Updated 1 February 2007

Introduction

The practice guide is designed to help mortgage managers understand:

- whether they are required to hold a finance brokers licence in WA; and

- if they are required to be licensed, what restrictions particularly impact on mortgage managers.

Overview

Licensing: Mortgage managers will generally have to be licensed in WA if they negotiate or arrange loans for residents of WA other than on an occasional basis. This is the case whether mortgage managers deal direct with the borrower or not.

Commission disclosure: The new Code of Conduct is expected to commence in June 2007. It is expected to require commission disclosure at both loan writer and aggregator level. The commission/margin derived by mortgage managers will not need to be disclosed if:

(a) the mortgage manager does not offer a choice of brand (ie markets loans only under one brand), and is not dealing direct with the borrower on that particular loan; or

(b) the mortgage manager is not paid commission on a loan by loan basis, but rather is effectively running a lending business (eg a securitisation / trust manager); or

(c) the borrower is sophisticated (net assets of at least $2.5m or gross income for the last two financial years of at least $250,000 per year); or

(d) the borrower is a publicly listed company or a statutory authority.

Although commission/margin disclosure may not be required, managers will still need to be licensed in WA if the manager's "negotiating or arranging" activities have sufficient nexus with WA.

Working With This Practice Module

This practice module is divided into separate annexures, as follows.

1. Outline of the law

2. Decision-making flow chart

3. Nexus with WA (ie when does a finance broking activity have sufficient connection with WA to create an obligation to be registered in WA?)

4. General Q & A

ANNEXURE 1 OUTLINE OF THE LAW

When Is A Licence Required?

1. Required for both UCCC regulated and non-UCCC regulated credit

The regulation of finance brokers applies to all credit, and not just UCCC regulated credit. This extension beyond UCCC regulated credit is unique to WA. (In contrast, the requirement for credit providers to be licensed in WA applies only to lenders of UCCC regulated credit). This means that businesses which arrange or manage commercial loans may need to be licensed.

2. When is a Loan Covered by This Regulation?

The legislation only applies if the transaction has a relevant nexus to WA. The Finance Brokers Control Act 1975 (WA) does not specify what the relevant nexus is and therefore businesses are required to make their own assessment of the jurisdictional limit. As a rule of thumb, there will be a relevant nexus and a licence will be required if:

- the business has a physical office in WA;

- the business advertises specifically in WA; or

- the borrower lives in WA, regardless of the location of the real estate security.

However, if a business located outside WA makes occasional loans to WA residents without specifically targeting WA residents as customers, the legislation is unlikely to apply and the business need not be licensed. Compare this situation with ACT where the requirement to register as a finance broker is clearly limited to cases where the borrower is resident in the ACT and the loan is regulated by the UCCC.

3. What kind of business activities require a license?

A finance broker is a person who "as an intermediary, in the course of business negotiates or arranges loans of money for or on behalf of other persons, or in the course of business, manages loans of money arranged or negotiated by the person for or on behalf of other persons".

Finance brokers and aggregators

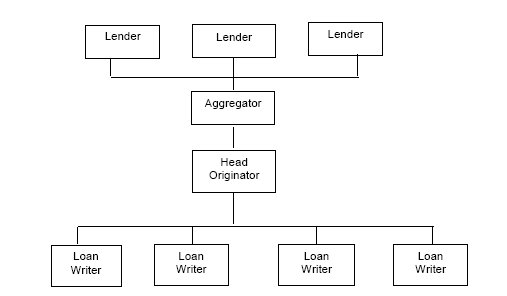

The WA Department of Consumer and Employment Protection (DOCEP) considers that any entity involved in the negotiating or arranging loans (eg aggregators and not just loan writers) must be licensed. This includes anyone involved in giving credit approval except of course the lender itself. In the diagram below, each of the aggregator, head originator and loan writers would need to be licensed. However, loan writers would not need to be licensed if they are employees of the head originator and under the bona fide control of the head originator.

|

However, if the business has no physical presence in WA and does not specifically target WA residents, a licence will not be required if an occasional loan is made to WA residents. |

Mortgage managers, trust managers and securitisation managers

Mortgage managers, trust managers, and securitisation managers will need to be licensed if they negotiate or arrange loans. Managers who solely manage loans negotiated or arranged by others will not need to be licensed. This is because the definition of a finance broker only applies to a business which "manages loans of money arranged or negotiated by [the business]" – ie not one that manages loans negotiated or arranged by others.

DOCEP considers that a manager is involved in negotiating or arranging if it is involved in the credit process. This is the case even if the manager only deals through introducers who are licensed brokers and does not ordinarily deal direct with the borrower.

