: The fund must ensure all outstanding CIMA fees are paid; annual returns are filed and provide evidence that it has ceased business and completed the liquidation process.

- Investor Communication: Clear communication with investors regarding the liquidation process, asset distribution, and expected timelines is essential.

- Administrative Fines Regime: Filing with CIMA in a timely manner is critical to avoid fines and ensure a smooth deregistration.

Strategic Planning for a Smooth Liquidation

Early and thorough planning is key to a successful voluntary liquidation. The Maples Group can assist companies and funds to navigate the process, manage regulatory filings, and assist with the liquidation. This approach not only ensures compliance but also minimises costs and administrative burdens.

The Maples Group's voluntary liquidations team offers comprehensive support for the dissolution of corporates, investment funds, and structured finance vehicles. Their integrated service model provides clients with access to fiduciary, fund administration, regulatory compliance, and legal expertise, ensuring a seamless wind-down process.

Conclusion

The voluntary liquidation of a Cayman Islands company or regulated fund is a process defined by strict deadlines and regulatory requirements. Early action, careful planning, and expert guidance are essential to avoid unnecessary costs, meet all obligations, and achieve a timely and efficient dissolution.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]