Q3 2021 MARKET INSIGHTS

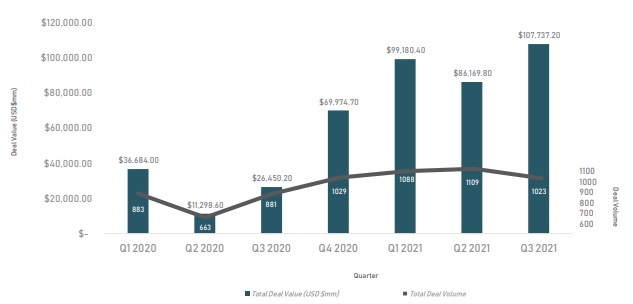

While Canadian M&A activity slipped from the prior quarter, dealmaking remained at close to record levels in Q3/21. Volume declined almost 8% over Q2/21, but outpaced Q3/20 by 16%. Value was, once again, propelled by a number of significant deals: CP Rail's bid to acquire Kansas City Southern, along with fourteen other mega-deals ($1 billion+) including Agnico Eagle's bid for Kirkland Lake Gold.

Geographically, dealmakers continue to reach across borders, with cross-border deal volume continuing to show strength, and a notable acceleration in inbound activity.

Note: Dollar values are in USD.

DEAL ACTIVITY

Total Deal Value & Volume (2020 – 2021 YTD)

Source: Capital IQ October 12, 2021

Where the deals are...

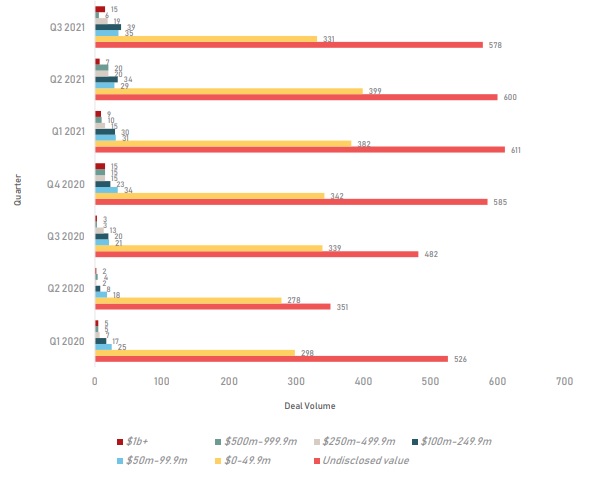

As always, Canada's mid-market continued to drive activity in Q3/21, comprising 91% of deal volume.1 There was, however, a 17% decline in transactions in the sub-$50 million range, partially offset by increased volume in deals in the $50-250 million value range. At the upper end of the value spectrum, mega-deal activity spiked in the quarter with 15 transactions, compared to 7 in Q2/21.

Deal Volume by Deal Size (2020-2021 YTD)

Source: Capital IQ October 12, 2021

Footnote

1 In this case, volume includes all transactions with disclosed value.

To read the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.