- within Real Estate and Construction, Immigration, Litigation and Mediation & Arbitration topic(s)

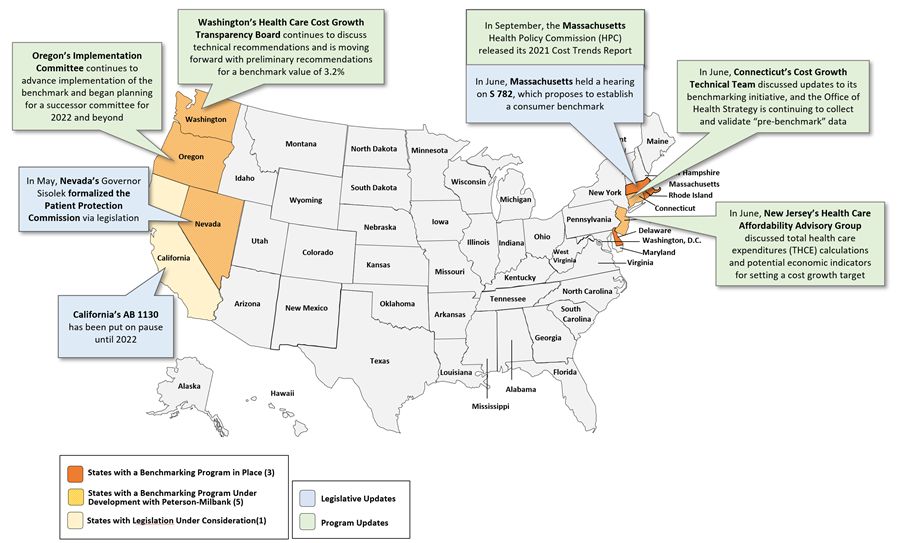

Benchmarking Updates as of September 17, 2021

Detailed State Updates as of September 17, 2021

| Legislative Updates | |

| State | Update |

| Nevada |

On May 27, Governor Sisolak approved Assembly Bill 348, which moves the Patient Protection Commission (PPC) to the Department of Health and Human Services and designates the PPC in law as the entity responsible for the state's participation in the Peterson-Milbank Program for Sustainable Health Care Costs, which works with states to establish and implement health care cost growth targets. Under AB 348, the PPC is also charged with facilitating interoperability of health information in the state, making recommendations on how the state can analyze and use health care data to improve access and quality, and how to make that data publicly available and transparent. |

| Massachusetts |

On June 29, the Massachusetts State House and Senate held a joint hearing on Senate Bill 782, "An Act to Ensure More Affordable Care," which proposes to establish a consumer benchmark for premiums and OOP costs set at the state's aggregate cost growth benchmark beginning in 2023. This bill is now pending a recommendation from committee members. |

| California |

California's legislative deliberations on Assembly Bill 1130 have been paused until next year. AB 1130 proposed to, among other provisions, establish the Office of Health Care Affordability within the Office of Statewide Health Planning and Development, and charge the office with analyzing the health care market for cost trends and drivers of spending, developing data-informed policies for lowering health care costs for consumers, setting and enforcing cost targets, and creating a state strategy for controlling the cost of health care and ensuring affordability for consumers and purchaser. As Assemblyman Jim Wood, one of the leading champions of the cost growth benchmarking program in California, notes (regarding AB 1130), "although much progress has been made . other priorities in the state force us to begin discussions again next year." |

| Program Updates | |

| State | Update |

| Massachusetts |

On September 16, the Massachusetts HPC released its 2021 Annual Cost Trends Report, sharing several recommendations that have implications for the state's cost growth benchmarking program, including:

Other recommendations outlined in the report include advancing health equity for all by setting health equity targets, addressing social determinants of health, and improving data collection; and other targeted strategies and policies to address a range of other issues, including curbing pharmaceutical drug spending, improving investments in primary care and behavioral health, and continuing to address low-value care. |

| Oregon |

In late July, the Oregon Sustainable Health Care Cost Growth Target Implementation Committee announced plans to conduct broad provider outreach to expand awareness of the statewide benchmark and its implications for providers. The committee also identified priority analyses for implementation in 2022, including spending trends by market, geography, service category, and demographics, as well as quality measures and an assessment of negative impacts that may arise in pursuit of the cost growth target. The committee has also started planning for the establishment of a successor committee for 2022 and beyond, a Cost Growth Target Advisory Committee under the Oregon Health Policy Board (OHPB). The Advisory Committee will be charged with overseeing ongoing program implementation; reviewing, understanding, and monitoring cost growth trends and cost drivers; and advising OHA, the Department of Consumer and Business Services (DCBS) and OHPB, among other responsibilities. |

| Washington |

In August and September, the Washington Health Care Cost Transparency Board continued to explore its preliminary recommendation to set the benchmark value using a 70/30 hybrid of the state's historical median wage and PGSP, which yields a benchmark value of 3.2%. The board also plans to tighten the benchmark over four years, following similar protocols implemented by other benchmarking program states. In September, the board modeled potential savings from various scenarios of cost growth benchmark value reductions over time, ranging from 3.0% to 3.2% to start in 2022 and 2023, down to 2.8% to 3.0% by 2026, and continued to deliberate its final recommendation of the benchmark value. The board has also discussed other technical recommendations, including the use of statistical confidence intervals to determine insurer and provider entities' benchmark performance, a method currently under development in Oregon and Connecticut. |

| Connecticut |

Connecticut's OHS is currently collecting and validating pre-benchmark data from payers and large provider entities as it works to establish its analytic processes and quality assurance procedures. OHS intends to release cost growth data in the fall of 2021 at the state and market levels only. |

| New Jersey |

As of late May,2 the New Jersey Health Care Affordability Advisory Group finalized its charter, and it is discussing options for calculating total health care spending, as well as criteria and options for an economic indicator to which the state's spending growth target would be tied. Members of the advisory group emphasized the need for an indicator that links to "the pocketbooks of New Jersey consumers," is predictable and sustainable over time, and promotes quality and other desired investments. |

Footnotes

1. Massachusetts' Center for Health Information and Analysis (CHIA) reports annually on Relative Price and Provider Price Variation data, which facilitates the comparison of average provider prices and is one potential tool that may be used to classify the state's "high price" providers.

2. The New Jersey Health Care Affordability Advisory group also met on June 23, 2021. Meeting materials are not yet publicly available.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.