- within Food, Drugs, Healthcare and Life Sciences topic(s)

- in Oceania

- within Food, Drugs, Healthcare and Life Sciences topic(s)

- within Insolvency/Bankruptcy/Re-Structuring, Criminal Law, Litigation and Mediation & Arbitration topic(s)

Introduction:

The recent financial collapse of Healthscope, while based on unique failures, is nevertheless a forewarning of emerging challenges to the broader private hospital system. This in turn poses risks of flow on with negative impacts to the already stressed public system.1 The private system has been a fundamental pillar of Australia's health system and has been critical in supporting Australia's public hospital system, and any significant impact on the private will therefore impair the public as well.

In order to sustain the private hospital model going forward, it is therefore time to consider the treble response of more efficient private hospital operations and asset management, a National Public Private Hospitals Partnership and a new Private Health Insurers and Private Hospitals Agreement. Without implementing such responses, the risk increases of a failure of the private hospital system, leading to significant impact on the public hospital system and ultimately bringing risks to patient care.

Australia's health system was recently ranked number one in the world for its performance during the pandemic by the Commonwealth Fund in New York. The evidence behind this was substantiated in the Lancet Journal last year, which published results from the Global Burden of Disease Study, with over 11,000 public health researchers contributing. The Lancet reported an average loss of global life expectancy from the start of 2019 to the end of 2021 as minus 1.6 years. In the United States, the loss of life expectancy was 2.0 years. In Australia, by contrast, life expectancy rose by 0.2 years during the pandemic.2 This continues to be an astonishing national achievement.

To many people however, it may seem counterintuitive that we have the number one ranked health system in the world. Hospital waiting lists for elective surgery have grown (Queensland alone is 62,727 as of May 2025), emergency department bypasses and ambulance ramping (waiting time for ambulance patients to see a Doctor in Emergency Departments) have increased and bulk billing has fallen from 88.5 percent to 77.7 percent or by nearly 11 percent since mid-2022.3 The system is under pressure and as highlighted by some of the most recent Federal Government announcements, there is a need to reduce the costs on Australians and pressures on the State Health Systems.

However, every health system around the world is under pressure. It just happens that the Australian hybrid model of public and private shared care has arguably but factually performed better than almost any other system. Our Australian Health system is neither like the US largely private model with its soaring peaks but significant inequality of access, nor like the UK's, NHS which is facing ongoing degradation by almost every measure, is in crisis with performance and productivity declines, ballooning costs and waiting lists, in addition to reports of workforce shortages and plummeting staff morale.

Nevertheless, the singular feature of Australia's health system which gives it a clinical operational advantage, the hybrid partnership of public and private hospitals, is under threat and needs reform. In that context, the collapse of Healthscope is not a stand-alone event, as also seen by the closure of up to eight private maternity units including Darwin, Hobart and Cairns.4 It is widely assumed that the purchasers paid too much for Healthscope and there may have been less than perfect management, but there are also structural changes that are occurring in terms of decreasing trends for bed nights in long stay hospitals, increased use of day and low acuity facilities due to improved clinical outcomes, and increasing cost and reimbursement pressures which are placing material burdens on private long stay hospitals in general.

The October 2024 Commonwealth Department of Health and Aged Care Private Hospital Financial Viability Health Check concluded very simply: "The private hospital sector is an important part of the Australian health system, offering patient's choice, providing the hospital sector additional capacity and a complimentary workforce for public hospitals."5

Indeed, the Australian Private Hospitals Association "Private Hospital Viability: Immediate Response to Crisis" paper of November 2024 warned that: "The Private Hospital sector is at a critical stage. It is experiencing threats to viability, sustainability and investment. If the trends illustrated in this paper continue, they will have a greater adverse impact on private hospitals and force the sector to write off capacity to service privately insured patients. It may become unviable for many hospitals to continue operation."6

This warning has sadly come to pass not only with the risk to Healthscope's operation but other closures that have occurred or are foreshadowed.

