- within Immigration, Litigation and Mediation & Arbitration topic(s)

- with Senior Company Executives and HR

- in United States

- with readers working within the Automotive, Basic Industries and Insurance industries

Several of my friends who are not affiliated with the oil and gas industry have asked me lately what the U.S. rig count is and why it has been featured in so many news articles in recent months.

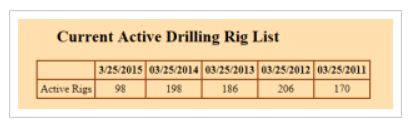

In fact, the Wall Street Journal recently reported that the "U.S. Oil Rig Count Keeps Falling: Latest Decline Marks 15th Consecutive Weekly Drop." In addition, the North Dakota Industrial Commission, Department of Mineral Resources, Oil and Gas Division ("NDIC") is reporting the following rig count for the State of North Dakota:

It's no wonder that people are wondering what this means in layman's terms.

The U.S. rig count correlates to the number of brand new wells being drilled domestically – it is the number of drilling rigs. It does not take into account the number of existing wells or whether or not existing wells are being produced.

The U.S. rig count is used as an indicator for the amount of overall domestic oil and gas activity. It is used as part of a predictive model. Historically, it is used as not only an indicator of the ability and likelihood of an increase in future production in the United States, but also as an indicator of the oil and gas sector as a whole.

It reflects the oil and gas sector as a whole because it has so many ancillary impacts, such as use of well service companies, employees that will be needed, housing needs – even down to the number of people walking into a town's diner for a hamburger after a shift.

It should be noted that many people believe that the U.S. rig count alone is not the gospel when it comes to predicting future production and where the oil and gas industry is headed. There are many other factors and activity indicators that must be considered in such a complex analysis.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]