The COVID-19 pandemic has alerted businesses to the fragility of global supply chains. Heightened demand, trade restrictions, factory closures, rising freight rates and reliance on 'just-in-time' inventory systems have led to global shortages and inflation. The disruption to supply chains has become more widespread, growing from an industrial problem to a threat to economic stability. Shortages and rising input costs have meant that prices of food, fuel and construction materials have continued to surge. Promoting flexible and resilient supply chains will be key to weathering the storm.

Vulnerabilities in Supply Chains Globally

Supply chain disruptions lead to shortages of key goods, price inflation, factory closures, unloaded shipping containers and negative effects on a nation's economic wellbeing. They also affect a wide spectrum of products, from expensive goods, such as cars and electronics, to necessities, such as food, medicines, oil and gas – all of which has an impact on the cost of living. The significant and compounding effects of supply chain bottlenecks and rising freight costs on prices, particularly for producers and manufacturers that import products like fertiliser and construction materials, have serious economic implications. Economies in the Asia Pacific, many of which rely heavily on imported goods, are vulnerable to the consequences of supply chain disruption for production and consumption.

Focus on cost efficiency before the pandemic

In the years before the pandemic, supply chains were focused on getting goods quickly and cheaply to customers. To do this, companies relied on outsourcing parts of the supply chain (thereby increasing the complexity of the chain) to cut storage overheads and ensure they had the products 'just in time' to fulfil customer orders.1 Similarly, manufacturers reduced the volume of spare stock at plants to cut costs, preferring to rely exclusively on the supply chain as demand varied. This meant supply chains were rigid, working as a network with many component parts, each vulnerable to even minor disturbances to other links in the chain.

This complexity means the accumulated effect of disruptions can take a long time to be resolved. For example, the Suez Canal blockage in March 2021 temporarily stopped 369 ships from passing through the canal and delayed an estimated US$9.6 billion worth of trade each day.2 The effects of the delay were still being felt months after the blockage was resolved. Even in non- pandemic times, a shock of that proportion could impact supply chains for six to nine months ahead.

The Global Supply Chain Pressure Index, plotted below, reached an all-time high during 2021. This index uses data on sea shipping costs from the Baltic Dry Index, as well as the Bureau of Labor Statistics airfreight cost indices for freight flights between Asia, Europe and the US. It also uses three supply chain–related components – delivery times, backlogs and purchased stocks—from the Purchasing Managers' Index surveys for manufacturing firms across Europe and the Pacific.

Global Supply Chain Pressure Index3

Source: Federal Reserve Bank of New York

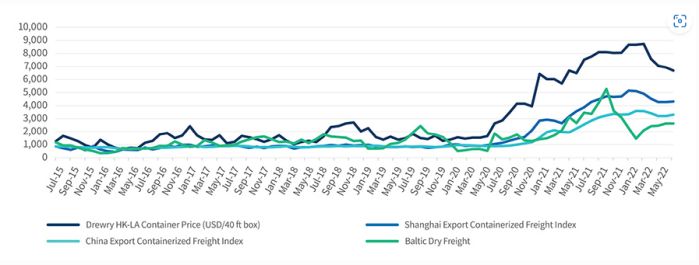

As illustrated below, record-breaking global freight rates across containerised and dry bulk shipping markets have increased the cost of shipping and importing as logistics companies have sought to recover higher fuel costs. This flows through the supply chain from the shipper to the carrier and on to the receiver, eventually working its way into higher consumer prices. Higher consumer prices can have adverse effects on small island developing states and the least developed countries whose consumption and production depend heavily on international trade.4 Port congestion has also affected the efficiency of supply chains. With ships waiting to unload, ports waiting for trucks to move containers, and trucks waiting for ships to dispose of empty containers, backups in the chain accumulate very quickly, and take time to recover from.

