- within Corporate/Commercial Law topic(s)

- within Law Practice Management, Criminal Law, Litigation and Mediation & Arbitration topic(s)

New leadership and agenda priorities at the U.S. Securities and Exchange Commission (SEC) are likely to cause some investors to rethink potential exit strategies, including an IPO exit.

One of the top priorities under the new leadership is to spur capital formation, especially by easing rules for private and emerging companies. IPO volumes have fallen over the past two decades due in part to the significant regulatory burden private companies face to become public. To address this, the SEC, under the direction of the Trump administration, is considering several changes to accommodate greater access to the public markets. These include reducing disclosure requirements to streamline the registration process and extending — and expanding — the benefits provided to emerging growth companies (EGCs) under the JOBS Act. These changes are expected to expand capital raising options for companies, including private equity investors, as they get closer to a monetization event.

One of the most important things private equity investors, company executives, deal counsel, or the board of directors for a fledgling company can do now is to implement an IPO readiness review. Despite potential regulatory easing, there are several new financial, tax, accounting and operational requirements that a company would need to develop and pressure-test in advance of an IPO consideration. Getting in front of the issues now can help management teams prioritize critical action items, irrespective of market conditions.

Maximizing Deal Value With an IPO Readiness Assessment

To better understand your company's position and timeline on the IPO journey, an IPO readiness assessment identifies a list of items, along with prioritization and timeline. An IPO readiness assessment is a comprehensive review of all processes and procedures, from accounting to tax to the company's internal control environment. This comprehensive review looks at the current state of the company and provides insights into actions required to meet the heightened scrutiny of reporting and filing quarterly and annual financial statements required by public companies. To obtain a an objective and robust assessment, your company may need to hire people and external advisors and invest in systems and process improvements.

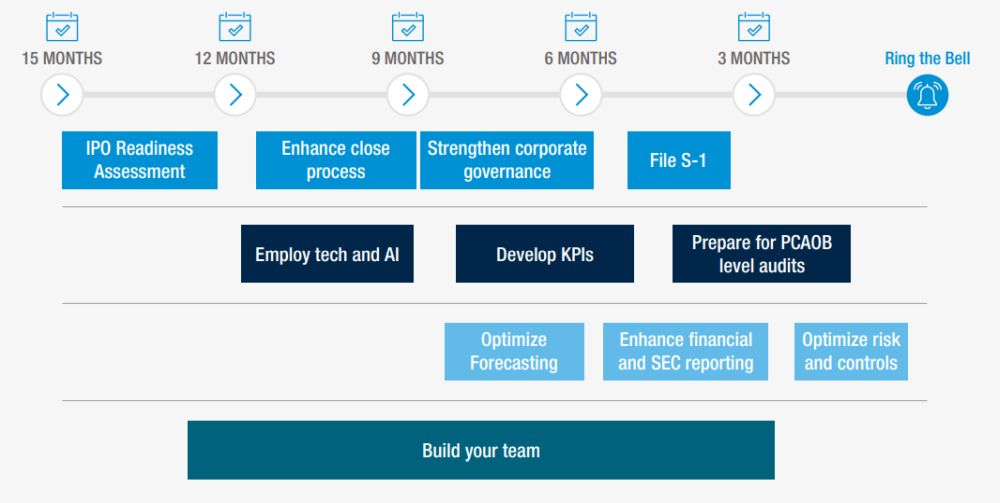

Illustrative IPO Readiness Process and Timeline

In the last several years, the IPO market has shown increased momentum based on several factors, including market stability, the tech sector leading the IPO charge, IPOs being backed by private equity, and increasing investor confidence driven by activity related to AI and fintech offerings. Emerging industries like the cryptocurrency market are also poised to take advantage of the right market conditions. In the last several months, much of the momentum has been muted with uncertainty around trade and tariffs. Now more than ever, it is critical for investors, company executives, deal counsel, and boards of directors at companies planning to go public to undertake a readiness assessment to determine if going public is an option or if more time is needed.

Preparing to Become a Public Company

A successful IPO requires careful planning. An aspiring company must prepare its management team and business units to begin thinking, acting and functioning as a public company, both internally and externally. A multi-functional, holistic approach to readiness is critical to preparing the organization to operate as a public company. A narrow focus on accounting and financial reporting matters surrounding preparation of the offering document is the wrong approach.

