In this article, we will:

- provide a quick refresher on how and when transfer duty and call option assignment duty is assessed under the Duties Act 1997 (NSW) (Duties Act); and

- provide an update on the proposed changes on transfer duty after announcement of the 2021-2022 State Budget.

PART 1 – A SUMMARY ON THE EXISTING FRAMEWORK

When does the payment liability occur?

Liability of transfer duty payment kicks in immediately on transfer of a dutiable property. In land contracts, this liability arises once the parties enter into a contract for sale. In land option transactions, a transfer of dutiable property is taken to have occurred when the option is exercised by the party entitled to the option and a binding contract for sale is created simultaneously.

If a call option holder has a right to assign its interests in or nominate a third party under a put and call option deed and exercises that right with valuable consideration, then call option assignment duty and transfer duty will arise in different stages of the transaction.

When is duty payable?

Duty is payable within three months from the date of the transaction.

If settlement of a transaction occurs before the 3 months period expires and a dealing is required to be registered, then duty is payable on or before settlement so that the dealing can be registered.

Who pays duty?

The transferee is the party liable for payment of transfer duty.

Call option assignment duty is payable by option holder.

What is the amount payable?

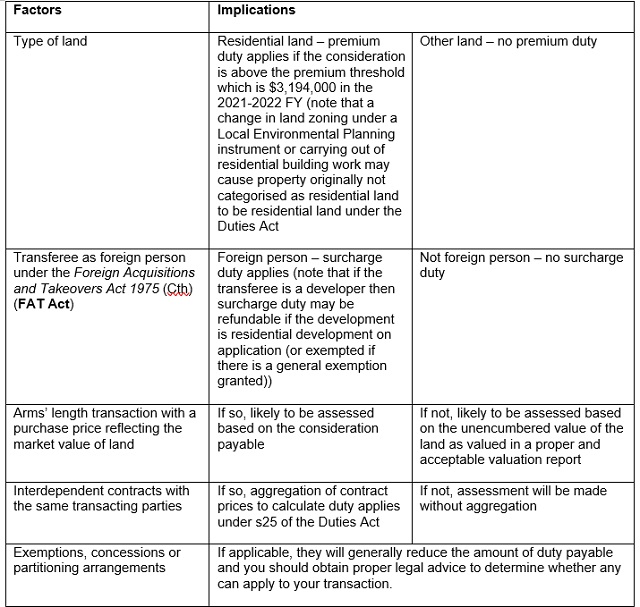

In land transfers, the amount of transfer duty payable will generally be assessed based on the following:

If the transaction involves different types of land, apportionment of the dutiable property may apply under s27 of the Duties Act so they will be treated as different and separate transactions.

Nomination under put and call option deed with valuable consideration

When a call option holder in a put and call option deed enters into an agreement to assign its interest or nominate a third party to exercise that option for valuable consideration, call option assignment duty and transfer duty (and surcharge call option assignment duty if applicable) will apply at different stages of the transaction. This gives rise to complex and potentially onerous duty obligations on both the call option holder and the nominee.

The amount of duty payable will depend upon the way in which the nomination is structured and any such proposed transaction should be subject of specific legal advice prior to the transaction being entered into.

Note that if the nomination is made and the call option holder and the nominee are corporations within the same group of corporations, an exemption from call option assignment duty may apply under s111(1)(d) of the Duties Act.

PART 2 – PROPOSED CHANGES TO THE EXISTING FRAMEWORK

Under the NSW property tax proposal published by the NSW Government on 11 June 2021, local purchasers may have the option to:

- continue paying stamp duty on purchase and land tax during ownership (if applicable); or

- pay an annual property tax (APT) rather than stamp duty and land tax (if applicable). The APT is calculated based on the unimproved land value (as opposed to the market value or capital value of the land) and will not be aggregated and will "run with the land". This means that it will apply to incoming purchasers which is something that will need to be adjusted on completion.

From a developer's perspective, implementation of the APT may mean that developers can contribute more capital per unit of land encouraging building construction to move upwards rather than outwards.

These proposed changes remain in the assessment phase and were under consultation until 30 July 2021. No further steps have been publicly announced as at the time of publication of this article.

MOVING FORWARD

Duty is an important factor when assessing transaction and project costs and cash flow. A simple mistake may be very costly and potentially unrectifiable. We highly recommend developers, fund investors and other purchasers to carefully structure the transaction and seek specific legal advice before entering into any binding agreement.

Given the proposed changes to the duty framework, developers and fund investors should also consider carefully its impact on the supply and demand in the housing market on different types of housing if any.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.