Global Shipping Costs

Implications for the Food Industry

Supply chain shocks have led to increases in the prices of food. Agriculture follows a fine-tuned schedule based around seasons and weather. A small disturbance in one season can cause a ricochet effect on the yield and output of subsequent seasons. The food supply chain has five key stages: agricultural production, post-harvest handling, processing, distribution and consumption.5

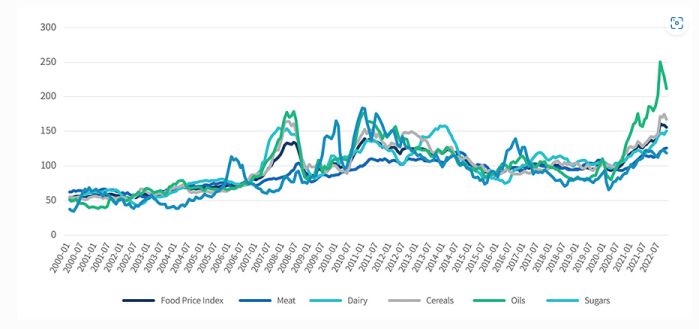

- Staple products, such as wheat, corn, maize, soybeans and oilseeds, can be quite capital intensive, while high-value produce, like fruit, vegetables and fisheries, tends to be more labour intensive. As illustrated below, the Food and Agriculture Organization (FAO) Food Price Index shows that prices of key foodstuffs have increased significantly over the past two years.

- Labour shortages due to the pandemic have caused disruptions in labour-intensive work such as sowing and harvesting on farms. Many of these jobs were previously filled by temporary or seasonal workers, and the absence of local or migrant workers due to illness or migration restrictions has affected the supply chain. For example, in the UK, the 'Pick for Britain' campaign aimed to source local workers to harvest crops due to shortages of overseas workers.6

- Logistical challenges mean that farmers can struggle to get their product to market. In the US, members of the Dairy Farmers of America cooperative dumped gallons of milk every day as they could not get their product onto shelves due to supply chain disruptions and the closure of restaurants.7 Disruptions of food flow from manufacturers and/or producers to end users and can have negative effects on food quality, freshness, food safety and affordability.

- Food processing plants, which are labour intensive, are adversely affected by lockdowns and restrictions on workers due to illness. For example, meat processing plants were considered high-risk sites during the early stages of the pandemic.8 Closing down food plants causes a ripple effect across the food supply chain, and producers are often forced to cull their farm animals as they cannot sell their livestock to processing plants.

FAO Food Price Index (2014-16=100)9

Source: Food and Agriculture Organization of the United Nations

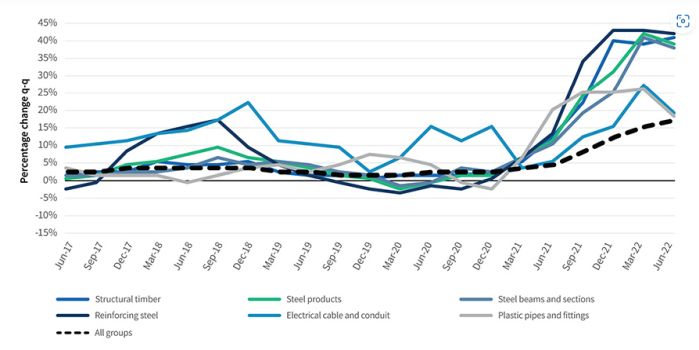

Implications for the Construction Industry

Material and labour costs are rising rapidly – in Australia, costs increased by around 15 per cent in 2021, which is more than the price rises seen over the previous seven years. Essential construction materials, such as reinforcing steel and structural timber rose by more than 40 per cent over 2021.10

Any slowdown in the housing and commercial property markets could restrict the construction industry further, with constrained builders likely to fall into insolvency. Recent high-profile collapses include Probuild and Condev and the FTI Consulting-managed insolvencies of Privium and BA Murphy. Some contractors are now asking for 'rise and fall' provisions to be included in contracts and seeking extensions for completing jobs because of materials shortages.

Builders can help manage their risks by:

- building extra time into contracts to allow for supply chain delays

- requiring contractors to allow for a buffer for key supply items

- requiring contractors to price in the risk of delays and then fixing the cost subsequently

- requiring contractors to pay deposits for offshore supplies earlier than usual

- sourcing items locally.

