- within International Law topic(s)

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- with readers working within the Technology industries

- within Government, Public Sector, Criminal Law and Insurance topic(s)

The rise of President Trumps' tariffs in 2025 has brought uncertainty to the profitability of product sales and has thrown a wrench in previously stable supply relationships. Reminiscent of the 2020 push to review force majeure provisions after the onset of Covid and the push to evaluate pricing provisions due to supply chain disruptions in the post-Covid years, today, buyers and suppliers alike are keen on understanding what their rights are vis-à-vis their commercial contracts with respect to tariffs.

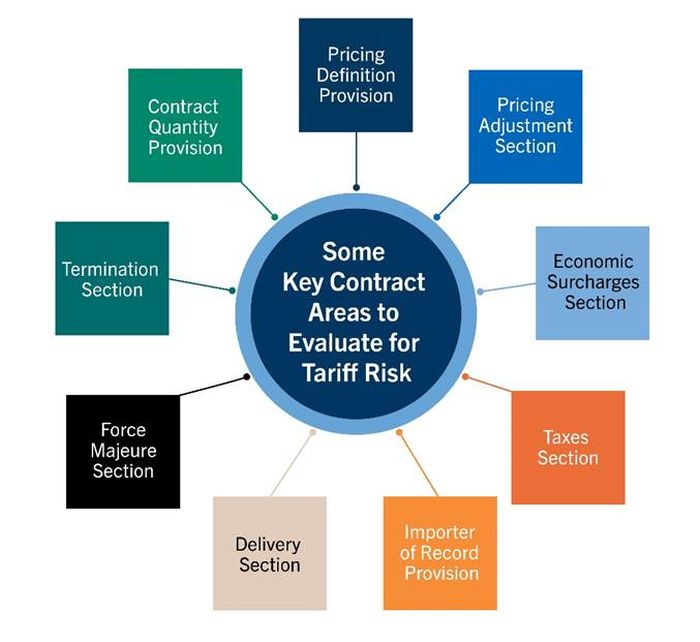

Reuters reported in April of this year that suppliers across various industries are combing through billions of dollars' worth of contracts to check their exposure to tariffs.1 To support those efforts, the intent of this series is to shine light on areas within existing commercial contracts that could present risk in the event of tariff changes, as well as to provide guidance for supply chain participants when entering into new contracts.

"Tariffs and Your Contracts" Series – Topics

This Tariffs and Your Contracts series will cover the following topics:

- Article 1. Tariffs and Your Contracts: Why do pricing and tax provisions matter?

- Article 2. Tariffs and Your Contracts: Why do delivery terms matter?

- Article 3. Tariffs and Your Contracts: Why does the "importer of record" provision matter?

- Article 4. Tariffs and Your Contracts: Why do force majeure provisions matter?

- Article 5. Tariffs and Your Contracts: Why do termination rights matter?

- Article 6. Tariffs and Your Contracts: Why does the contract quantity matter?

Contract Review Considerations

While this series highlights key provisions within commercial contracts that could be impacted by tariffs, provisions that permit a party to adjust pricing, terminate a contract, or that trigger another type of change to the status quo may not be obviously stated or set forth within an expected section of the contract. Therefore, when evaluating a contract for tariff-related provisions, it is always recommended that a full analysis of all the provisions of the entire contract be performed either in-house or by your outside counsel team.

Footnote

1. Hepher, Tim, et al. "Aerospace Firms Scour Contracts over Tariffs after Supplier Challenge." Reuters, 7 Apr. 2025, https://www.reuters.com/business/aerospace-defense/aerospace-firms-scour-contracts-over-tariffs-after-supplier-challenge-2025-04-07/.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.