- with Finance and Tax Executives

Gathering information from Clients is a critical stage of the workflow process and, when done well, can have a very positive impact on efficiency.

The exact scope of work you have agreed with the Client, the jurisdiction in which you work and other factors will determine what information you need from your Client to commence work.

Best Practices include:

- Sending the checklist early. Some Accountants send the checklist together with the Engagement Letter and initial invoice

- Following up to ensure the Client understands the contents

- Avoiding asking for information which you already have or is obvious. (This will irritate the Client and cause delays)

- Showing you are serious about getting this important information. Stick to your deadlines and follow up diligently

- Avoid excessive customisation of checklists since the time spent will not yield results

- Gathering information is administrative work, NOT the work of an Accountant

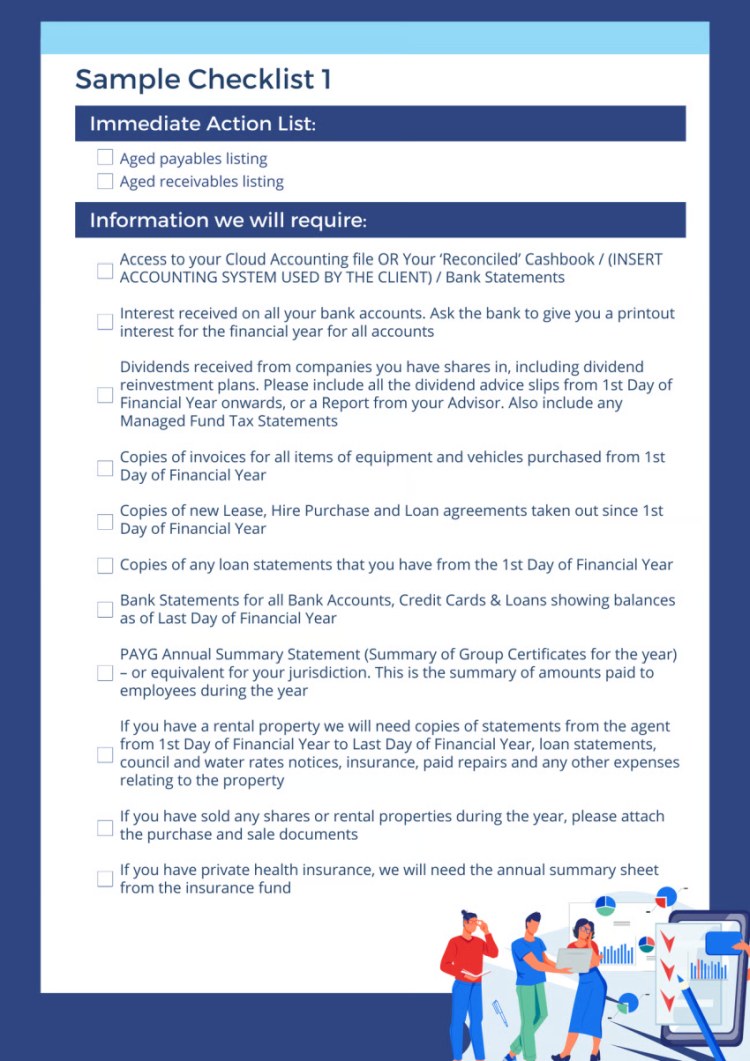

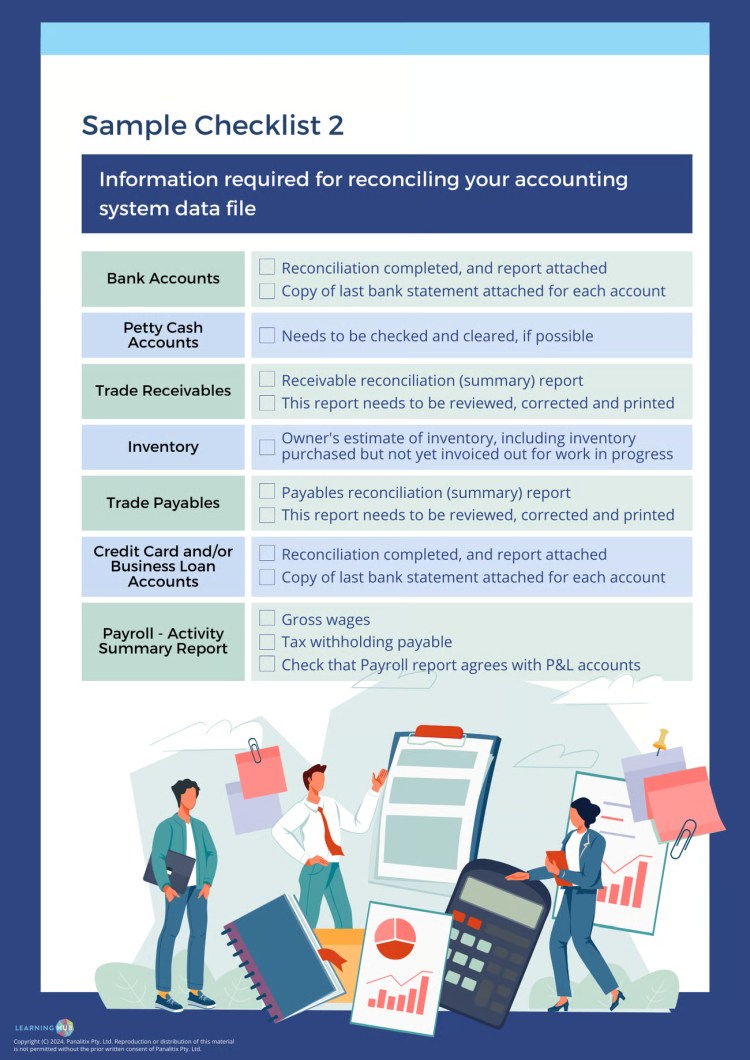

An Australia-based accounting business recently updated their checklists as below. These may be a useful guide to firms – in any jurisdiction – which need help in this area.

Do your checklists need a review? How can you improve the way you receive information from Clients?

Watch a video on this topic here!

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.