Construction Materials - Key Groups11

(Weighted average of 6 capital cities)

Source: ABS 6427.0 Producer Price Indexes, Australia

Implications for the Fuel Industry

The ongoing conflict in Europe, along with tightening oil markets and increased demand for transport fuels post pandemic, has led to uncertainty, price increases and disruption to supply chains for fuel. In some countries, supply chains have had to be restructured as they move away from Russian oil. This has caused increases in both retail and wholesale prices.12

- Fuel companies should look at sourcing fuel from a wider number of countries and storing it in a diverse number of locations to ensure supply chain flexibility. For example, AMPOL has established strong partnerships with producers in the US, improving sourcing capability and diversifying its supply chain.13 14

- Fuel companies should engage with market participants to understand market dynamics and pre-empt the impacts of global disruption on local suppliers. This could inform key decision-making as supply chains rebalance in response to these disruptions.

- Finally, fuel companies should try to coordinate activities on a national scale in response to a supply chain crisis rather than work in isolation. The benefits of working together to ensure security of supply could outweigh any short-term competition concerns.

Key Supply Chain Strategies

It could cost businesses more to promote supply chain resilience in the short term but in the long term, a more resilient supply chain will reduce the impact of external shocks on the bottom line. Most businesses affected by supply chain shocks during the pandemic have said they intend to make their supply chains more flexible, agile and resilient. The following outlines some of their strategies.

Inventory cushions

- This means having 'extra' stock or component parts on hand should the supply source face disruption. While it may be hard to justify the cost of additional inventory, recent experience has shown the cost to business if there is a delay in obtaining such inventory. For example, the global microchip shortage has put the automotive and electrical industries under stress and left thousands of laptop orders unfilled.16

- Alternatively, businesses might stockpile inventory, carefully considering when to release it and at what price.

Digitalisation

- Businesses could use AI to identify risks and potential shocks or underperformance in the supply chain well before they get out of hand. Access to sales information and predictions could allow suppliers to more accurately determine the amount of stock that is needed.

- Technology can also be used to map a business's supply chain more accurately, not only to the first tier (the business's direct supplier) but to the second tier (the business's supplier's supplier) and beyond. An accurate and in-depth supply chain map can more clearly identify riskier points along the chain, allowing businesses to mitigate that risk and make their chain more reliable.

Localisation and 'nearshoring'

- Some firms are taking advantage of more local materials in an attempt to rely less on international trade and supply chains.

- Nearshoring means relying on suppliers that are geographically closer to production facilities to reduce transport costs and time, improve product quality and reduce risk. Sometimes nearshoring is a better or more realistic alternative to localisation, as some products may use materials that cannot be sourced locally.17

- Production can also be brought onshore - in July 2022, the US Congress passed the CHIPS Act to strengthen domestic semiconductor manufacturing, design and research, and to reinforce America's chip supply chains.18

Diversification of suppliers

- The shortage of component parts for the automotive industry shows the importance of having multiple sources of supply.

- Prior to the pandemic, Vietnam had positioned itself as an alternative supply chain hub – its proximity to China, trade arrangements that promote exports, and a strong component supply economy gave it such an opportunity.19

Strategic partnerships

- Partnering with suppliers of key raw materials can increase visibility and a business's control of their supply chain.

- This may have implications for business restructuring as well as for competition policy.

Monitoring free trade agreements

- Supply chain professionals should keep abreast of free trade agreements and what they mean for their respective supply chains. There have been recent efforts to promote free trade in the APAC region, including the Regional Comprehensive Economic Partnership Agreement,20 the Comprehensive and Progressive Agreement for Trans-Pacific Partnership,21 and the Pacific Agreement on Closer Economic Relations Plus.22 Such agreements can affect decisions on competitive locations for plants, distribution functions, sales and sourcing inputs.

Government initiatives

- Government can play a role in facilitating smooth trade and putting in place temporary supportive measures to help businesses struggling with supply chain disruption.