The system wide consequences of a decay or failure of significant parts of the private hospital sector in Australia were expressly addressed by the APHA paper: "Without a robust private hospital sector, the objective of sharing the public health burden across the public and private pillars of the system cannot be realised."7 In short, there would be loss of choice, increased public and private wait times, loss of jobs, increased public sector costs and perhaps even more importantly, significant risks to quality of care and medical innovation.8

Fortunately, there is a pathway forward over the next five years based on three key actions. First, a focus on running a fiscally and productive core business that maximises existing investments, assets and workforce to drive returns that enable the ongoing financial base and viability of operations.

Second, a National Public and Private Hospital Partnership which could include any and all of 4 different models. In essence both systems need each other and the lessons of both the 2017 and 2021 reforms and the 2020 Covid Viability Partnership can be applied now to a long term public private hospitals partnership which will strengthen both systems.

Third, there is also the opportunity for a renewed Private Hospitals and Private Health insurance Partnership which builds on the 2017 and 2021 reforms.

The sustainable viability and success of the private hospital network is therefore everyone's business. The Commonwealth Government, States, the public and private hospitals, private health insurers and both public and private hospital patients are all invested in the success of the private hospital system.

Section 1: The Australian Model

In order to understand the reforms which may underpin the sustainability of the Australian Private hospital system, it is necessary to understand the role of Private Hospitals in the Australian health system and the challenges they are facing.

The Australian Private Hospital system provided 41.2 percent of all hospital admissions in 2022/23 and 70 percent of all elective surgeries.9 As of July 2024, these procedures and admissions were carried out in 647 private hospitals, although there have been some closures and openings since. Taken together, there were over 5 million admissions and procedures in a private setting in 2021/2022.10

The simple summary is that with over 40 percent of all hospital admissions and 70 percent of elective surgeries, the private hospital sector is fundamental not just to the viability but also to the central running of the Australian health and hospital system. Australia has a true hybrid model relying on both the public and private hospital systems.

Underpinning the Australian private hospital system is a strong private health insurance model.

The latest Australian Prudential Regulation Authority (APRA) Quarterly data shows that after a period of decline prior to 2017, following the 2017 Commonwealth reforms, private health insurance with hospital cover rose from 45.1 percent in June 2018 to 45.3 percent at the end of the March quarter in 2025. In real terms this represents an increase of over 1.2 million covered Australians from 11.25 million to 12.48 million.11

General private health insurance, or extras as they are commonly known, also rose from 54.3 percent in June 2018 to 55.1 percent in March 2025. This represented an increase of over 1.6 million people covered from 13.5 million to 15.1 million.12

The takeaway is that contrary to some reports, private health insurance has consolidated through two rounds of reform in 2017 and 2021. Covid also arguably contributed to an increase in awareness of health and the value placed on access to health coverage.

There are however competing value propositions at work with regards to uptake of PHI.

On the one hand, the cost-of-living crisis has placed added pressure on people's ability to afford private health cover, while the comparatively high quality of our public health system has raised further questions about the value of private health for some. On the other hand, increasing public health waiting lists, the Medicare levy surcharge for higher income earners and the private health insurance rebate for lower income earners have all acted as incentives to take up private health insurance.

The net result though has been a growth in Private Health Insurance (PHI) in real terms and the addition of over 1.2 million people with hospital coverage since the 2017 reforms, which established tiered private health cover as well as adding mental health and rural coverage in return for a deal with the private hospitals and device makers.

Section 2: Global and Australian Trends and Challenges

Three trends since Covid 19 have however created structural, operational and financial challenges for private hospitals.

First, there has been a shift from private overnight admissions to day procedures across much of the globe. The Commonwealth Financial Health Check found that from 2018/19 to 2022/23 private day hospital admissions had grown by a Compound Average Growth Rate (CAGR) of 2.66 percent. By contrast, overnight admissions grew by a CAGR of 0.22 percent per annum, down from 1.07% over the previous four years.13 This represents an 80 percent drop in the growth rate of overnight

procedures across the respective four-year period – a key revenue and profitability driver for Private Hospitals.

In essence, Covid crystallised and accelerated an underlying global trend: the growing preference for shorter hospital stays, driven by surgical advancements and supported by Telehealth and improved remote monitoring capabilities.

