The federal government has extended the vast majority of filing deadlines for businesses, partnerships, trusts and individuals as part of its COVID-19 relief efforts. Importantly, many of the filings that are normally due on March 31 have been extended. This bulletin will highlight some of the deadlines that may be relevant to you and your business.

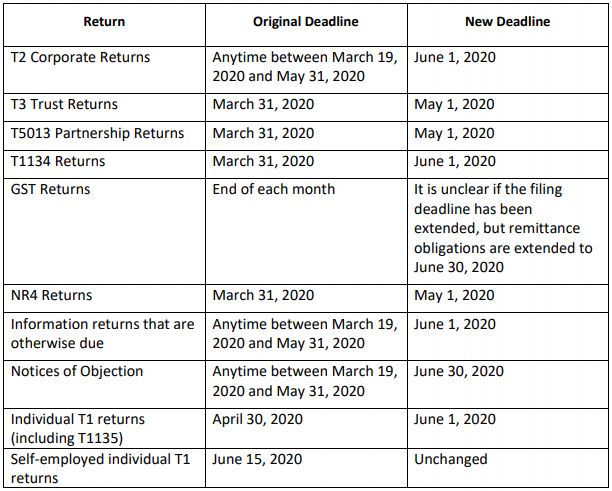

Filing deadlines between March and June

The following returns which are commonly due anytime between March and June of 2020 have been extended:

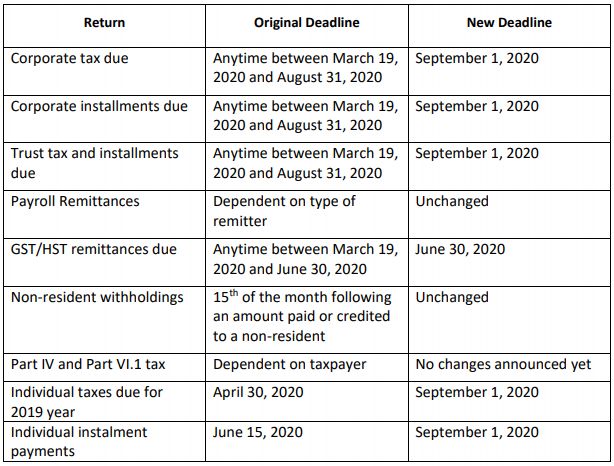

Payment deadlines extended

In addition to extended filing deadlines, the federal government has also extended remittance and payment deadlines as follows:

Footnotes

1. Tax payment deferral includes provincial income tax. On the income tax payment deferral deadline, it is our understanding that the payment extensions announced will apply to provincial income tax in those provinces where the federal government collects tax. Alberta and Quebec have announced their own extensions.

2. Penalties and interest will not be charged if deferred payments are made by the new deadlines.

3. For payments not described above, penalty and interest relief will be considered on a case by case basis if the balance is not paid on time.

4. The Canada Revenue Agency is regularly updating this information, and you should check the following website for the most up-to-date information: https://www.canada.ca/en/revenueagency/campaigns/covid-19-update/covid-19-filing-payment-dates.html.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.