- within Government and Public Sector topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Banking & Credit and Telecomms industries

The majority of Australian Financial Services (AFS) and Credit Licensees are aware of the (potentially) serious ramifications associated with non-compliance. The Corporations Act, National Consumer Credit Protection Act and other associated legislation, prescribe the penalties associated with non-compliance whether monetary or otherwise.

However, many AFS and Credit Licensees fail to consider the ramifications of non-compliance beyond the penalties prescribed by legislation.

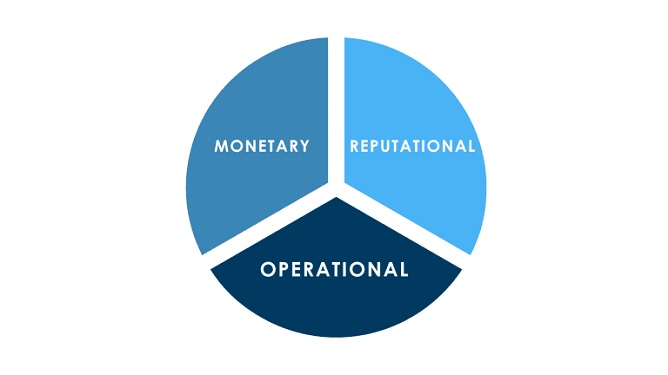

Monetary Implications

Of course there is the monetary cost of having to pay a fine but what about the incidental costs associated with non-compliance?

When an instance of non-compliance first arises, AFS and Credit Licensees generally divert resources to investigating and/or resolving the issue of non-compliance. This diversion of resources means representatives are taken away from their normal business duties to focus on the non-compliance issue, often resulting in reduced resources in areas of the business that generally generate business.

If an AFS or Credit Licensee finds themselves in the unfortunate scenario of being the subject of a regulatory investigation (and in some scenarios, litigation) there are significant costs (both internal and external) associated with preparing for and defending a matter. These costs are also generally unexpected and financial resources are diverted from other areas of the business – leading to operational implications.

Operational Implications

When an instance of non-compliance first arises, a diversion of human resources occurs which takes representatives away from their normal business duties. But what does this mean for the day-to-day operations of the business?

Generally, a diversion of resources sees other business teams being under resourced (human and financial). This means that business teams that are usually effective often experience issues of their own e.g. tasks that were previously completed in a timely manner may take longer, funds that were previously readily available are no longer.

AFS and Credit Licensees should also consider the implications on clients – are slower processing and response times going to lead to an increase in disgruntled clients? And then an increase in client complaints? In more serious scenarios, if an AFS or Credit Licensee is subject to a regulatory investigation, the business may be required to cease providing services to clients entirely until the investigation is complete. The cessation of services can have significant operational (and monetary!) implications.

Reputational Implications

If a representative involved in a non-compliance matter finds themselves being personally named by the regulator, the reputational damage can be far worse than the damage to the business. Nobody wants to be the individual named in a regulator media release for any wrongdoing. From a AFS or Credit Licensee perspective, the reputational implications can be devastating. Representatives are likely to move on in an attempt to disassociate themselves from the non-compliance, and clients are likely to move to other service providers. The loss of representatives and clients can lead to monetary and operational implications.

So, what does this all mean?

It is important that AFS and Credit Licensees have robust compliance processes, procedures and resources available to mitigate instances of non-compliance. Compliance obligations must be regularly and routinely attended to.

AFS and Credit Licensees should consider conducting a review of their compliance processes, procedures and resources to ensure they are adequate for the size, nature and scale of the business.

With this in mind, Sophie Grace can provide ongoing compliance solutions including :

- conducting a review of and updating compliance policies and registers;

- creation of a compliance calendar to distribute the compliance workload to responsible persons and make it easier to meet obligations;

- assisting with lodging statutory filings;

- responding to compliance questions and queries; and

- conducting marketing reviews for any marketing material to be released.

Sophie Grace also has a range of compliance programs and document templates that can be purchased from our online shop. These documents can assist you in ensuring your compliance obligations are met.