Only the legal lender is clearly outside this definition. Any intermediary whether acting for the lender or the borrower who arranges or approves loans is captured. In this regard, it is relevant to remember that WA had problems with brokers who arranged risky loans for investors, and so the WA regime focuses on intermediaries who act for lenders as well as borrowers.

|

Example 2: Mortgage Manager markets commercial loans having a nexus with WA. Mortgage Manager is involved in the approval process of the loan. The lender is a trustee. Mortgage Manager will need a licence as it is arranging loans. This is the case irrespective of whether Mortgage Manager deals direct with borrowers, or only deals through brokers who are licensed in WA. |

|

Example 3: Trust/Securitisation Manager markets loans. Trust/Securitisation Manager is involved in the approval process of the loan. The lender is a trustee. Trust/Securitisation Manager will need a licence as it is arranging loans. This is the case irrespective of whether Mortgage Manager deals direct with borrowers, or only deals through brokers who are licensed in WA. |

|

Example 4: Trust/Securitisation Manager manages loans. The final credit approval (at least from a legal point of view) can only be given by the Trust/Securitisation Manager. The Trust/Securitisation Manager is acting as the manager of the lender, and may even be the agent of the lender. However, the Trust/Securitisation Manager has contracted for XYZ company (possibly in the same corporate group) to undertake the arranging and negotiating process, including the right to approve loans (ie a DLA) The Trust/Securitisation Manager does not need a licence as it is not arranging or negotiating loans. XYZ company would need to be licensed. If Trust/Securitisation Manager had not outsourced the approval process, Trust/Securitisation manager would need to be licensed if dealing with loans with sufficient nexus with WA. It is irrelevant whether Trust/Securitisation Manager deals direct with borrowers or not. If Trust/Securitisation Manager is legally the agent of the lender, it may be argued that Trust/Securitisation Manager is acting as the lender and not as an intermediary. If this is correct, Trust/Securitisation Manager would not need to be licensed. |

Exemptions

Section 5 of the Finance Brokers Control Act exempts a number of businesses from obtaining a licence or complying with any of the other provisions of the Act, including the following:

- banks;

- friendly societies;

- insurance companies;

- pastoral companies;

- an AFSL licensee but only when dealing in securities (but a licence will be required to

- deal with loans);

- lawyers when acting incidentally to the practice of law (but a licence will be required

- to deal with other loans);

- a retailer or other supplier of goods who arranges finance for payment of the purchase

- price.

Types of Licences

There are 4 types of licences.

A class licence (unrestricted licence)

No restriction on the type of lenders with whom the licensee may negotiate or arrange loans of money.

B class licence (restricted licence)

Most brokers hold a B class licence. B class licensees are restricted to arranging loans with lenders who are:

- a registered managed investment scheme;

- a credit provider licensed in WA;

- banks and building societies; or

- registered as a financial corporation under the Commonwealth Financial Sector (Collection of Data) Act 2001). A lender (except ADIs) should register as a financial corporation if:

- its total assets exceed $5,000,000 and its sole or principal business in Australia is borrowing money and the provision of finance; or

- its assets arising from the provision of finance exceed 50% of its total assets in Australia.

C class licence (restricted licence)

C Class licensees are subject to the same restrictions as B class licensees, but in addition, the licensee must carry on business under the exclusive supervision of a nominated broker who holds an A or B class licence.

This class of licence is designed for new entrants to the industry who cannot satisfy the two years' experience requirements.

D class licence (education and experience requirements do not apply)

The D class licence allows directors and partners to obtain a licence (thereby enabling their companies and partnerships to obtain a licence) where the directors or partners cannot satisfy the education and experience requirements, so long as the company or partnership has an A or B class licensee in bona fide control of the finance broking operations in WA of the business.

The licensee in bona fide control does not need to be physically located in WA if control can be exercised from elsewhere. However, the licensee will need to be physically located where the business is conducted (eg head office). Usually, each branch office will need a licensee in charge. The requirement for people to be WA residents was removed in 2006 and now licensees only need to be resident in Australia.

Employees and Contractors

Employees who work under the brand and control of their employer will not need to be separately licensed unless they are in control of a separate physical branch.

DOCEP considers that contractors (as distinct from employees) must be separately licensed. This means that irrespective of whether a mortgage manager is licensed in WA, any loan writer who is a contractor (even exclusive contractors) will need to be licensed if dealing with WA nexus loans.

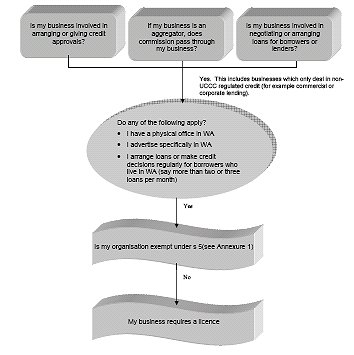

ANNEXURE 2 DECISION-MAKING FLOW CHART

ANNEXURE 3 NEXUS WITH WA

A requirement to be licensed arises if the activities have a sufficient connection with WA to be subject to WA law.

