- with readers working within the Property industries

- within Litigation, Mediation & Arbitration, Family and Matrimonial and Strategy topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

InWylarah Pastoral Co Pty Ltd ATF Tallong Family Trust v Chief Commissioner of State Revenue [2024] NSWCATAD 366, the NSW Civil and Administrative Tribunal ("the Tribunal") found that a rural property which had mixed uses did not qualify for the primary production exemption in NSW. This case is significant to owners of properties with mixed uses in that state and has some interesting issues for discussion in respect of Victoria which refers to the land "primarily" being used for primary production in sections 65 - 67 Land Tax Act 2005 (Vic), rather than the "dominant use". In particular, owners that also have rented out residential premises on their properties should be aware of this case.

Background

The taxpayer initially purchased land located in NSW in May 2022 with a view to maintain cattle, claiming that because they had intended to purchase the land to maintain cattle, they would be exempt from land tax.

Throughout 2022 and 2023, significant work was carried out to prepare the land for cattle. However during these years, there was no income being generated from the sale of cattle. A residence was located on the land which the taxpayer rented out for $650 a week during the 2022 and 2023 years. This was the only revenue being derived from the land.

On 24 September 2024, several cattle were stocked on the land with expectations of future income from their sale. However during this time, the main source of income from the land remained with the rental payments from the residential property.

On 30 January 2023, the Chief Commissioner issued a land tax assessment for the 2023 and 2024 years denying the taxpayer from claiming land tax exemption on the basis of the primary production exemption.

The main issue was whether the dominant use of the land was for the maintenance of cattle for sale, thereby qualifying for the primary production exemption from land tax.

Decision

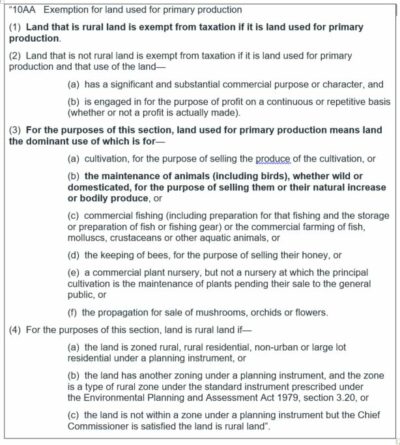

Under section 7 of the Land Tax Management Act 1956 ('LTMA') land tax is to be levied and paid on the taxable value of all land in NSW unless an exemption applies. The exemption that the taxpayer relied on was section 10AA of the LTMA which provides the following (our emphasis):

There was no contest that the land was rural land. The overarching issue was whether the dominant use of the land was for the maintenance of cattle, which the taxpayer claimed was the case. In assessing the authorities, the Tribunal noted that there is no single factor that can determine the dominant use, to the exclusion of other relevant factors. The factors that may be taken into account to determine which use is dominant include:

- The nature and intensity of competing uses;

- The extent of the physical area in which each use takes place;

- The time and labour spent for each use;

- The money spent or assets deployed for each use; and

- The value derived from each use.

The taxpayer asserted two factors supported the view that the dominant use of the land was for the maintenance of the cattle. These included the two national Vendor Declarations and Waybills which showed the presence of cattle on the land and their maintenance on the land as well as the significant works being done on the land to prepare it for cattle maintenance. Of note here is the aerial images obtained by the Chief Commissioner which did not indicate that there was any cattle on the land. Further, there were discrepancies in the Vendor Declaration and Waybills which cast significant doubt on whether cattle was being maintained on the land.

The taxpayer's most convincing point, which the Tribunal accepted, were factors which indicated that the dominant use of the land was for the maintenance of cattle, were the significant preparatory works being conducted on the land for the purposes of the maintenance of cattle. These included the improvement of pastures, improvement of fencing, application of fertilisers, application of insecticides, improvement of roads, the installation of a stormwater system around the machine shed and installation of water tanks and plumbing. Further, in regard to the intensity of competing uses, the taxpayer stated that given 5% of the land was being used for the generation of rental income and the rest was planned for the maintenance of cattle, this was a strong indicator that the land's dominant use was for the primary production purpose.

On the other hand, the Chief Commissioner contended that the rental payments, amounting to $650 per week and $58,500, for the years in question, indicated that the dominant use of the land was for the provision of accommodation to secure rental income. Significantly, the tribunal found that the expenditure in relation to the residence outweighed the expenditure on the land itself.

Hence, while there was evidence to suggest that the dominant use of the land was for cattle maintenance, this did not outweigh the evidence presented by the Commissioner that the dominant use was for the generation of rental income and residence.

Analysis and Key Takeaway

This case underpins the difficulties in assessing whether land is used dominantly for primary production in NSW (or primarily for primary production in Victoria) where there are multiple uses for that property.

A fatal aspect of the taxpayer's case included the fact that the expenses relating to the residence outweighed that of the primary production purposes, as well as the fact that the documentation for the Vendor Declaration Waybills had discrepancies. We believe that there may have been a different outcome had the documentation been properly kept and the income from the primary production exceeded the expenses from the rental activity.

As such, to ensure that your property remains exempt from stamp duty under the primary production exemption:

- Proper documentation is necessary. For example, keeping financials on income and expenses coming from each use (residential/primary production) as well as proper documentation indicating that it was for primary production (the taxpayer here failed to do this given there was a discrepancy in their Vendor Declaration and Waybill.

- Assess the expenses being devoted to primary production in contradistinction to the rental activity.

- Analyse what the main source of income from the land is. In this case, the fact that the only income was from the residence was a significant factor in determining that the land was not for primary production.

Should you wish to discuss the above, please contact Tony Pointon and Andrew Pointon of our Taxation Team.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.