- within Accounting and Audit topic(s)

Cam Ansell and Andrew Ryan discuss the issues facing aged care providers

During these trying times, proactivity and transparent communication with financiers is key, no matter your circumstances.

The current state of play

The aged care sector is presently facing the heaviest headwinds so far this century. We don't have to look far to see operator profit margins eroding, with Australia's only two publicly listed companies, Estia and Regis, reporting operating losses for the 2022 Financial Year.

Their experiences reflect that of most of Australia's aged care providers, with over 60% of operators reporting losses last financial year.1

Liquidity pressures are underpinned by wage escalation, COVID-19, mounting administrative costs and slowing Refundable Accommodation Deposit (RAD) receipts.

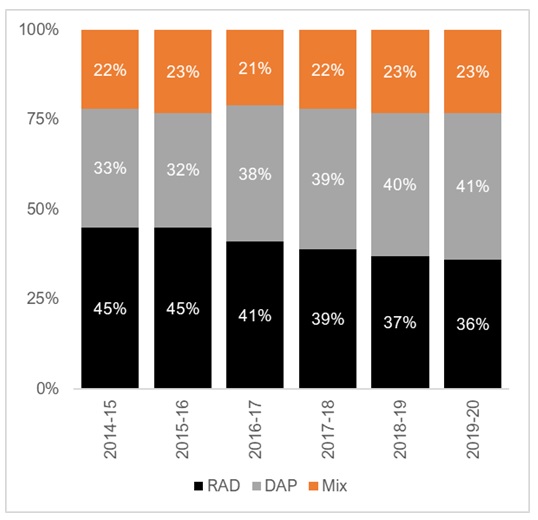

What's changing with accommodation payments?

Providers across Australia have experienced declines in the proportion of people paying RADs (although this may change with increasing Maximum Possible Interest Rate (MPIR)).

As the property market cools, the pricing of RADs is likely to be affected. In the past, a softer property market has also tended to slow down RAD payments where a resident needs to sell their home.

Graph 1. Aged Care Payment Preferences

Sources: Aged Care Financing Authority, 2014-2020

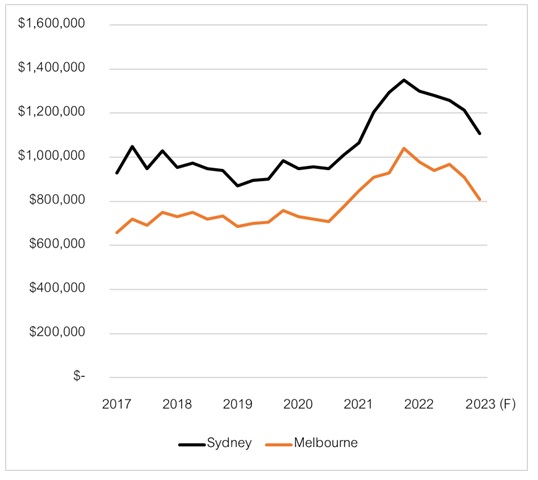

While the reduction in RADs has previously been offset by an increase in RAD values (propped up by a strong property market), the current economic environment has led to weaker property markets in Victoria and New South Wales.

Graph 2. Median House Price Trends

Source: Australian Bureau of Statistics, Value of Dwellings

June 2022, CoreLogic NAB Economics Dwelling Price

Forecasts

We are finding that more of our clients are under pressure in the management of their bank facilities. While the banks understand that these are short-term issues, there is now less enthusiasm among the banking community to extend their financing exposure to the aged care sector.

We are starting to see the impacts of these trends in full force, with a growing number of distressed asset sales, facility closures and several operators facing the risk of an insolvency event.

Our learnings

Although an insolvency event can spiral quickly out of control, we have worked with proactive providers who have successfully emerged from liquidity problems by working collaboratively with advisors and financiers.

There is natural tendency for us to avoid the difficult conversation about liquidity strain.

Providers in this situation might not communicate transparently with core stakeholders, including their financiers, until they reach the tipping point. This has resulted in distressed sales or facility closures with far-reaching consequences on consumers, staff and reputation.

In contrast, we have seen providers recover from short-term liquidity challenges by:

- Identifying the key stakeholders impacted by their liquidity issues.

- Working with advisors to assess their current position, consider all options and developing a recovery strategy (restructuring, divestment, refinancing etc); and

- Developing a communication plan that transparently engages lenders and other stakeholders throughout the process.

How do you work with your bank?

For many, confronting their bank with bad news can be daunting.

However, this step is fundamental to the recovery process and there

are several actions that providers can take to negotiate the best

outcome with their financiers:

- Communicate The first and most critical action is to communicate openly with your financiers. Communicating early and informing them of your current position, future plans and any potential issues before they occur will create trust. If a 'head in the sand' approach is employed, banks become more inclined to protect their own position. In contrast, banks can become more flexible and cooperative with transparent communication, even when faced with bad news.

- Forecasting Together with open communication, sound financial hygiene is a must. This includes cashflow controls, three-way financial forecasts (with achievable assumptions and scenarios) and a well thought out corporate strategy. It pays to model some scenarios that provide for contingencies if the projected conditions do not hold true. For example, if the borrower is unable to trade out because of prolonged external influences, alternative income or cost saving strategies could be modelled to cover the bank's exposure. In aged care, cost savings need to be considered in the context of service quality. Any strategy to reduce roster costs should be carefully balanced against the risk to service standards and, therefore, longer term sustainability.

- Liquidity Thirdly, the borrower should consider if non-core assets can be identified for sale with proceeds used for debt-reduction. Again, an open conversation and financial scenario analysis to show the potential impact on the business following non-core asset sales brings trust and credibility.

Working with the Federal Government

Most of the transparency concepts applying to banks are true also of the Federal Government under the Aged Care Act 1997 and the Fees and Payment Principles 2014.

In our experience, the Commonwealth Government will work to minimise disruption to residents in care. They are generally supportive of strategies that meet that end.

As guarantors of resident RADs, they are usually key stakeholders that need to be engaged in the consultation before the point at which RAD repayments are at risk of default. The options available to a provider can be severely limited if they do not report a material breach of their Liquidity Management Strategy.

As with banks, the Government will be invested in a successful recovery, but securing their support requires transparency and a focus on solutions rather than problems.

Keep in mind

The aged care industry is under increasing liquidity strain in the post-COVID world, with pressures further exacerbated by changing payment preferences and a slowing property market.

During times of trouble organisations tend to avoid conversations about liquidity strain, but we have witnessed positive outcomes from those who:

- Communicate early and openly with their stakeholders, bank, and advisors; and

- Develop a strategy to manage liquidity.

Footnote

1StewartBrown December 2021 Survey Results

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]