- with Senior Company Executives, HR and Inhouse Counsel

- in Asia

- with readers working within the Oil & Gas industries

Michael Bacina, Steven Pettigrove, Jake Huang, Luke Higgins and Luke Misthos of the Piper Alderman Blockchain Group bring you the latest legal, regulatory and project updates in Blockchain and Digital Law.

AI agents exchange tokens in possible Crypto x AI first: Coinbase

Brian Armstrong, founder of Coinbase, has announced an interesting first, artificial intelligence powered agents (which are planned to be automated assistants to help take mundane tasks away from needing to be done by humans) have exchanged AI tokens (not crypto tokens) between each other autonomously.

In a post on X (formerly Twitter), Mr Armstrong said this is the first step but will expand further to stablecoins soon:

AI agents cannot get bank accounts, but they can get crypto wallets. They can now use USDC on Base to transact with humans, merchants, or other AIs. Those transactions are instant, global, and free.

Armstrong was promoting MPC Wallets from Coinbase that can integrate via the Coinbase Developer Platform, with a hope that AI agents could be empowered to undertake financial transactions using wallets funded by humans.

This opens up possibilities of using AI agents to gain functionality that online businesses don't currently offer, like giving an AI agent a standing order to make purchases when a price reaches a certain level (but where the website involved doesn't offer that feature) or other "if this then that" style logic which present systems can run but which require subscriptions and coding and testing to get right. The flexibility of AI systems being able to utilise and build on smart contracts is a fascinating extension of the ability to use the internet for even more value creation and convenience than ever before.

With regulation struggling to keep up with definitions of crypto, AI use of crypto is sure to move even further ahead of policy makers and regulators, and need careful thought on how to approach the balance of innovation and consumer protection. We have seen OpenAI and Anthropic just agreeing to share their LLM code with the US government, in what might be protective for consumers, or might just set up privacy and scam risks given the higher chance of the code being leaked or falling into hostile actor's hands.

Hold my beer: SEC weighs in on FTX plan

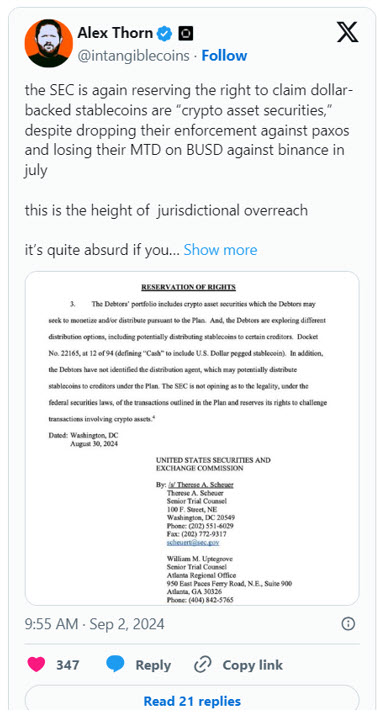

The United States' Securities and Exchange Commission (SEC) has signaled a possible (although unlikely) opposition to FTX's bankruptcy plan, particularly concerning distributions involving stablecoins. According to a recent court filing, the SEC entered a formal reservation of rights in respect of transactions contemplated by the bankruptcy plan that involve the distribution of crypto assets, like US dollar-pegged stablecoins, to creditors.

The bankruptcy estate of FTX proposed a plan earlier this year that promised 98% of creditors a return of 118% of their claims, primarily in cash, within 60 days of court approval. However, the definition of "cash" included stablecoins, which the SEC flagged in its filing on Friday. While the SEC has not yet adopted a position on the plan, it has reserved it rights to challenge the legality of such transactions under federal securities laws, while unhelpfully not giving any guidance as to how the plan should proceed to be compliant.

