- within Finance and Banking topic(s)

- within Employment and HR and Law Practice Management topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Business & Consumer Services, Insurance and Metals & Mining industries

Introduction

Transferring shares in an Australian company is an exceedingly common activity in Australian commerce.

Despite this, there is some apparent confusion among company operators, accountants and even the corporate regulator, as to what steps are required to perform a legally effective share transfer.

This article discusses the requirements of a valid share transfer in accordance with the Corporations Act 2001 (Cth) (Corporations Act)1 and the adverse consequences that may arise from an invalid transfer.

Common misconception

There may be a misconception that a transfer of shares can be made simply by lodging a Form 484 with ASIC to update ASIC's register of members for a company.

This misconception may well arise because the Australian Securities and Investments Commission (ASIC) suggests on its website that a share transfer can be carried out by the company 'online', by lodgement of a Form 484. This is far from the full picture, and is not helpful coming from an authority such as Australia's corporate and securities regulator.

It is important to distinguish between the public register of a company which is operated by ASIC and a company's own registers. The ASIC register acts as a sort of "signpost" to the world as to the composition of the company's members but it is not the definitive document.

While the officeholders of a company have an obligation to ensure ASIC's public register is kept up to date, a company must:

- separately maintain, either on paper or electronically, a register of members in accordance with the provisions of Part 2C.1 and part 2C.2 of the Corporations Act; and

- under section 1071B of the Corporations Act, only register a transfer of shares if a proper instrument of transfer is delivered to the company (which is required despite anything to the contrary in the company's constitution).

The obligation to maintain a standalone register of members is significant, as provisions of the Corporations Act such as section 176 make such registers of a company – and not the ASIC public record – the primary source of proof of the matters relating to the company.

Importantly, an ASIC Form 484 (whether lodged in paper form or online) is not a proper instrument of transfer of shares.

The proper process for performing a share transfer

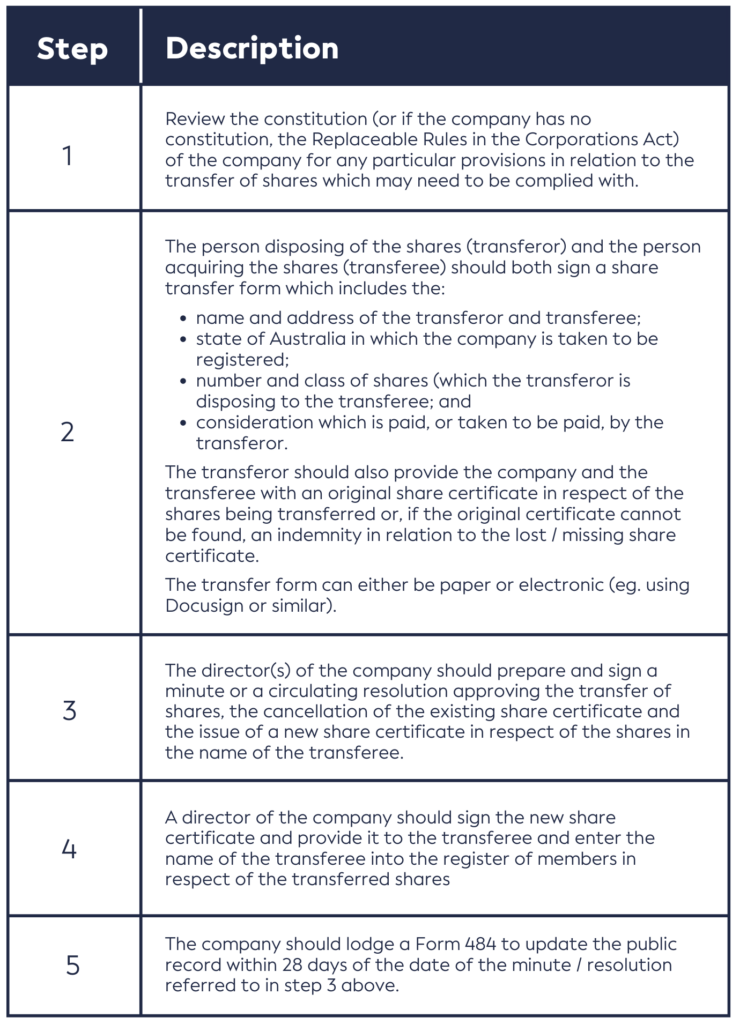

The table below sets out the required steps for a valid share transfer.

Consequences of invalid transfer

Failing to effect a valid share transfer can have serious consequences, particularly for a transferee. This is illustrated by the case of Ku v Song [2007] FCA 1189; 63 ACSR 661.

In that case a transfer of shares was effected only by:

- Mr Ku and Mr Song making a verbal agreement to transfer the shares; and

- Mr Ku lodging a Form 484 with ASIC to update the public register for the company to reflect the transfer of his shares to Mr Song.

After the transfer, Mr Song, as sole shareholder, passed resolutions to remove Mr Ku from various offices of the company, including as a director, and to replace him with a new director who was friendly to Mr Song.

Mr Ku challenged these actions, and the Federal Court found in his favour, on the basis that Mr Song did not validly hold Mr Ku's shares and therefore could not pass the resolution alone.

In the circumstances of the case, the transfer of shares was part of a larger settlement of an intellectual property dispute to which the company was a party, so Mr Song's inability to remove Mr Ku as a director was significant.

While the rules relating to share transfers discussed in this article have not been extensively tested by the courts, it is apparent that failure to use a proper instrument of transfer of shares, may permit a transferor of shares to use a similar argument to Mr Ku in order to "unwind" a transaction or to otherwise interfere in the operation of a company despite the transferor having received its part of the bargain (e.g., being paid for the shares).

To avoid any headaches, parties to a share transfer should ensure that the transfer is effected by way of a proper instrument of transfer (i.e. a standard share transfer form).

Footnote

1 Excluding a transfer of shares carried out through a prescribed clearing and settlement facility, such as that operated by ASX for the transfer of shares in listed companies, or a devolution of shares by will or by operation of law. This article is not directed at those types of transfers.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.