- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Healthcare industries

On 25 March 2025, the Quebec government tabled the 2025-2026 Budget (Budget). The Budget proposes significant changes to the public utilities tax or taxe sur les services publics (TSP) regime that could have a major implications on businesses operating in the electricity, telecommunications1 and gas distribution sectors.

Current Rules

The TSP was introduced in the 2004-2005 budget as an exception to the municipal property tax for immovables which form part of a telecommunications system, a gas distribution system, or an electric power production, transmission or distribution system.

Administered by Revenu Québec, the TSP is calculated on the basis of the net value of certain immovable assets (NVA) forming part of the operator's system as shown in its financial statements. It is payable by the operator itself. For example, in the case of an electricity generation project held through a limited partnership, it would be the limited partnership and not its partners that would be subject to payment of the TSP.

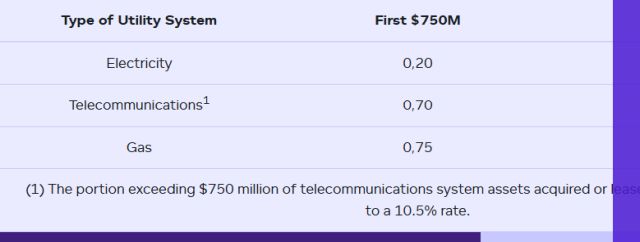

TSP rates vary according to the type of utility system. Furthermore, the current TSP regime is progressive: the first $750 million NVA is subject to a lower rate and the excess is subject to a higher rate. This $750 million limit is shared among the total NVA of associated operators. The table below depicts the current rates:

Net Value of the Assets

The legislation currently provides for an exemption from the TSP for municipalities, as well as corporations or partnerships all of the shares or interests of which are held directly or indirectly by a municipality.

Proposed Changes

The Budget proposes to introduce a number of significant changes to the TSP regime.

- Gradual Increase in Tax Rates

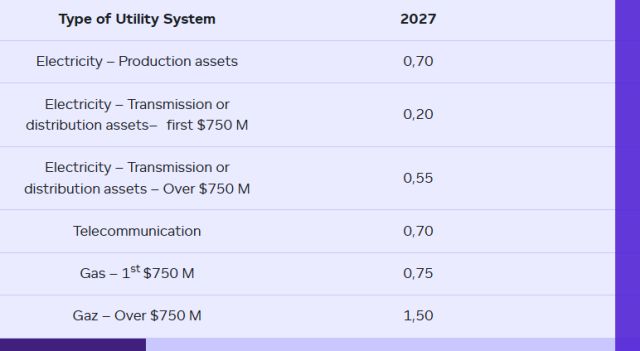

Starting in 2027, the government proposes to gradually increase the various TSP rates until 2035. The 2035 rates will apply to all subsequent years.

The increase in the TSP rate for operators of electrical networks will only apply to electricity production assets. The rates applicable to electrical power transmission or distribution assets will remain unchanged.

In addition, for electricity production assets, the government is proposing to eliminate the lower rate applicable to the first $750 million and to introduce a single rate applicable to the first dollar of NVA. As illustrated below, the progressive rate applicable to assets forming part of a gas distribution system will be progressively eliminated from 2027 to 2035, to form a single rate in 2035.

The following table illustrates the new rates announced in the Budget:

Type of Utility System

In the light of the above, an operator producing electrical energy could be subject to a TSP rate increase from 0.2% to 1.5% of NVA, thereby representing an increase of 7.5x the initial rate. In addition, the Budget does not provide for any exemptions or rate freezes for existing projects for which the former rate would have been taken into account in calculating the project's profitability.

- Exemption for Municipal and Public Entities

The new rules also propose to extend the TSP exemption to municipal or public organizations performing government functions (which term could include certain indigenous administrations) and to corporations and partnerships, all of the shares or units of which are held by such organizations.

- Repayment Mechanism

Where a project is operated in collaboration between a producer and a partner that would otherwise have been entitled to the above exemption (such as a municipality or indigenous administration), the project would not be exempt from TSP.

To remedy this situation, the government is proposing a TSP refund for exempt entities, calculated based on the proportion of the TSP paid for the particular calendar year by the operator in relation to the total voting shares or interests of the corporation or partnership held by the exempt entity.

The refund is made directly to the exempt entity, not to the system operator.

Conclusion

The TSP rate increases are substantial and will have a significant financial impact on the public utility sector. It is therefore essential for operators to fully understand these new rules and their implications in order to effectively manage their current and future operations.

No draft legislation has yet been tabled in respect of the above-mentioned rules. We will continue to monitor the progress of the proposed measures. For more information on TSP, please contact any of the members of our team.

Footnote

1. Defined term "telecommunications" means the transmission or broadcast of sound, images, signs, signals, data or messages by wire, cable, waves or other electric, electronic, magnetic, electromagnetic or optical means.

To view the original article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.