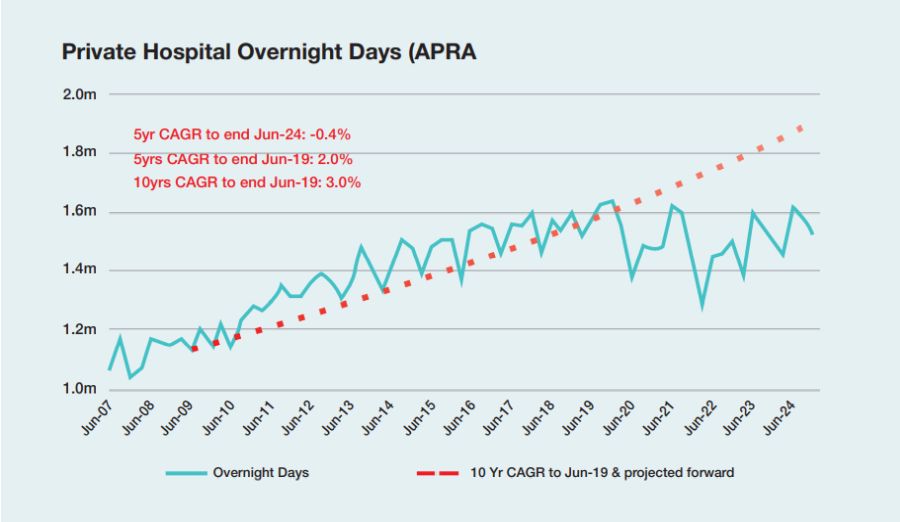

This has translated to stagnant total nights in private hospitals. More recent APRA data and analysis has shown that actual total bed nights dropped from mid-2019 to mid-2024.14

Australian Prudential Regulation Authority – Private Hospital

Overnight Days Data (through Feb 2025)

By June 2024, there was a negative 5-year growth rate of 0.4 percent per annum in actual bed nights in overnight private hospitals across Australia. The consequences for predominantly overnight focussed hospitals were clear, this was a structural change which will likely worsen into the future.

The second major change is the related impact of technology on the nature of both public and private care. In addition to less invasive surgical techniques requiring either shorter stays or day procedures only, Telehealth and remote monitoring are also enabling different methods of care.

Maternity recovery in hotel style accommodation is well established in Australia. Known models include partnerships between Private Hospital Operators and Hotelier groups that are subsidised for low complexity births. It is both lower cost on average than an overnight hospital stay, and in non-complex cases often preferred by patients and their families.

This Medihotel, or Low Acuity model, has been enabled by Telehealth and remote diagnostics, and has now been extended to broader patient cohorts, both around the world and particularly in South Australia and Queensland, with the support from the respective state governments. Operators such as Amplar Health and KNG Health are leading this shift and the trend toward low-cost care for otherwise non-complex but longer staying patients is likely to accelerate.15 When it is a transfer from public hospitals, it also helps free up beds, thereby reducing public hospital waiting times.

The extension of technology into home based care has already been evident in aged care, with a fivefold increase in medical home care across Australia over the past decade. Building on this, both state governments and private hospitals are now trialing 'hospital in the home' models based on visiting nurses. Greater use of telehealth and the rapid expansion of real time monitoring devices capable of transmitting patient data directly to hospital staff are further supporting this shift. As these technologies become more widespread, 'hospital in the home' is expected to grow both globally and in Australia, fundamentally changing the model of traditional, asset-intensive hospital operations.

While the shift towards day procedures, low acuity and home care models is overwhelmingly positive, developments in patient care and health resource efficiency are also consequential in building financial challenges for individual private hospitals or providers undergoing disruption of traditional models of care.

This leads to the third major challenge, which has been an increase in costs to operate, increases in costs to sustain assets and inflation within hospital delivery. The Commonwealth Health check found an increase in private hospitals expenditure of 4.1 percent per annum from 2018/19 to 2021/22.16 Updated data from the Australian Private Hospitals Association found that by mid 2023 there had been a five-year average growth in annual expenses of 5.3 percent.17

The causes of this growth in costs include growth in wages, growth in cost of materials, general inflation and in the case of Healthscope, heavy rental payments relative to both balance sheet and income.

