- within Strategy and Finance and Banking topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Law Firm industries

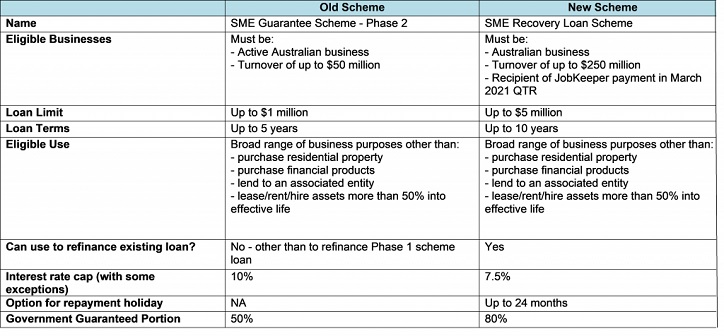

A SIDE BY SIDE COMPARISON

While many other easements are ceasing, in an effort to continue supporting Australian small business, the Federal Government just announced the extension and expansion of the government SME loan guarantee scheme, one of the key economic strategies introduced to support businesses during the Coronavirus pandemic. The purpose of the new scheme (the SME Recovery Loan Scheme) is to support the economic recovery of businesses now that JobKeeper has ended and to provide more opportunity for viable businesses to access funding to recover from the pandemic and invest for the future.

It has been reported that take up of the SME loan guarantee scheme to date has been low. By mid-February 2021, there had been approximately 35,000 loans provided under the scheme to the total value of approximately $3.4 billion. Well short of the $40 billion loan capacity allowed for under the scheme. The following is a side-by-side comparison of the proposed changes to the existing loan scheme:

The new scheme will be accessible to more borrowers given the loosening in the eligibility criteria. Furthermore, it will provide more generous loan terms including an option for a repayment holiday of up to 24 months. The increase of the government's guaranteed portion to 80% of the loans appears to also be intended to increase the take up of the scheme by making it more attractive to lenders.

A noteworthy change in the new SME loan scheme is that it will allow borrowers to refinance any existing loans. However, there are some restrictions preventing refinance of defaulting loans or lending to insolvent entities. The Treasurer advised that the purpose of this change was to allow SME's to access more concessional interest rates, access extended loan terms and thus lower their regular repayments and increase their cashflow.

The refinance option is likely to be enticing for lenders as it will provide an additional form of security of their existing lending but, given the current historically low interest rates and that the loan term is limited (rather than extended), in our view, such a move is unlikely to provide much benefit to the SME borrower or achieve the stated purposes of the SME loan guarantee scheme. The ability to refinance does not appear to address its intended purpose and it will be interesting to see how much of any increased take up of the scheme may be attributed to lenders pushing for existing customers to refinance.

It appears that the most significant proposed changes intentionally seek to address the lack of popularity to lenders of the old scheme, who not only retain full discretion for any lending, but are also most likely to be the main drivers promoting the scheme to SME borrowers. Only time will tell as to whether the changes are successful.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.