The SEC is not opining as to the legality, under the federal securities laws, of the transactions outlined in the Plan and reserves its rights to challenge transactions involving crypto assets

The SEC also seems to object to the plan's failure to identify a distribution agent for crypto-assets, presumably on the basis that it would seek to challenge such agent's authorizations to perform that role under US securities law. Once again the SEC has not put forward any legal basis for an objection and continues to use the phrase "crypto asset securities" which appears in no US law and which has been criticised by judges in at least one case brought by the SEC.

Despite not explicitly blocking the use of stablecoins, the SEC's stance has added another layer of uncertainty to FTX's already complex bankruptcy proceedings.

Industry players took to X to vent their frustrations.

FTX's creditors, who have been waiting for resolution following the platform's collapse now face potential further delays as the court assesses the SEC's objections and the potential implications for crypto asset distributions.

The defunct exchange's restructuring plan has been overwhelming approved by creditors and is set for consideration by the bankruptcy court on 7 October. If approved, the plan could see creditors with claims of less than US$50,000 obtain distributions within 60 days of the effective date of the plan.

CFTC and Uniswap settle charges over leveraged tokens

The US Commodity Futures Trading Commission (CFTC) has fined Uniswap Labs (Uniswap) $175,000 settling allegations that it illegally offered leverage or margined retail commodity transactions in digital assets, via a decentralized digital asset trading protocol. As part of the settlement, the CFTC also requires Uniswap to cease and desist from violating the Commodity Exchange Act (CEA).

The Uniswap website user interface is operated by Universal Navigation Inc. (t/a Uniswap Labs), a Delaware company based in New York. It is one of the most popular Decentralised Finance (DeFi) protocols, facilitating token swaps on more than a dozen blockchain networks. It has more than $4.4 billion in total value locked, according to DefiLlama.

CFTC highlighted the settlement as part of its continuing enforcement efforts in the DeFi space:

Today's action demonstrates once again the Division of Enforcement will vigorously enforce the CEA as digital asset platforms and DeFi ecosystems evolve.

Case background

According to the CFTC, Uniswap contributed to the development and deployment of a blockchain-based digital asset protocol that allowed users to trade digital assets through use of the Ethereum blockchain. The protocol allows users to create and trade with liquidity pools, which consist of a matched pair of digital assets that are valued against each other.

In order to facilitate access to the protocol, Uniswap Labs also developed and maintained a web interface that it made available to users. Through the interface, users could trade in hundreds of liquidity pools on the protocol.

Specifically, CFTC's enforcement action focused on leveraged tokens being traded in these liquidity pools:

Among the digital assets traded on the protocol and through the interface were a limited number of leveraged tokens, which provided users leveraged exposure to digital assets such as Ether and Bitcoin.

CFTC alleged that these leveraged tokens are leveraged or margined commodity transactions that can only be offered by a CFTC designated or registered contract market, which Uniswap Labs was not. This is important as CFTC generally only has jurisdiction to regulate derivatives products, not spot commodity markets or securities.

Uniswap's smart contract based swapping protocol is permissionless and allows users to establish liquidity pools and create ways to trade, including leveraged tokens without permission from Uniswap Labs as the developer of the protocol and provider of the interface. In this case, Uniswap Labs subsequently took steps to blacklist and remove access to these tokens from its interface but not the underlying permissionless protocol, and very limited trading in the leveraged tokens occurred.

Uniswap's chief legal officer, Katherine Minarik, said in a statement that the CFTC investigation involved:

a small fraction of a percent of trading through our interface related to a handful of tokens

and highlighting that the settlement did not involve any admission or denial of the regulator's findings. Uniswap appeared to have been cooperative with the CFTC, which resulted in a reduced civil monetary penalty in this case.

Uniswap was previously successful in defeating a civil class action which had sought damages for breaches of securities laws over user losses suffered from dealings in scam tokens via the platform. The judge in that case emphasised the decentralised nature of the Uniswap protocol and the responsibility of the token issuers for their misuse of the software.