Depending on the Private Hospital operator, the major drivers of expenditure increase, have been both employee related expenses and the requirement to maintain large asset footprints. This is supported by the rise of real wages across Australia including for example the 28.4 percent increase over four years for Victorian Government nurses which in turn the Private Hospitals typically have to meet to be workforce competitive. To put this into perspective, an operator with an EBITDA of four percent would turn a significant loss if they were to match the Victorian Government increases. Additionally, the AHPA asserts that the ongoing maintenance and management of assets generally requires Hospitals to be operating at a 15 percent EBITDA return to remain financially sustainable.

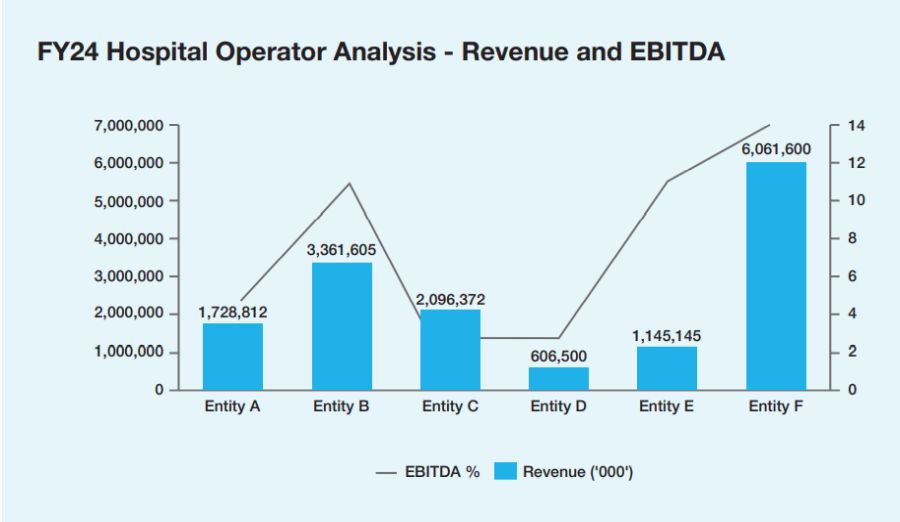

The Commonwealth concluded that the net impact of these challenges was an average growth in private hospital revenue from 2018 to 2022 of 2.9 percent against an increase in costs of 4.1 percent. This in turn contributed to a decline in EBITDA from 8.7 percent to 4.4 percent across known hospitals for which data was supplied. The Commonwealth estimated a broader weighted average across the whole sector, presumably including assumptions about Ramsay Health, of an EBITDA of 7-8 percent, although no data or methods were supplied.18 Perhaps most importantly it recognised that 33 percent of Private hospitals were already loss making on EBITDA, far from the required 15 percent of profit required to sustain assets and operations.

By contrast, the Private Hospitals Association response outlined a sector wide annual minus 13.5 percent EBITDA from 2018 to 2023 and an annual decay in operating profit before tax of 28.3 percent from $1.5 billion to $300 million.19 These figures from the Commonwealth imply a sector under stress and the explicit statement of the APHA indicates a sector in crisis.

Source: Snapshot of key Hospital operator revenue and EBITDA -

Australian Healthcare and Hospitals Association (ACNC)

Due to these three trends, hospitals need to evolve - and will have to evolve - to become systems of care across a variety of overnight, day, low acuity and in the home settings, rather than simply being a large traditional asset intensive model of care. These changes are incumbent on the hospitals themselves and their operators, whether public or private, thereby intensifying the need for operational and fiscal discipline. They also represent a systemic challenge for Governments.

Given the impacts on revenue as well as costs and viability, there is an urgent need for Private Hospitals to focus on building financial sustainability in the short term. This is crucial while they wait for broader policy intervention that will support viability in the medium term, aiming to meet public objectives of reducing public waiting lists and emergency department congestion. The term "too big to fail" is sometimes used, but in this case, it might be said that the Australian private hospital network is "too important to fail".

Although the Australian Hospital system isn't in critical condition yet, intervention is required across a range of key areas. These include further enhancing operational and financial focus within the control of Private Hospital operators, building a closer and more sustainable partnership between Private Hospital operators and government and reforming key agreements that underpin the relationships between government, Health Insurers and Private Hospital operators.

Section 3: Solutions

In order to address the current and future challenges facing the private hospital network and therefore the Australian health and hospital system, there are three primary actions that we would propose for consideration.