Customs clearance:

- removing non-tariff barriers to trade

- reducing costly constraints to smooth operation of supply chains such as customs and clearance checks.

Price flexibility:

- playing a role in preventing businesses from gouging in an environment of rising and volatile prices by introducing temporary restrictions on pricing behaviour.23

Protections for struggling businesses:

- helping businesses struggling with rising input prices and scarcity of raw materials by introducing temporary measures that prevent a business from shutting down permanently (for example, through domestic contracts).

- Trade facilitation: supporting regional cooperation by maintaining open trade policies and mutually beneficial initiatives (such as the Supply Chain Resilience Initiative),24 building trust in trading commitments and avoiding policy interventions that impede smooth trade.

Overview

Where companies once focused on cost efficiency, they have now turned their attention to increasing the resilience of their supply chains. Increasingly, ensuring supply means improving the visibility of the different links and dependencies in the chain. One way companies can improve transparency is by using data analytics and AI to uncover vulnerabilities ahead of a potential disruption. Another is to use more flexible contractual arrangements – it's often easier to achieve transparency when dealing with just one supplier.

Agility is also vital. Supply chains need to be able to respond to rapid changes in retail demand, quickly divert goods to another location or find alternative sources of supply. To achieve this, companies need to consider whether to pursue diversity of supply or rely on the convenience of just one supplier. Consolidation and mergers with a view to bringing links in the supply chain 'in-house' will have implications for business restructuring and potentially for competition policy.

Alongside these concerns, sustainability and carbon neutrality are big talking points, not only among businesses and consumers, but among investors and regulators. Supply chains make up 60 per cent of all carbon emissions globally.25 To achieve net zero means that supply chains may need to be reconfigured.

Going forward, some of the key trends we are likely to see in supply chains are:

- Visibility – increasing the transparency of supply chains and using technology to make proactive decisions. This will avert the need to engage a host of different links and suppliers in the chain and navigate their respective systems.

- Resilience – developing chains that are resilient and agile by strategically choosing suppliers.

- Environmental goals – pursuing environmental goals among businesses and consumers, which will affect how supply chains are structured.

How FTI Consulting Can Help

Disruptions in global supply chains and rising materials and labour costs present considerable challenges and opportunities in a range of areas including:

- demand forecasting

- cost forecasting

- dispute resolution

- business forecasting

- asset valuation.

The Economic & Financial Consulting team at FTI Consulting has deep experience providing advice on these issues and can help businesses navigate the challenges and the opportunities. For more information on these issues, please reach out to a member of our team.

Footnotes

1: Just in time inventory management aligns raw-material orders from suppliers directly with production schedules. Companies order goods only as they need them for production processes, and this reduces waste and cost. Source: Oracle Netsuite (2020), 'Just-in-Time Inventory (JIT) Explained: A Guide', accessed online August 2022, https://www.netsuite.com/portal/resource/articles/inventory-management/just-in-time-inventory.shtml#:~:text=What%20Is%20Just%2Din%2DTime,on%20hand%20to%20 meet%20demand.

2: BBC News, 'The cost of the Suez Canal blockage', 29 March 2021, https://www.bbc.com/news/business-56559073.

3: Source: Federal Reserve Bank of New York, Global Supply Chain Pressure Index, accessed online August 2022, https://www.newyorkfed.org/research/gscpi.html.

4: UNCTAD (2021), 'Review of Maritime Transport 2021', accessed online August 2022, https://unctad.org/system/files/official-document/rmt2021_en_0.pdf.

5: Alabi, M.O. and Ngwenyama, O. (2022), "Food security and disruptions of the global food supply chains during COVID-19: building smarter food supply chains for post COVID-19 era", British Food Journal, https://doi.org/10.1108/BFJ-03-2021-0333.

6: Department for Environment, Food & Rural Affairs (2021) 'Pick for Britain Campaign - FOI2021/10325' accessed online August 2022, https://www.gov.uk/government/publications/pick-for-britain-campaign-foi202110325.

