- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Accounting & Consultancy, Aerospace & Defence and Basic Industries industries

Last year, we released a 5-part series alerting that "Trust distributions are under ATO attack - the time to act is NOW". We had indicated that section 100A of the Income Tax Assessment Act 1936 (Cth) is a very live issue that can result in a hefty tax bill in respect of discretionary trust distributions (e.g. family trust distributions). We also set out in the series a strategy that could be employed by clients to prepare for section 100A, including reviewing historical large distributions of trust income (where the funds have not been used by the beneficiary but by another person/entity on a higher marginal tax rate, including the trustee) and gathering facts and evidence. The series can be accessed here.

This week, the ATO released three new pieces of guidance that formally provides their aggressive position on discretionary trust distributions. The guidance is comprised of:

- A draft Taxation Ruling (TR 2022/D1) - this is the long-awaited draft ruling from the ATO on section 100A;

- A draft Practical Compliance Guideline (PCG 2022/D1) - this sets out the sorts of arrangements which the ATO would dedicate compliance resources concerning section 100A; and

- A Taxpayer Alert (TA 2022/1) that applies section 100A immediately where parents benefit from trust entitlements to children over 18 years of age.

In addition, the ATO released a draft Taxation Determination (TD 2022/D1) on when an unpaid present entitlement or amount held on a sub-trust is the provision of "financial accommodation" by a private company under Division 7A of the Income Tax Assessment Act 1936 (Cth).

The ATO's crackdown on trust distributions is now officially underway.

What is section 100A?

Originally, section 100A was enacted in 1979 as an anti-avoidance measure to target trust stripping arrangements. But its wording goes so much further. It allows the Commissioner to disregard trust distributions that form part of a "reimbursement agreement" and instead impose tax on the trustee at the top marginal tax rate (currently 47% including the Medicare levy). Worse, the Commissioner has an unlimited time to invoke section 100A, which means it can be applied to trust distributions back to the 1970s!

What are the key requirements to section 100A?

There are a few key issues to be aware of, the first is: What is a "reimbursement agreement"? This can exist where a beneficiary is made presently entitled to trust income (that is, the trustee's exercise of discretion is in their favour) and the beneficiary's present entitlement arises out of, or in connection with, an arrangement:

- involving a benefit being provided to another person (e.g. payment of money, transfer of property or provision of services);

- intended to have the result of reducing someone's tax liability (e.g. the beneficiary pays a lower amount of income tax than that someone who had benefited from the income would have paid); and

- is not entered into in the course of an ordinary family or commercial dealing.

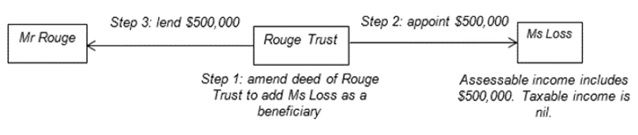

Consider Example 11 from PCG 2022/D1:

Some key points from the new guidance

We have set out below some key points from the ATO's latest guidance.

Ordinary family or commercial dealing exception - TR 2022/D1

- Given the wide scope of section 100A, the ordinary / commercial dealing exception is key. Agreements that are entered into "in the course of ordinary family or commercial dealing" are not subject to section 100A.

- The meaning of the term "ordinary family or commercial dealing" is not any clearer under the new guidance.

- Having said that, the ATO's view is that there is an "ordinary family or commercial dealing" where the arrangement is capable of being explained by regular familial or commercial objects and do not demonstrate a purpose of tax avoidance. This will depend on the facts at hand.

- To determine whether the exception can apply, an assessment is required of the particular familial or commercial relationships of relevant parties (e.g. the family group) and determine whether the trust distributions (or arrangement) are capable of being explained by ordinary familial and/or commercial objects.

- An arrangement that is commonplace and involves no artificiality is not necessarily an "ordinary family or commercial dealing". However, an arrangement that is clearly tax driven and which make the arrangement appear artificial or contrived is unlikely to satisfy the exception.

