- within Energy and Natural Resources topic(s)

- in Australia

- with readers working within the Environment & Waste Management, Utilities and Law Firm industries

- within Energy and Natural Resources, Transport, Media, Telecoms, IT and Entertainment topic(s)

- with Inhouse Counsel

Australia's renewable electricity certification transition: legal insights on REGOs, PPAs, and market dynamics

Australia is transitioning from the Renewable Energy Target (RET) scheme, which mandates surrender of Large-scale Generation Certificates (LGCs), to the Guarantee of Origin (GO) scheme launched in November 2025. The GO scheme introduces Renewable Energy Guarantee of Origin certificates (REGOs), offering greater flexibility and granularity in energy claims through hourly timestamping and broader eligibility – including batteries and hybrid projects, which can now produce REGOs. Unlike the compliance-driven LGCs, REGOs operate in a voluntary market, with demand expected to be shaped by corporate ESG goals and alignment with international frameworks.

During the transition period to 2031, LGCs and REGOs will coexist, but only one certificate can be issued for each unit of energy. This creates contractual complexity and pricing uncertainty. Power Purchase Agreements (PPAs) must address this transition and ensure that both schemes are contemplated where LGCs and REGOs may potentially be supplied.

PPAs are becoming more prescriptive about when and how the transition occurs. This includes careful construction of the definitions of these green products, minimum generation requirements, offtaker elections of new green products, change in law provisions, cost-sharing and risk allocation. There are also specific issues to keep in mind when drafting for battery integration or the interplay of international certificate frameworks.

Regulatory landscape: RET and GO schemes explained

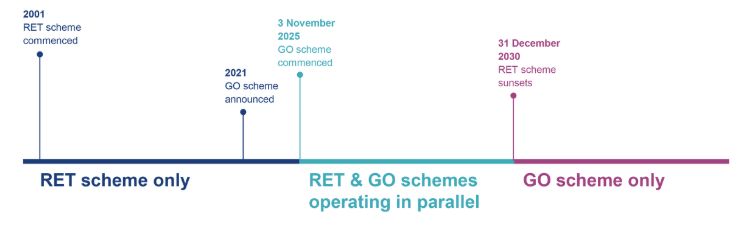

Australia's renewable energy certification landscape is undergoing significant change, with the longstanding Renewable Energy Target (RET) scheme set to sunset at the end of 2030 and the new Guarantee of Origin (GO) scheme having just commenced on 3 November 2025. This section outlines the key features of both schemes and provides a timeline illustrating their interaction and transition.

| Instrument | Overview |

|---|---|

| RET Scheme |

The RETis an Australian Government initiative that began in 2001 with the objective of reducing greenhouse gas emissions in the electricity sector and promoting investment in renewable energy generation. The RET targets the delivery of an additional 33,000 gigawatt-hours (GWh) of renewable electricity per year by the end of 2030. The RET generates demand for renewable energy by mandating that entities purchasing wholesale electricity (e.g., retailers) surrender a prescribed number of renewable energy certificates annually. These liable entities source a set percentage of their load from renewable generation. It operates via two limbs:

The RET scheme is due to sunset on 31 December 2030. |

| GO Scheme |

Commencing on 3 November 2025, the GO scheme is a voluntary certification framework for measuring the emissions intensity of products, such as hydrogen, and verifying renewable energy generation and consumption. The GO scheme is a key element of the Australian Government's Future Made in Australia plan, fostering investment in low-carbon products and renewable electricity. Critically, the GO scheme is designed to address:

The GO scheme enables organisations to credibly claim the use of green electricity in their operations through its two components:

The REGO design builds upon the strengths of the RET scheme while implementing greater flexibility to facilitate further expansion of the voluntary surrender market. The REGO will initially operate alongside the RET. |

This article focuses on large-scale generation (LGCs and REGOs), rather than STCs and the PGO.

While the RET and GO schemes share a common objective and some structural similarities, they diverge in fundamental ways that impact certificate value, contractual complexity, and market dynamics. This section explores these differences and examines the key drivers expected to shape demand for REGOs.

| Similarities |

|

| Differences |

|

Practical insights for contracting under the REGO framework

This section provides practical guidance on how REGOs are being negotiated in PPAs, particularly those that contemplate both LGCs and REGOs over their terms. We address key considerations including structuring the transition to different certificate types, aligning minimum generation requirements, managing incremental costs and risk allocation, and navigating emerging developments like battery integration and international certificate frameworks.

Drafting strategies for PPAs incorporating REGOs

Structuring the transition: from LGCs to REGOs and beyond

Given the uncertainty around REGO pricing and the need for REGO provisions to be clear and operational before 1 January 2031, PPAs are becoming more prescriptive about when and how the transition occurs. The timing for registration and creation of REGOs will need to align with the "switch" from LGCs to REGOs, ahead of delivery.

PPAs can be structured to remain future proof during the transition from LGCs to REGOs by initially defining green products as LGCs, then shifting to REGOs (and potentially other products) once registrations are complete. Parties may also need to carve out the end of LGCs and start of REGOs from more generic change in law provisions, which may otherwise capture the RET scheme's 'expiry' and have unintended consequences.

During the period in which both LGCs and REGOs are in effect, parties should clearly delineate which product is intended to be created and delivered under the PPA. Offtakers may prefer LGCs during the overlap period until 2031, and REGO prices might be more volatile due to the absence of a mandatory surrender regime. These market dynamics will inform how pricing structures and contractual obligations are drafted in PPAs. Many existing PPAs include bundled pricing, entitling offtakers to request delivery of new green certificates, such as REGOs, without any adjustment to the bundled price. This approach may change. Offtakers may also want to include a reasonable endeavours obligations to ensure that REGOs are timestamped and include any specific REGO attributes as agreed between the parties.

