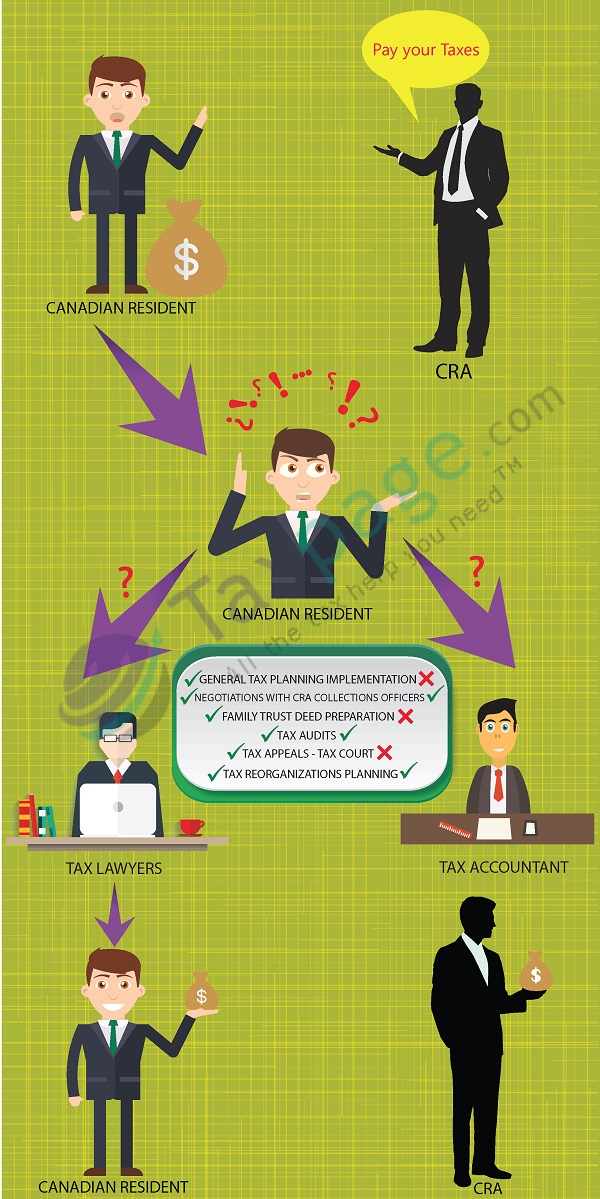

DIFFERENCES BETWEEN TAX LAWYERS AND ACCOUNTANTS

| CATEGORY | TAX LAWYERS | ACCOUNTANTS |

|---|---|---|

| GENERAL TAX PLANNING | ✓ | TAX ACCOUNTANTS ONLY |

| GENERAL TAX PLANNING IMPLEMENTATION | ✓ | x |

| TAX REORGANIZATIONS - PLANNING | YES | TAX ACCOUNTANTS ONLY |

| TAX REORGANIZATIONS - IMPLEMENTATION | YES | NO |

| TAX REORGANIZATIONS - FORMS | x | ✓ |

| ESTATE PLANNING | ✓ | ✓ |

| WILL DRAFTING | ✓ | x |

| ESTATE RETURN PREPARATION | x | ✓ |

| TAX RETURN PREPARATION | x | ✓ |

| FINANCIAL STATEMENT PREPARATION | x | ✓ |

| TAX AUDITS | ✓ | ✓ |

| TAX APPEALS - NOTICES OF OBJECTION | ✓ | ✓ |

| TAX APPEALS - TAX COURT | ✓ | x |

| NEGOTIATIONS WITH CRA COLLECTIONS OFFICERS | ✓ | ✓ |

| TAXPAYER RELIEF (FAIRNESS) APPLICATIONS | ✓ | TAX ACCOUNTANTS ONLY |

| VOLUNTARY DISCLOSURE (TAX AMNESTY APPLICATION) | ✓ | SOME ACCOUNTANTS WILL SUBMIT, BUT NO PRIVILEGE IF THEY DO |

| BUSINESS PLANS | x | ✓ |

| LOAN APPLICATIONS | x | ✓ |

| BUY VS LEASE CALCULATIONS | x | ✓ |

| FAMILY TRUST DEED PREPARATION | ✓ | x |

| TRUST T3 TAX RETURNS | x | ✓ |

| TAX RESEARCH | ✓ | TAX ACCOUNTANTS ONLY |

| TAX OPINION LETTERS | ✓ | TAX ACCOUNTANTS ONLY |

| TAX OPINIONS FOR OFFERING MEMORANDUM OR PROSPECTUS | ✓ | x |

| CALCULATION OF POTENTIAL TAX LIABILITY | x | ✓ |

Take Note

This document is not intended to create an attorney-client relationship. You should not act or rely on any information in this document

without first seeking legal advice. This material is intended for general information purposes only and does not constitute legal advice. If you

have any specific questions on any legal matter, you should consult a professional legal services provider.