Lawyers use the word nexus to refer to an activity having a relevant connection with a place to make that activity subject to the law of that place.

A business is only required to be licensed if it carries on the business of finance broking or holds itself out as a finance broker (see s.26(1) of the Finance Brokers Control Act). What amounts to carrying on business in WA will depend on the facts of each situation. It is clear that isolated or occasional finance broking deals having a nexus with WA will not amount to carrying on a finance broking business in WA.

The following examples are given to assist assessing whether your business has sufficient nexus. The following examples assume that your business:

- does not have a physical presence in WA;

- does not advertise targeting WA residents (eg local radio, television, newspapers); and

- does not have sub-originators based in WA using your brand.

Examples

1. Borrower lives outside WA, security property in WA.

The security property being located in WA will not normally be a factor indicating a nexus.

2. Borrower lives in WA, security property outside WA.

The degree of nexus created depends on whether the borrower approached your business physically outside WA. There will be a greater nexus arising if the borrower approached you on line or by telephone and the borrower was at all times physically located in WA. If your business regularly arranges loans for WA residents a licence will be required.

3. Retail website which does not specifically target WA residents.

There is no need to have any warning or special words for WA residents unless there is sufficient nexus with WA arising from other factors (eg regular dealings with WA residents, physical presence in WA, or specifically advertising in WA through radio television or press). Once a sufficient nexus is established, a licence is required, and the internet site would need to disclose the WA Finance Brokers Licence Number.

4. What impact does the loan amount have on nexus?

The amount of the loan is irrelevant (ie very small and very large loans are treated equally). Rather, it is the number of transaction having a nexus with WA which will determine whether you are conducting business in WA and need to be licensed.

Note that in WA:

- lenders of UCCC regulated credit must be licensed as a credit provider in WA if lending to WA residents; and

- brokers with a restricted licence (B or C) may only deal with lenders (ie the legal lender/mortgagee of record – does not include mortgage managers) who are:

- a registered managed investment scheme;

- a credit provider licensed in WA;

- banks and building societies; and

- registered as a financial corporation under the Commonwealth Financial Sector (Collection of Data) Act 2001.

5. Loans to WA residents representing 10% of dollar volume have been sourced from two loan writers located in WA.

The size of loans or the proportion of all loans sourced from WA is not normally relevant in determining nexus. The number of transactions having a nexus with WA is more relevant in determining whether you are conducting a business in WA.

If the 10% by dollar value represents a regular flow of transactions (say more than three or four a month), there will be sufficient nexus.

Remember, once a sufficient nexus is created, mortgage managers will only need to be licensed as a finance broker if the manager is involved in the negotiating or arranging of loans. DOCEP considers this means being involved in the approval process. If the approval is wholly outsourced and the mortgage manager is only involved in management of loans, the manager will not be required to be licensed.

6. A WA based broker has asked my mortgage management business to contribute to advertising in WA newspapers.

If the advertisements mention the mortgage manager, the advertising will create a sufficient nexus in WA to trigger licensing.

If the advertising does not mention the mortgage manager, the mortgage manager may still be considered to be conducting business in WA by virtue of the arrangement to contribute to the advertising. If business is produced, the likelihood of a sufficient nexus being created is much greater.

ANNEXURE 4 GENERAL Q + A

1. What is proposed for commission disclosure?

The new Code of Conduct is expected to commence in June 2007. It will require commission to be disclosed at both the loan writer and aggregator level irrespective of who is paying that commission. Remember that the term "commission" includes any type of payment and will include an interest margin relating to individual loans.

Contrast the WA requirement for disclosure at aggregator level with NSW, ACT, and Victoria which require disclosure only at the loan writer level.

The commission/margin derived by mortgage managers will not need to be disclosed if:

(a) the mortgage manager does not offer a choice of brand (ie markets loans only under one brand), and is not dealing direct with the borrower on that particular loan; or

(b) the mortgage manager is not paid commission on a loan by loan basis, but rather is effectively running a lending business (eg a securitisation / trust manager) – but these businesses may need to be licensed; or

(c) the borrower is sophisticated (net assets of at least $2.5m or gross income for the last two financial years of at least $250,000 per year); or

(d) the borrower is a publicly listed company or a statutory corporation.

Although commission/margin disclosure may not be required, the manager will still need to be licensed in WA if the manager's "negotiating or arranging" activities have sufficient nexus with WA.