- For example, a trustee making a lower-taxed beneficiary presently entitled to trust income while paying the underlying funds to another person or persons who would otherwise pay higher tax will not be an agreement entered into in the course of ordinary dealing solely because it can be explained as increasing collective post-tax family or group wealth.

- The ATO sets out 9 examples in TR 2022/D1 on how section 100A

can apply. These examples include: (a) Trusts established under a

will;

(b) Distribution to spouses;

(c) Gifts from parents to a child;

(d) Unpaid entitlements held on separate trusts; and

(e) Loans on commercial terms.

ATO compliance approach on section 100A - PCG 2022/D1

- The Practical Compliance Guideline shows the sorts of trust arrangements that the ATO is dedicating compliance resources on section 100A. There are 4 risk zones - White, Green, Blue and Red. We consider both ends of the "risk spectrum" below.

- White zone: Importantly, the ATO will not

consider the application of section 100A for arrangements entered

into in income years that ended before 1 July 2014, unless: (a) the

ATO is already reviewing the taxpayer's income tax affairs for

those years;

(b) the arrangement was entered into before 1 July 2014 and continues after that date; or

(c) the trust and beneficiary tax returns that were required to be lodged for those years were not lodged before 1 July 2017. - Red zone: These are arrangements where:

-

- the beneficiaries' entitlements appear to be motivated by sheltering the trust's net income from higher rates; and

- the arrangement involves contrived elements directed at enabling someone other than the presently entitled beneficiary having the use and enjoyment of economic benefits referable to the trust net income.

Examples include:

- (Scenario 1) The beneficiary lends or gifts some or all of their entitlement to another party;

- (Scenario 2) Trust income is returned to the trust by the beneficiary in the form of assessable income (i.e. a washing arrangement). This arrangement was recently considered by the Federal Court of Australia in Guardian AIT Pty Ltd ATF Australian Investment Trust v Commissioner of Taxation [2021] FCA 1619, and is currently on appeal;

- (Scenario 3) The presently entitled beneficiary is issued units by the trustee and the amount owed for the units is set-off against the beneficiary's entitlement;

- (Scenario 4) The share of net income included in a beneficiary's assessable income is significantly more than the beneficiary's entitlement;

- (Scenario 5) The presently entitled beneficiary has losses; and

- (Scenario 6) Arrangements subject to a Taxpayer Alert (e.g. see below)

- The ATO is continuing to identify taxpayers who wish to nominate themselves as a test case to obtain further judicial guidance.

Parents benefiting from trust entitlements of their children over 18 years of age - TA 2022/1

- The ATO has warned that they are already reviewing trust arrangements where parents enjoy the economic benefit of trust income appointed to their children who are over 18 years of age.

- The common feature of these arrangements is that trust income is appointed between members of the family group but, in substance, it is the parents who exercise control over and enjoy the economic benefit of the income.

- The ATO's concern is a manipulation of the tax rate through the use the lower marginal tax rate applying to adult children (e.g. the tax-free threshold of $18,200) in circumstances where the benefit of the income is being enjoyed by the parents (e.g. to meet household expenses). This is a common arrangement. Accountants need to take caution, as the ATO has indicated that registered tax agents involved in the promotion of this type of arrangement may be referred to the Tax Practitioners Board to consider whether there has been a breach of the Tax Agent Services Act 2009.

What happens from here?

Taxpayers and accountants assisting with family trust arrangements need to consider the new guidance and prepare against a review for section 100A. As a starting point, we recommend that you review larger distributions of income in the last few income years and seek legal advice on your position and options. If you are documenting and/or considering a current trust distribution, it is prudent that you consider the new guidance.

The ATO will undertake public consultation on TR 2022/D1 and PCG 2022/D1. Submissions can be made to the ATO until 8 April 2022. Once finalised, the TR 2022/D1 and PCG 2022/D1 are intended to apply prospectively and retrospectively.

TA 2022/1 is not subject to public consultation. The ATO is already reviewing these sorts of arrangements.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.