Planning, executing and managing an IPO is a complex task for any organization. The preparation process can often be lengthy, depending on the maturity of a company's existing processes. It is vital that the company understand and address any gaps before going public. The significance of the improvements required will determine the number of resources needed. Companies should consider an orderly plan that is executed over a one- to two-year period.

A successful IPO has three equally important elements: a thorough IPO readiness assessment, a working group focused on the immediate process of going public, and a working group focused on the tasks required to prepare the business for being public.

Some of the tasks a company must review and prepare in order to go public include the following:

- Financial reporting: Preparing financial statements, modeling financial trends, and assessing historic financial information

- Governance: Ensuring the company has strong internal controls and risk management

- Internal processes: Preparing for increased scrutiny from regulators and investors

- Strategy: Developing a strategic plan and understanding the specific requirements

- Management: Ensuring the company has an experienced management team

- Organization: Making changes to the company's structure, leadership and management responsibilities

- Transparency: Ensuring the company is transparent and delivers on promises to investors

There are 10 core areas of focus for companies planning to take the IPO path once market conditions are favorable:

1. Build Your Team

- Evaluate your current team for skills and resource gaps (e.g., SEC reporting or SOX compliance), because the first year of being a public company will be a monumental labor- and time-intensive period for the company.

- Fill any key positions. Many private companies often need to fill positions such as Chief Financial Officer, Chief Legal Officer/General Counsel, Chief Information Security Officer, and Chief Technology Officer, among others. These roles can take time to fill, to which you must add the time it takes a person to become acclimated to the business and its people.

- Consider the need for an internal audit leader, a requirement if you plan to be listed on the NYSE.

2. Enhance Efficiency and Effectiveness of the Close Process

- Consider what financial close best practices and accelerators can be implemented, including checklists, calendars and automation.

- Prepare for quarterly reporting to align with new publiccompany requirements.

3. Employ Automation and AI to Streamline Processes

- Consider the need to make investments in ERP, AIpowered solutions and other back-office applications to ensure timely and accurate reporting.

- Focus on integration between core financial systems, key customer-facing business systems (e.g., systems that generate accounting events such as revenue and billings), and reporting/accounting systems that support forecasting, consolidations, eliminations and financial reporting.

- Take advantage of this opportunity to transform your business and operational oversight to set the stage for a faster, more agile enterprise in the future. A move toward more automation should also focus on controls (especially internal controls over financial reporting (ICFR)) to maintain an appropriate control environment.

4. Strengthen Corporate Governance

- Evaluate compliance with governance requirements imposed by stock exchanges and SEC rules, as well as related disclosure requirements expected of a U.S. public company.

- Identify Board and Audit Committee members who align to the company's vision and have deep experience in the industry.

- Create an Audit Committee charter to codify audit responsibilities, scope, reporting relationships and more.

5. Develop KPIs

- Develop key performance indicators for management to evaluate the performance of the business. Common non-GAAP measures include ARR, EBITDA, Adjusted EBITDA and Free Cash Flow.

- Once chosen, benchmark these KPIs against your peers. This structured approach turns traditional reporting and finance activities into new opportunities for value creation pre- and post-IPO.

6. Establish and Optimize Financial Forecasting and Guidance

- Build out your FP&A team to support cross-functional predictive insights and corporate decision-making.

- Establish reliable forecasts. Long-term predictability of forecasting results impacts valuation and is key to the success of a public company. Poor forecasting can lead to missed guidance and the beginning of a tailspin for a new public company.

- Decide what type of financial guidance will be released by the company annually or quarterly. By communicating guidance in a strategic way, companies can educate analysts and investors and mitigate the risk of swings in stock prices.

7. Enhance Financial and SEC Reporting Capabilities

- Complete accounting policies/technical analysis and finalize new disclosures in accordance with SEC Regulation S-X.

- Draft a Management Discussion & Analysis (MD&A).

- Implement a more robust financial reporting tool for unified data and reporting capabilities.

- Review your operating segments and assess how they should be structured.

- Update financial statements and disclosures to include SEC-required items such as EPS and segment reporting.

