Significant acquisitions trigger specific financial statement requirements for the acquiring company. Part I of this publication covered determining if an acquisition is considered significant and what target and pro forma financial statements are required. In this, Part II, we discuss when those financial statements need to be filed or updated and under what circumstances securities of the acquiring company can be offered before those financial statements are available. This is part of our series on Financial Statement Triggers.

A Combination of SEC Rules and Market Practice

If the acquisition of a business is considered significant because it exceeds 20% on any one of the three significance tests, the SEC requires the acquiring company to file target and pro forma financial statements within approximately 75 days following the closing. If the acquiring company registers or offers securities, it may need to file such financial statements sooner. It may also have to update target and pro forma financial statements that it filed previously. While some of these requirements result from technical SEC financial statement rules, others are based on market practice and judgment calls about investors' expectations, materiality and legal risk.

Signing 8-K, Closing 8-K and 8-K/A

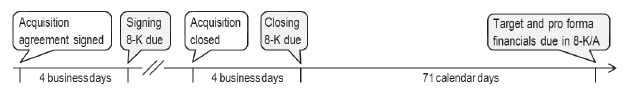

A significant acquisition by a US public company typically triggers an 8-K at three different times: (1) when the acquisition agreement is signed, (2) when the acquisition closes and (3) within approximately 75 days of closing to file required target and pro forma financial statements, unless they were previously filed in a registration or proxy statement.

- Signing 8-K. Specified trigger events require a US public company to file an 8-K within four business days to report the event and provide certain related information. One of the trigger events is a material agreement outside the ordinary course of business. An agreement for a significant acquisition will typically meet this test and thus trigger an 8-K due within four business days of signing. In addition, the acquiring company may want to announce the transaction promptly to avoid leaks and comply with the stock exchanges' "prompt release" policies with respect to material information. No target or pro forma financial statements are required at announcement, although the acquiring company may provide certain financial information to the market on a voluntary basis.

- Closing 8-K. The closing of a significant acquisition constitutes a separate 8-K trigger event, and the corresponding 8-K is due within four business days of the closing. If the acquisition does not involve a business or if it is not considered significant because it does not exceed 20% on any of the three tests it may still trigger a closing 8-K if the acquiring company's equity in the net book value of the assets acquired or the amount paid exceed 10% of the acquiring company's total assets. No financial statements are required in this situation.

- 8-K/A. The closing of an acquisition with a significance level of more than 20% also triggers a requirement for the acquiring company to file target and pro forma financial statements within 71 days of the due date of the closing 8-K, or a total of four business days plus 71 calendar days after closing. They are filed in an 8-K/A amendment to the closing 8-K. The following chart illustrates the overall timeline of trigger events and filing deadlines.

- Permitted age of financial statements backdated to filing date of closing 8-K. Financial statements in the 8-K/A will generally be deemed current if they would have met the permitted age requirements on the filing date of the closing 8-K, rather than the filing date of the subsequent 8-K/A. As discussed in Part I, the permitted age of target financial statements depends on the target filer status, and the pro forma financial statements need to cover the most recent fiscal year and interim period for which the acquiring company had already issued financial statements when it filed the closing 8-K. As an exception to this backdating, if a registration statement of the acquiring company becomes effective after the filing of the closing 8-K and before the 8-K/A is due, but omits target and pro forma financial statements in reliance on the SEC grace period described below, the permitted age of the financial statements in the 8-K/A is determined as of the effective date of the registration statement.

- Option to retest significance if new 10-K is filed before 8-K/A. If an acquisition closes after year-end but before the filing of the new 10-K, the acquiring company may reevaluate the significance of the acquisition based on the annual financial statements in the new 10-K if it is filed before the 8-K/A is due. If the acquisition is not significant on that basis, the 8-K/A with target and pro forma financial statements does not need to be filed.

Download - Financial Statements Triggered By Acquisitions - When You Need Them

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.