Dissent within CFTC

CFTC Commissioners Summer Mersinger and Caroline Pham both issuing blistering dissenting opinions. Mersinger pointed out that Uniswap had already blocked trading of the tokens at issue, and the settlement was a wasteful example of "regulation through enforcement":

Rather than applauding Uniswap for being attentive to our enforcement efforts and initiating steps to respond to our approach in policing the DeFi space, we brought charges against Uniswap covering the time period before those particular tokens were blocked from its platform

She continued,

It was my hope that one day soon the commission would consider rulemaking, or at the very least guidance, making clear how DeFi protocols could comply with them...Unfortunately, today is not that day.

Commissioner Pham also said in her dissents:

I believe the CFTC can and should vigorously pursue fraud and manipulation in our markets and bring bad actors to justice...But that is not what this case is about. It is regretful that the Commission's action today is instead a misguided and rushed attempt to beat the SEC to the punch and claim jurisdiction over DeFi.

While the CFTC's order does not identify the tokens' issuer, they appear to be created by Index Coop, a DeFi protocol specialising in leveraged yield strategies. It is not clear whether the CFTC plans to take any action against the issuers.

The cofounder of paradigm compared this the approach of the CFTC as seeking to criminalise a tool and ignoring the actual law breakers:

Enforcement actions against Uniswap and DeFi

In April this year, Uniswap also received a Wells notice from the US Securities and Exchange Commission (SEC), an indication that the regulator was planning to take action against the company. Uniswap has publicly responded to the Wells Notice, advocating for the recognition and support of open source technologies that aim to enhance traditional financial systems.

In recent years, both the SEC and the CFTC have taken action not only against centralized exchanges like Binance but also against decentralized crypto projects that employ automated software in place of traditional intermediaries. Some of these cases have been settled, while others continue through the courts.

Takeaways

The Uniswap settlement order demonstrates how US regulators such as CFTC have sought to continue regulation by enforcement, focusing on technology as a choke point and not seeking to hold the individual users engaging in the objectionable conduct (issuing leveraged tokens) responsible.

US authorities continue this hardline approach to trying to regulate decentralised technologies is likely to chill innovation, enforcing centralisation and leave US users more exposed to the risk of unregulated scams and tricks. US authorities have adopted an approach of trying to find a person responsible they can enforce against in actions, while the EU has left open some scope for fully decentralised platforms to operate outside the MiCA regime.

In light of this decision, software developers and platform operators now must consider what steps they should take to mitigate the risks of inadvertently facilitating regulated securities or derivative transactions given the potentially very serious penalties for breaching financial services laws.

While the CFTC settlement could be seen as casting a shadow on DeFi systems which enable anyone to access swaps, sensible dissent like Commissioners Mersinger and Pham continue to powerfully debate the current administration's approach, and it remains to be seen how Congress will approach these issues in legislation in the years ahead.

In the eye of the needle: Decentralisation under MiCA

BCAS, a global network of blockchain specialist lawyers and consultant, has recently released their handbook titled "Decentralisation under MiCA: the definitive handbook for DeFi". The handbook explores which regulatory considerations under the EU's MiCA regime may apply to certain projects and protocols that are branded as DeFi projects, cross-chain bridges, or Layer-2 (L2) solutions. The handbook also contemplates what measures can be implemented outside of the MiCA regime to balance innovation and consumer protection.

The 67-page handbook is broken up into three main analytical parts:

- Decentralisation from Technical and Organisational Points of View;

- Decentralisation under MiCA; and

- Issuances and Offers to the Public.