8. Prepare for PCAOB-Level Audits and Quarterly Reviews

- Prepare financial statements that are compliant with the SEC disclosure rules. Depending on the JOBS Act elections, financial statements (F-pages) filed in a registration statement on Form S-1 commonly include two to three years of audited financial information and must be compliant with Regulation S-X.

- Conduct audits with an independent accounting firm that is registered with the PCAOB. Annual financial statements included in Form S-1 must be audited in accordance with PCAOB standards. PCAOB audits are performed at a lower level of materiality and within more rigid guidelines and may result in unexpected challenges and delays.

- Partner with a strategic audit advisor to efficiently manage audit resources and best practices.

9. Optimize Risk and Controls Framework

- Optimize internal controls. In the transition from private to

public, internal control standards have become much more robust. As

public registrants, companies are subject to compliance with the

Sarbanes-Oxley Act of 2002 (SOX), which among other things requires

management to report on the adequacy of internal controls over

financial reporting (ICFR) and disclosure control procedures (DCP).

Three critical aspects of compliance with

SOX include:

- Section 302/906 requires management to certify it has designed and evaluated its DCP in all 1934 Act Filings commencing with its first 1934 Act filing (i.e., its first Form 10-Q or Form 10-K), and that a periodic report containing the financial statements fully complies with SEC requirements and are materially accurate.

- Section 404(a) requires that company management certify the effectiveness of the company's ICFR and provide evidential matter of its evaluation in the second annual Form 10-K.

- Section 404(b) requires an auditor attestation on the operating effectiveness of ICFR. EGCs, in accordance with the JOBS Act, receive up to a five-year reprieve from section 404(b) – auditor attestation of the operating effectiveness of internal controls over financial reporting.

- Evaluate the effectiveness of your IT general controls (ITGCs), the basic controls that can be applied to IT systems such as applications, operating systems, databases and supporting IT infrastructure. Determine whether an internal audit function is needed.

- Maximize the post-audit debrief and create a project plan to remediate any material weaknesses or control deficiencies. Companies will routinely run into a complicated series of audit issues they must be able to quickly address. But they also need a proactive audit approach and strategic partnership with an audit advisor to ensure that their risk and controls framework is optimized with automated controls.

- Create a cyber risk framework and reporting process to support recent SEC requirements and cybersecurity framework for reporting to the board.

- Prepare internal control documentation and coordinate testing

of these controls with the auditors. An effective internal control

environment in a public company is much more involved than in a

private company. Areas to improve upon or rely upon external

advisors for support often include:

- Creating effective entity level controls

- Adopting IT general controls and standards for reviewing the quality and integrity of your IT setup and supporting effective reporting and financial statement audits

- System and organization controls (SOC) that report to your customers to support their financial audits

10. Build Out a Transaction Working Group

- Build a transaction working group. Companies require expert direction and assistance from external advisors to guide and complete a successful IPO. These experts could include: SEC counsel; independent auditors; accounting, financial and reporting advisors; investor relations firms; underwriters; underwriter counsel; tax advisor; and cybersecurity experts. The company will need to identify a leader of the project management office (PMO) to coordinate and drive this group.

Dual-Track Process

In addition to a traditional IPO preparedness process, we've also seen an increase in dual-track processes.

The dual-track process involves pursuing both an IPO and a private-sale process simultaneously. As both transactions progress, one will emerge as the best to meet the needs of the company and its shareholders. Such a process can offer many benefits, including possibly higher valuations and increased flexibility, but comes with unique challenges.

Advantages of a Dual-Track Process

- Less dependence on market conditions and greater flexibility

- A more competitive sales environment

- Increasing sense of urgency to the acquisition process

- An opportunity to get the "house in order" with improvements to governance, internal controls, and financial management and reporting

Disadvantages of a Dual-Track Process

- Management distraction and risk to business

- Competing priorities can lead to a suboptimal results

Next Steps

Whether the markets are up or down, any company considering an IPO journey must take the necessary steps to implement an IPO readiness assessment. Private equity investors, company executives, deal counsel, boards of directors and other key stakeholders must undertake this review to outline a roadmap to going public and prepare the company for the additional regulatory oversight now — even as regulators move toward easing requirements to expand capital market access.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.