Managing offtaker elections

Many PPAs contemplate elections by offtakers of new green products and consultation processes where the generator has multiple offtakers. The management of those elections, the level of generator discretion in those decisions and the cost consequences all come into play.

Generators with multiple offtakers should carefully consider which offtaker has priority over new green products and establish clear protocols for scenarios where multiple offtakers seek particular volumes of LGC and REGOs within the same timeframes. During the interim period, when the RET and GO schemes coexist, generators may create both LGCs and REGOs for different generation, without having to elect one scheme for all output.

We anticipate the introduction of REGOs to cause many of the election and consultation provisions to be tested, with potential disputes if an offtaker "misses out" on receiving new green products it wanted to secure.

Integrating minimum generation requirements into the transition

Minimum generation requirements often form the base of the minimum number of green products that must be transferred (failing that, an obligation to provide replacement green products or damages may apply). As a result, it is important to ensure that the minimum generation and remedy regime reflects the green products used.

The transition framework from LGCs to REGOs could be tied into a PPA's minimum generation requirements by initially linking these requirements solely to LGCs and then, upon transition, exclusively to REGOs.

For minimum generation or green product delivery requirements, volumes should align with eligible amounts and, where permitted, residual amounts, incorporating controls to prevent double counting and improper certificate creation.

Risk allocation and managing incremental costs under the GO scheme

The GO scheme is phased in over time and requires participants to pay fees and charges for certain scheme activities.2 Additional costs are expected for metering, data management, and compliance to meet the section 73 measurement standard,3 support audits and information gathering, and manage certificate invalidations and corrections. These costs charges are commonly passed through to offtakers in some proportion or priced in.

We have seen the direct, incremental costs of registering under the new GO scheme being shared between the parties or passed through to offtakers in various ways. To circumvent disputes, PPAs should set clear thresholds for any cost-sharing between parties when electing new green products and be clear on the types of costs that can be passed through e.g. direct, verifiable and without margin, administrative costs or overheads. Pass through rights may also only apply to any incremental costs of creating, registering and transferring REGOs when compared to LGCs.

Because many details of the GO scheme are set out in rules, PPAs should anticipate robust change-in-law provisions that capture changes to these rules or any future voluntary schemes that are applicable.

Parties to transactions involving REGOs should also carefully consider the application of the financial services licensing regime under Corporations Act 2001 (Cth), bearing in mind that depending on the entity and its activities and surrounding circumstances, an Australian Financial Services Licence (or exemption) may be required to trade in these certificates if these activities constitute a financial services business.

New terminology

The REGO framework introduces new terminology, such as "facility", "retire", and "GO Register", whereas the equivalent terms under the LRET are "power station", "surrender", and "REC Register".

Battery integration and international frameworks: key contractual considerations

Battery integration

Under the GO Act, energy storage systems qualify as registerable facilities to create REGOs for renewable electricity dispatched from storage, provided that renewable energy has been used to charge the energy storage system and can be verified. The GO Act's definition of direct supply relationships between generation and storage permits the creation of REGOs to track stored and subsequently dispatched electricity with integrity.

Registration requires detailed metering and data obligations for compliance with the section 73 standards, including accounting for inputs, losses, and round-trip efficiency. Where storage draws from multiple sources, operators must demonstrate renewable origin, for example, by retiring REGOs (or LGCs) for electricity used to charge the energy storage system. To avoid compliance risks, PPAs should prevent overlapping components across multiple registered facilities and incorporate stringent data obligations aligned with section 73.

International frameworks and cross-border certificate strategies

For PPAs contemplating both national certificates and I-RECs, drafting should establish a hierarchy, for example prioritising REGOs and / or LGCs, with I-RECs used as a fallback. This hierarchy upholds certificate integrity and avoids conflicts between schemes. Integrity concepts - such as those addressing improper creation and double counting4 - should be supported with mutual exclusion clauses to prevent overlapping claims in respect of different certificates.

The GO Bill Explanatory Memorandum articulates an objective of aligning with international frameworks. To advance this objective, it would be helpful to explore provisions that recognise international certificate schemes, permit buyers to use REGOs for global reporting purposes, or specify fallback arrangements where foreign frameworks require different attributes. This approach supports compliance with both domestic and global reporting standards and fosters consistency between jurisdictions.

HSF Kramer's renewable energy expertise

The introduction of the REGO scheme marks a pivotal shift in Australia's renewable energy certification landscape, offering enhanced flexibility and specificity of information, broader eligibility, and features that align with global decarbonisation frameworks. This development creates new opportunities for innovative PPA contracting and market participation, yet also introduces complexity, particularly during the transition period when LGCs and REGOs coexist. In addition, pricing impacts remain uncertain and will depend on PPA wording. Parties to PPAs should anticipate and respond to these challenges with robust drafting around green product election, minimum generation requirements, cost and risk allocation, pricing and compliance.

Footnotes

1. GO Bill Explanatory Memorandum.

2. See Future Made in Australia (Guarantee of Origin Charges) Act 2024; Future Made in Australia (Guarantee of Origin Charges) Regulations 2025; Part 6 of the Future Made in Australia (Guarantee of Origin) Rules 2025.

3. Future Made in Australia (Guarantee of Origin) Act 2024.

4. Sections 103 and 99 of the GO Act.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]