- within Insolvency/Bankruptcy/Re-Structuring, Criminal Law, Litigation and Mediation & Arbitration topic(s)

The IRS recently announced a significant update simplifying the process for submitting research credit refund claims under section 41. This change, effective immediately, reduces the burden on taxpayers by removing two specific information requirements. Below is the information you need to know to know to ensure your claims are compliant and complete.

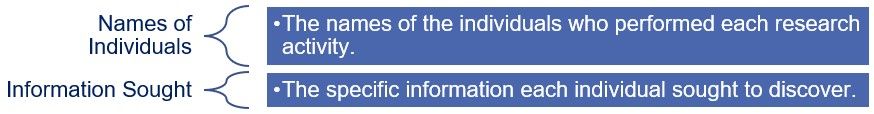

As of June 18, taxpayers no longer need to provide the following information when submitting research credit refund claims:

This update aims to streamline the submission process, making it less cumbersome for businesses to claim their rightful research credits. However, it's important to note that while this information is no longer required upfront, the IRS may still request it if your refund claim is selected for examination.

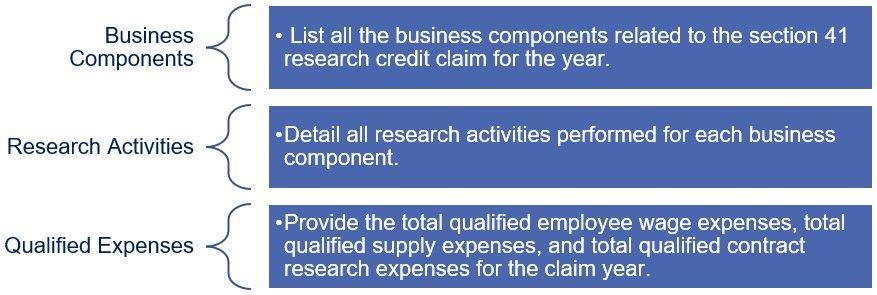

Despite these changes, taxpayers still need to provide several key pieces of information when submitting their research credit claims. The remaining required information includes:

The IRS initially outlined these requirements in October 2021, alongside field attorney advice (FAA 20214101F). The goal was to clarify the documentation needed to support research credit claims, ensuring consistency and compliance.

Recognizing that taxpayers may need time to adjust to these requirements, the IRS extended the transition period for the changes until January 10, 2025. During this period, taxpayers can supplement research credit refund claims that have been deemed incomplete. This extension provides additional flexibility, allowing businesses more time to gather and submit the necessary documentation.

For businesses engaged in research and development, these updates mean a simpler and potentially quicker process for claiming research credits. By removing the need to provide detailed personal information about researchers and their specific investigative goals, the IRS has made it easier for companies to focus on their core activities without being bogged down by administrative requirements.

However, it remains crucial for businesses to maintain thorough records of their research activities and expenses. Even though the initial submission requirements have been relaxed, the IRS may still request detailed information during an examination.

The IRS's recent changes to research credit refund claims are a welcome simplification for many businesses. By reducing the amount of detailed personal information required, the process becomes more straightforward and less time-consuming. Nevertheless, it's important to stay vigilant and prepared to provide additional documentation if needed.

As we approach the extended deadline of January 10, 2025, businesses should ensure their claims are complete and accurate to take full advantage of the research credits available to them.

Originally Published 9 July 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.