Part 1 – Decentralisation from Technical and Organisational Points of View

The handbook offers some valuable insights for projects to navigate whether they are "fully decentralised" and therefore fall outside of the regulatory scope of MiCA. The handbook outlines five key areas of decentralisation:

- Settlement Layer Decentralisation– projects that avoid central control over transaction processing and rely on consensus mechanisms like proof-of-work (PoW) or proof-of-stake (PoS) are closer to achieving decentralisation;

- Architecture Decentralisation– trustless smart contracts form the backbone of DeFi, but off-chain components like oracles and L2 scaling solutions can introduce centralisation risks;

- Governance Decentralisation– DAOs should provide true governance power to its members, though governance tokens may not always reflect genuine decision-making authority within the DAO ecosystem and governance structure;

- User Interface Decentralisation– projects must avoid reliance on a single user interface, as it could restrict access to underlying smart contracts and limit decentralisation; and

- Operations Decentralisation– ensuring that payment flows and contributor management are decentralised is crucial to avoiding centralisation.

Part 2 – Decentralisation under MiCA

The handbook states that under MiCA, decentralisation takes on a nuanced meaning. Sufficient decentralisation could exclude certain actors from being classified as Crypto-Asset Service Providers (CASPs), thereby falling outside MiCA's scope.

This distinction is critical for DeFi, where activities performed without intermediaries may not trigger regulatory obligations. However, despite MiCA's comprehensive framework, there remains ambiguity – recital 22 of MiCA implies decentralised activities are exempt, yet the exact parameters of "fully decentralised" remain unclear. MiCA regulates those issuing, offering, or providing services relating to crypto-aseseys, categorising them into E-Money Tokens (EMTs), Asset-Referenced Tokens (ARTs), and Other Crypto Assets (OCAs).

For the DeFi ecosystem, understanding these definitions is essential to navigating the regulatory landscape while embracing decentralisation. Even if not legally binding, BCAS warns that regulatory recitals should not be ignored as they often hint at future interpretations, requiring careful consideration as DeFi continues to evolve.

Part 3 – Issuances and Offers to the Public

Although the concept of decentralisation does not directly extend to the issuance of crypto-assets, it remains crucial when considering token minting on DeFi platforms where crypto-assets might be issued.

Under MiCA, an issuer is broadly defined as a person or entity with control over the creation of such assets, and the framework acknowledges that where no such control exists – like in the case of immutable smart contracts – the issuer may be non-identifiable, potentially exempting the asset from regulatory obligations.

However, any issuance that involves a "public offer" (defined as a communication with sufficient information enabling potential buyers to make a purchase decision) may trigger regulatory compliance under MiCA's Titles II, III, or IV:

- Offers that fall under Title II (other crypto-assets)– the offeror must prepare and publish a whitepaper, notify the national authority, and comply with general obligations such as withdrawal rights;

- Offers that fall under Title III (ARTs)– offerors need national authority approval, including a wihtepaper as part of the process; and

- Offers that fall under Title IV (EMTs) – offerors must be licensed as e-money or credit institutions and comply with whitepaper and notification requirements.

Even airdrops can fall within this scope if users provide data or other benefits to the offeror. BCAS recommends that operators in DeFi tread carefully and otherwise ensure that they do not inadvertently conduct public offers or issue regulated tokens such as EMTs or ARTs.

Conclusion

In concluding the exploration of decentralisation in DeFi under MiCA, the handbook suggests that "full decentralisation" is likely more myth than reality. What matters is that decentralisation, even in degrees, is possible – an achievement in itself that challenges traditional finance.

BCAS contends that no DeFi protocol has yet achieved perfect decentralisation across the five key dimensions examined above. Importantly, decentralisation exists on a spectrum, and while the concept of "sufficient decentralisation" is flexible, it remains the goal for DeFi to live up to its own name.

Within MiCA, decentralisation plays a critical role. To be exempt from the regulation, a protocol must avoid qualifying as a CASP (Crypto-Asset Service Provider). The less decentralised the protocol, the greater the risk of falling under MiCA's CASP framework, particularly if crypto-asset services are offered for consideration.

Care must be taken with online interfaces, which often simply provide access to smart contracts. While token issuances may not trigger regulatory obligations, public offers of crypto-assets can. DeFi operators must be vigilant, as even an airdrop may qualify as an offer to the public, invoking regulatory obligations.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.