- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Securities & Investment and Law Firm industries

The Federal Court has found that Money3 failed to make reasonable inquiries about the living expenses of the consumers, including failing to verify their living expenses, in a judgement from September 2025. Money3 is a provider of car finance that ASIC alleged breached responsible lending laws.

Money3 offered "Micro Motor" loans which involved lending a maximum of $8,000 to consumers for the purposes of purchasing second-hand vehicles. Money3 utilised internal documents, such as a matrix and guide, which set out the features, conditions and lending criteria of the Micro Motor loan product, and included knockout criteria to help Money3 determine whether an applicant was eligible for the product.

ASIC alleged that Money3 contravened the responsible lending obligations in relation to five Micro Motor loans it entered into with six consumers. Shortly after entering the loans, each consumer suffered financial hardship.

The Court found that Money3 failed to make reasonable inquiries about the living expenses of the consumers, including failing to verify their living expenses. As a result, Money3 was found to have breached the National Consumer Credit Protection Act 2009 (Cth) ("National Credit Act").

ASIC and Money3 disagreed largely on the way the unsuitability assessment provisions in the National Credit Act are constructed. Below, we have highlighted some key points that the Court emphasised which provide some insight as to how the responsible lending obligations operate in practice:

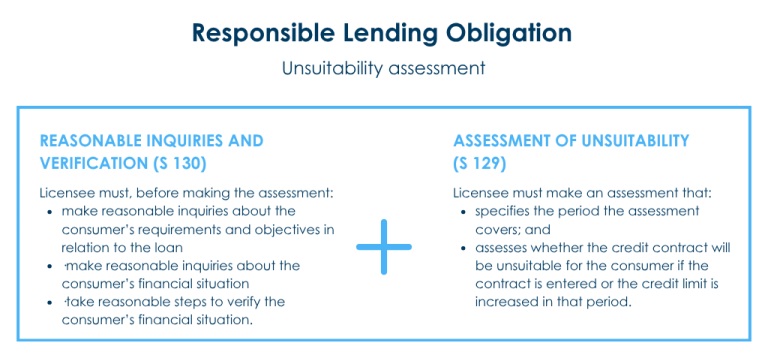

- The Court emphasised that the requirement contained in section

130 of the National Credit Act to:

- make reasonable inquiries about the consumer's requirements and objectives in relation to the loan;

- make reasonable inquiries about the consumer's financial situation;

- take reasonable steps to verify the consumer's financial situation;

- is distinct from the requirement to make an assessment as to whether the loan will be unsuitable for the consumer (section 129 of the National Credit Act). If a credit licensee fails to make reasonable inquires and verify the consumer's financial situation, it does not automatically mean that they have failed to assess whether the loan is unsuitable.

- The Court found that section 130 of the National Credit Act does not prescribe minimum requirements when making reasonable inquires and/or taking reasonable steps to verify a consumer's information. Rather, what is considered "reasonable" depends on the standard behaviour expected of a reasonable credit licensee in the position of Money3 at the time it was making those inquires and taking those steps to verify the consumer's financial situation.

- The obligation to make reasonable inquiries and take reasonable

steps to verify:

- does not in all cases require the credit licensee to obtain declared living expenses from the consumer or to inquire about and verify actual or likely future living expenses; and

- is undertaken to make a prospective assessment of the risks of the consumer defaulting under the loan arrangement and hence the unsuitability conclusion.

In summary, the Money3 case brought by ASIC highlights that the responsible lending obligations are a question of what is considered "reasonable" rather than a checklist of minimum requirements that must be met.

Background

Responsible lending obligations apply to all Australian Credit Licence ("credit licence") holders who:

- enter into credit contracts with consumers, increase credit limits of an existing credit contract, or make unconditional representations to the consumer that they are eligible to enter into a credit contract or increase a credit limit i.e.lenders; or

- suggest or assist consumers to apply for credit contracts or an increased credit limit, or suggest the consumer remains in a credit contract i.e.brokers.

Further Reading

- ASIC Regulatory Guide 209: Credit licensing: Responsible lending conduct

- Australian Securities and Investments Commission v Money3 Loans Pty Ltd (No 3) [2025] FCA 1086

- Court delivers ruling in Money3 responsible lending case

- National Consumer Credit Protection Act 2009(Cth)

- Responsible Lending Policy

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.