7: New York Times (2020) 'Dumped Milk, Smashed Eggs, Plowed Vegetables: Food Waste of the Pandemic' accessed online August 2022, https://www.nytimes.com/2020/04/11/business/coronavirus-destroying-food.html.

8: NSW Government Australia (2021) 'Abattoirs and the meat processing industry', accessed online August 2022, https://www.nsw.gov.au/covid-19/business/safety-plans/abattoirs-and-meat-processing.

9: Source: Food and Agriculture Organization of the United Nations, FAO Food Price Index (FFPI), August 2022, https://www.fao.org/worldfoodsituation/foodpricesindex/en/.

10: Park, J. et al. (2022) 'Building and Construction Industry in the Eye of the Perfect Storm'. Accessed online, August 2022, https://www.fticonsulting.com/insights/articles/building-construction-industry-eye-perfect-storm.

11: Source: Australian Bureau of Statistics, Producer Price Indexes, Australia, June 2022, https://www.abs.gov.au/statistics/economy/price-indexes-and-inflation/producer-price-indexes-australia/latest-release#construction

12: AMPOL (2021) 'Managing global supply chain disruptions', accessed online August 2022, https://www.ampol.com.au/about-ampol/powering-next/global-supply-chains/managing-global-supply-chain-disruptions.

13: AMPOL (2021) 'Managing global supply chain disruptions', accessed online August 2022, https://www.ampol.com.au/about-ampol/powering-next/global-supply-chains/managing-global-supply-chain-disruptions.

14: McKinsey (2021) 'How COVID-19 is reshaping supply chains', accessed online August 2022, https://www.mckinsey.com/business-functions/operations/our-insights/how-covid-19-is-reshaping-supply-chains.

16: New York Times (2021) 'A Tiny Part's Big Ripple: Global Chip Shortage Hobbles the Auto Industry', accessed online August 2022, https://www.nytimes.com/2021/04/23/business/auto-semiconductors-general-motors-mercedes.html

17: Scalzo, R. (2022) 'Is it Time to Consider Bringing Your Supply Chain `Home'?'. Accessed online, August 2022, https://www.fticonsulting.com/insights/fti-journal/time-consider-bringing-supply-chain-home.

18: Semiconductor Industry Association (2022) 'Congress Passes Investments in Domestic Semiconductor Manufacturing, Research & Design', accessed online August 2021, https://www.semiconductors.org/chips/.

19: DP World (2021) 'The future of Asia Pacific supply chains', accessed online August 2022, https://www.dpworld.com/insights/expert-opinions/the-future-of-asia-pacific-supply-chains.

20: Department of Foreign Affairs and Trade (2022) 'Regional Comprehensive Economic Partnership,' accessed online August 2022, https://www.dfat.gov.au/trade/agreements/in-force/rcep.

21: Department of Foreign Affairs and Trade (2022) 'Comprehensive and Progressive Agreement for Trans-Pacific Partnership,' accessed online August 2022, https://www.dfat.gov.au/trade/agreements/in-force/cptpp/comprehensive-and-progressive-agreement-for-trans-pacific-partnership.

22: Department of Foreign Affairs and Trade (2022) 'Pacific Agreement on Closer Economic Relations Plus,' accessed online August 2022, https://www.dfat.gov.au/trade/agreements/in-force/cptpp/comprehensive-and-progressive-agreement-for-trans-pacific-partnership.

23: ABC News (2022) 'Are record corporate profits driving inflation? Here's what experts think', accessed online August 2022, https://abcnews.go.com/Business/record-corporate-profits-driving-inflation-experts/story?id=85593108.

24: Australian Government (2022) 'Funding for businesses to invest in capabilities to address supply chain vulnerabilities' accessed online August 2022, https://business.gov.au/grants-and-programs/supply-chain-resilience-initiative.

25: Accenture (2022) 'How sustainable supply chains can unlock net zero emissions' accessed online August 2022, https://www.accenture.com/us-en/insights/supply-chain-operations/supply-chains-key-unlocking-net-zero-emissions.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.