Where a mortgage manager deals direct with borrowers and (b) (c) or (d) do not apply, the manager is obliged to disclose its commission/margin. The MFAA has objected strongly to this. This result is different from NSW where managers do not need to disclose their commission/margin where they are not conducting a broking business and have an exclusive or first choice arrangement. Mortgage managers may want to change their business model in WA to avoid the need to disclose commission/margin, for example by operating solely through subcontractors in WA.

Example: Mortgage Manager distributes through Aggregator and the borrower deals with Broker Limited. It is expected that in this case the Aggregator and Broker Limited will be required to disclose their commission, but Mortgage Manager will not so long as Mortgage Manager operates through a single brand. If Mortgage Manager dealt direct with the borrower, Mortgage Manager would be obliged to disclose its commission/margin unless one of the exceptions listed in (b) to (d) above applies.

The disclosure requirements will only apply to loans made after the new regulations come into effect.

2. Which companies in a securitisation program need to be licensed?

We established a mortgage program. We have three companies which fulfil the following roles:

- trust/securitisation manager;

- loan servicing;

- marketing.

Although the arrangement described is quite common, there are significant differences between business models. In this situation a company will need to be licensed (assuming they have transactions with sufficient nexus) if:

- it is involved in granting credit approval (the mere fact that the trust/securitisation manager has the residual legal right to grant credit approval and can set credit policies will not trigger an obligation to be licensed if the trust/securitisation manager has outsourced the actual credit approval); or

- it is involved in branded marketing of the product or acts as an aggregator.

3. How do I obtain a licence?

Your lawyer may be able to help you, or you can undertake the work yourself. Forms and process can be obtained from http://www.docep.wa.gov.au/consumerprotection/financebrokers/Pages/forms.html

There is no official period of grace, and so if you are required to be licensed, act now.

4. What about the prescribed maximum commissions?

DOCEP is reviewing the prescribed maximum commissions.

The maximum commission is prescribed in the WA Government Gazette dated 20 February 2004, ref CE301. These maximums generally apply only when commissions are paid on a loan by loan basis. For example, they would not apply to the manager of a securitisation program or mortgage trust who derives residual income from a portfolio.

Different limits apply depending on whether the lender is a "Credit Provider" or not. A Credit Provider is a lender:

regulated under the FSR or APRA;

(b) a licensed credit provider in WA; or

(c) registered as a financial corporation under the Commonwealth Financial Sector (Collection of Data) Act 2001). .

If the lender is a Credit Provider, the maximum commission payable from either the borrower or the lender is in aggregate 2% upfront and 0.5% pa trail.

If the lender is not a Credit Provider, the maximum commission 2% for loans over $25,000 paid by the borrower and 1.5% upfront and 0.5% pa trail paid by the lender.

A maximum is prescribed for "Total Mortgage Management": 8% of interest collections.

These figures appear not to have been adjusted to allow for GST. Accordingly, they must be treated as being GST inclusive. Many industry participants consider that the limits are too low. Other industry participants consider that there should be no limit on commission paid by lenders.

These limits may be less than the amount properly and usually paid for mortgage management in some cases. This creates a bias in a favour of non-distributed models, and may cause some "non-bank" lenders not to provide loans to WA residents.

Higher brokerage fees are prescribed for personal and equipment finance.

There may be a written agreement between the borrower and the broker which specifies the time when commission is payable, but otherwise it is payable upon the loan being obtained (except where failure to obtain the loan was the fault of the borrower).

These maximums relate to the total commissions received from all sources. Accordingly, the commission received from the borrower and the lender taken together, must not exceed these limits.

The WA Finance Brokers Supervisory Board (prior to its undertaking being moved to DOCEP) considered that fees charged to borrowers in budget management/wealth creation/debt reduction plans are "so integrally and intimately connected with" arranging the loan, that fees charged for these services are fees charged for negotiating and arranging the loan. Accordingly, commission maximums, and requirements for FBCs will apply.

Regulations limit the amount that can be charged for:

application fees;

(b) inspection fees;

transfer of mortgage between investor clients;

(d) extension of mortgage;

(e) discharge fee;

(f) commission on interest collections; and

(g) miscellaneous charges such as production of title, bank cheques etc.

5. What else do I need to know if I become licensed?

There are extensive regulations which apply to licensed finance brokers. These are summarised in – for more information see the MFAA Regulation Module.

In particular, licensees must maintain an audited trust account into which any money is paid which belongs to the lender (eg valuation fees or application fees). A trust account is not required if cheques are drawn in favour of the third party (eg valuer or lender).

For more information, please contact:|

Sydney |

||

|

Jon Denovan |

t (02) 9931 4927 |

e jdenovan@nsw.gadens.com.au |

|

Vicki Grey |

t (02) 9931 4753 |

e vgrey@nsw.gadens.com.au |

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.