First, a refocus on operational and fiscal discipline, maximising existing investments and assets and delivering productivity.

3.1 Operational and Fiscal Discipline, Maximising Existing Investments and Assets and Delivering Productivity

From A&M's recent experiences working alongside both Public and Private Hospital operators in Australia and globally, there is a widespread need for operators to focus on sustaining financial and operational foundations in challenging conditions.

Operators across both public and private are having to refresh their modus operandi of operational and financial business performance to instil greater operational and financial discipline. Many Private Hospital Operators are exploring how to lift EBITDA in excess of 8 percent. Key topics to drive improvement include the usual methods of procurements of goods and services (clinical and non-clinical), scheduling, rostering, repairs and maintenance, cost avoidance measures and revenue capture (>15 percent YoY).

To improve business performance, operators need to take full advantage of both public investment in digital health, particularly in areas including: Artificial Intelligence and automation; telehealth; remote devices and monitoring, and greater use of patient data. These advances not only drive productivity but also support the ongoing shift in patient care, including 'care at home' and enhanced access in rural and regional locations. In its 2024 Research Paper, "Leveraging digital technology in healthcare", the Australian Productivity Commission identified significant benefits to be gained by Operators including "up to 30 percent of the tasks undertaken by the workforce could be automated using digital technology and artificial intelligence".20 These are overwhelmingly administrative tasks, freeing up time and resources for improved patient care.

Additionally, Private Hospital operators are viewing additional infrastructure cautiously and looking to maximise existing investments. This includes the increased utilisation of facilities. Some organisations are running at lower-than-expected elective surgery capacity (many organisations have been running at 45 – 60 percent of total capacity) resulting in a material and negative impact on their financial position.

To view the full pdf, click here.

Footnotes

1. https://economictimes.indiatimes.com/news/international/new-zealand/healthscope-in-critical-condition-inside-the-collapse-of-australia s-second-biggest-private-hospital-network/articleshow/121408289.cms?from=mdr

2. The Lancet, Global age-specific mortality, life expectancy, and population estimates in 204 countries and territories and 811 subnational locations, 1950–2021, and the impact of the COVID-19 pandemic: a comprehensive demographic analysis for the Global Burden of Disease Study 2021 (Report, 11 March 2021)

3. The Commonwealth Department of Health and Aged Care, National Accounts for Medicare Bulk Billing to 31 December 2024 (10 Feb 2024)

4. Why HealthScope maternity closures are an 'absolute crisis' and a symptom of a bigger problem - ABC News (21 Feb 2025)

5. The Commonwealth Department of Health and Aged Care, Private Hospital Financial Viability Health Check (October 2024)

6. Australian Private Hospitals Association, Private Hospital Viability: Immediate Response to Crisis (Nov 2024)

7. Australian Private Hospitals Association, Private Hospital Viability: Immediate Response to Crisis (Nov 2024)

8. Australian Private Hospitals Association, Private Hospital Viability: Immediate Response to Crisis (Nov 2024)

9. The Commonwealth Department of Health and Aged Care, Private Hospital Financial Viability Health Check (October 2024)

10.The Commonwealth Department of Health and Aged Care, Private Hospital Financial Viability Health Check (October 2024)

11. APRA, March Quarterly PHI Membership Coverage (29 May 2025)

12. APRA, March Quarterly PHI Membership Coverage (29 May 2025)

13. The Commonwealth Department of Health and Aged Care, Private Hospital Financial Viability Health Check (October 2024)

14. APRA, March Quarterly PHI Membership Coverage (29 May 2025)

15. Public hospital patients treated at Gold Coast hotels - ABC News (August 2024)

16. The Commonwealth Department of Health and Aged Care, Private Hospital Financial Viability Health Check (October 2024)

17. Australian Private Hospitals Association, Private Hospital Viability: Immediate Response to Crisis (Nov 2024)

18. The Commonwealth Department of Health and Aged Care, Private Hospital Financial Viability Health Check (October 2024)

19. Australian Private Hospitals Association, Private Hospital Viability: Immediate Response to Crisis (Nov 2024)

20. Australian Government Productivity Commission, Leveraging digital technology in healthcare, Research paper (2024)

Originally published 03 July 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.